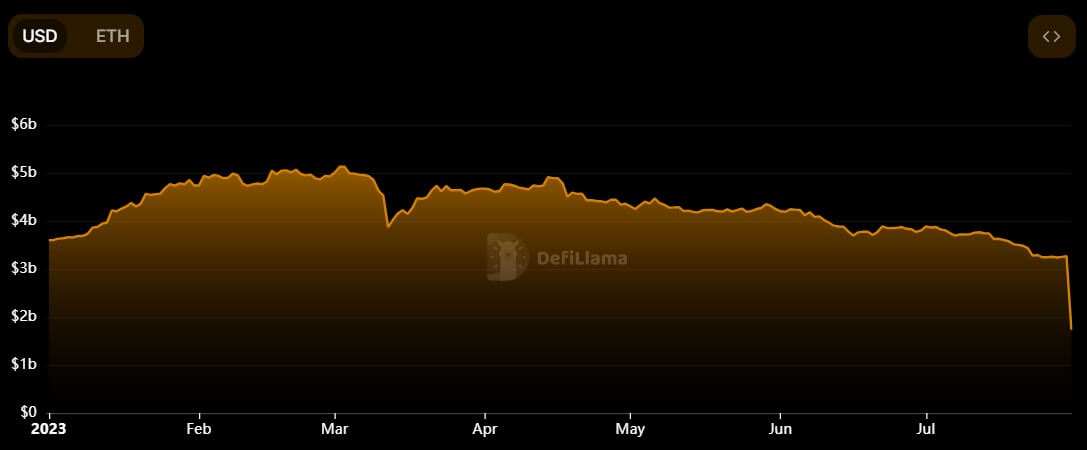

The whole worth of property locked on decentralized finance protocol Curve Finance (CRV) plunged almost 50% within the final 24 hours to $1.731 billion from $3.26 billion recorded on July 30, in response to DeFiLlama information.

The exodus could be attributed to an exploit of the protocol, which elevated fears of liquidation and dangerous debt amongst neighborhood members who instantly withdrew their property from the crypto venture.

Vyper vulnerability impacts Curve Finance

On July 30, a malfunctioning ‘reentrancy locks vulnerability’ was discovered on a number of variations of Vyper, a sensible contract language for the Ethereum (ETH) digital machine (EVM). The programming language confirmed the incident, revealing that crypto initiatives working Vyper 0.2.15, 0.2.16, and 0.3.0 may very well be impacted.

Following the information, Curve Finance stated that a few of its steady swimming pools working Vyper 0.2.15 had exploited the malfunctioning reentrancy lock vulnerability.

A reentrancy assault permits an attacker to empty funds of a weak contract by repeatedly calling the withdraw perform earlier than it updates its stability. This assault has been generally used to exploit a number of DeFi protocols.

BlockSec, a blockchain safety agency, said the reentrancy assault might probably danger all swimming pools with wrapped Ether (WETH).

Whereas it was unclear how a lot was stolen from Curve Finance’s stablecoin swimming pools, some estimates suggest that as a lot as $70 million may need been stolen.

Nonetheless, a MetaMask developer, Taylor Monahan, noted “a lot of whitehat exercise + automated MEV bots,” that means the quantity could be lesser.

CRV’s worth tank

The exploit has made Curve’s CRV token extremely unstable, with its worth dumping by round 15% to $0.64707 on the time of writing, in response to CryptoSlate’s information.

In the meantime, CRV’s on-chain worth hit lows of $0.109 as liquidity tapered off after the CRV/ETH pool was attacked.

South Korean crypto trade Upbit suspended deposits and withdrawals for the token, citing vulnerabilities found on the DeFi venture’s platform. The trade additional warned that CRV’s worth was “experiencing important volatility.”

Unhealthy debt and contagion fears

With hackers holding a big quantity of CRV, there are considerations that the token’s worth may fall additional if they begin promoting. This presents a contagion danger as a result of Curve founder Michael Egorov used the token as collateral on a number of lending protocols, together with Aave.

With Egorov having over $100 million in CRV as collateral on Aave, Inverse, and Abracadabra, a liquidation attributable to a drop in CRV worth will have an effect on Curve and all of the protocols.

To keep away from liquidation, Egorov has been paying down a number of the loans. Nonetheless, this won’t stop dangerous debt and spillover results for different lending protocols uncovered to Curve.

In the meantime, Aave Ethereum v2 model has turned off the CRV borrowing perform. Wu Blockchain reported that this was in all probability accomplished to forestall merchants from utilizing the Curve vulnerability to panic and the malicious shorting of borrowed CRV to advertise serial liquidation.