Key Takeaways

- The crypto market misplaced over $500 billion in response to Trump’s tariff announcement.

- XRP, ADA, and SOL recorded double-digit losses after their latest rallies.

Share this text

Round $500 billion has been worn out of the crypto market prior to now 24 hours forward of Trump’s tariff deadline.

XRP, Cardano (ADA), and Solana (SOL)—the three main crypto property that posted main beneficial properties on Trump’s proposed crypto reserve—have now suffered steep losses, posting double-digit declines as market sentiment shifts.

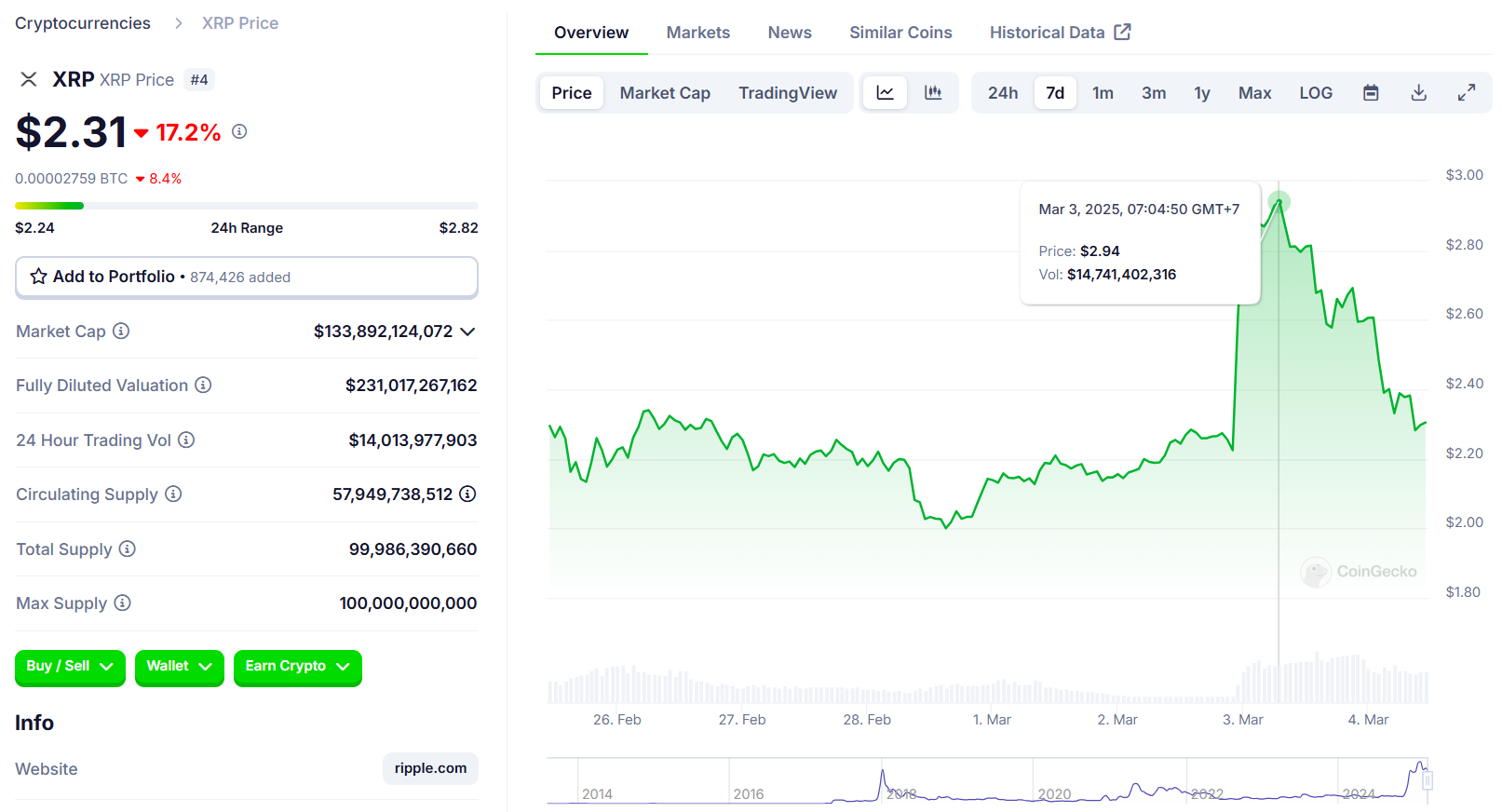

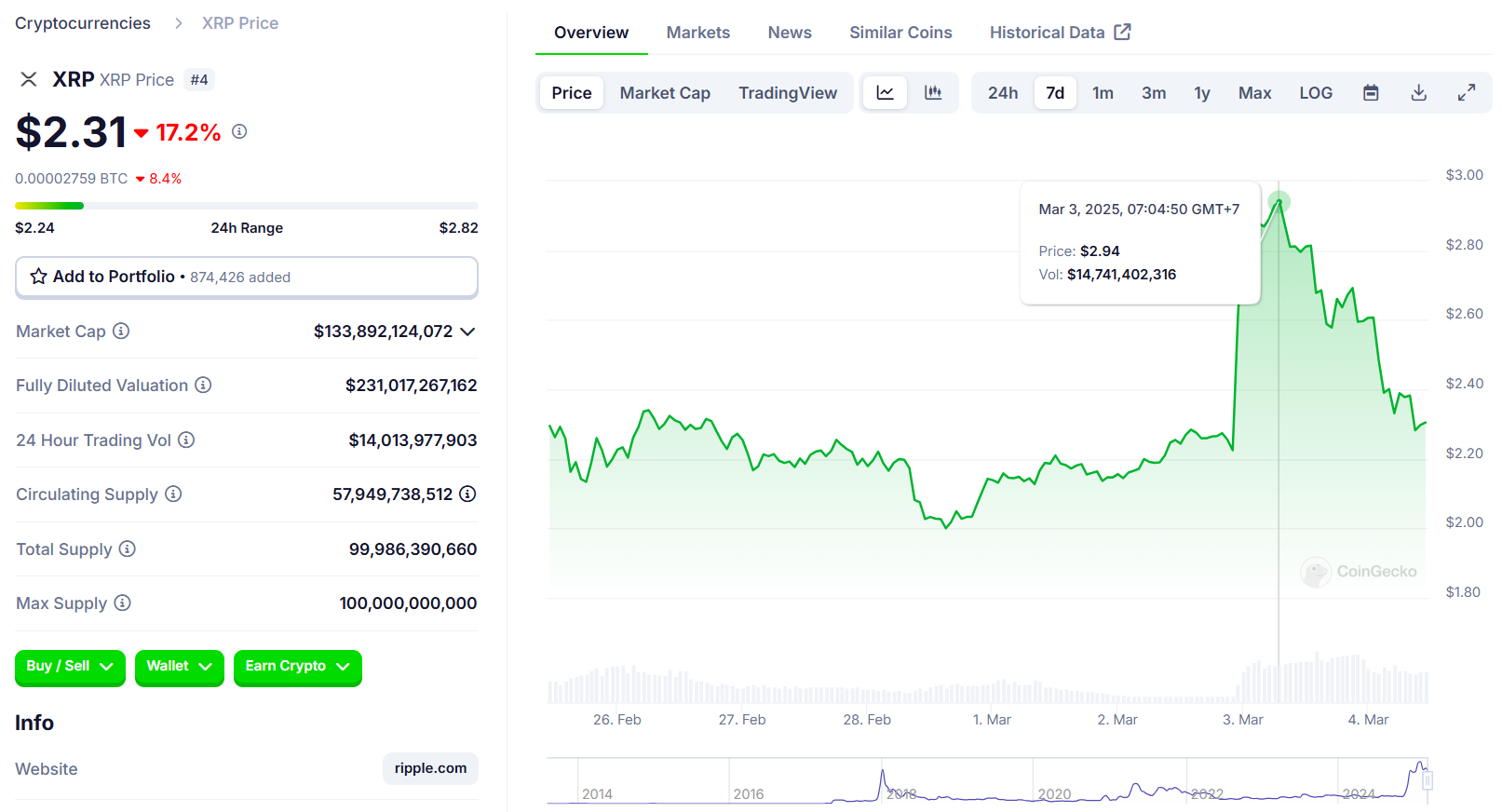

In line with knowledge from CoinGecko, XRP dropped 17% within the final 24 hours, erasing beneficial properties that adopted Trump’s earlier assertion about together with the crypto asset within the US reserve. The asset had beforehand surged over 25%, reaching almost $3.

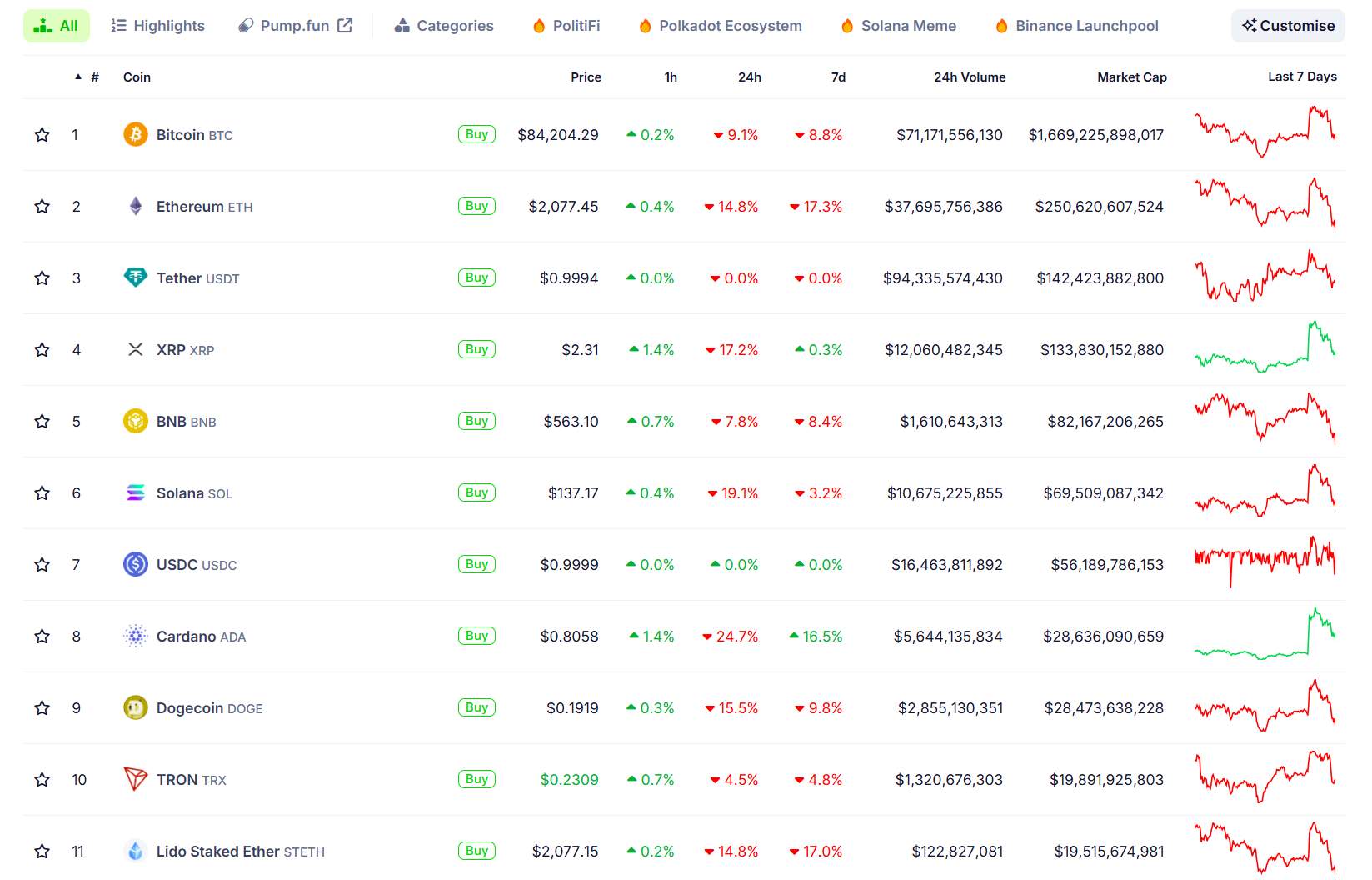

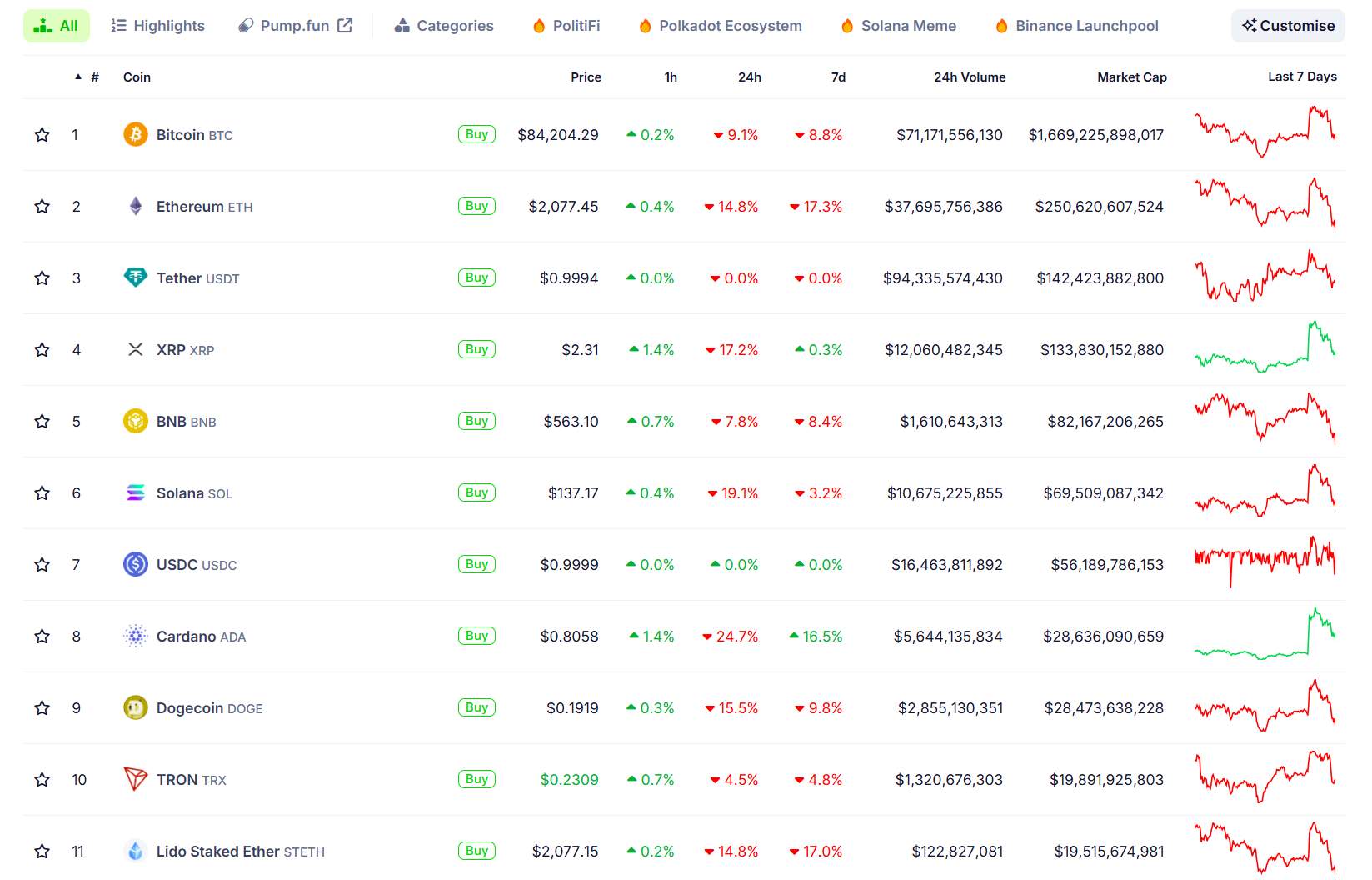

ADA and SOL skilled related declines, falling roughly 25% and 20% respectively. ADA, which had surged over 75% to above $1 on Sunday, retreated beneath $0.8. SOL declined from $177 to $135.

The whole crypto market cap has shrunk by over 12% over the previous 24 hours. Bitcoin, after surging previous $94,000 on Sunday, has pulled again. The digital asset is now buying and selling at round $83,700, down nearly 10%.

The second largest crypto asset, Ethereum, is down round 15%, whereas loads of decrease cap cash are down even additional.

Tariffs on Canada and Mexico to take impact tomorrow

Commerce warfare fears swiftly extinguished the hype that had constructed up across the US crypto reserve.

The market downturn intensified after Trump confirmed that 25% tariffs on Canada and Mexico every would take impact on Tuesday.

“They’re going to need to have a tariff. So, what they need to do is construct their automotive vegetation — frankly — and different issues in the USA, during which case they don’t have any tariffs,” Trump acknowledged.

Concerning China, the White Home additionally introduced a 20% tariff on Chinese language imports. Initially, a ten% tariff was imposed, and as of March 4, 2025, an extra 10% tariff has been added.

This marks a pointy escalation within the U.S.-China commerce warfare, with tariffs rising a lot quicker than throughout Trump’s first time period.

These tariffs elevate the price of commerce between the US, Canada, and Mexico, which might harm companies and financial progress.

Financial progress forecasts slashed

The US financial system could also be contracting at its quickest tempo for the reason that COVID-19 lockdown, in keeping with the Federal Reserve Financial institution of Atlanta’s GDPNow mannequin, which now initiatives a 2.8% decline in gross home product for the primary quarter of 2025.

Only a month in the past, the identical mannequin estimated the financial system was on monitor for almost 4 p.c progress. Whereas GDP forecasts will be risky, different financial indicators—similar to a record-high commerce deficit, falling client confidence, and slowing spending—reinforce issues a couple of deepening slowdown.

If realized, this contraction might mark the start of what some analysts are calling a “Trumpcession,” drawing comparisons to the sharp financial decline of 2020.

How did these have an effect on crypto?

In line with The Kobeissi Letter, mounting financial uncertainty and commerce warfare fears have already weighed on monetary markets.

The true driver right here is the GLOBAL transfer in the direction of the risk-off commerce.

As commerce warfare tensions rise and financial coverage uncertainty broadens, ALL dangerous property are falling.

This was seen in shares, crypto and oil costs which all fell sharply at this time.

Secure havens are thriving. pic.twitter.com/qUFfcdWNgy

— The Kobeissi Letter (@KobeissiLetter) March 4, 2025

The monetary markets have skilled a sudden sell-off prior to now few hours, and the downturn was largely pushed by weak spot within the US inventory market, triggered by latest bulletins from President Trump.

The inventory market downturn spilled over into crypto, as buyers offered off dangerous property in response to financial uncertainty. Larger tariffs might sluggish financial progress, lowering investor urge for food for speculative property like Bitcoin and altcoins.

Share this text