WTI, Brent Crude, Oil – Talking Points

- WTI looks to halt post-OPEC slide, support found around $83

- Symmetrical triangle brewing as crude looks for next major move

- Trendline support offers bulls a safety net for attacks on higher prices

Recommended by Brendan Fagan

Get Your Free Oil Forecast

WTI Technical Outlook: Neutral

Crude oil has reversed sharply in recent sessions after a sharp post-OPEC rally. A late-September decision from OPEC+ to cut output saw oil prices surge by more than 20%, but those gains have evaporated as recession fears remain top of mind. President Joe Biden has also announced that the US will release an additional 15 million barrels from the Strategic Petroleum Reserve (SPR) to help US consumers. While supply concerns will continue to dominate the headlines, traders will be looking to the chart for clues to near-term direction.

WTI has fallen nearly 9% from the OPEC fueled rally that topped out at $93.62. While a myriad of fundamental factors took the price of oil higher, WTI ultimately reversed course and trended lower after reaching severely overbought conditions. On the 4-hour timeframe, the relative strength index (RSI) reached 84 before easing. Price has since consolidated into a symmetrical triangle, which may hint that a big move could be on the cards in the near-term. A positive sloping RSI also indicates that bullish momentum is building, which could lead traders to speculate on a bullish breakout.

WTI 4 Hour Chart

Chart created with TradingView

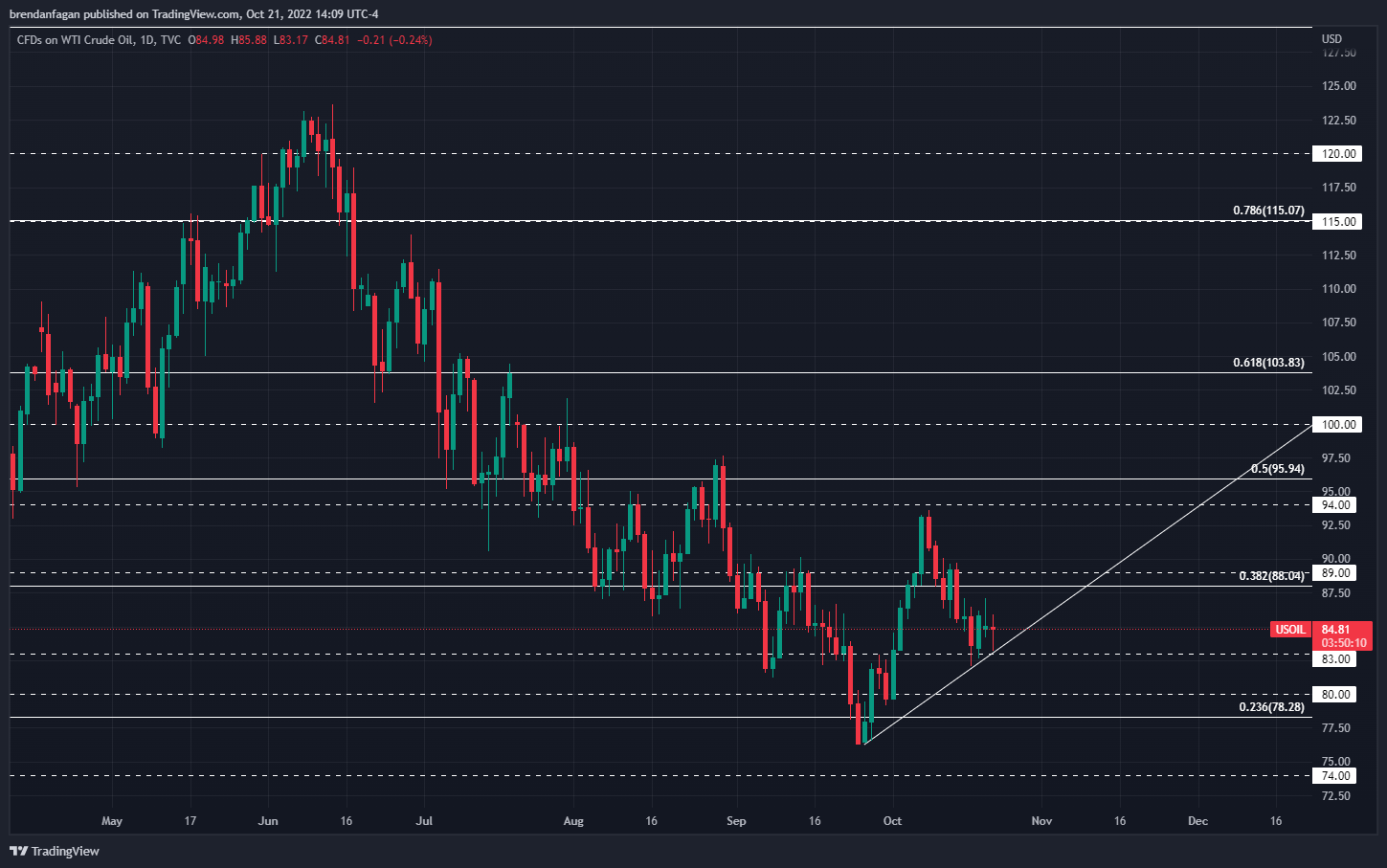

When we back out to the daily timeframe for WTI, we see a notable trend shift out of the multi-month downtrend. While there had been some rallies of notable size throughout the summer months, almost all lacked the structure of a true regime shift. This post-OPEC rally has notched both a higher swing-high and higher swing-low, while also holding trendline support in the process. The $83 level has also held nicely as support following the retrace of the OPEC fueled gains. Should oil break through fib resistance at the $88.04 level, WTI may look to trade back to the early October swing-highs below $94/bbl. In order for bullish continuation, those highs would need to break in order to retest the massive $100/bbl level.

WTI Daily Chart

Chart created with TradingView

WTI SENTIMENT

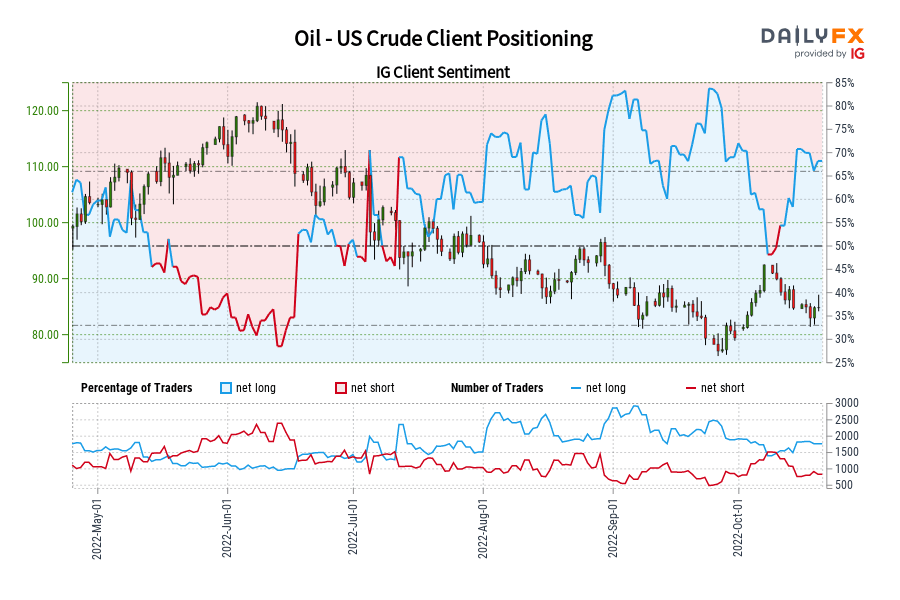

Oil- US Crude:Retail trader data shows 67.55% of traders are net-long with the ratio of traders long to short at 2.08 to 1.The number of traders net-long is 3.11% lower than yesterday and 8.05% lower from last week, while the number of traders net-short is 2.60% lower than yesterday and 1.35% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsOil– US Crude prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil – US Crude price trend may soon reverse higher despite the fact traders remain net-long.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter