BRENT CRUDE OIL (LCOc1) ANALYSIS

- EU Russian oil ban takes center stage.

- Chinese slowdown impacting oil demand.

- Symmetrical triangle break could lead to higher oil prices.

CRUDE OIL FUNDAMENTAL FORECAST: BULLISH

Brent crude prices climbed on Friday despite the NFP beat (dollar strength) dampening initial upside. Elevated crude oil prices stem from increasingly determined talks by the EU to ban Russian oil imports by its member states, with Russian oil shipping services to be terminated in just 3 months’ time. Some countries have been exempt from the ban such as Hungary, Slovakia and the Czech Republic but the threat of a majority ban has oil bulls biting at the bit.

Learn more about Crude Oil Trading Strategies and Tips in our newly revamped Commodities Module!

Next week, U.S. economic data could weigh on higher oil prices should inflation come in higher than expected and continue the incremental upward trend since mid-2021. From the Chinese perspective, higher inflation would act as a headwind against economic forecasts (including crude oil demand) and the Chinese appetite for growth and stimulus, with the Chinese Yuan deteriorating quickly along with significant capital outflows seen in both local bond and equity markets.

This being said, under current fundamental circumstances I expect the Russian oil embargo to outweigh the impact driven by lesser Chinese demand and dollar support.

U.S./CHINA ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

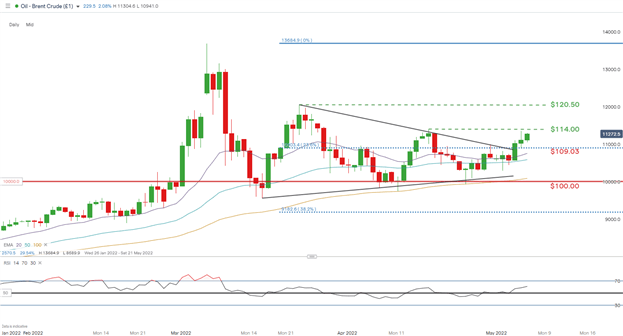

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily brent crude chart shows this weeks break above the converging symmetrical triangle pattern (black) coinciding with the 23.6% Fibonacci at $109.03. The April swing high at $114.00 will be my first port of call to see whether bulls have the conviction to break above this level with a candle close before looking at subsequent upside targets.

Key resistance levels:

Key support levels:

- $109.03

- 20-day EMA (purple)

- 50-day EMA (blue)

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are marginally NET LONG onCrude Oil, with 51% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, after recent changes in positioning the bias points to short-term upside.

Contact and follow Warren on Twitter: @WVenketas