Crude Oil, OPEC+, WTI, US Greenback, VIX, RBOB, OVX Index – Speaking Factors

- Crude oil seems rudderless going into the Thursday session

- The OPEC+ lollipop has been devoured by markets because it settles within the vary

- The underlying construction of the market appears to reaffirm a variety commerce for now

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

The crude oil worth has stabilised after a tumultuous begin to the week that noticed a 5-week peak earlier than working again into the vary.

This sort of worth motion has been an indicator of many asset lessons whereby a variety is established, it breaks on both aspect, after which retreats again contained in the vary.

From a macro perspective, this would possibly mirror the juxtaposition of central banks and the dilemma they face between reining in inflation whereas retaining their respective economies afloat.

Up till not too long ago, the tightening cycle was deemed vital, and in some elements important for the long-term well-being of the monetary stability and prosperity of society. The issue now’s the uncertainty round financial coverage and markets appear to be reflecting this unknown charge path.

Taking a look at volatility throughout markets and it’s obvious that this directionless sample has turn out to be entrenched.

The extensively watched VIX index, a measure of market-priced volatility on the S&P 500, dipped to its lowest stage since November 2021 this week.

Related measures of volatility throughout bonds, currencies, oil and gold have crumbled in the previous few days. See the chart beneath. A decrease stage of volatility would possibly lend itself to extra vary buying and selling eventualities.

CROSS MARKET VOLATILITY CHART – BONDS (MOVE), S&P 500 (VIX), OIL (OVX), GOLD (GVZ) AND FX (EVZ)

Chart created in TradingView

For crude oil, the dearth of follow-through from the OPEC+ manufacturing minimize introduced over the weekend might reveal the underlying weak spot in international demand.

On the flip aspect, the US has made it clear that they’ll search to replenish the Strategic Petroleum Reserve (SPR) ought to oil keep beneath US$70 bbl.

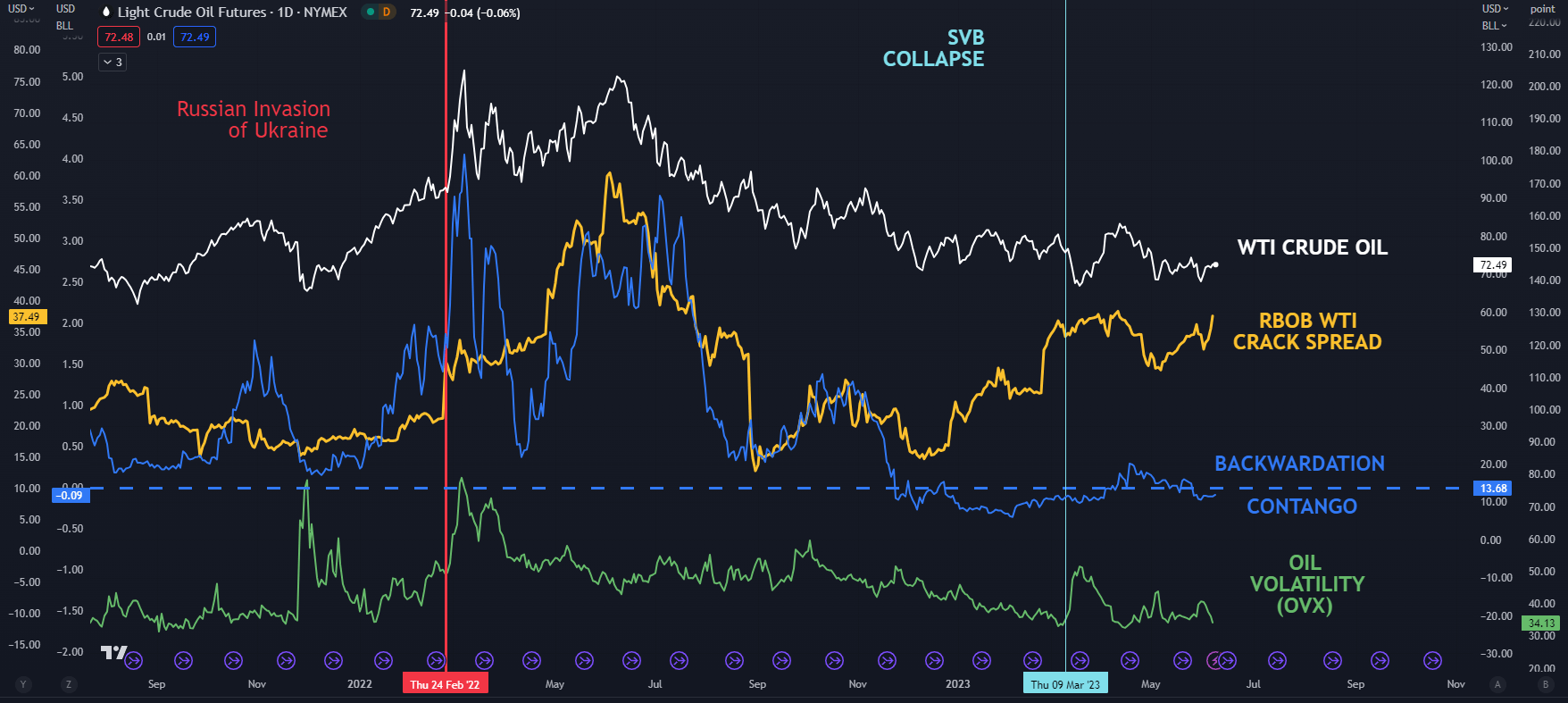

Doubtlessly lending some assist to black gold is the RBOB crack unfold that has ticked up once more this week. The RBOB crack unfold is the gauge of gasoline costs relative to crude oil costs and displays the revenue margin of refiners.

RBOB stands for reformulated blendstock for oxygenate mixing. It’s a tradable grade of gasoline. If profitability will increase for refiners, it could result in extra demand for the crude product.

On the identical time, the distinction in worth between the entrance two WTI futures contracts is comparatively benign and may be suggestive that the vary state of affairs is undamaged for now.

Up to date crude oil costs could be discovered right here.

Advisable by Daniel McCarthy

The way to Commerce Oil

WTI CRUDE OIL, CRACK SPREAD, BACKWARDATION/CONTANGO, VOLATILITY (OVX)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel by way of @DanMcCarthyFX on Twitter