Crude Oil, WTI, Fed Pivot Bets, CPI Report – Speaking Factors:

- Crude oil extends losses throughout Tuesday Asia-Pacific buying and selling session

- Market uncertainty could also be pushed additional with merchants eyeing US CPI

- One other sticker print might reinvigorate hawkish Fed coverage estimates

Really helpful by Daniel Dubrovsky

The best way to Commerce Oil

WTI crude oil costs fell 2.55% on Monday as market volatility remained elevated within the fallout of final week’s collapse of Silicon Valley Financial institution. Since final Wednesday, the commodity is down about 3.3%.

Sentiment-linked crude oil was and should proceed to stay weak within the coming days/weeks/months as merchants assess the probability of america financial system getting into a recession. Regardless of steps taken by the federal government to shore up confidence within the banking system, buyers punished regional financial institution shares on Monday.

Nonetheless, a better look reveals that the market response on Monday appears to position way more emphasis on expectations of a Federal Reserve pivot than worries a couple of recession (for now). The truth is, merchants have priced in about 150 foundation factors in price cuts by the Fall of this 12 months. In response, the haven-linked US Greenback sank, and merchants piled into tech shares. The Nasdaq 100 outperformed the Dow Jones.

Throughout Tuesday’s Asia-Pacific buying and selling session, sentiment woes continued deteriorating crude oil costs, with WTI falling nearly 1.25% by 3 GMT.

Over the remaining 24 hours, market uncertainty could possibly be pushed additional. All eyes are on the 12:30 GMT US CPI report. In February, inflation is seen slowing additional to six.0% y/y from 6.4%. As a reminder, January’s print was stickier than anticipated. One other surprisingly robust print might carry again Fed price hike expectations, putting crude oil in danger.

Crude Oil Technical Evaluation – Every day Chart

On the every day chart, crude oil is quick approaching the ground of a Bearish Rectangle chart formation. The worth appears to be round 72.27. Nonetheless, instantly beneath is the December low at 70.10 – 71.13. Confirming a breakout beneath the latter exposes lows from Might 2021.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

Chart Created Utilizing TradingView

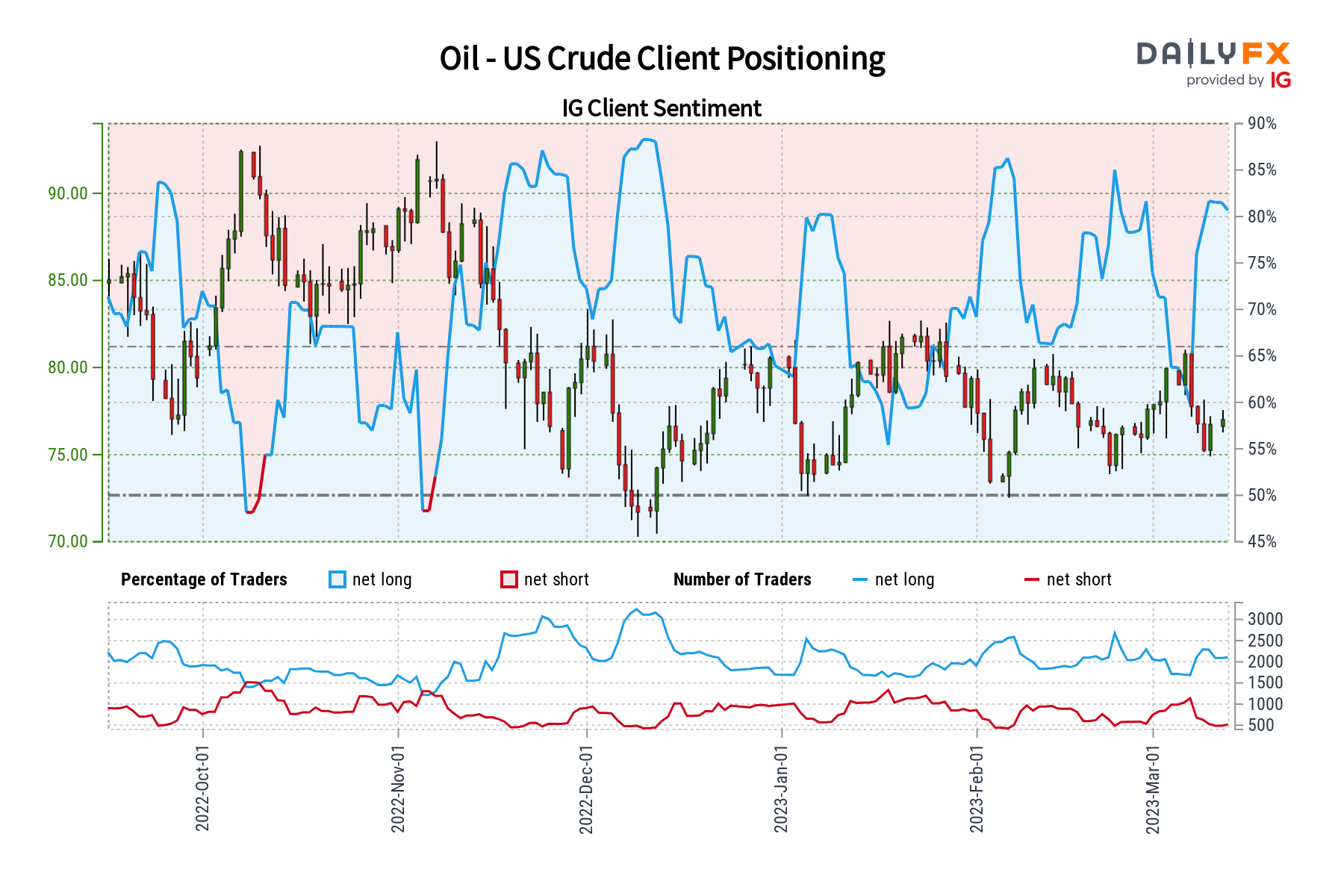

Crude Oil Sentiment Evaluation – Bearish

IG Shopper Sentiment (IGCS), which tends to be a contrarian indicator, about 82.78% of retail merchants are net-long crude oil. Since most of them are biased to the upside, this hints that costs might proceed falling. In the meantime, upside publicity elevated by 9.56% and 30.63%, respectively. With that in thoughts, the mixture of general positioning and up to date modifications in publicity affords a stronger bearish bias.

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, comply with him on Twitter:@ddubrovskyFX