jetcityimage/iStock Editorial via Getty Images

Cracker Barrel Old Country Store (NASDAQ:CBRL) controls over 650 restaurants across the United States marketing a “homestyle” food experience. The challenge for the company this year has followed many of the trends in the broader restaurant industry dealing with a weaker economic environment and inflationary cost pressures. Indeed, shares of CBRL are down more than 25% year to date, and off nearly 45% from its 2021 high.

Recognizing a reset of expectations and softer earnings, we like the stock at the current level which is well positioned for a rebound. Our bullish case here is that the recent trend of lower gas prices supports a more positive operating environment for dining as customers get back on the road. We’ll also note that CBRL stands out with a 5.3% dividend yield which is among the highest in its peer group, supported by overall fundamentals.

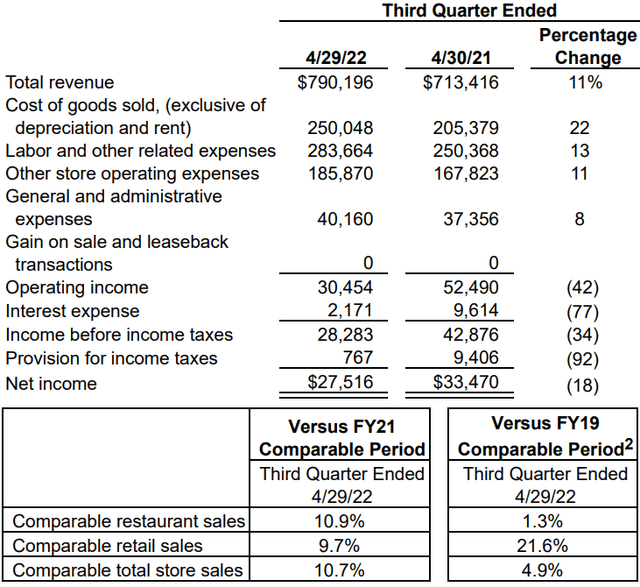

CBRL Key Metrics

The company last reported its fiscal Q3 earnings back in early June with non-GAAP EPS of $1.29 misses which missed expectations by $0.02. Revenue of $790 million, up 11% year-over-year, was also slightly below the market estimate. While there was positive growth including comparable total sales up 4.9% compared to the 2019 pre-pandemic benchmark, the story here was a surge in costs and tighter margins.

The combination of a 22% increase in the cost of goods sold based on food inflation, along with a 13% higher labor costs resulted in a 42% decline in operating income compared to the period last year. The operating margin of 3.9% was down from 7.4% in Q3 2021 and also a strong 8.8% margin in Q3 2019. Adjusted EBITDA at $59.6 million fell 28% y/y.

source: company IR

The message from management is that the challenging economic environment has impacted the top and bottom lines and the headwinds are expected to continue. In terms of guidance, the company is targeting 8% y/y revenue growth for Q4 while an adjusted operating margin range between 4.0% and 4.5%, would be roughly flat to Q3 on a reported basis.

Operationally, a key initiative for Cracker Barrel has been the expansion of its “Maple Street Biscuit Company” fast-casual breakfast-focused restaurant concept as a sister brand. The attraction is that Maple Street is expected to generate higher margins with four new locations in fiscal Q4 as an incremental growth driver.

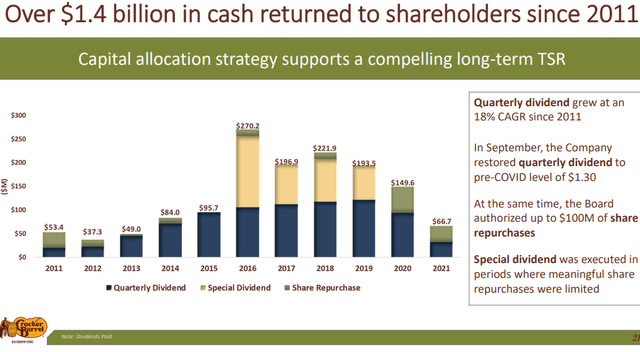

source: company IR

The company ended the quarter with $24.7 million in cash and equivalents against $373 million in long-term debt. Considering approximately $252 million in adjusted EBITDA over the past year, we calculate a net leverage ratio of 1.4x which highlights an overall solid balance and liquidity position.

Finally, we note that Cracker Barrel has been active with share buybacks, repurchasing $39 million in stock during the quarter. A new $200 million buyback authorization was also announced. This is on top of the regular $1.30 per share quarterly dividend that currently yields 5.3%.

source: company IR

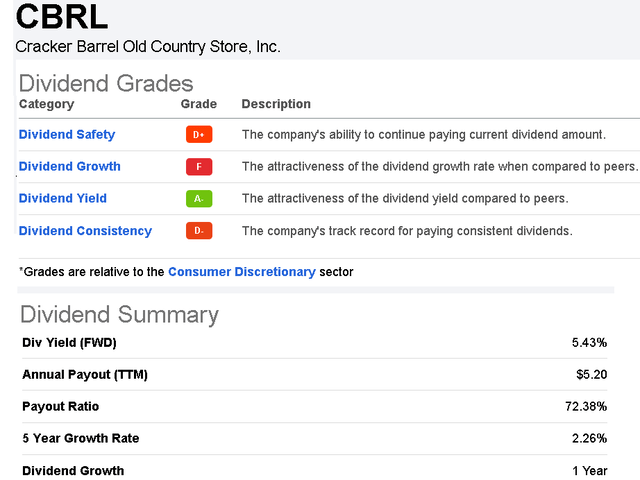

Is The Dividend Safe?

One of the great features of Seeking Alpha premium is its extensive stock ratings based on quantitative metrics. The function extends to assigning stocks a “dividend grade”.

In this case, CBRL screens poorly particularly considering its dividend was suspended for a year between 2020 and 2021 during the depths of the pandemic when restaurants were closed. The dividend consistency grade of (D-) reflects this setback in its track record with a lesson being that no dividend is ever “100% safe”. Similarly, the system gives CBRL an (F) grade for dividend growth, as the last increase in the quarterly rate occurred back in 2019. We agree with these grades which are all relative to the consumer discretionary sector.

Seeking Alpha

On the other hand, the dividend safety grade at (D+) is up for debate. The first point here is that the payout ratio at 73% of net income is elevated particularly against the weaker trend in earnings over the last few quarters. Still, we would highlight the annual dividend payout of around $120 million is more than covered by the positive operating cash flows which totaled $196 million over the past year.

The issue here comes down to the generous high yield of the stock reflected in the (A-) yield grade that ends up conflicting with the safety score. In other words, if the payout was lower, the yield grade would be discounted as the safety score goes up. Our take is that while CBRL’s “high yield” dividend above 5%, by definition, implies high risk, all indications are that the payout is sustainable for the foreseeable future.

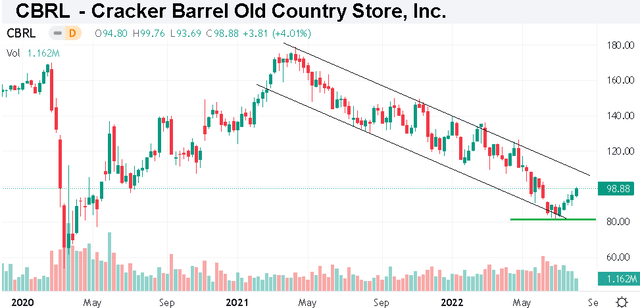

CBRL Stock Price Forecast

CBRL remains exposed to macro headwinds and the understanding is that high inflation hitting consumer discretionary budgets is a poor backdrop for casual dining. According to “NPD Group”, restaurant traffic fell 2% in Q2 and down 6% below 2019 levels as more consumers chose to dine at home. It’s likely the selloff in the stock reflects some of these recent indicators.

Seeking Alpha

That being said, there is some good news which has been the sharp drop in gas prices over the last several weeks. We bring this up because transportation is often a major component of household spending and one of the main culprits of the high inflation this year. A confirmation that inflation has peaked has positive implications for the broader economy.

According to AAA, gas prices are down $0.83 per gallon as a national average since their peak in mid-June with the trend heading under $4.00 per gallon nationally. Consumers saving $10-20 dollars filling up each gas tank translates into more discretionary income for everything else, including an extra meal at Cracker Barrel Country Stores.

We believe some of this dynamic is in play as shares have already rallied more than 20% from their low in mid-June alongside the broader stock market gaining momentum. From there, a bullish case for the stock is that operating conditions improve going forward, with room for margins to recover helping to lead to revisions higher in forwarding estimates. With the stock beaten down as it is, the question becomes if the worst-case scenarios of a deteriorating outlook have already been priced in.

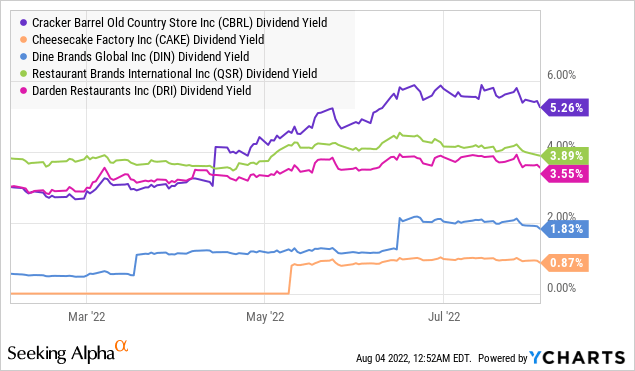

Naturally, the outlook should impact the entire industry and all restaurant stocks. We come back to the dividend yield for CBRL which is well above the average of other “casual dining” peers like Cheesecake Factory Inc. (CAKE), Dine Brands Global Inc. (DINE), Restaurant Brands International Inc. (QSR), and Darden Restaurants Inc. (DRI) closer to 2.5%.

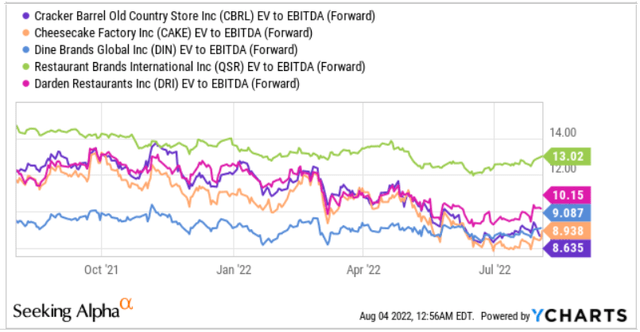

In our view, CBRL is a value-pick among restaurant names considering both its high yield and it also trades at a valuation discount. Its EV to forward EBITDA multiple of 8.6x compares to CAKE at 8.9x, DINE at 9.1x, DRI at 10.2x, and QSR at 13.0x. We make the case that CBRL is simply undervalued and could outperform to the upside.

source: YCharts

Final Thoughts

CBRL is a good stock that has been caught up in the broader market volatility and tough economic environment. The 5.3% dividend yield is particularly attractive with a view that shares are well-positioned to rebound higher in a scenario where a narrative of improving macro conditions takes hold. For the fiscal Q4 earnings report next month, comparable store sales and the operating margin will be the key monitoring points.