- Discussions concerning the measurement of the November Fed fee lower proceed

- Blended labour market information so far with ADP shocking on the upside

- Friday’s information issues essentially the most; non-farm payrolls seen rising by 140k

- Geopolitics increase demand for greenback, information might reverse this pattern

With the market attempting to determine the following growth within the Center East and the possible market affect, the concerning the measurement of the November Fed fee lower continues. On Monday, Chairman Powell poured chilly water on expectations by suggesting that the Fed would possible keep on with 25bps fee cuts shifting ahead, with a complete of 50bps of easing to be introduced within the two remaining gatherings for 2024.

The Fed doves should not but prepared to just accept defeat with the market nonetheless pricing in a sizeable 36% likelihood for a 50bps transfer in early November. Nevertheless, with the financial system progressing effectively, the housing market displaying indicators of life, and inflation remaining comfortably north of three%, the bears face an unlimited process to collect sufficient votes on the subsequent FOMC assembly to attain a second consecutive 50bps fee lower.

Having mentioned that, since Powell’s Jackson Gap speech in late August, the labor market has turn out to be a vital issue within the Fed’s decision-making course of. This isn’t odd for the reason that Fed operates with a twin mandate of worth stability and full employment, opposite to the ECB’s single goal of worth stability. As such, the incoming labor market information, primarily Friday’s non-farm payrolls determine, might put the choice of one other aggressive fee reduce on the desk.

Blended US Labor Market Knowledge Up To Now

Regardless of the optimistic job opening determine, each the and PMI manufacturing surveys stay comfortably beneath the 50 threshold. Moreover, their respective employment subcomponents have resumed their latest downward pattern, thus bringing some smiles to the doves’ faces.

Nevertheless, these smiles have most likely disappeared following yesterday’s employment report. It managed to supply a small upside shock by posting a 143k enhance, above the market forecasts for an 120k bounce, with the August quantity additionally getting a small upwards revision. Nevertheless, each the Fed doves and market members must be cautious because the ADP employment determine tends to be a really weak predictor of the non-farm payrolls print.

Key Knowledge At present, However the Focus Is on Friday’s Calendar

At present’s month-to-month Challenger job cuts, the and, predominantly, the ISM and PMI providers surveys ought to function the perfect appetizer for Friday’s information. One other set of weak prints at this time will add to the present theme of a labour market weak spot, and presumably pressure economists to decrease their forecasts for tomorrow’s information.

Economists are presently searching for a 140k enhance within the non-farm payrolls determine with each the unemployment fee and the typical hourly earnings development seen steady at 4.2% and three.8% respectively. Affirmation of those expectations or an upside shock, notably in non-farm payrolls, would quickly pause the dialogue for a 50bps fee lower on November 7, with the doves hoping that the following set of labour market information in early November is extra beneficial to their case.

Nevertheless, a sub-100k print tomorrow, a downward revision to August’s non-farm payrolls determine and an abrupt enhance within the unemployment fee might assist arguments for a 50bps fee lower in November, with the doves rapidly showing on the newswires to assist such a transfer.

Greenback Might Underperform Upon a Weak Set of Knowledge

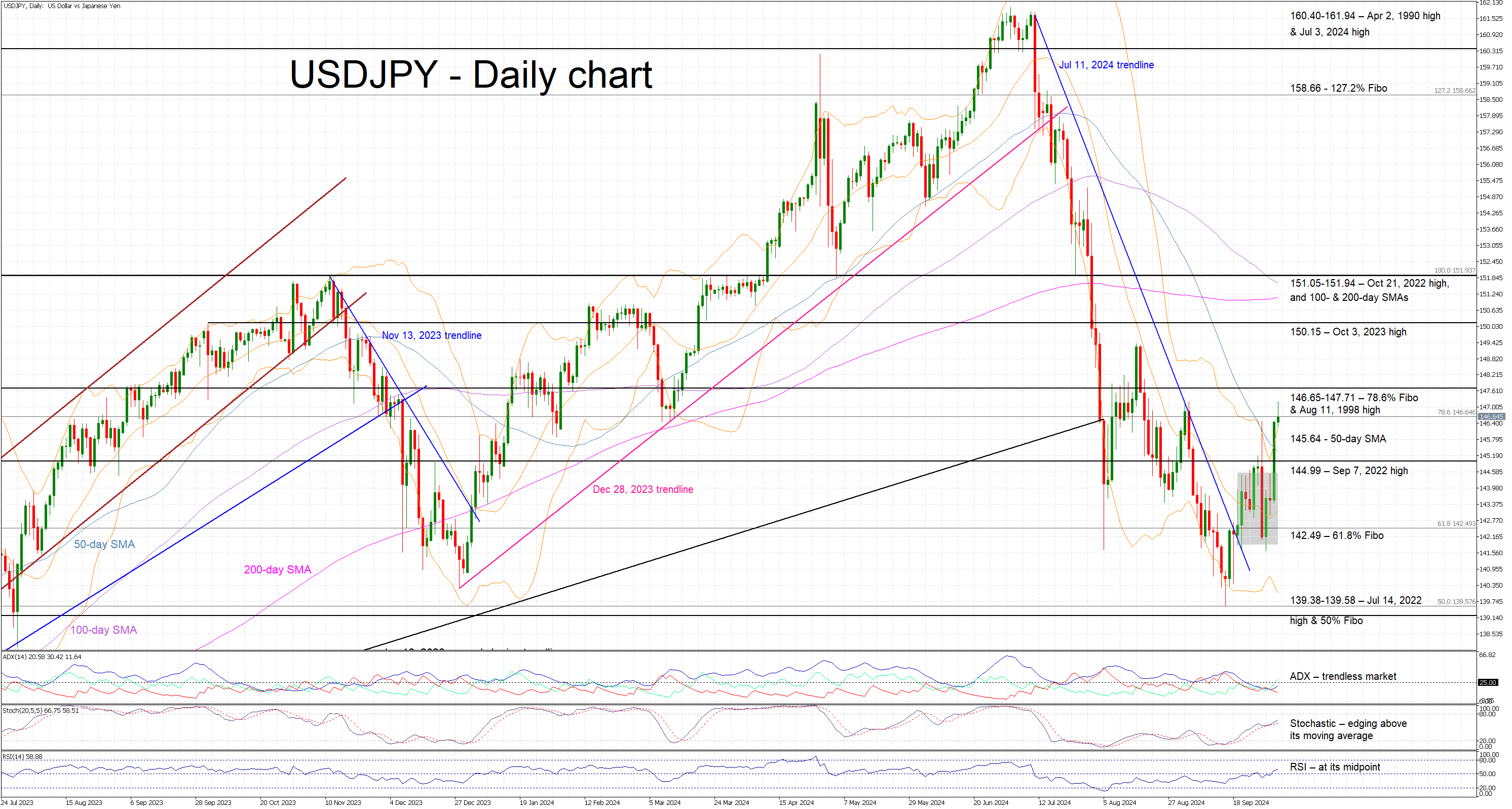

The geopolitics-induced risk-off response has boosted the with the pair dropping in the direction of the 1.1020 area and recovering abruptly. Assuming that there isn’t any additional escalation within the Center East, weak labour market information on Friday will hold the dialogue alive for an additional 50bps fee lower in November, and thus probably reverse the present greenback/yen upleg. The 142.49 degree might be the believable goal for the greenback bears.

On the flip facet, an upside shock within the non-farm payrolls determine and a probable acceleration within the hourly earnings might assist the greenback preserve its latest features. A break above the busy 146.65-147.71 space might open the door for a extra protracted rally in greenback/yen.