ablokhin

January 6, 2023 proved to be a very nice day for shareholders of Costco Wholesale Company (NASDAQ:COST). Along with benefiting from common optimism available in the market, the corporate’s share worth additionally elevated in response to sturdy gross sales knowledge overlaying the month of December. All issues thought-about, the corporate is performing exceptionally properly within the present setting. However this doesn’t essentially imply that it makes for a great buy right now. Due to how shares are priced for the time being, I do nonetheless imagine {that a} ‘maintain’ ranking is acceptable for the corporate, a ranking that’s indicative of upside or draw back potential that may kind of match the broader marketplace for the foreseeable future.

Blended however usually favorable outcomes

On January sixth, shares of Costco Wholesale roared greater, and had been buying and selling up about 6.5% as of the time of this writing, in response to some relatively favorable knowledge administration revealed. In the course of the month of December, comparable retailer gross sales for the corporate elevated by 5.5% 12 months over 12 months, though the agency did see its e-commerce gross sales drop by 6.4%. Contemplating the overwhelming majority of income comes from in-store, this knowledge is overwhelmingly optimistic. In greenback phrases, gross sales totaled $23.80 billion, up from $22.24 billion seen one 12 months earlier. For the trailing 18-week interval, comparable retailer gross sales had been even greater, coming in at 6.1%, with e-commerce gross sales down a extra modest 4.8%. If we ignore modifications in overseas foreign money and gasoline costs, comparable gross sales progress for the latest five-week window would have been 7.3% in comparison with the 7.1% skilled for the 18-week window with the identical finish date. As for e-commerce gross sales, these numbers are down 5.4% and three.4% throughout their respective home windows.

In a vacuum, this knowledge is extremely optimistic when you think about the final rhetoric surrounding the retail area. Most notably, on January 4th, information broke that rival retailer Goal (TGT) had been downgraded from Obese to Equal Weight as a result of its outlook has ‘deteriorated meaningfully’ due to a sustained interval of comparable gross sales weak spot usually merchandise, unfavorable retailer visitors anticipated for the ultimate quarter of 2022, and margin restoration points related to the COVID-19 pandemic and up to date provide chain issues. The identical analyst answerable for this downgrade listed Goal and Costco Wholesale each as being within the ‘backside 5’ retailers in danger on this setting. So this company-reported knowledge marks a major change in expectations for traders to ponder.

Though the rise we’re seeing in share worth is great for traders within the firm, this doesn’t change my total view of the agency. In late September of 2022, I wrote an article in regards to the enterprise, detailing how its future seems to be brilliant from a revenue and money stream perspective. Having mentioned that, I additionally talked about that shares had been too expensive for the time being. That finally led me to price the corporate a ‘maintain’. And to date, that decision has performed out pretty properly. Whereas the S&P 500 is up 3.8% because the publication of that article, shares of Costco Wholesale are up solely 0.4% regardless of the surge in worth skilled on January sixth.

Creator – SEC EDGAR Information

After all, the previous is the previous. The larger query for traders is whether or not the image now warrants a revision in my very own steering. In truth, I might say that the reply isn’t any. To see what I imply, we want solely cowl knowledge reported for the primary quarter of the corporate’s 2023 fiscal 12 months. Sure, gross sales did are available in greater 12 months over 12 months, with income of $54.44 billion translating to a year-over-year enhance of 8.1%. Regardless that e-commerce gross sales had been down 4% 12 months over 12 months, with that decline coming in at solely 2% if we ignore overseas foreign money and gasoline worth fluctuations, total comparable gross sales for the corporate had been up. No matter overseas foreign money and gasoline worth fluctuations, comparable gross sales had been up 7% 12 months over 12 months. The corporate additionally benefited from a 7% enhance in paid membership at its areas, in addition to from a modest enhance within the renewal price it expenses to prospects.

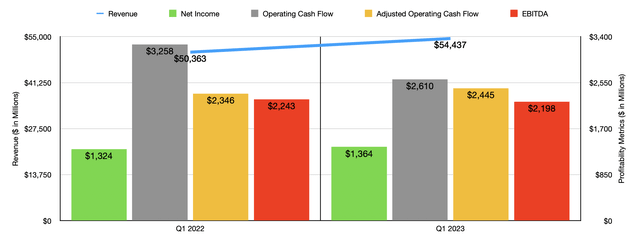

With the rise in income, earnings for the corporate additionally improved. Web earnings of $1.36 billion beat out the $1.32 billion reported one 12 months earlier. On the identical time, working money stream did worsen, falling from $3.26 billion to $2.61 billion. But when we alter for modifications in working capital, the metric would have risen from $2.35 billion to $2.45 billion. Over that very same window of time, EBITDA skilled a little bit of ache, declining from $2.24 billion to $2.20 billion.

Creator – SEC EDGAR Information

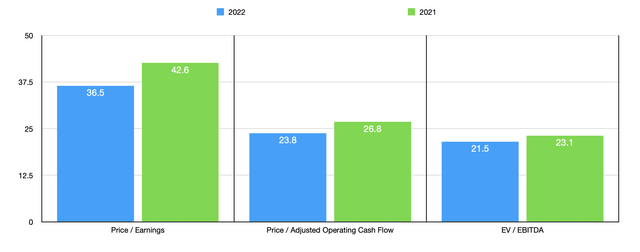

As a result of administration doesn’t provide any important steering, and since it’s nonetheless fairly early within the 2023 fiscal 12 months, I do assume it could be extra smart to worth the corporate based mostly on knowledge from its 2022 and 2021 fiscal years. Utilizing the info from 2022, the corporate is buying and selling at a worth to earnings a number of of 36.5. That is down from the 42.6 studying that we get utilizing knowledge from 2021. From 2021 to 2022, the value to adjusted working money stream a number of for the agency dropped from 26.8 to 23.8, whereas the EV to EBITDA a number of declined from 23.1 to 21.5. As a part of my evaluation, I additionally in contrast the corporate to 5 related companies. To be honest, the membership warehouse mannequin actually solely applies to 2 of those companies. However the different three are main retailers that vie for patrons’ consideration, so I imagine that together with them within the image is just applicable. On a price-to-earnings foundation, these firms ranged from a low of seven.1 to a excessive of 45.3. 4 of the 5 companies had been cheaper than Costco Wholesale. Utilizing the value to working money stream method, the vary was from 3.8 to twenty.9. And on the subject of the EV to EBITDA method, the vary was from 3.1 to 16.7. In each circumstances, our prospect was the most costly of the group.

| Firm | Worth / Earnings | Worth / Working Money Stream | EV / EBITDA |

| Costco Wholesale Company | 36.5 | 23.8 | 21.5 |

| Walmart (WMT) | 45.3 | 17.1 | 16.7 |

| BJ’s Wholesale Membership Holdings (BJ) | 19.1 | 13.2 | 11.1 |

| Goal | 21.9 | 20.9 | 11.5 |

| The Kroger Co (KR) | 14.3 | 7.1 | 5.9 |

| Albertsons (ACI) | 7.1 | 3.8 | 3.1 |

Takeaway

I absolutely perceive the investor optimism centered round Costco Wholesale right now. The very fact of the matter is that the corporate is doing very properly in what can solely be thought-about a tough setting. Though a few of its profitability metrics are combined, the adjusted working money stream a number of is doing fairly properly and gross sales proceed to climb at a pleasant clip. However none of which means the corporate makes for an excellent prospect to think about right now. Given how expensive shares look, I do assume that upside from right here is actually restricted. And due to that, I can’t in good conscience give the agency a ranking any greater than a ‘maintain’ right now.