The most recent report appears to have given Wall Road one thing to cheer about. Headlines touting resilience in client spending elevated hopes of a “comfortable touchdown” boosting the inventory market. Nevertheless, as is commonly the case, the satan is within the particulars.

We uncover a extra troubling image after we peel again the layers of this seemingly constructive information. Seasonal changes, downward revisions, and rising delinquency charges on bank cards and auto loans counsel a extra cautious view. The patron—the spine of the U.S. financial system—could also be in additional hassle than the headline numbers point out.

The Mirage of Seasonal Changes

The July retail gross sales report confirmed a pointy improve of 1.0% month-over-month, surpassing expectations. Nevertheless, whereas that quantity helps the concept of a resilient client, these spikes have been extra anomalous than not.

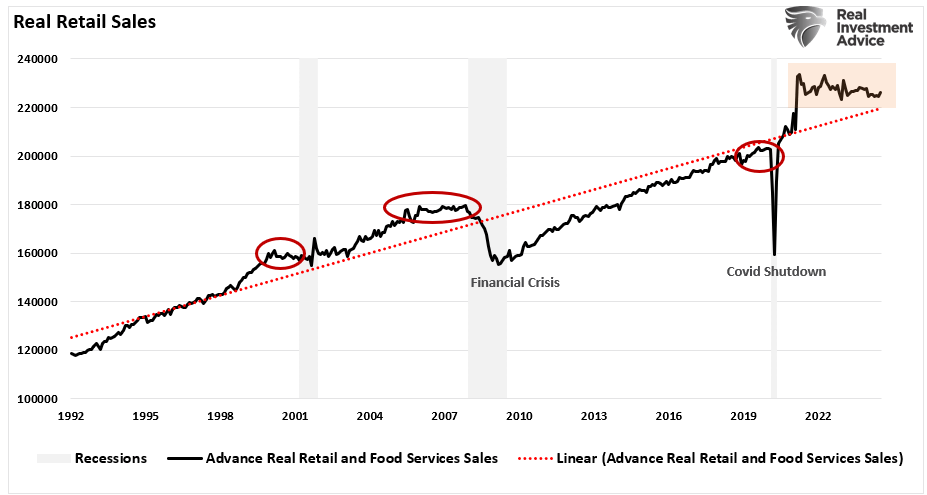

Since 2021, actual retail gross sales have nearly flatlined. Such is unsurprising as customers run out of financial savings to maintain their way of life.

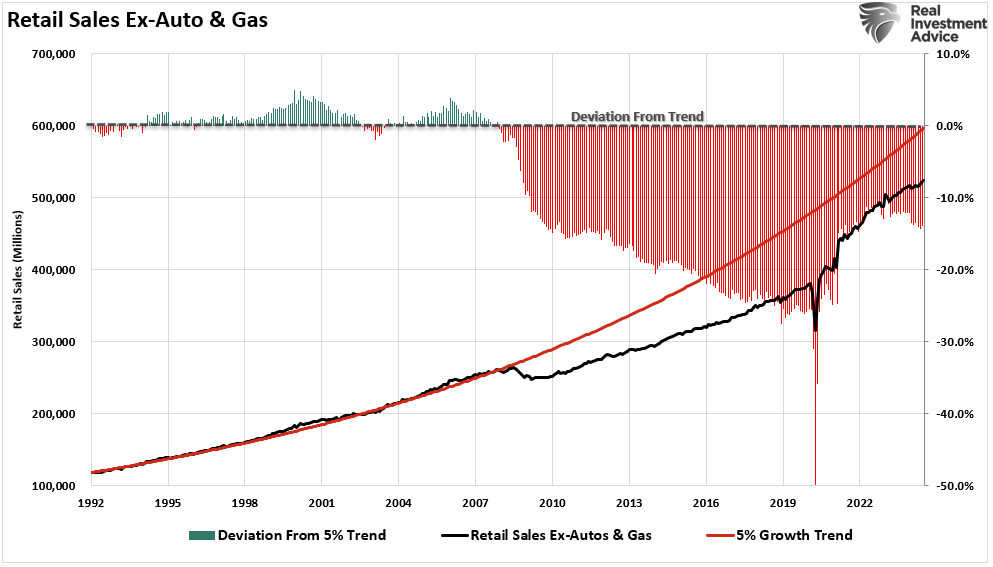

The next chart of actual retail gross sales clearly exhibits the buyer dilemma. Over the previous two years, retail gross sales haven’t grown to help extra strong financial development charges. Notably, flat actual retail gross sales development was pre-recessionary and a “crimson flag” of weakening financial development.

Nevertheless, given the large surge in spending pushed by repeated rounds of Authorities stimulus, the reversion of retail gross sales to the long-term pattern has taken longer than earlier durations, main economists to consider “this time is completely different.”

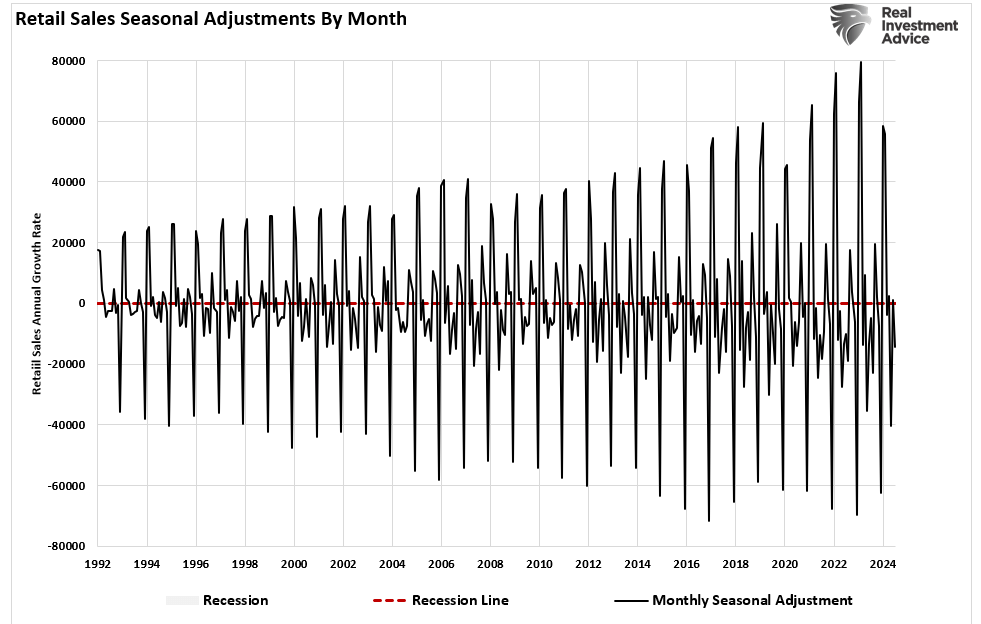

However earlier than we escape the champagne, let’s look at how these numbers are calculated. Retail gross sales information is notoriously unstable. Elements like climate, holidays, and even the day of the week play a big function.

To clean out these fluctuations, the info is seasonally adjusted. The chart exhibits the magnitude of those seasonal changes since 1992. Apparently, the magnitude of those changes is rising over time.

However what occurs when these changes paint a very rosy image?

Downward Revisions: A Rising Development

Seasonal changes are a double-edged sword. Whereas they intention to offer a clearer view of underlying tendencies, they’ll additionally distort actuality, particularly in an financial system as dynamic and unpredictable as ours.

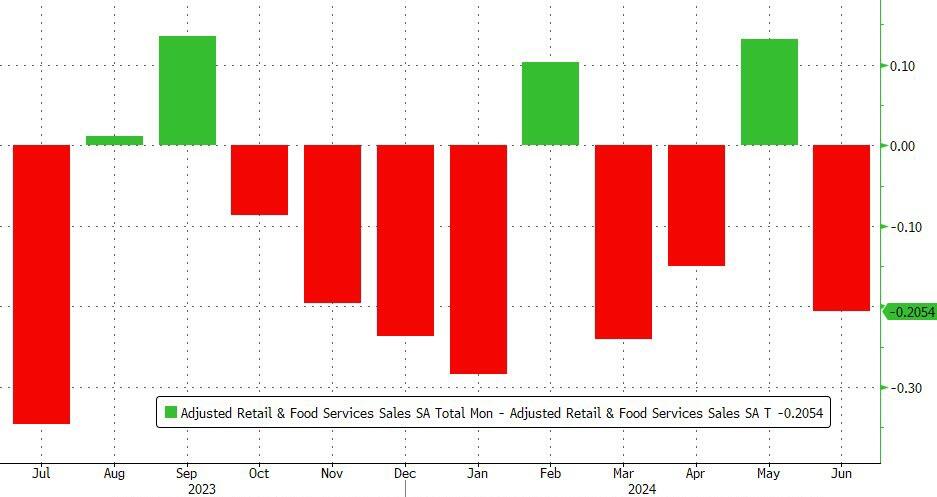

Sadly, these changes are sometimes revised in hindsight as extra information turns into accessible. For instance, a “crimson flag” is that eight of the previous twelve-monthly retail gross sales stories had been revised considerably decrease, making the latest month-to-month “beat” a lot much less spectacular.

Why are retail gross sales being revised downward so regularly? One doable rationalization is that preliminary estimates are overly optimistic, maybe attributable to seasonal changes.

As extra correct information turns into accessible, the true image emerges, and it’s not as fairly as many consider. So, is there probably a greater technique?

As famous, month-to-month retail gross sales are unstable attributable to varied occasions. Christmas, Thanksgiving, Easter, summer season journey, back-to-school, and climate all impression client spending.

Subsequently, “seasonally adjusting” the uncooked information could appear essential to clean out these durations of upper volatility. Nevertheless, such a course of introduces substantial human error.

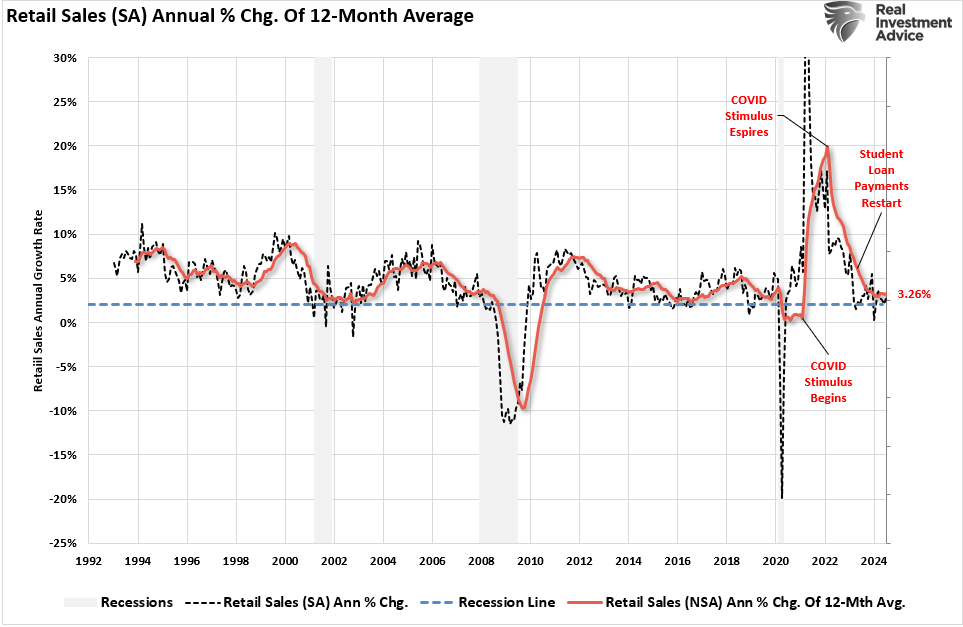

Utilizing a simplistic 12-month common of the non-seasonally adjusted information (uncooked information) supplies a smoother and extra dependable evaluation of client power.

Traditionally, when the 12-month common of the uncooked information approaches or declines beneath 2% annualized, it’s a “crimson flag” for the financial system. Once more, the large spike in COVID-related stimulus is reversing in direction of ranges that ought to concern traders.

In different phrases, if we strip out the seasonal changes and apply a smoothing course of to unstable information, the difficulty of client power turns into extra questionable.

One other “crimson flag” is realizing that retail gross sales ought to develop because the inhabitants grows. If we take a look at retail gross sales per capita, we see that earlier than 2010, retail gross sales grew at a 5% annualized pattern.

Nevertheless, that modified after the “monetary disaster,” retail gross sales fell properly beneath the earlier pattern regardless of an rising inhabitants. Whereas that hole improved following the Covid-stimulus helps, the hole is as soon as once more widening.

As you may see, the info exhibits a way more subdued image of client spending, which raises a essential query: Are we being lulled right into a false sense of safety by the headline numbers? The truth is probably going way more sobering.

The Debt Bomb: Rising Delinquency Charges

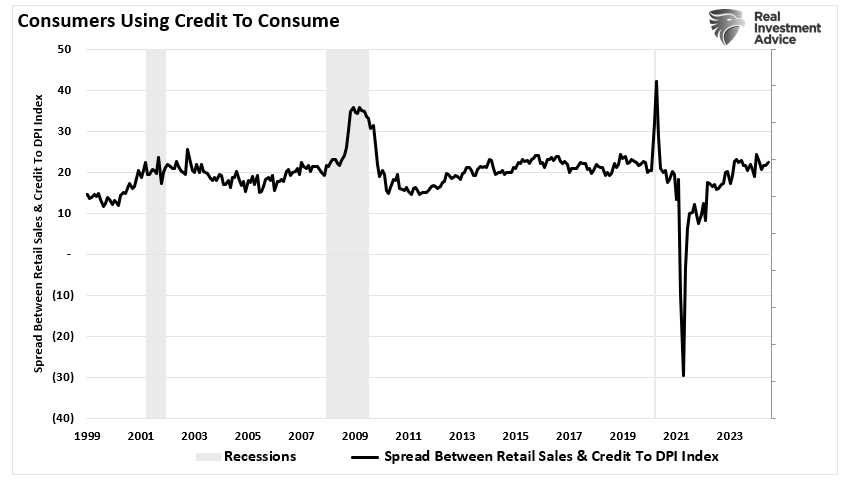

Maybe essentially the most alarming sign comes from the rising bank card and auto mortgage delinquency charges. Customers have been relying closely on credit score to take care of their spending habits within the face of excessive inflation and stagnant wage development.

The unfold between retail gross sales and client credit score to disposable private earnings rises as COVID-related stimulus runs dry and inflation is outstripping wages, forcing customers to show to credit score.

However there’s a restrict to how a lot debt customers can tackle earlier than the home of playing cards tumbles.

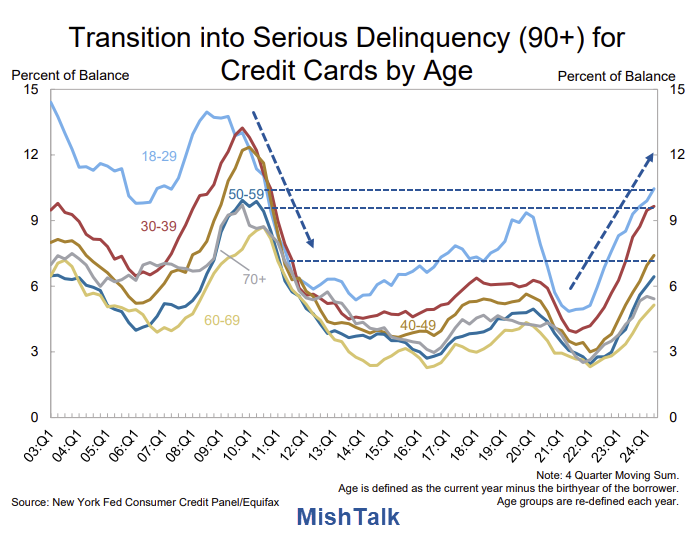

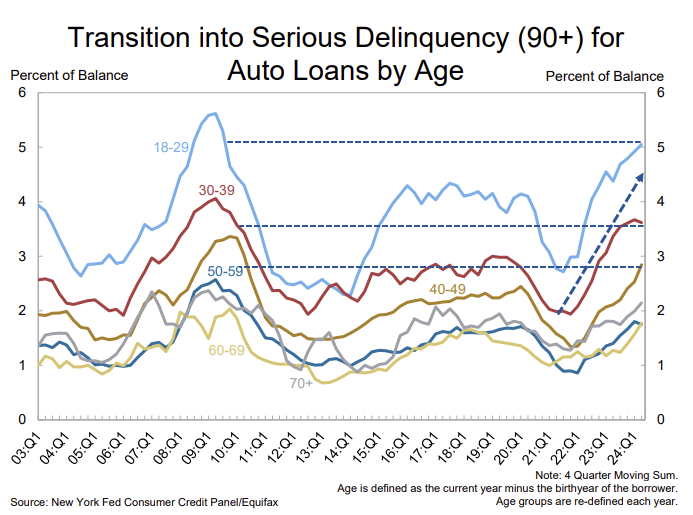

In response to the newest information, delinquency charges (greater than 90 days) on each auto loans and bank cards have reached their highest degree since 2012.

Notably, delinquency charges are rising the quickest for youthful generations that are likely to have decrease incomes and fewer financial savings. (Charts courtesy of Mish Shedlock)

These rising delinquency charges are a warning signal that customers wrestle to maintain up with their debt obligations. As extra customers fall behind on their funds, the danger of a broader financial slowdown will increase.

In any case, client spending accounts for practically 70% of U.S. GDP. If the buyer falters, the whole financial system is in danger.

The Implications for Future Consumption

Given these “crimson flags,” it’s troublesome to see how the present degree of client spending may be sustained. Rising delinquency charges, downward revisions to retail gross sales, and questionable seasonal changes all counsel the buyer is operating out of spending energy.

Within the close to time period, we might proceed to see headline retail gross sales numbers that seem wholesome, particularly if seasonal changes proceed to offer a tailwind. Nevertheless, the underlying information tells a special story.

As extra customers attain their debt limits and delinquency charges proceed to rise, we might see a big spending slowdown later this 12 months.

That slowdown would have far-reaching implications for the broader financial system. Retailers might see additional income declines, resulting in potential layoffs and additional weakening of client spending. Banks and monetary establishments might additionally face larger mortgage losses, notably within the bank card and auto mortgage sectors.

In abstract, whereas the newest retail gross sales report might have given the market a short-term enhance, suggesting a “comfortable touchdown” economically, the underlying information suggests we must be cautious.

Seasonal changes and downward revisions are masking the precise state of client spending whereas rising delinquency charges are a transparent signal of hassle forward.

Traders and policymakers would do properly to look past the headlines and concentrate on the financial system’s actual dangers. The patron could also be hanging on for now, however the cracks are beginning to present. Ignoring these crimson flags might result in a impolite awakening within the months forward.