Hinterhaus Productions/DigitalVision via Getty Images

By Robert Hughes

The final October results from the University of Michigan Surveys of Consumers show overall consumer sentiment was little changed from September and remains at very low levels (see first chart). The composite consumer sentiment increased to 59.9 in October, up from 58.6 in September. The index hit a record low of 50.0 in June, down from 101.0 in February 2020 at the onset of the lockdown recession. The increase for October totaled just 1.3 points or 2.2 percent, leaving the index about 10 points above the record low. The index remains consistent with prior recession levels.

The current economic conditions index rose to 65.6 versus 59.7 in September (see first chart). That is a 5.9-point or 9.9 percent increase for the month. This component has had a notable bounce from the June low of 53.8 but remains consistent with prior recessions.

The second component – consumer expectations, one of the AIER leading indicators – fell 1.8 points to 56.2. This component index posted a strong bounce in August but was unchanged in September and fell slightly in the most recent month. The index is still consistent with prior recession levels (see first chart). According to the report, “With sentiment sitting only 10 index points above the all-time low reached in June, the recent news of a slowdown in consumer spending in the third quarter comes as no surprise.” The report adds, “This month, buying conditions for durables surged 23% on the basis of easing prices and supply constraints. However, year-ahead expected business conditions worsened 19%. These divergent patterns reflect substantial uncertainty over inflation, policy responses, and developments worldwide, and consumer views are consistent with a recession ahead in the economy.” Furthermore, “While lower-income consumers reported sizable gains in overall sentiment, consumers with considerable stock market and housing wealth exhibited notable declines in sentiment, weighed down by tumult in those markets. Given consumers’ ongoing unease over the economy, most notably this month among higher-income consumers, any continued weakening in incomes or wealth could lead to further pullbacks in spending…”

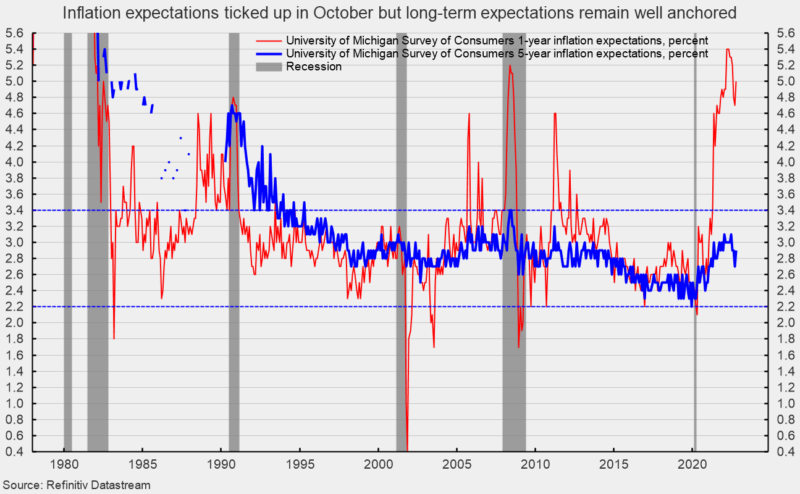

The one-year inflation expectations rose in October, rising to 5.0 percent. The jump follows a string of declines over the five months through September after hitting back-to-back readings of 5.4 percent in March and April (see second chart).

The five-year inflation expectations also ticked up, coming in at 2.9 percent in October. Despite the uptick, the result is well within the 25-year range of 2.2 percent to 3.4 percent (see second chart). The report states, “The median expected year-ahead inflation rate rose to 5.0%, with increases reported across age, income, and education. Last month, long-run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then, expectations have reverted to 2.9%. Uncertainty over inflation expectations remains elevated, indicating that inflation expectations are likely to remain unstable in the months ahead.”

Pessimistic consumer attitudes reflect a confluence of events, with inflation leading the pack. Persistently elevated rates of price increases affect consumer and business decision-making and distort economic activity. Overall, economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, and the continued fallout from the Russian invasion of Ukraine. As the midterm elections approach, the ramping up of negative political ads may also weigh on consumer sentiment. The economic outlook remains highly uncertain. Caution is warranted.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.