Ask economists how they forecast financial exercise. It’s possible they’ll point out productiveness, demographics, debt, the Fed, rates of interest, and a litany of different components. Financial confidence might be not on the high of the record for many economists. It’s tough to gauge as it may be inconsistent. Nevertheless, confidence can generally change rapidly and sometimes with vital financial impacts.

Have a look at the 2 photos under. Can you notice a distinction between them?

The distinction is delicate. The restaurant on the left has 54 diners. Whereas the one on the fitting is lacking the three diners within the entrance.

What if the three lacking diners determined to eat at dwelling that day as a consequence of waning confidence within the financial system and, finally, issues concerning the security of their jobs and investments? Might such an imperceptible distinction matter to the restaurant? Now, think about the restaurant represents the financial system.

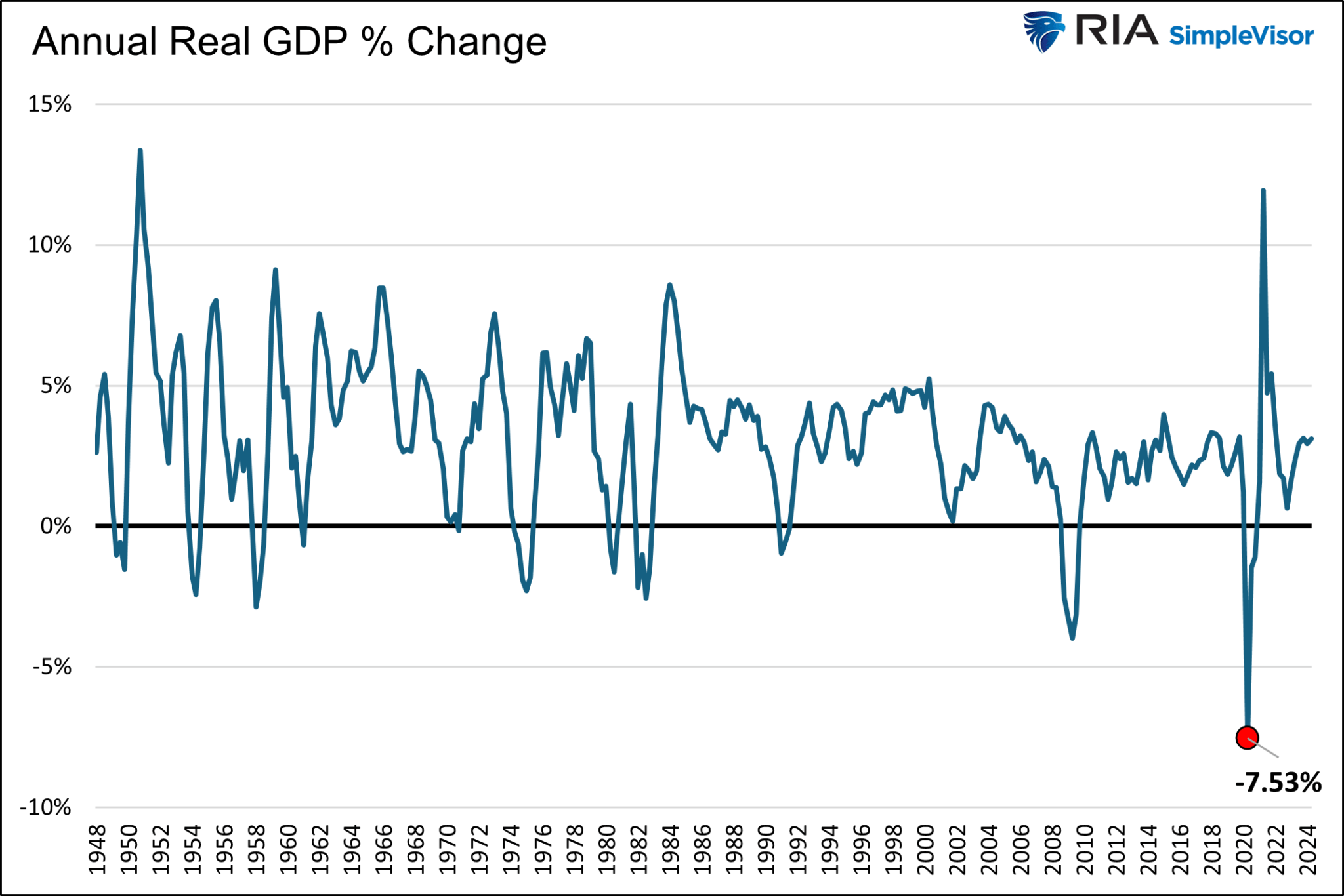

The “financial system” on the left is working at 100% of its capability. Regardless of being packed, the “financial system” on the fitting is just operating at 94% capability. A 6% decline in financial exercise might not appear to be so much. Nevertheless, since 1947, the nation’s annual actual financial development fee has declined by 6% or extra solely as soon as.

Confidence Is Difficult

Whereas we observe many enterprise and surveys launched usually, we don’t write almost as a lot on them as different financial subjects. Like many buyers and economists, mushy sentiment/confidence knowledge can generally be tough to make sense of.

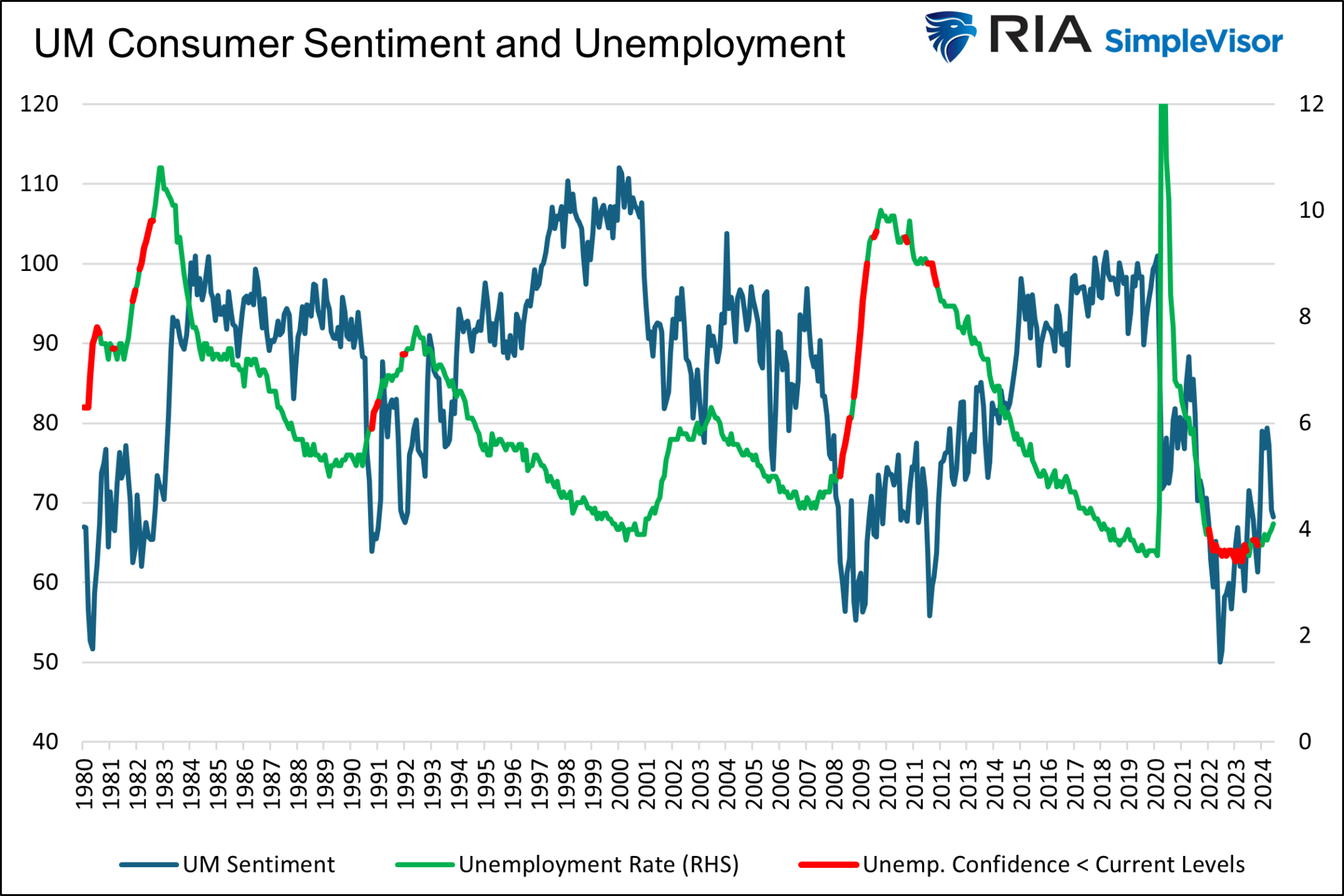

For instance, the well-followed College of Michigan Index is close to its lowest stage within the final 45 years. Be aware that confidence and the are likely to have an inverse relationship. Not surprisingly, individuals are extra assured when the unemployment fee is low and vice versa.

Earlier than the current expertise, the typical unemployment fee when the Michigan sentiment studying was at or under present ranges was almost 8%. Right this moment, it’s roughly half of that determine, but sentiment is awful.

The takeaway is that there’s not all the time a direct correlation between confidence and the financial system. If all we needed to assess the financial system was the boldness studying above, we’d presume the financial system has been mired in a recession for the final 4 years.

Confidence could be impacted by many financial and non-economic components, thus making it arduous to attract direct conclusions concerning the financial system and the way confidence might have an effect on it. We share three essential components to understand influences that may increase or weigh on confidence.

Politics

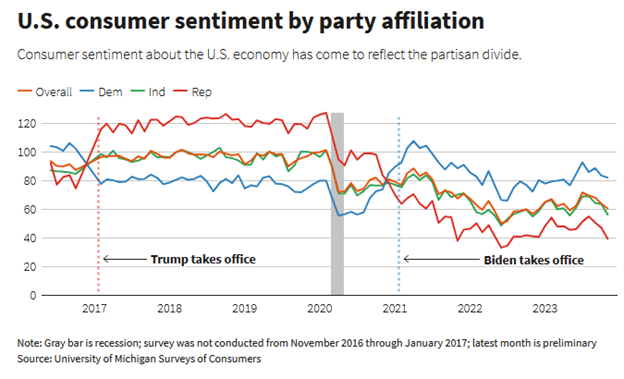

Political opinions can sway confidence, particularly throughout mid-term and Presidential elections. As an example, the graph under, courtesy of Reuters, exhibits the distinct modifications in financial confidence because the political get together of the President modifications.

It’s essential to notice that each events’ survey developments are extremely related. Thus, the broader pattern is extra essential to observe than absolutely the stage.

Inventory Market and Actual Property

The inventory market and actual property valuations can considerably impression our financial confidence. Any wealth you have got available in the market, be it a brokerage, retirement account, or property, is unrealized. In different phrases, it’s paper wealth till you promote stated property. Regardless, modifications in our wealth, realized or unrealized, have an outsized affect on confidence.

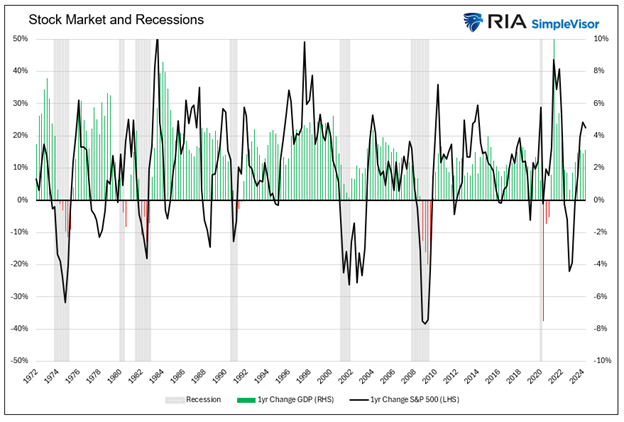

Contemplate a well-liked rule of thumb to understand higher the interplay of the inventory market with confidence and the financial system. The inventory market usually leads the financial system by six to 9 months. Such a concept is predicated on the broadly held perception that buyers are forward-looking. Subsequently, when inventory costs rise, it displays forecasts for extra sturdy financial development and vice versa.

The logic sounds right, however what if it’s backward? Might decrease inventory costs for causes apart from financial pessimism scale back confidence, leading to even decrease costs? Furthermore, as we mentioned, may weaker confidence be as a result of inventory market feeding into financial confidence and inflicting extra individuals to tighten their purse strings?

The graph under exhibits that, at occasions, the inventory market declines earlier than recessions or weak financial exercise.

However is the market a very good predictor, or is a weakening financial system ensuing from poor confidence induced by the market decline? Perhaps it’s extra of a hen or the egg query than most economists assume.

Frequent Data

Ben Hunt lately wrote a really astute article, Joe Biden And The Frequent Data Recreation. Regardless of being on politics, the article could be insightful for financial confidence.

The gist of his article is that, individually, we harbor issues, however till we sense that many individuals share those self same issues, our sentiments or financial actions might not change. For many individuals, the second of fact for Joe Biden was his dreadful debate, through which thousands and thousands of Biden supporters and the media acknowledged that Biden was not match to be President for an additional time period. In Hunt’s phrases:

That’s the second the place all of us noticed what all of us noticed that Joe Biden shouldn’t be mentally competent to be President of the USA.

To raised respect frequent information, we share the excerpt under.

Just about everybody in Hollywood knew that Harvey Weinstein was a rapist and a extremely dangerous man, together with his spouse and his enterprise companions and all of the actors who wished a task in one among his motion pictures. It was widespread non-public information, verging on public information. I imply, in the event you’re making jokes about it on 30 Rock, it’s on the market.

But it surely didn’t matter that everybody in Hollywood knew that Harvey Weinstein was a rapist. Nobody’s conduct modified. Nobody shunned the man. No actor turned down a task. No politician turned down a donation. His spouse didn’t depart him, and his enterprise companions simply upped the D&O insurance coverage and paid out settlements.

All of them knew, and I’m certain they cared just a little and shook their heads in a tsk-tsk type of manner, however they didn’t care sufficient to alter their transactional relationships with Harvey Weinstein. As a result of that’s the factor about non-public info, irrespective of how widespread. Even when everybody on the planet believes a sure piece of personal info, nobody will alter their conduct. Habits modifications ONLY after we imagine that everybody else believes the knowledge. THAT’S what modifications conduct.

Latest occasions, like vital inventory market volatility and an sudden leap within the unemployment fee, may be the second frequent information turns into evident to the lots. In an financial sense, it would happen after we understand that we’re not alone in harboring issues concerning the financial system. Once you verify your fears are frequent, you usually tend to spend much less, perhaps go for McDonald’s (NYSE:) over a fancier restaurant.

As we led, it doesn’t take a lot of a change in confidence to tip an financial system from operating on all cylinders to a recession.

Abstract

The market occasions of the previous couple of days, coupled with a weak employment report, might weigh on confidence. However will it’s sufficient to change consumption habits? We can pay shut consideration to the following set of financial knowledge to see if current market occasions are altering consumption patterns.