da-kuk

Abstract

Readers could discover my earlier protection through this hyperlink. My earlier score was a maintain, as I believed Cohu (NASDAQ:COHU) valuation was low cost. Nonetheless, valuation has since fallen by round 2x to the present ranges. Together with the newest 2Q23 information which supplied me with clear visibility to FY24/25 development, I imagine the valuation is comparatively cheaper at the moment. Therefore, I’m upgrading to a purchase score as I anticipate COHU to see accelerating development over the subsequent 2 years, simply because it has carried out in previous cycles.

Financials/Valuation

The 22% drop in income that COHU reported for 2Q23 to $169 million was consistent with expectations. In it, Techniques income was down 33% to $88 million, whereas recurring income of $81 million was down 5%. The corporate’s non-GAAP gross margin elevated by 130bps, reaching 47.8%. Adjusted EBITDA margin got here in at 19.7%, or $33.3 million. At $0.48, non-GAAP EPS was 9 p.c larger than anticipated.

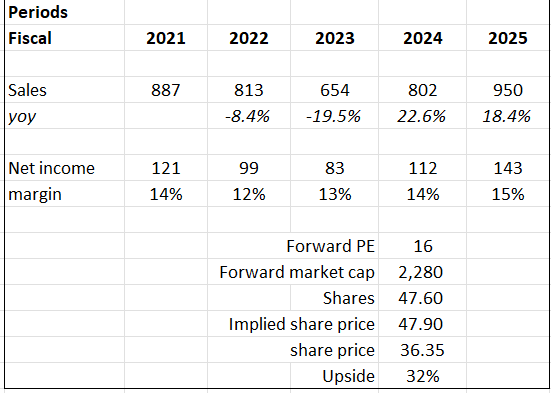

Based mostly on writer’s personal math

Based mostly on my view of the enterprise, COHU ought to be capable of develop at a gradual tempo over the subsequent 2 years because the upcycle begins. Based mostly on historic cycles, I anticipate COHU to see an analogous price of 40+% development from the trough in FY23. This sturdy development ought to come along with elevated margins as recurring income turns into a bigger a part of the combination. Gross margin growth, as evident within the efficiency thus far, ought to assist with web margin growth as properly. Not like beforehand, the place it was buying and selling at 18x ahead PE (above the usual deviation vary), the valuation isn’t comparatively cheaper at 16x. Additionally in contrast to my earlier put up in July, with the 2Q23 up to date information, I see a clearer path to development acceleration in FY24. Therefore, I imagine the market will proceed to worth on the present 16x a number of within the close to time period.

Feedback

Regardless of the 18% drop following earnings, I nonetheless suppose the 2Q23 outcomes are optimistic and warrant a purchase. The headline numbers had been unfavorable (when in comparison with the earlier yr), however I don’t imagine they precisely signify the state of affairs. Beforehand, I mentioned COHU’s sturdy demand, noting that the corporate’s recurring income has grown for 4 consecutive quarters. Regardless of the tough surroundings within the semiconductor trade, 2Q23 nonetheless managed to develop by 6% quarter over quarter. The recurring enterprise additionally continues to signify an even bigger a part of the income combine (from 35% in 2Q21 to 48% in 2Q23). Will increase within the proportion of recurring income streams contribute to monetary stability, a stronger free money stream era, and a better price of return to shareholders. As well as, demand-driven sequential order development is anticipated as companies anticipate a pick-up in spending from purchasers with ties to the Automotive and Industrial sectors. Most significantly, as I discussed in a earlier put up, COHU delivered a non-GAAP gross margin of 47.8% in 2Q23, 80bps above steerage regardless of the unsure market circumstances.

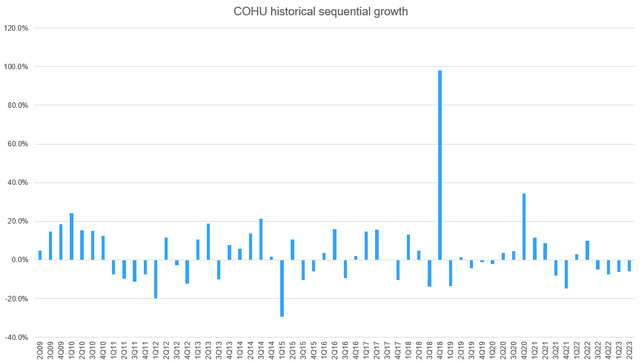

Trying forward, I anticipate the restoration in FY24 (or FY25) to be a robust one, as COHU is now within the 4th quarter of sequential unfavorable development. Based mostly on earlier cycles, COHU has solely seen such development charges in 2011 and 1Q23, the place thereafter income soared from a low of $200 million to $333 million in FY14, an nearly 50% development price. I anticipate this to occur within the subsequent two years.

Based mostly on writer’s personal math

Accordingly, I imagine COHU is at the moment executing very properly, and the corporate could have reached a backside. Nonetheless, I imagine it’s also truthful to say that there are rising warning indicators that should be watched. Regardless of my optimism relating to the restoration of the Automotive and Industrial markets, the mixed gross sales from these segments fell by 9% within the 2Q23 (after falling by 12% within the first quarter) to $52 million. Clients within the Mobility phase additionally proceed to carry again on their spending, with 2Q23 Mobility income falling 43% sequentially and 71% year-over-year. It is doable that this excessive weak spot alerts a bottoming, however given the low tester utilization charges, it is laborious to say when or by how a lot the cycle will recuperate.

Conclusion

COHU continues to exhibit sturdy efficiency, and I upgraded my score to purchase with optimism for the subsequent two years. Regardless of a 22% drop in 2Q23 income, the corporate’s non-GAAP gross margin elevated by 130bps to achieve 47.8%, and adjusted EBITDA margin stood at 19.7%. Non-GAAP EPS exceeded expectations at $0.48, reflecting resilience in difficult market circumstances. I anticipate regular development over the subsequent two years because the trade upcycle beneficial properties momentum, mirroring historic cycles with 40+% development charges. The increasing recurring income phase and bettering gross margins contribute to this optimistic outlook. Nonetheless, warning is warranted, as some segments, comparable to Automotive and Industrial, have confronted declines. COHU’s efficiency is carefully linked to tester utilization charges, and the timing and extent of restoration in these segments stay unsure.