The shift from bodily to digital funds has created a large divide within the U.S. economic system – whereas customers routinely faucet their telephones to purchase espresso, dealerships promoting $50,000 automobiles nonetheless wait days for wire transfers to clear or watch clients stroll out to retrieve cashier’s checks. This friction in high-ticket transactions prices retailers billions in misplaced gross sales and processing charges yearly, with auto sellers alone paying as much as 3% on card transactions whereas going through chargebacks that may wipe out total revenue margins. Clerq bridges this hole with an account-to-account funds platform particularly engineered for high-ticket retailers, enabling prompt financial institution transfers that mix the comfort of Venmo with the safety and economics required for 5 and six-figure purchases. The platform has already achieved 6x income progress over the previous yr whereas processing lots of of thousands and thousands of {dollars} for Fortune 500 retailers and main dealership teams together with Friedkin Automotive. By chopping cost charges by 75% in comparison with playing cards whereas eliminating the days-long settlement delays of conventional ACH, Clerq is positioned to turn out to be a dominant participant within the $3T in annual high-ticket cost quantity throughout automotive, powersports, and gear verticals.

AlleyWatch sat down with Clerq Co-CEO and Cofounder Ben Markowitz to be taught extra in regards to the enterprise, the corporate’s strategic growth plans, current $12M funding spherical that brings the entire funding raised to $21M, and far, far more…

Who have been your buyers and the way a lot did you elevate?

Clerq raised a $12M Collection A spherical led by 645 Ventures, with participation from present buyers FirstMark Capital, Fika Ventures, Commerce Ventures, and Sprint Fund. The Collection A additionally included new strategic participation from Friedkin and Yossi Levi, founding father of Automobile Dealership Man. Clerq has raised $21 million since inception.

Inform us in regards to the services or products that Clerq affords.

Clerq is an account-to-account funds platform for high-ticket retailers.

What impressed the beginning of Clerq?

Truett Dwyer (cofounder) and I have been buyers in Fintech and Funds previous to beginning Clerq and noticed how card-first incumbents weren’t assembly the wants of high-ticket, margin-sensitive companies. The dimensions and seemingly intractable nature of this downside impressed us to start out Clerq.

How is Clerq totally different?

Clerq is purpose-built to fulfill the wants of its goal retailers, beginning with auto, powersports, and gear (and extra lately house & workplace and personal journey). Our core funds product and threat administration are tailor-made to those high-ticket industries.

Clerq has additionally centered on constructing out vertical-specific integrations and workflows, in contrast to most horizontal cost processors.

What market does Clerq goal and the way huge is it?

Clerq began with the $1T+ U.S. auto vertical, the place it’s already powering funds for a number of of probably the most acknowledged manufacturers within the trade. With confirmed traction, the corporate has expanded into high-growth adjacencies together with, however not restricted to, powersports, house & workplace, and personal journey. In whole, the high-ticket verticals we give attention to symbolize $3T+ of cost quantity.

What’s your corporation mannequin?

We primarily cost a percentage-based payment on processed quantity.

How are you getting ready for a possible financial slowdown?

Given the huge secular progress alternative that now we have in entrance of us and our sturdy capital place, we’re primarily centered on capturing market share. We’re not centered on macro enterprise cycles proper now.

What was the funding course of like?

We have been excited to fulfill 645 Ventures by means of one among our present buyers. We love how free-thinking they’re and the way supportive they’re of their portfolio corporations.

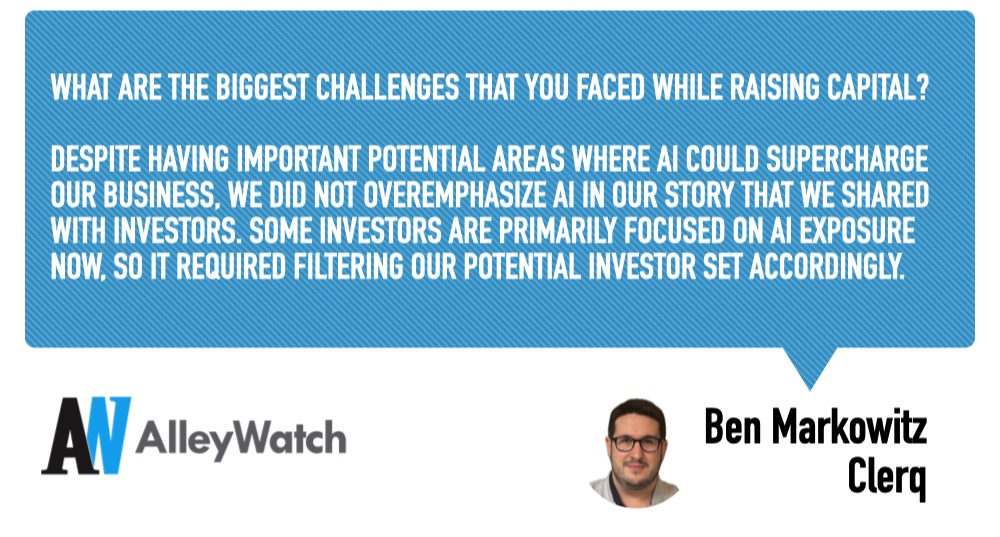

What are the largest challenges that you simply confronted whereas elevating capital?

Regardless of having essential potential areas the place AI may supercharge our enterprise, we didn’t overemphasize AI in our story that we shared with buyers. Some buyers are primarily centered on AI publicity now, so it required filtering our potential investor set accordingly.

What elements about your corporation led your buyers to write down the test?

From Nnamdi Okike @ 645 Ventures – “At 645, we put money into founders who’ve purity of motivation and deep insights into their clients and markets. Whereas many corporations goal to introduce new cost strategies into present industries, usually unsuccessfully, Truett and Ben developed a deep understanding of the cost challenges of automotive dealerships and developed a product that has been a game-changer for each sellers and their finish clients. We’re excited to accomplice with them as they scale this platform inside the automotive trade and into new industries, driving significant account share and creating important worth for his or her clients.”

What are the milestones you intend to attain within the subsequent six months?

We’ve signed a number of, giant enterprise contracts in our core verticals. We’re centered on rolling these out and persevering with to seize market share.

The place do you see the corporate going now over the close to time period?

We see Clerq changing into the dominant different funds platform in auto and powersports and increasing into further verticals.

What’s your favourite fall vacation spot in and across the metropolis?

The Hudson Valley is gorgeous within the fall. Taking Amtrak up the Hudson is by far the nicest practice experience in New York!