undefined undefined/iStock through Getty Photographs

I started protection of ClearPoint Neuro (NASDAQ:CLPT) in July of 2022 with a “purchase” score (although noting that the “present valuation is not compelling) and reiterated that verdict in January of this 12 months. The inventory has continued to commerce down, however as I clarify in at the moment’s article, I nonetheless consider that the inventory will repay in the long run.

The poor efficiency thus far mirrors that of most small cap biotech shares over that timeframe; and through the latest earnings name, the corporate talked about three elements which have particularly been unexpectedly worse than initially forecast (with my emphasis):

During the last couple of years, we have now seen each the chance and the need to reinforce our technique in gentle of dramatic modifications to the price of capital, provide chain constraints and quantity of elective procedures. These strategic changes have included increasing preclinical providers and capabilities for our pharma companions, coming into the therapeutic machine market with the Prism Laser Remedy System, and evolving our navigation platform past the MRI and into the working room.

Whereas the primary issue is prone to be operative going ahead, there’s anecdotal proof supplied throughout many corporations’ earnings calls that offer chains are slowly normalizing. And it is unlikely that elective procedures might be postpone indefinitely, so I personally consider we’ll finally see a return to pre Covid numbers on that entrance as properly.

ClearPoint Neuro

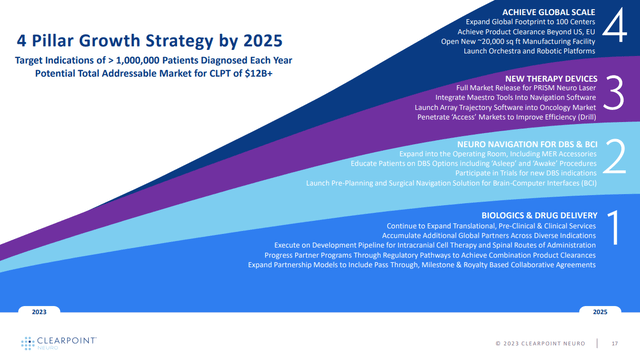

As I’ve mentioned beforehand, CLPT has a “4 pillar” technique to convert its core competencies into commercially viable merchandise.

As outlined within the slide beneath, these encompass:

- Biologics and Drug Supply

- Navigation to Help Deep Mind Stimulation and Mind-Pc Interfaces (suppose Elon Musk’s Neuralink with out all of the hype)

- Neuro Laser and different new therapies

- Increase gadgets 1 to three globally

Investor presentation

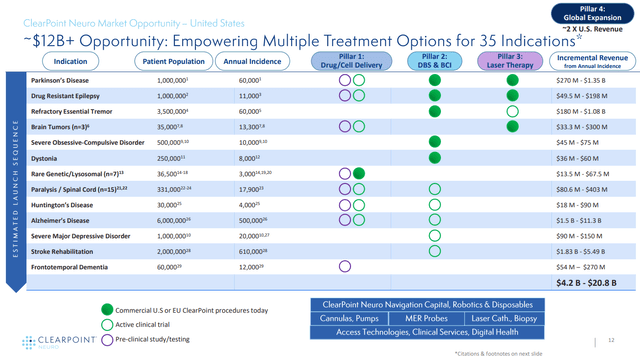

This slide identifies (a few of) the goal markets for every “pillar” in addition to giving the standing of scientific progress in every. As could be seen, the primary three pillars have exercise starting from pre-clinical testing by to regulatory and commercially approved procedures; and not less than by that metric, the corporate has been making continued progress in growing its technique.

Investor presentation

Razors / Razorblades

To me not less than, the great thing about CLPT’s strategy is that it’s constructed on a mannequin by which revenues are largely generated from the sale of disposables. That’s, as soon as a CLPT piece of apparatus or approach has been accepted as half of a bigger FDA approval, there are persevering with revenues from disposables utilized in each process. And the moat for these persevering with revenues is the FDA approval itself (which particularly consists of the CLPT product, not some generic product class). See my earlier articles for an elaboration of this thesis.

On the earnings name, the corporate up to date its rollout of regional websites that do or will characteristic CLPT gear. The numbers look good for continued income enlargement and money move positivity by the tip of 2025 (run fee). With my emphasis:

[O]ur purposeful neurosurgery navigation enterprise added new websites to our put in base within the quarter and we proceed to count on greater than 10 website installations in 2023. That is maintaining us on tempo to attain an put in base objective of 100 particular person prospects by the tip of 2025. As a reminder, our technique is to not set up ClearPoint at each native hospital however quite deal with these sufferers with persistent circumstances at regional remedy facilities that benefit from scale and expertise. Simply 100 facilities doing two procedures per week may probably ship $100 million in income to the corporate. At current, we have now greater than 50 hospitals energetic in our acquisition funnel, which means we’d like only a 20% closure fee this 12 months to attain our 2023 objective.

Shifting into Pre Scientific Work and Milestone-Based mostly Partnerships

As its been working with scientific companions, CLPT has realized that it could present worth in pre-clinical work as properly. Not solely does this present earlier revenues, however extra importantly, it secures CLPT’s involvement from the very get-go of latest therapies and approaches. The corporate elaborated on this facet throughout its earnings name (with my emphasis):

Importantly, our extension into preclinical providers has reworked our relationship and length of partnership, permitting us to work alongside pharma properly earlier than the primary affected person is enrolled. Now we have now signed our first milestone based mostly settlement with a pharma companion whereby ClearPoint is ready to share inside the success of necessary improvement and regulatory milestones with the drug sponsor. We count on this deal to turn out to be the blueprint for future agreements with our pharma companions and permit us to kind extra inventive and complex strategies of collaboration that higher worth the distinctive help that we consider we provide in drug improvement.

The primary such deal was introduced with companion UCB (OTCPK:UCBJY), a Belgian biopharmaceutical with 8,400 workers and an EV of $18.8B.

This is a abstract of this deal introduced on Might twenty fourth (once more with my emphasis):

[CLPT] introduced that it has entered right into a multi-year license settlement with UCB (EURONEXT BRUSSELS: UCB), a world biopharmaceutical chief, to companion on drug supply platforms for UCB’s gene remedy portfolio.

“We’re extraordinarily excited to companion with UCB, a world biopharmaceutical chief, with a concentrate on innovating by the adoption of subsequent technology science and new applied sciences,” said Jeremy Stigall, Govt Vice President and Common Supervisor of Biologics and Drug Supply at ClearPoint Neuro. “Over the previous 12 months, we have now invested closely in increasing our Biologics and Drug Supply staff, in addition to our product and providers portfolio to draw companions of UCB’s caliber. UCB sought complete instruments to empower a seamless transition from benchtop testing to business success, and that’s exactly what our staff can ship at the moment.”

Below the phrases of the license settlement, UCB will make the most of ClearPoint Neuro’s proprietary expertise and providers in reference to the event and commercialization of UCB’s gene remedy merchandise. ClearPoint Neuro will obtain success-based milestone funds.

Hopefully, that is the primary of many such offers!

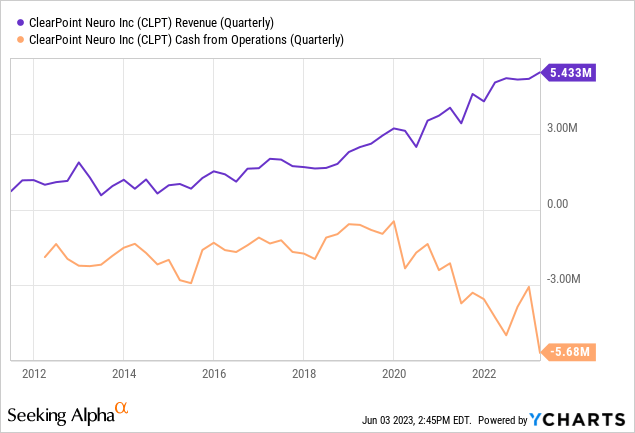

Monetary Efficiency

Whereas CLPT has been steadily rising its revenues, it has additionally been burning more money in its operations. This after all is not good, however I reduce the corporate some slack as a consequence of its enlargement on a number of fronts (see dialogue of 4 pillars above) in addition to the harder post-Covid surroundings. Nonetheless, I will not be upping my “Purchase” score to “Robust Purchase” till we see money move from operations strategy breakeven or higher.

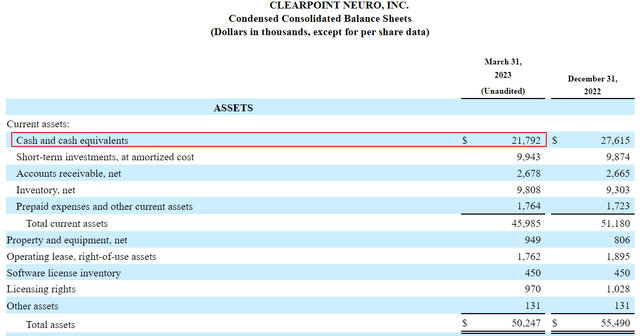

Money on Hand and Money Burn

The corporate at present has about $21M in money readily available. On condition that it is burning greater than $5M per quarter (utilizing the most recent quarter’s run fee), there is a good probability the corporate might want to elevate cash within the subsequent six months or so. I will not be including to my place till the money place is improved.

sec.gov

The corporate itself is a bit more sanguine on this subject, however I want to be conservative with regards to money readily available. From the most recent earnings name (my emphasis):

From a money standpoint, we proceed to carry out in step with our expectations with greater than $30 million in money and equivalents on the finish of the quarter, primarily in brief time period US treasuries. We really feel like we have now the overwhelming majority of our staff already in place to attain operational money breakeven and count on future hiring to be centered on scalable personnel in operations and scientific specialists. Though, we have now allowed our stock and pay as you go bills to develop so as to navigate provide chain challenges, as these provide dangers begin to wane, we count on to convey down that stock degree to extra historic days on fingers targets and additional scale back our operational burn. We consider that as we strategy the tip of 2023 and transfer into 2024, we plan to hit an inflection level and count on to see gross sales development outpace expense development, particularly when the brand new facility is up and operating in 2024.

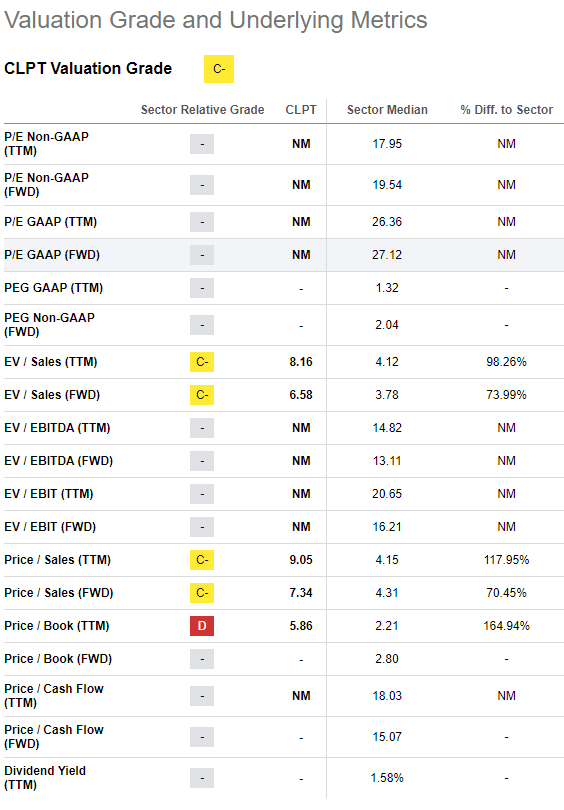

Valuation

As a improvement stage firm, CLPT does not but have many significant metrics, however right here is the valuation abstract supplied by Searching for Alpha only for thoroughness (with the inventory buying and selling at $7.77):

Searching for Alpha

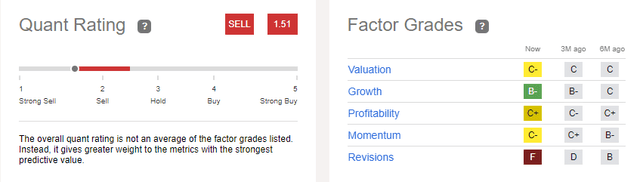

Quant Scores

Equally, listed here are Searching for Alpha’s quant score and issue grades, each of which can tackle extra significance as soon as the corporate’s business actions have progressed to succeed in money move breakeven.

Searching for Alpha

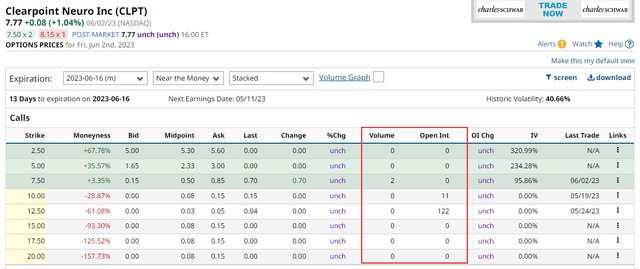

Choices

CLPT trades choices, however at present they’re fairly illiquid. Nevertheless it is good to find out about them in case there’s ever a brief time period spike in worth which may then be used to write down coated calls towards one’s place (which I’ve accomplished now and again).

BigCharts

Dangers

CLPT is a improvement stage firm which will by no means turn out to be worthwhile, therefore any place within the firm must be commensurate with a speculative scenario.

The larger threat, nevertheless, is that even when the corporate finally turns into worthwhile, the variety of money raises, and therefore stockholder dilution, could stop present homeowners from ever benefiting financially from profitability. I, for one, will not be including to my small place till the corporate has each 18 months of money readily available and a money burn approaching zero.

Abstract

CLPT has made progress on all 4 pillars of its technique regardless of a harder working surroundings. The variety of companions and hospital websites that includes its gear continues to develop, feeding the razorblade mannequin. Furthermore, the corporate is now working with massive biopharmaceuticals from very early pre-clinical levels, as evidenced by the current take care of UCB.

The draw back, nevertheless, is that the corporate is operating low on money, whereas its money burn has elevated regardless of rising revenues. I will not be including to my place, nor up-rating my suggestion to “Robust Purchase” till the money and money burn points are clearly behind the corporate.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.