Just_Super/iStock by way of Getty Photographs

By Garey J. Aitken, CFA & Timothy W. Caulfield, CFA

Falling Yields Spark Canadian Inventory Surge

Market Overview

Following a subdued second quarter, the S&P/TSX Composite Whole Return Index (‘TRI’) surged 10.5% in Canadian {dollars} within the third quarter to achieve new all-time highs. The third-quarter advance marked the strongest absolute return quarter for Canadian equities because the 17.0% rebound within the second quarter of 2020, instantly following the COVID-related selloff earlier that 12 months. The S&P/TSX Composite TRI has superior 17.2% 12 months thus far and 26.7% during the last 12 months — heady returns for a market posting meek working earnings development, albeit with strong market expectations for double-digit earnings development in 2025. Canadian equities additionally outperformed the S&P 500 Index’s (SP500, SPX) advance of 4.6% within the third quarter (in Canadian {dollars}) — the primary time the benchmark S&P/TSX Composite has outperformed the S&P 500 in seven quarters.

Serving to propel fairness markets to new heights was a significant drop in benchmark 10-year rates of interest in Canada and the U.S., ending the second quarter at 2.96% and three.78%, respectively. Rates of interest now sit properly under their respective 4.24% and 4.99% October 2023 highs. The decline in rates of interest, and subsequent low cost charges, has direct optimistic implications for fairness valuations, all else equal. The U.S. Federal Reserve formally launched into their new rate-cutting cycle with a 50 foundation level lower in September following the Financial institution of Canada’s third 25 bps reduce since June. For the BoC, a much less strong economic system in Canada relative to the U.S. and a extra extremely indebted house owner going through pending mortgage price renewals has contributed to its dovish coverage stance.

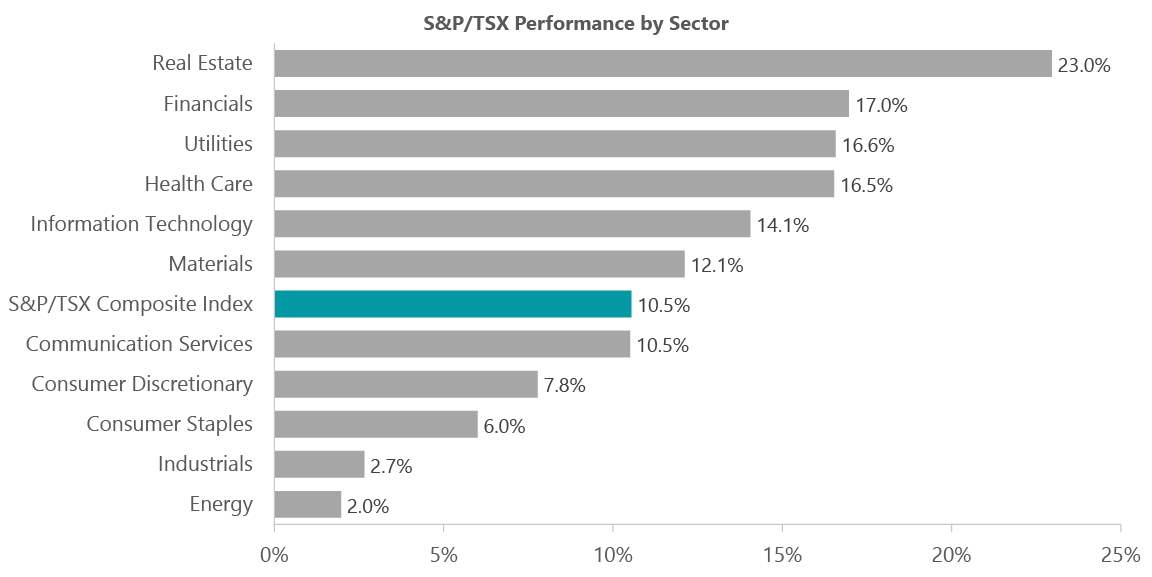

Declining rates of interest undoubtedly performed a job within the divergence between sector returns within the third quarter, with extra rate of interest delicate and higher-yielding equities typically shining by. All 11 GICS sectors in Canada superior, with seven of them posting double-digit returns. Actual property, utilities and financials had been the three top-performing sectors, whereas the extra defensive client staples, together with the extra cyclically oriented industrials and vitality sectors, posted the weakest returns.

Exhibit 1: Fee-Delicate Sectors Led Third-Quarter Rally

Notice: Whole Return. Knowledge as of Sept. 30, 2024. Supply: FactSet.

The Canadian info expertise sector was robust, regardless of missing the generative synthetic intelligence (GenAI) enablers of the U.S. fairness market — as Canadian sector heavyweight Shopify (SHOP) superior practically 20% with bettering investor sentiment. With power in gold and copper costs, the supplies sector was additionally a double-digit advancer. Gold was the standout, with the gold sub-industry within the benchmark advancing over 17% within the quarter. The gold sub-industry now accounts for a 7.5% weight within the broader benchmark. Gold bullion gained 12.7% for the quarter to US$2,636/oz (COMEX) and copper superior 3.7% to complete at US$4.55/lb (COMEX).

Shopper staples sector noticed muted returns in a robust market atmosphere, together with sector heavyweight and Technique holding Alimentation Couche-Tard (OTCPK:ANCTF) declining following its introduced proposal to embark upon an acquisition of Japanese comfort retailer operator Seven & i Holdings (OTCPK:SVNDY). In industrials, share worth weak point was extra widespread, with considerations surrounding weaker financial circumstances having a extra fast influence on profitability within the close to time period. In vitality, crude oil costs continued their slide within the third quarter, ending down 16.4% to US$68.17/bbl (West Texas Intermediate). The numerous bifurcation in North American pure gasoline costs remained, with NYMEX pure gasoline costs growing 12.4% to US$2.92/mmbtu (NYMEX) whereas native Alberta (AECO) costs continued to languish. Noteworthy for the Canadian vitality sector, the long-awaited Trans Mountain pipeline growth is now on-line, and with LNG Canada anticipated to begin exporting liquefied pure gasoline in 2025, prospects have improved for regional crude oil and pure gasoline costs in Western Canada.

Efficiency Overview

Regardless of posting robust absolute returns, the ClearBridge Canadian Fairness Technique underperformed the benchmark within the third quarter. Probably the most important relative detractors from efficiency included our underweight positioning within the outperforming financials sector, our obese place within the underperforming client staples sector, our obese positioning and poor safety choice within the underperforming industrials sector, in addition to poor safety choice within the vitality sector. Moreover, regardless of proudly owning a small place within the outperforming Shopify, our giant underweight positioning in IT detracted from efficiency.

A brilliant spot for efficiency included an obese and robust safety choice within the outperforming utilities sector. Whereas a better rate of interest atmosphere had been weighing on sentiment for such securities, decrease benchmark rates of interest and predictable money flows helped push the sector meaningfully greater within the third quarter. In financials, a resurgent quarter for banks and insurers helped the sector within the benchmark submit a 17.0% return, its finest quarter because the World Monetary Disaster. Canadian Imperial Financial institution of Commerce (CM) was a significant detractor given our underweight place within the outperforming financial institution. Our comparatively small place within the inventory was eradicated on power through the quarter. In client staples, each Alimentation Couche-Tard and Saputo (OTCPK:SAPIF) had been weak, meaningfully detracting from efficiency.

“The S&P/TSX has superior 26.7% during the last 12 months – heady returns for a market posting meek working earnings development, albeit with strong earnings expectations for 2025.”

In industrials, weak point was typically widespread; nevertheless, Boyd Group Providers (OTCPK:BYDGF), AtkinsRealis Group (OTCPK:SNCAF) and Telus Digital (TIXT) — previously Telus Worldwide — had been notable detractors. Shares of Boyd, a supplier of auto collision restore companies, remained underneath strain with weak second-quarter outcomes, pushed by gentle winter driving circumstances resulting in fewer accidents in addition to many customers deferring repairs, opting to keep away from the rising prices of deductibles and potential insurance coverage premium will increase. Although we see these impacts as largely transitory, a swift restoration in {industry} exercise is unlikely. We stay assured within the firm’s long-term prospects and talent to compound worth by growing retailer counts and tendencies favoring bigger collision restore companies, and added to our place through the quarter.

In the meantime, Telus Digital shares had been significantly weak given the mixture of tightening shopper IT budgets in addition to aggressive pricing pressures for its companies. Having traditionally sought to take care of greater margins, the corporate has just lately conceded on pricing to win extra enterprise. Telus Digital continues to have robust free money circulation conversion and performs a significant function to the digital transformation of its mum or dad and majority shareholder, Telus. Whereas our estimate of the corporate’s intrinsic worth has been revised decrease, we nonetheless imagine it represents a robust danger/reward and we’ve been including to the place.

In vitality, just a few names contributed to weak safety choice, together with Parex Assets (OTCPK:PARXF), Headwater Exploration (OTCPK:CDDRF) and ARC Assets (OTCPK:AETUF). Parex delivered weak second-quarter outcomes, reflecting disappointing manufacturing ranges at Arauca — a main development vector for the corporate. A fabric revision to steering has resulted in intense share worth strain regardless of the worth of the enterprise being supported by its present manufacturing, reserve worth and a clear steadiness sheet. Enhancing its valuation will rely upon administration’s potential to regain confidence and execute on its revised plan, which entails extra of a concentrate on lower-risk improvement drilling and fewer exploration capital.

Portfolio Positioning

Buying and selling exercise within the third quarter of 2024 was broad-based with shopping for centered round extra out-of-favor cyclical names together with Headwater, Canadian Nationwide Railway (CNI), Financial institution of Montreal (BMO) and Toronto-Dominion Financial institution (TD). Additions included two new holdings within the quarter, ATS in industrials and iA Monetary (OTCPK:IAFNF) in financials.

We used a latest slowdown in EV gross sales that pressured the share worth to provoke a place in ATS. The corporate is a worldwide chief in offering superior automation options to prospects throughout key industries reminiscent of life sciences, EVs, meals and beverage, and client merchandise. With its deep experience and world capabilities, ATS addresses complicated manufacturing wants in sectors with excessive limitations to entry. The corporate has delivered spectacular efficiency over the previous 5 years, pushed by robust natural development, margin growth and strategic M&A. Regardless of near-term headwinds, its robust backlog in much less cyclical markets gives stable long-term development potential. Moreover, ATS is well-positioned to learn from broader tendencies like provide chain close to shoring and automation as an answer to labor shortages, whereas ongoing margin growth and M&A exercise provide additional upside. We imagine the corporate’s latest bookings success and bettering outlook outweigh the considerations traders have concerning the tempo of EV adoption.

“Underperforming when momentum and potential are driving animal spirits, after which outperforming when the market is extra consumed with danger, exemplifies the essence of the Technique.”

iA Monetary is the smallest publicly traded Canadian life insurance coverage firm, offering life and medical health insurance merchandise, financial savings and retirement plans, mutual and segregated funds and different monetary merchandise. It’s an incumbent in Canada’s concentrated life insurance coverage {industry}, with area of interest concentrate on the mid-market (a high-margin enterprise relative to different life insurance coverage segments) with a distinctly giant distribution community for its dimension. This community additionally advantages the wealth administration aspect of the enterprise, as it’s the primary vendor of segregated funds in Canada. Within the U.S., iA has expanded its footprint each organically and thru acquisition. The corporate’s natural annual capital era aids its extra capital place, permitting deployment by a steadily growing dividend and buybacks.

Transactions additionally included trimming choose holdings on power together with just a few defensive/extra interest-rate delicate holdings — Enbridge (ENB), Agnico Eagle Mines (AEM), Dollarama (OTCPK:DLMAF), Loblaw (OTCPK:LBLCF), Manulife Monetary (MFC) and Colliers Worldwide Group (CIGI). We eradicated three positions within the quarter: Wheaton Treasured Metals (WPM) in supplies in addition to Canadian Imperial Financial institution of Commerce (CM) and Solar Life Monetary (SLF) in financials.

At quarter finish, the Technique’s largest sector exposures had been financials, industrials, vitality and utilities. Relative to the benchmark, the Technique is obese the widely defensive/non-cyclical client staples and utilities sectors, in addition to industrials. The Technique is most underweight the usually worth/cyclically oriented financials, supplies and vitality sectors.

Outlook

Following two years of tougher relative efficiency for the ClearBridge Canadian Fairness Technique, we offer perspective on our latest efficiency, funding strategy, key components of our efficiency goals, in addition to anticipated efficiency profile. Extra particularly, over the trailing two-year interval the Technique has notably underperformed the S&P/TSX Composite TRI by about 250 bps, annualized (gross of charges), and 290 bps (web of charges) a disappointing end result. Nonetheless, zoom out one further 12 months to seize the trailing three-year interval and the Technique is forward of the benchmark by an equal magnitude, a robust end result that the truth is exceeds our relative efficiency goals detailed under.

Given the stark distinction between two- and three-year efficiency, this era serves as a useful illustration of the makings of our efficiency profile over time. Our funding type together with our efficiency goals can are inclined to lead to distinctive efficiency patterns relying in the marketplace’s course. As an example, previously 24 months, the Canadian fairness market superior at an thrilling 17.8% per 12 months whereas the Technique superior 15.3% per 12 months (gross of charges) and 14.9% (web of charges). Within the 12-month interval previous to that, the market declined 5.4% whereas the Technique superior 5.7% (gross of charges) and 5.3% (web of charges). Taken in mixture, the Technique has outperformed by about 240 bps annualized (gross of charges) and 200 bps (web of charges) over the three-year interval, reflecting the facility of draw back safety — a product of our funding strategy that manifests in our distinctive efficiency profile over time.

Our focus is on proudly owning high-quality companies the place we imagine danger is being discounted into the share worth, the place we’ve good visibility to future excessive profitability that permits us to successfully handicap danger/reward, stable secular development prospects and efficient capital allocation that reinforces our thesis. We’re in the hunt for the perfect danger/reward relationships we will discover, whereas remaining conscious of focus/diversification issues or unintended correlations inside the portfolio. In flip, our efficiency goals replicate what our purchasers can count on from us over time, incorporating 4 distinct components — absolute returns, relative returns, danger and risk-adjusted returns.

Absolute returns are initially, and it needs to be famous that we’re greater than glad to see the Technique advance 15.3% yearly over the previous two years, even when it wasn’t maintaining with the Joneses. These returns replicate the shopper being compensated for the chance inherent in fairness investing, with our particular goal to exceed the fairness price of capital. Concerning relative returns, we attempt to supply 200+ bps of extra annual return past the benchmark, a degree that we imagine will stay aggressive within the market going ahead. As for danger, our main goal relates again to making sure we produce satisfactory absolute returns whereas sustaining a volatility profile for the Technique that’s lower than that of the benchmark. Lastly, we’ve a beta goal of 0.8 to 0.9. It is a defining factor of our strategy, combining to focus on extra returns whereas concurrently assuming much less danger/volatility than the benchmark — concluding in our fourth and supreme risk-adjusted return goal that may be quantified as 300+ bps of alpha, annualized.

Whereas our efficiency profile is extra intuitive when factoring within the numerous components of our funding strategy and efficiency goals, markets are unpredictable. The vagaries of fairness markets and distinctive components of any market cycle may end up in the Technique outperforming the benchmark in sure stronger environments and vice versa, however our funding strategy and efficiency goals stay constant. Over this specific trailing three-year interval, the expertise of underperforming when cash is flowing freely and momentum and potential are driving animal spirits, after which outperforming when the market is extra consumed with danger, exemplifies the essence of the Technique.

With superior predictability and draw back safety obtainable at an affordable worth, we proceed to understand and emphasize the extra defensive posturing of the Technique. Our positioning can present ballast in tougher fairness market environments, permits the Technique to energy forward with predictable development, and serves as dry powder when higher danger/reward alternatives come up. With this strategy, the ClearBridge Canadian Fairness Technique has efficiently navigated numerous market circumstances characterised by each robust and weak sentiment, in addition to shifts in sector management and financial landscapes, for greater than 40 years. Our bottom-up technique prioritizes figuring out and capitalizing on market inefficiencies. We’ll seize on alternatives as they come up, looking for to construct on our monitor document of delivering superior absolute, relative and risk-adjusted returns over the long run.

Portfolio Highlights

Through the third quarter, the ClearBridge Canadian Fairness Technique underperformed its S&P/TSX benchmark. On an absolute foundation, the Technique generated positive aspects in eight of the ten sectors through which it was invested (out of 11 complete). The first contributors had been the financials and utilities sectors whereas the primary detractor was the industrials sector.

Relative to the benchmark, sector allocation and safety choice had been each detrimental. Specifically, a sector underweight within the strongly performing financials sector, in addition to an obese to the underperforming client staples sector detracted. Unfavorable inventory choice in industrials and vitality detracted additional. On the optimistic aspect, safety choice in utilities, an obese to utilities and an underweight to vitality contributed to relative efficiency.

On a person inventory foundation, main absolute contributors included Royal Financial institution of Canada (RY), Toronto-Dominion Financial institution (TD), Brookfield Company (BN), Financial institution of Nova Scotia (BNS) and Fortis (FTS). High absolute detractors included Boyd Group Providers, Parex Assets, Cenovus Vitality (CVE), Telus Digital and Headwater Exploration.

Garey J. Aitken, CFA, Head of Canadian Equities

Timothy W. Caulfield, CFA, Dir. Canadian Eq. Analysis

|

Previous efficiency isn’t any assure of future outcomes. Copyright © 2024 ClearBridge Investments. All opinions and information included on this commentary are as of the publication date and are topic to alter. The opinions and views expressed herein are of the writer and should differ from different portfolio managers or the agency as a complete, and aren’t meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. This info shouldn’t be used as the only real foundation to make any funding determination. The statistics have been obtained from sources believed to be dependable, however the accuracy and completeness of this info can’t be assured. Neither ClearBridge Investments, LLC nor its info suppliers are answerable for any damages or losses arising from any use of this info. Efficiency supply: Inner. Benchmark supply: Customary & Poor’s. |

Authentic Publish

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.