haydenbird

The Calamos World Dynamic Revenue Fund (NASDAQ:CHW) is a closed-end fund, or CEF, from Calamos Investments, which admittedly will not be essentially the most well-known fund home amongst buyers. This doesn’t forestall the CHW fund from being a doable supply of earnings for shareholders, as its 11.49% present yield is among the many highest within the trade. Certainly, this can be a very respectable yield for a dynamic earnings fund, that are usually in a position to alter their composition between several types of securities with a purpose to cut back losses throughout rising-rate environments and generate capital good points throughout falling fee environments. This fund takes issues a step additional than most dynamic earnings funds although, because it additionally has the flexibility to incorporate frequent shares and different non-debt devices in its portfolio.

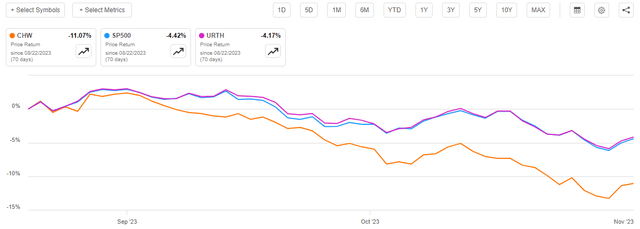

As common readers could recall, we final mentioned this fund in late August 2023. Sadly, the fund’s market efficiency since that point has been very disappointing. As we are able to see right here, the fund’s share value has declined by 11.07%, which is worse than both the S&P 500 Index (SP500) or the MSCI World Index (URTH):

In search of Alpha

It is usually worse than the Vanguard Whole World Bond ETF (BNDW), which is just down 2.02% over the identical interval. Thus, the fund’s general latest efficiency has definitely left lots to be desired. Sadly, the truth that it has the next yield than these indices can not absolutely shut the distinction as buyers who bought shares of the fund on the date that my earlier article was revealed are down 9.50% even after contemplating the distributions paid by the fund.

That is unlucky as there are some issues to love about this fund. Specifically, it helps American buyers clear up one of many greatest issues that they’ve, which is overexposure to the US. As I identified in a latest article, overexposure to the US exposes buyers to a considerable quantity of dangers surrounding the economic system of a single nation. Overexposure to any single nation additionally makes it harder to pursue engaging funding alternatives elsewhere. The Calamos World Dynamic Revenue Fund has the flexibility to put money into property from all world wide, which permits it to resolve each of those issues. Nonetheless, the poor latest efficiency is definitely going to place off potential buyers so we should always have interaction in a considerably deeper investigation of this fund and attempt to decide the causes of this underperformance and the way a lot of an issue they current.

About The Fund

In accordance with the fund’s web site, the Calamos World Dynamic Revenue Fund has the first goal of offering its buyers with a excessive stage of present earnings. That is truly a bit stunning contemplating the technique that the fund employs. As the web site describes,

The Fund seeks to offer a excessive stage of present earnings with a secondary goal of capital appreciation. The Fund has most flexibility to dynamically allocate amongst equities, convertible bonds, fixed-income securities and different investments world wide.

Usually, a fund that has the first goal of offering present earnings will focus its investments on bonds or different debt devices. It’s because debt securities are primarily earnings automobiles because of the easy indisputable fact that they haven’t any internet capital good points over their lifetimes and all funding returns are within the type of direct funds to the shareholders. Widespread shares, however, are whole return automobiles since buyers purchase them each for earnings by way of dividend funds and capital good points that ought to consequence because the issuing firm grows and prospers.

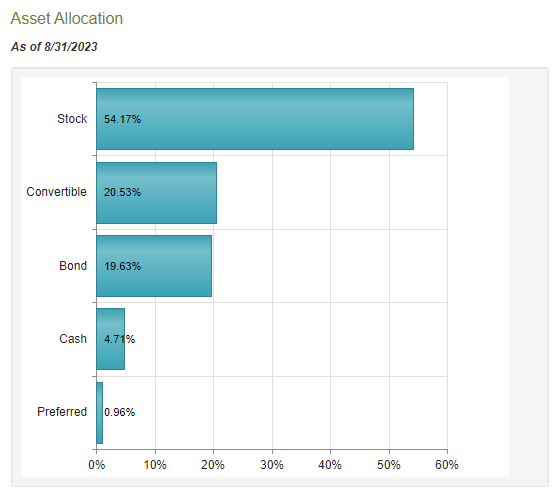

After we contemplate the variations in return profiles, it’s maybe stunning that almost all of the fund’s property are invested in frequent inventory. As we are able to see right here, at the moment 54.17% of the fund’s property are invested in frequent inventory and the rest is invested in a mix of convertible securities, conventional bonds, money, and most well-liked inventory:

CEF Join

This asset allocation appears rather more like a fund that’s looking for whole return, not present earnings. In any case, the frequent shares within the portfolio will present a mix of earnings and capital good points, however admittedly not very a lot earnings.

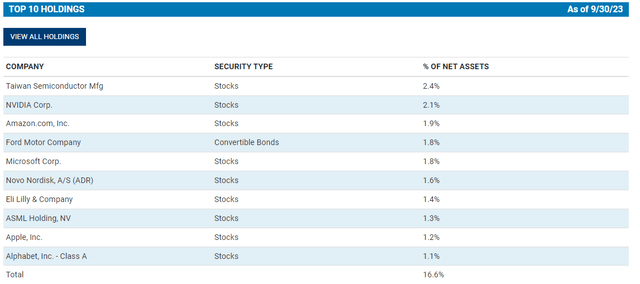

We will see this by wanting on the dividend yields of the biggest shares within the portfolio. Listed below are the biggest positions held by this fund as of the time of writing:

Calamos Investments

Listed below are the present dividend yields of those shares:

|

Firm |

Present Dividend Yield |

|

Taiwan Semiconductor Mfg (TSM) |

2.09% |

|

NVIDIA Corp. (NVDA) |

0.04% |

|

Amazon.com (AMZN) |

0.00% |

|

Microsoft Corp. (MSFT) |

0.89% |

|

Novo Nordisk, A/S (NVO) |

0.91% |

|

Eli Lilly & Co. (LLY) |

0.82% |

|

ASML Holding, NV (ASML) |

1.05% |

|

Apple, Inc. (AAPL) |

0.56% |

|

Alphabet (GOOGL) |

0.00% |

The Ford (F) place is a convertible bond, so its yield might be comparatively first rate. We will clearly see although that all the things else within the top-ten holdings listing has a decrease yield than a cash market fund proper now. In brief, if this fund needed present earnings, it could be higher off simply promoting all of those shares and placing the cash into two-year U.S. Treasuries. With that stated, a couple of of those shares have delivered some fairly good good points year-to-date and the fund may promote a few of its positions and understand capital good points. That’s not present earnings although, it’s present good points. There’s a very huge distinction as a result of present earnings particularly refers to whole funding earnings and internet funding earnings in a fund’s monetary report. Capital good points aren’t included in funding earnings.

With that stated buyers could probably not care very a lot whether or not the fund is acquiring the cash that it pays out to the buyers via dividends, curiosity, or capital good points.

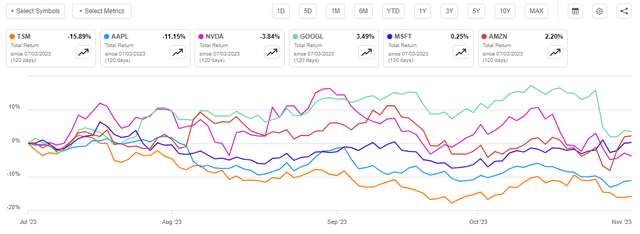

The fund’s largest holdings made a number of sense throughout the first half of the 12 months. In any case, that was a interval of nice optimism for the market. Many market individuals had been broadly anticipating that the Federal Reserve would quickly pivot with respect to financial coverage and begin reducing charges. Consequently, they had been keen to pay for long-duration property that will take a few years to develop into their valuation. Nonetheless, the year-over-year inflation numbers began turning into worse beginning in mid-July due largely to vitality costs going up. Buyers began being much less affected person and demanding a extra fast return of their cash. This brought about long-duration shares, similar to many within the expertise sector, to both decline or grow to be stagnant. As we are able to see right here, of the main expertise shares listed within the fund’s largest positions, Alphabet has delivered the most effective efficiency for the reason that begin of July and even it’s not significantly spectacular:

In search of Alpha

To place this in perspective, the U.S. Power ETF (IYE), which tracks a really low-duration sector, is up 4.89% over the identical interval.

In brief, the fund’s present holdings don’t make a substantial amount of sense proper now until rates of interest decline. That appears extremely unlikely contemplating that M2 has been comparatively static, and the Federal Authorities is actively competing in opposition to the non-public sector for investor capital. The one possible way for inflation to return down is that if the Federal Reserve switches to a quantitative easing coverage, and it is extremely laborious to see that taking place until the US enters right into a extreme recession. It’s because something that will get individuals borrowing and spending will trigger inflation to return. As such, the fund’s holdings could not make a number of sense within the present atmosphere. Realistically, it needs to be invested in floating-rate debt securities or different low-duration sectors with a purpose to maximize its returns.

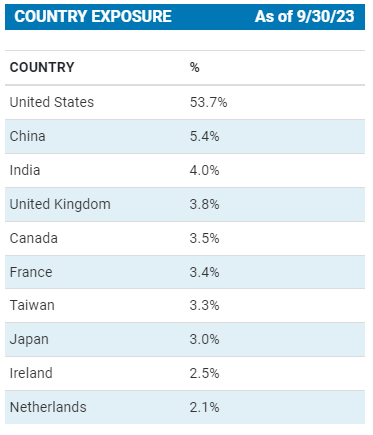

One factor that we are able to see above is that the fund seems to be closely invested in the US. In any case, seven of the ten corporations proven on the fund’s top-ten holding listing above are American companies. Nonetheless, the fund’s web site states that solely 53.7% of the fund’s portfolio is invested in American issuers:

Calamos Investments

This can be a decrease proportion than most world closed-end funds possess, though it’s nonetheless larger than the precise illustration of the US within the world economic system. As of proper now, the US accounts for slightly below 25% of the worldwide gross home product. Nonetheless, it accounts for 69.88% of the MSCI World Index. Thus, the fund is considerably underweighted to the US relative to the worldwide market capitalization.

The truth that the US accounts for such a considerable proportion of the worldwide market capitalization regardless of solely accounting for a a lot smaller portion of the particular world financial output ought to instantly set off alarm bells in anybody’s head. In any case, this could possibly be a really actual signal that there are some dangers that the American market typically is considerably overvalued and will have a protracted strategy to fall within the occasion of any financial calamity within the nation. In reality, as of proper now, the whole market capitalization-to-GDP ratio of the US is 151.20%. That’s effectively above the long-term common of 100%, though it’s not as unhealthy because it was initially of 2022. Nonetheless, this does nonetheless point out that the American market is overvalued typically.

Thus, it could be advisable for buyers to diversify their property internationally. This may each assist defend their property in opposition to potential future financial issues domestically in addition to current the chance to benefit from issues that will come up elsewhere on the planet. This fund definitely seems to be doing that to a comparatively excessive diploma when in comparison with many different funds and even the worldwide indices. It’s not good, nonetheless, and as such it may nonetheless be advisable to buy a global fund to attain higher world diversification.

Leverage

As is the case with most closed-end funds, the Calamos World Dynamic Revenue Fund employs leverage as a technique of boosting the efficient yield of its portfolio. I defined how this works in my earlier article on this fund:

In brief, the fund borrows cash after which makes use of that cash to buy shares, convertible securities, and bonds from issuers which can be positioned everywhere in the world. So long as the bought asset delivers the next whole return than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly effectively to spice up the efficient yield of the portfolio. This fund is able to borrowing cash at institutional charges, that are significantly larger than retail charges. As such, this state of affairs will often be the case. You will need to word although that this technique is far much less efficient immediately with charges at 6% than it was two years in the past when charges had been mainly 0%. It’s because the distinction between the speed that the fund has to pay on the borrowed cash and the return that it may get from the bought safety is far narrower than it as soon as was.

Sadly, the usage of debt on this vogue is a double-edged sword. It’s because leverage boosts each good points and losses. As such, we need to be sure that the fund will not be using an excessive amount of leverage as a result of that will expose us to an extreme quantity of threat. I typically don’t like a fund’s leverage to exceed a 3rd as a proportion of its property because of this.

As of the time of writing, the Calamos World Dynamic Revenue Fund has levered property comprising 28.05% of its portfolio. That is fairly a bit greater than the 26.46% leverage that the fund had the final time that we mentioned it, which is a regarding signal. This might point out that the fund is taking up extra debt regardless of the weakening inventory and bond markets. Nonetheless, we are able to additionally see that its internet asset worth is down 7.99% for the reason that date that we final mentioned this fund:

In search of Alpha

Thus, static leverage would nonetheless consequence within the fund’s general leverage ratio going up. It’s because the leverage doesn’t go down when property go down. The fund nonetheless owes the identical amount of cash that it did earlier than, so the leverage represents the next proportion of the portfolio.

Happily, this fund’s leverage nonetheless stays at an appropriate stage. The chance-reward steadiness seems to be affordable right here so we should always not have an excessive amount of to fret about.

Distribution Evaluation

As talked about earlier on this article, the first goal of the Calamos World Dynamic Revenue Fund is to offer its buyers with a really excessive stage of present earnings. As a way to do this, the fund invests in frequent shares, most well-liked shares, convertible securities, and varied different types of debt securities. Within the case of frequent shares, the yields aren’t particularly excessive however most of the different issues that this fund can put money into have respectable yields. The fund collects the funds that it receives from the entire debt and hybrid securities in its portfolio and combines it with any capital good points that it manages to appreciate from the frequent inventory holdings. It then pays out all of this cash to its shareholders, internet of the fund’s personal bills. This may end up in a reasonably excessive yield in sure market circumstances.

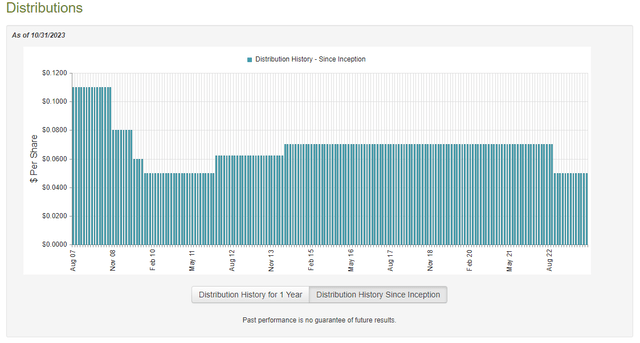

The Calamos World Dynamic Revenue Fund at the moment pays out a month-to-month distribution of $0.05 per share ($0.60 per share yearly), which provides it an 11.49% yield on the present value. This can be a a lot larger yield than simply about any index fund, though it’s in step with the yield of different leveraged closed-end funds. Sadly, the fund has not been particularly in step with respect to its distribution over time:

CEF Join

As we are able to see right here, the fund has each raised and minimize its distribution a number of occasions over the previous a number of years since its inception. A lot of the cuts got here at a time of inventory market weak spot, such because the Lehman Brothers collapse, the Nice Monetary Disaster, and naturally the termination of the Federal Reserve’s longstanding simple cash coverage final 12 months. Thus, the fund’s distribution seems to rely to a sure diploma on the general efficiency of the American inventory market, which makes a number of sense contemplating that the fund is weighted most closely to this specific market. Nonetheless, it would nonetheless show to be a turn-off for these buyers who’re looking for a secure and safe supply of earnings to make use of to pay their payments and finance their existence. In any case, we don’t actually like our capability to assist ourselves to be depending on the efficiency of the inventory market.

It’s all the time a good suggestion to research a fund’s funds earlier than investing in it. In any case, we don’t need to be the victims of a shock distribution minimize since that would cut back our incomes and virtually definitely trigger the fund’s share value to say no.

Sadly, we shouldn’t have an particularly latest doc that we are able to seek the advice of for the aim of our evaluation. As of the time of writing, the fund’s most up-to-date monetary report corresponds to the six-month interval that ended on April 30, 2023. As such, it doesn’t embody any details about the fund’s monetary efficiency over the previous six months. That is unlucky as a result of it appears possible that the previous six months would have delivered a a lot weaker efficiency than the interval that’s mirrored on this report. In any case, the market throughout the first half of the 12 months was fairly robust and whereas that undoubtedly introduced the fund with the potential to earn some capital good points, if it didn’t promote its appreciated property on the proper time a few of these good points would have been worn out. In reality, the truth that the fund’s internet asset worth is down 3.54% for the reason that begin of the 12 months means that a few of its good points from the primary half of the 12 months have been worn out.

Through the six-month interval that ended on April 30, 2023, the Calamos World Dynamic Revenue Fund obtained $3,669,337 in curiosity together with $3,523,022 in dividends from the property in its portfolio. A major proportion of the curiosity that the fund obtained was truly thought-about to be a return of principal and so will not be included in funding earnings. The fund additionally needed to pay a considerable amount of cash in international withholding taxes in opposition to its earnings. Thus, it solely reported a complete funding earnings of $4,768,806 throughout the interval. That was not enough to cowl the fund’s bills and it ended up reporting a internet funding lack of $2,351,266 throughout the interval. At first look, that is virtually definitely going to be regarding because the fund clearly didn’t have enough internet funding earnings to pay any distribution, but it nonetheless paid out $19,159,316 to its shareholders.

Nonetheless, the fund does produce other strategies via which it may acquire the cash that it must cowl its distribution. For instance, it would be capable of generate some capital good points by promoting appreciated property into a positive market. Capital good points aren’t thought-about to be funding earnings for tax or accounting functions however realized capital good points nonetheless clearly characterize cash coming into the fund. The fund had combined outcomes on this process throughout the latest quarter. The fund reported internet realized losses of $3,688,410 however these had been greater than offset by $53,689,645 internet unrealized good points. Total, the fund’s internet property went up by $28,490,653 throughout the interval after accounting for all inflows and outflows.

Technically, this fund did handle to cowl its distribution, however it needed to depend on unrealized good points to do it. This could possibly be problematic contemplating that a few of these good points may have very simply been erased by now. As already talked about, this does seem like the case contemplating that its internet asset worth is down year-to-date. This means that the fund could also be distributing greater than it may actually afford. If it did handle to lock in most of its unrealized good points earlier than the market turned then all is effectively, however there is no such thing as a assure that that is the case. We are going to sadly have to attend till the fund releases its annual report in a month or two earlier than we all know for sure the place it stands.

Valuation

As of October 31, 2023 (the latest date for which information is at the moment obtainable), the Calamos World Dynamic Revenue Fund has a internet asset worth of $5.99 per share however the shares at the moment commerce for $5.26 every. This offers the fund’s shares a 12.19% low cost on internet asset worth on the present value. That is barely higher than the 11.92% low cost that the shares have had on common over the previous month so general the value appears fairly affordable. This seems to be an inexpensive entry level if you’re focused on proudly owning this fund.

Conclusion

In conclusion, the Calamos World Dynamic Revenue Fund does probably not reside as much as its title. The title means that this can be a fixed-income fund, however it’s truly a worldwide blended fund that features each shares, fixed-income, and hybrid securities from world wide. It does handle to nail down the worldwide element fairly effectively, because the fund is definitely extra internationally diversified than the MSCI World Index.

Nonetheless, a number of Calamos World Dynamic Revenue Fund’s holdings encompass long-duration American shares which can be prone to take some bruises if rates of interest proceed to rise. The fund additionally won’t be capable of cowl its distribution as internet asset worth is down year-to-date and the fund relied on unrealized good points to carry its internet asset worth up throughout the first half of its fiscal 12 months. The valuation is sort of affordable proper now, although, and general this can be a higher fund than most of the different choices available in the market.