AUDUSD, W1

The USDIndex fell -0.23% on Tuesday and recorded a 1-week low. Yesterday, a rally in shares and feedback from Atlanta Fed President Bostic reinforcing hypothesis that the Fed is heading in direction of a pause in charge hikes, curbed demand for greenback liquidity. Nonetheless, the Greenback’s decline was restricted as the continued turmoil within the Center East elevated safe-haven demand for the Greenback. Atlanta Fed President Bostic stated, that he felt there was no want to lift charges once more and that he thought the present coverage charge was at a sufficiently restrictive place to carry inflation all the way down to 2%.

In the meantime, the Australian Greenback has skilled extra weak spot and volatility than every other forex just lately as a result of shifting demand in China.

Australian Greenback futures recorded document curiosity from merchants in September. Australia exports a considerable amount of commodities akin to gold, iron ore and coal, so it is sensible that their forex has a optimistic correlation with the demand and worth of those items.

AUDUSD weak spot can be a mirrored image of US rate of interest developments, which reinforces the concept the Federal Reserve may hold rates of interest increased for longer. Because the statistics change, so does the Fed’s rhetoric, altering their dot plot forecast of the Fed Funds charge in 2024 to five.1% from 4.6% at their assembly on 20 September. The apparent conclusion is that the market is in favour of the Fed and extra importantly the concept of a comfortable touchdown which permits rates of interest to stay excessive.

In the meantime, the RBA in its October assembly determined to maintain rates of interest on the present stage of 4.1%. The Australian greenback futures market worth remains to be very near the bottom level earlier than the pandemic hit in early 2020. This implies that market individuals suppose this can be a pause earlier than the worth enhance cycle resumes within the coming months.

RBA Assistant Governor Chris Kent indicated that whereas the influence of earlier financial tightening has not absolutely materialised, some additional tightening could also be so as to hold inflation in verify. He emphasised that the present insurance policies are beginning to constrain demand development, which is a crucial step in direction of mitigating inflation. Nonetheless, with inflation remaining excessive, he signalled the necessity for extra measures.

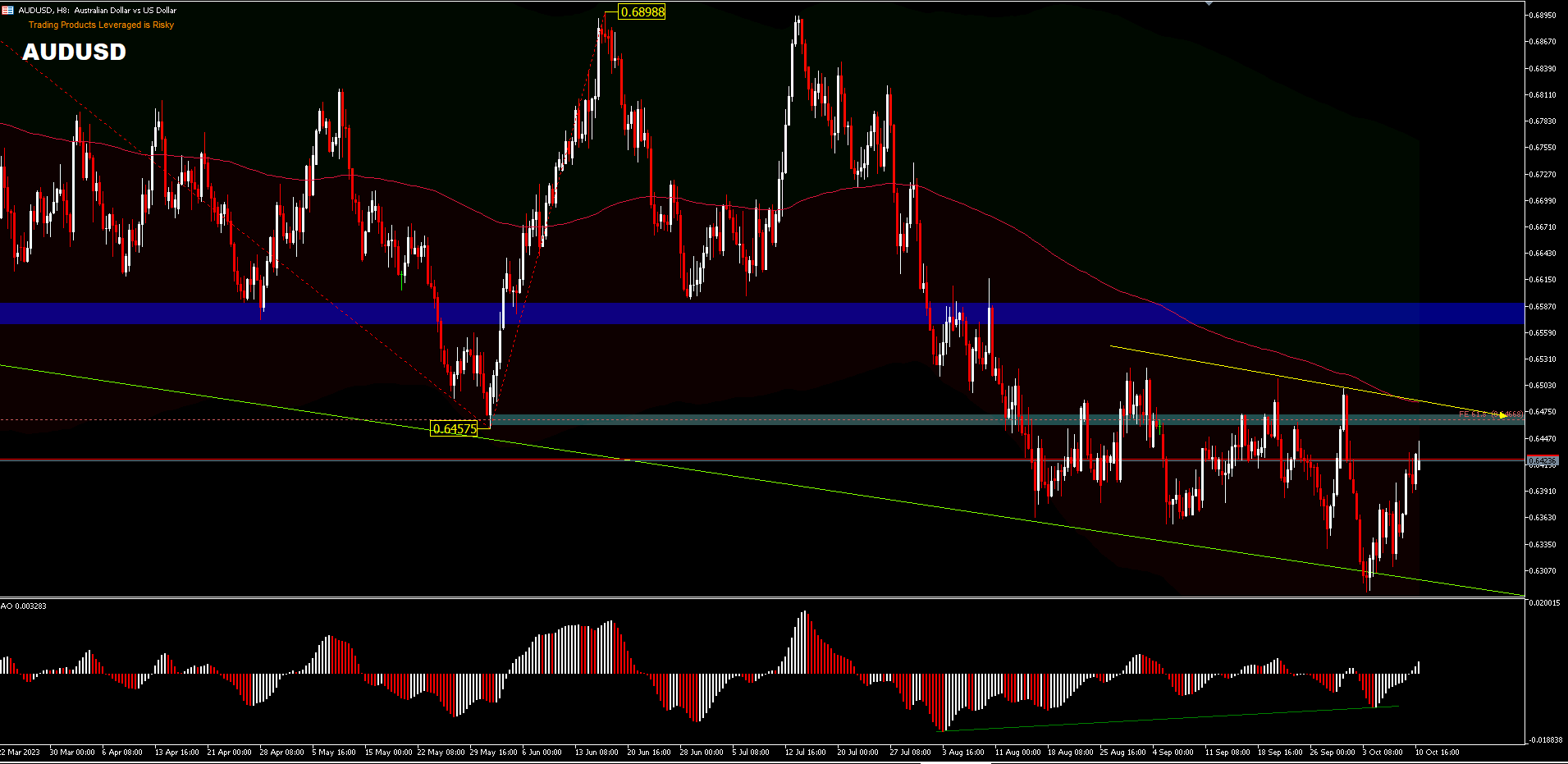

AUDUSD, H8

From a technical perspective, the outlook for AUDUSD hasn’t modified a lot because the bears’ dominance may nonetheless persist, regardless of skinny buying and selling within the final 8 days. Intraday bias stays impartial at this level, So long as worth trades beneath 0.6457 help worth bias might return to the draw back for FE100% projection at 0.6199 close to final yr low of 0.7156 – 0.6457 and 0.6898 pullback.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.