Pipat Yapathanasap/iStock through Getty Photos

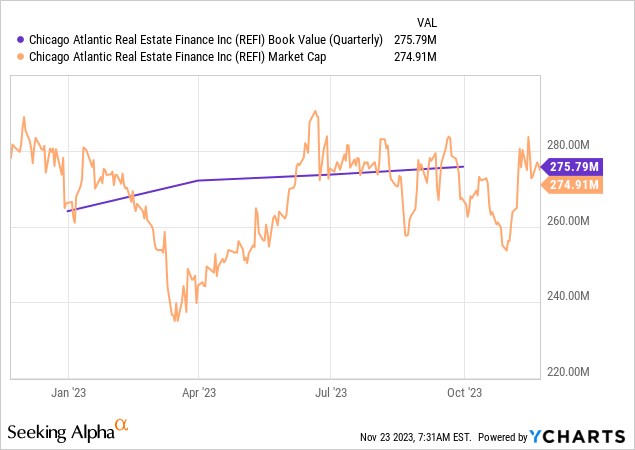

Chicago Atlantic Actual Property Finance (NASDAQ:REFI) is the marginally bigger hashish mortgage REIT versus peer AFC Gamma (AFCG). Its concentrate on hashish credit score has meant a multi-layered threat profile from each rising rates of interest during the last 2 years and focus in a single business that has seen intense headwinds to profitability and liquidity. The fats yield is the prize towards frequent shares which might be flat year-to-date with REFI final paying out a $0.47 per share quarterly distribution for a 12.4% annualized dividend yield. This was unchanged from its prior distribution and got here with the frequent shares basically buying and selling at par with a ebook worth of $275 million, round $15.17 per share. Diversification and threat administration are essential towards a sector that is realized a broad deterioration of liquidity and faces continued near-term legislative uncertainty. I final coated REFI again in Could and a reevaluation of its financials from the newest earnings and towards a set-to-change macroeconomic backdrop is required.

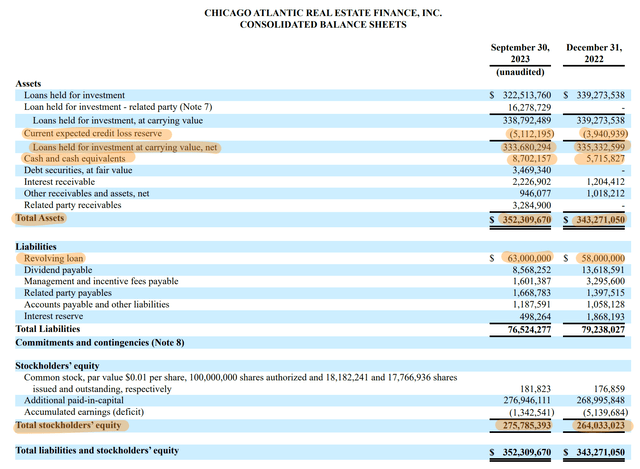

REFI’s credit score portfolio was valued at $333.7 million on the finish of its final reported fiscal 2023 third quarter after adjusting for a present anticipated credit score loss reserve of $5.1 million. CECL reserve was up 30% from the top of 2022 to drive a broad decline in its credit score portfolio of round $1.65 million. The mREIT has constructed a steadiness sheet extra on fairness with a complete debt of simply $63 million on the finish of the third quarter. This meant a debt-to-equity ratio of simply 0.22x, an extremely low base, and one of many lowest debt-to-equity ratios of any mortgage REIT.

Chicago Atlantic Actual Property Finance Fiscal 2023 Third Quarter Type 10-Q

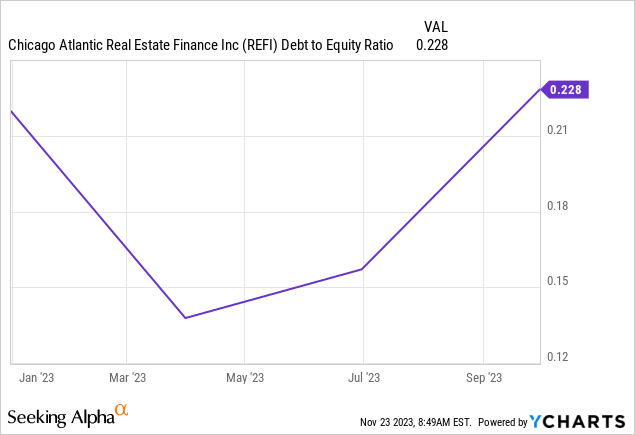

Debt-To-Fairness, Commitments, And Danger

While REFI’s debt-to-equity ratio has been on the rise, the present ratio is materially beneath the traditional 1x watermark of consolation. The externally managed mREIT has been prudent in its use of leverage by way of a heavy fairness layer which has basically rendered the commons safer. This infers decrease volatility for the dividend as REFI may lean on debt to fulfill any future shortfalls in a state of affairs the place there’s a degree of disruption to curiosity earnings.

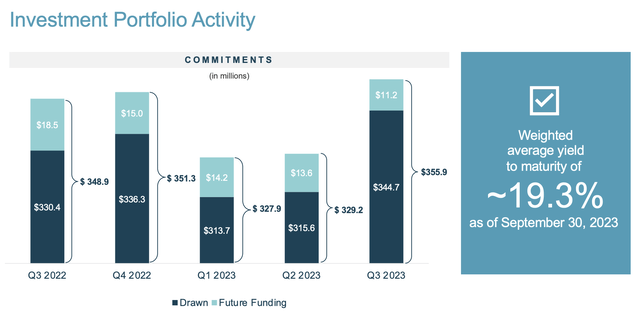

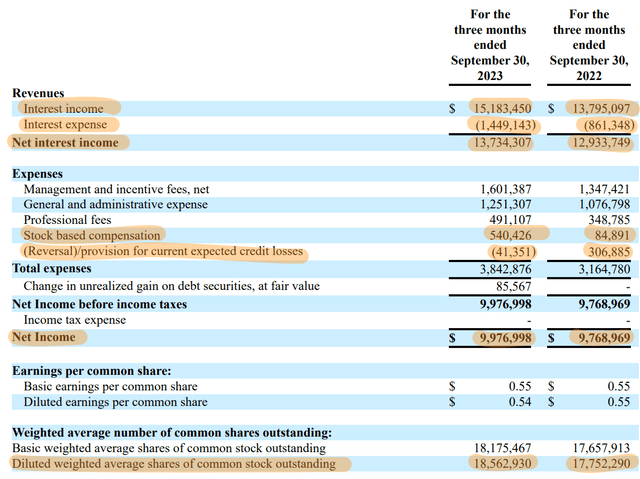

REFI reported third-quarter web curiosity earnings of $13.73 million, up 6.2% over its year-ago comp however a miss by $510,00 on consensus estimates. This was pushed by complete mortgage commitments of $355.9 million throughout 27 portfolio investments with roughly $11.2 million of this determine set for future fundings. REFI credit score portfolio got here with a weighted common yield to maturity of 19.3% on the finish of the third quarter, up 10 foundation factors sequentially. This yield is outsized on account of hashish being labeled as a Schedule I drug to broadly limit the provision of credit score. Therefore, there may be much less competitors in REFI’s mortgage origination pipeline which stood at $640 million on the finish of the third quarter.

Chicago Atlantic Actual Property Finance Fiscal 2023 Third Quarter Supplemental

This kinds a essential motive for purchasing REFI over different mREITs. US hashish gross sales, adult-use and medical, are set to come back in at $33.6 billion for 2023 with expectations of development to $56.9 billion by 2028. It is a giant and rising market that wants capital to develop. The inverse additionally kinds a core threat for REFI as its tenants. To be clear, much less competitors is nice for REFI’s yield but additionally not nice for the business’s capability to have fixed and expanded entry to capital required for wholesome steadiness sheets and long-term viability.

Operations, Diversification, And Dividend Protection

Chicago Atlantic Actual Property Finance Fiscal 2023 Third Quarter Supplemental

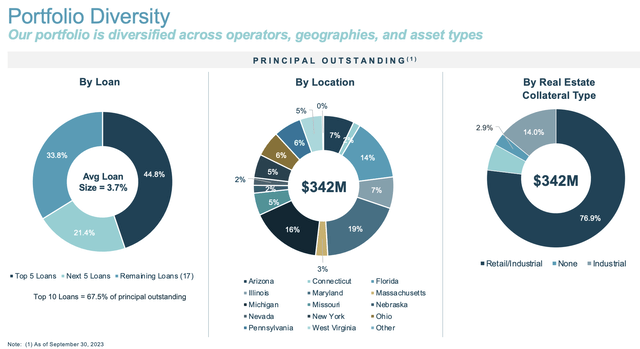

REFI is considerably diversified however with its high 5 loans constituting 44.8% of its principal and its high 10 loans accounting for 67.5% of its principal. The highest 5 focus is past my level of consolation even with REFI diversified throughout a number of states and with round 77% of collateral towards its loans from retail hashish property. The REIT has positioned its actual property collateral protection at 1.5x on the finish of the third quarter, unchanged sequentially.

Chicago Atlantic Actual Property Finance Fiscal 2023 Third Quarter Type 10-Q

Web earnings at $9.98 million meant diluted earnings per share of $0.54, down 1 cent over REFI’s year-ago comp. This got here because the mREIT realized complete gross originations of $35.4 million with round $32.8 million of this funding to new debtors. Repayments of $10.9 million meant web originations of $24.5 million in the course of the third quarter. The mREIT additionally has roughly $25 million in liquidity on the again of its revolving credit score facility. EPS at the moment means REFI is protecting its dividend by 115%, round an 87% payout ratio. Therefore, while the considerably heavy focus of simply 5 debtors may current a near-term headwind if credit score situations deteriorate for hashish corporations, REFI is confidently protecting its dividend. The ticker is a maintain on the again of its low leverage and excessive yield on debt.