koto_feja

Checkpoint Therapeutics, Inc. (NASDAQ:CKPT) focuses on focused immunotherapies for stable tumors. The corporate’s flagship drug candidate is Cosibelimab, a novel anti-PD-L1 antibody presently beneath FDA evaluate for treating cutaneous squamous cell carcinoma [cSCC] as a single-agent remedy. Cosibelimab might doubtlessly have indications for metastatic cSCC and regionally superior cSCC. Moreover, it has a twin mechanism of motion with NK cells that offers it a theoretical edge over different PD-L1 inhibitors. So, if Cosibelimab is accepted by December 2024, CKPT might turn out to be a serious participant in cSCC. Regardless of the inherent regulatory dangers and money runway issues, I believe CKPT is a viable speculative “purchase.” But, it’s undoubtedly a high-risk, high-reward inventory, so buyers ought to dimension their positions accordingly.

Cosibelimab: Enterprise Overview

Checkpoint Therapeutics is a clinical-stage biopharmaceutical firm based mostly in Waltham, Massachusetts. Based in 2014, the corporate develops revolutionary therapies for stable tumor cancers utilizing immunotherapy and focused therapies. CKPT’s essential worth driver is Cosibelimab. This Anti-PD-L1 antibody is designed to deal with metastatic and regionally superior cutaneous squamous cell carcinoma (cSCC) as a single-agent remedy.

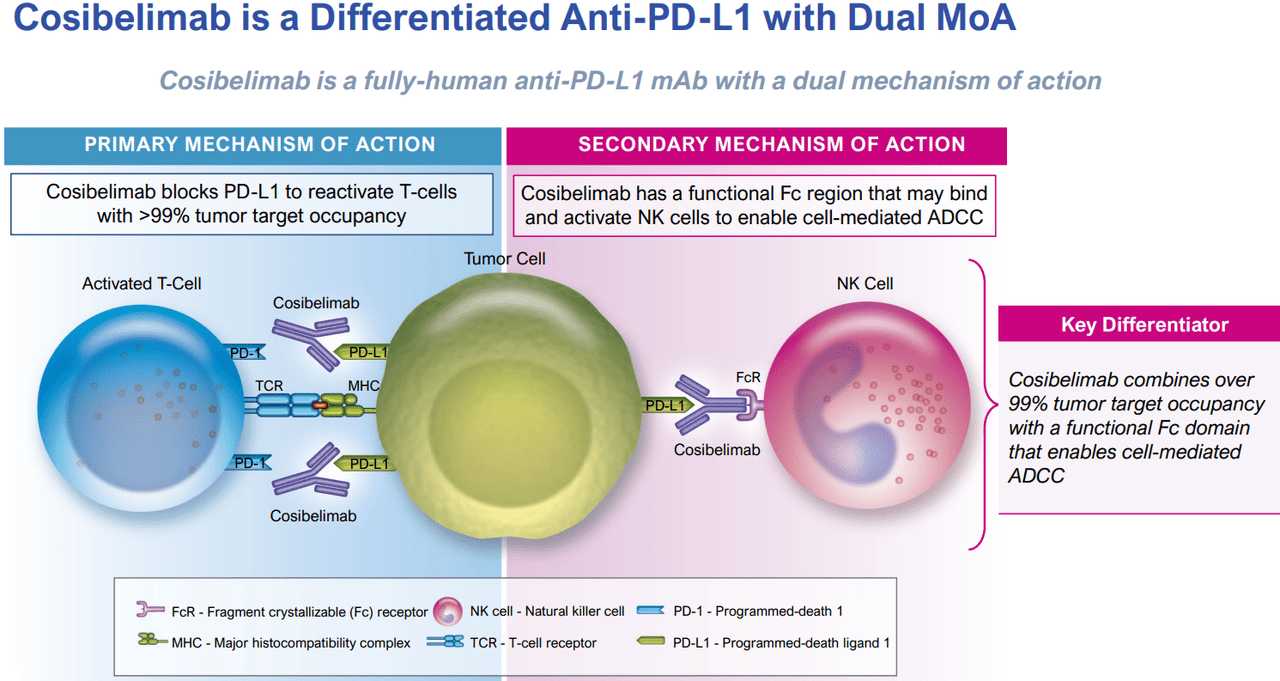

Supply: CKPT’s Q2 2024 Company Presentation.

Cosibelimab binds to the PD-L1 protein in most cancers cells, blocking it from attaching to the PD-1 receptor in T cells. Usually, PD-L1 permits most cancers cells to evade the immune system. Nevertheless, when Cosibelimab blocks it, T cells can acknowledge and destroy tumor cells. What units Cosibelimab other than different PD-L1 inhibitors is its potential to additionally bind to pure killer (NK) cells via its useful Fc area. This provides Cosibelimab a twin mechanism of motion as a result of it not solely reactivates T cells but in addition prompts NK cells. Thus, this theoretically provides Cosibelimab a extra complete impact on most cancers cells and may very well be a key aggressive benefit.

Furthermore, CKPT’s pipeline additionally contains different early-phase candidates. As an example, Olafertinib targets non-small cell lung most cancers (NSCLC) with 2nd-line EGFR mutation-positive circumstances. Olafertinib has to date accomplished its section 1 trials as a monotherapy. CKPT can also be engaged on a section 1b/2 trial testing Olafertinib together with Cosibelimab. Moreover, CKPT has CK-103 for myelofibrosis and MYC-amplified stable tumors. Nevertheless, CK-103 continues to be within the IND-ready stage. Lastly, the corporate’s CK-302 and CK-303 are preclinical drug candidates specializing in stable tumors, renal cell carcinoma, and different stable tumors.

Supply: CKPT’s Q2 2024 Company Presentation.

Extra not too long ago, on July 25, 2024, CKPT introduced that the FDA accepted their Biologics License Utility (BLA) resubmission for Cosibelimab. The FDA’s goal determination date is December 28, 2024. If the FDA approves it, Cosibelimab might turn out to be a key remedy for cSCC in adults who aren’t candidates for surgical procedure or radiation. It’s value noting that the FDA initially reviewed Cosibelimab again in December 2023. Nonetheless, that submission resulted in an entire response letter [CRL] on account of manufacturing points at a third-party CMO. Since then, CKPT has centered on resolving these issues, and its CEO appears optimistic about their approval odds.

Promising Outlook: Aggressive Profile

In my opinion, Cosibelimab’s outlook is promising, particularly for the reason that CRL didn’t increase issues about scientific information, security, or labeling. If the drug had security or effectiveness points, that may have been a major setback. Nevertheless, manufacturing issues are typically simpler to handle. What makes Cosibelimab notably compelling is its spectacular trial information. For metastatic cSCC, the drug achieved an general response price (ORR) of about 50%, with vital tumor discount, and 13% of sufferers reached full remission. In circumstances of regionally superior cSCC, Cosibelimab confirmed an ORR of 54.8%, with an entire response price of 26%. Simply as importantly, its security profile appears extra favorable in comparison with different anti-PD-1 medication.

Supply: Fierce Pharma.

To place this in context, Cosibelimab’s essential rivals are Regeneron’s (REGN) Libtayo and Merck’s (MRK) Keytruda. Libtayo and Keytruda had 42% and 39% response charges, respectively. So, Cosibelimab seems barely superior whereas sustaining an identical security profile. It’s additionally value mentioning that Regeneron bought Libtayo’s full rights from Sanofi (SNY) for $900 million in 2022. This provides us a way of Cosibelimab’s potential worth if efficiently developed and commercialized. That’s why I consider CKPT might doubtlessly turn out to be a critical contender within the cSCC market with Cosibelimab.

Moreover, CKPT estimates the market alternative for Cosibelimab in cSCC remedy to be over $1 billion within the US alone. The drug might doubtlessly deal with round 60% of cSCC sufferers who’ve unmet wants with present PD-1 inhibitors. I additionally consider Cosibelimab’s potential to interact NK cells is one other key differentiator. This characteristic makes Cosibelimab notably useful for immunosuppressed sufferers, akin to these with continual lymphocytic leukemia (CLL), transplant recipients, and others on immunosuppressive therapies.

Supply: CKPT’s Q2 2024 Company Presentation.

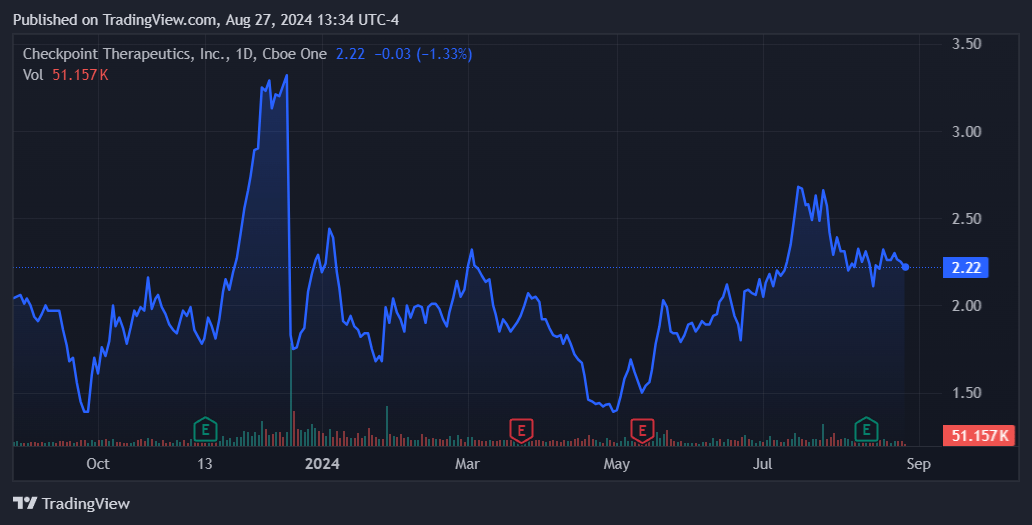

It’s additionally necessary to spotlight that CKPT owns Cosibelimab’s US rights till a minimum of 2038. So, this might simply place Cosibelimab as CKPT’s core oncology income supply for the subsequent decade. Moreover, after the FDA accepted Cosibelimab’s resubmission, CKPT’s inventory worth spiked. So, this reinforces the concept that the market can also be optimistic about Cosibelimab’s potential approval. So long as CKPT’s newly submitted BLA aligns properly with the FDA’s standards, Cosibelimab might ultimately seize a major share of the cSCC market.

Binary Final result: Valuation Evaluation

From a valuation perspective, CKPT presently trades at a market cap of $101.3 million. This locations it firmly within the microcap class inside its sector. This valuation appears notably low as a result of Cosibelimab is positioned as an identical drug to REGN’s Libtayo. Libtayo was bought for $900 million, so I consider the notable valuation disparity is probably going on account of CKPT’s comparatively low money reserves. This provides a substantial threat layer to its funding thesis.

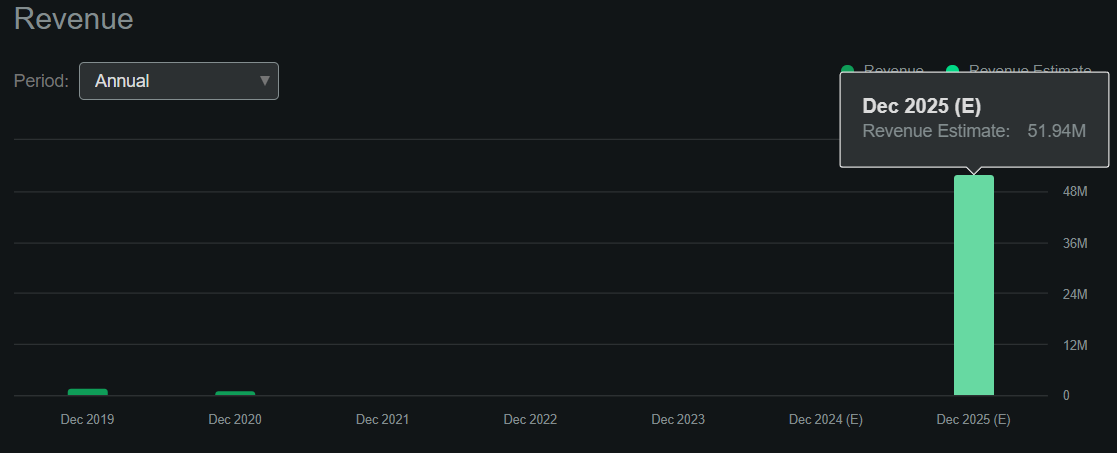

Supply: Searching for Alpha.

As of June 30, 2024, CKPT’s stability sheet had $5.0 million in money and equivalents with no monetary debt. Nevertheless, the corporate’s destructive e book worth of $15.7 million makes it troublesome to worth via conventional P/B multiples. Nevertheless, in accordance with Searching for Alpha’s dashboard on CKPT, the corporate is projected to generate $52.0 million in revenues by 2025. This might worth CKPT at a ahead P/S a number of of 1.9. For comparability, its sector’s median ahead P/S is 3.9, so the inventory additionally appears comparatively undervalued.

Furthermore, I estimate CKPT’s newest quarterly money burn was $6.2 million by including its CFOs and Internet CAPEX. This highlights the corporate’s speedy want for added funds to maintain operations till the FDA decides on Cosibelimab’s BLA. As beforehand famous, such a call’s goal date is December 28, 2024. Unsurprisingly, CKPT has introduced two fairness choices to handle its speedy financing wants. One is for $12.0 million, and one other is for as much as $5.9 million. These fairness choices would increase $17.9 million mixed, bringing CKPT’s money reserves to roughly $22.9 million. Primarily based on my money burn estimate, this would supply a money runway of about 3.7 quarters. I consider this ought to be enough to cowl operations till the FDA’s determination.

Funding Caveats: Danger Evaluation

Whereas this funding ought to carry CKPT via the FDA’s determination, it doubtless received’t be sufficient to finance Cosibelimab’s commercialization. So, I believe buyers will in all probability face some dilution in each situation. Nevertheless, if the FDA approves Cosibelimab, it may very well be a serious turning level for CKPT. This might doubtlessly result in vital upside, particularly given the low present valuation relative to the Libtayo sale. Conversely, if the FDA rejects the BLA or points one other CRL, CKPT might face critical challenges. The corporate would possibly want to boost further funds beneath unfavorable phrases and even doubtlessly think about chapter. This binary final result creates substantial dangers for buyers.

Supply: TradingView.

Nonetheless, the result of CKPT’s bull case will in all probability be resolved within the close to time period. Given the comparatively brief timeline for the FDA’s determination, CKPT may very well be a speculative “purchase” for buyers who perceive the inherent regulatory dangers and money runway challenges. I consider Cosibelimab’s promising trial information and favorable valuation in comparison with Libtayo make CKPT a compelling funding case. Thus, whereas the dangers are vital, CKPT’s upside potential justifies a speculative bullish stance, particularly on account of its near-term catalyst.

Extremely Speculative “Purchase”: Conclusion

Total, I believe CKPT’s Cosibelimab has an inexpensive likelihood of being accepted by the FDA quickly. If that occurs, it is going to have a stable aggressive profile in its market and will turn out to be a serious income supply for CKPT in the long term. Nevertheless, we will’t ignore the truth that Cosibelimab has confronted FDA setbacks earlier than. This provides a layer of uncertainty, coupled with CKPT’s low money reserves, making the inventory extremely speculative. Subsequently, I believe CKPT is a binary final result prone to be resolved by yearend or early 2025. However, on stability, I believe the upside potential for CKPT is much larger than its draw back. Additionally, I estimate its approval odds are favorable based mostly on the information out there immediately. Consequently, I price CKPT a viable speculative “purchase” for buyers who perceive the inherent uncertainties on this inventory.