Mario Tama/Getty Photographs Information

When Sweetgreen (SG) went public in late 2021, I wrote that shares had been overpriced and didn’t characterize a horny funding alternative. Quick-forward to at present and SG shares have declined over 75%. SG was unable to show a revenue, and I used to be skeptical that the valuation could be supported by actual earnings. Immediately, CAVA Group (NYSE:CAVA) is making ready to go public and boasting the same narrative. Can they keep away from SG’s destiny?

Comparability To Sweetgreen

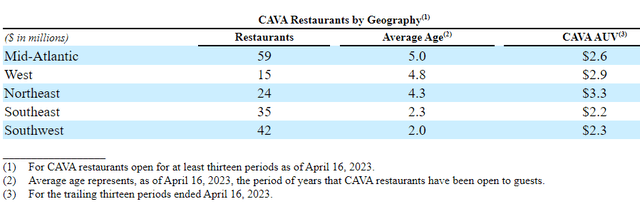

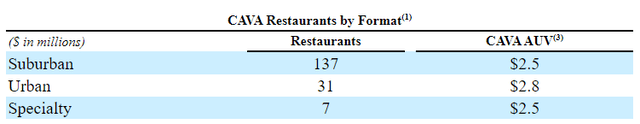

CAVA Timeline (CAVA S1) CAVA Areas (CAVA S1) CAVA Codecs (CAVA S1)

CAVA is searching for to boost $280m at a $19-$20 worth vary (14.44m shares). This represents a couple of $2.1B valuation ($2.4B market cap) web of money. How does it stack up in opposition to Sweetgreen?

|

AUV |

Restaurant Margins |

# of Areas |

SG&A (Q1-23) |

Similar Retailer Gross sales (SSS) % |

|

|

CAVA |

$2.5m |

25% |

263 |

$29.0m |

28% |

|

Sweetgreen |

$2.9m |

14% |

204 |

$34.9m |

5% |

(Supply – linked public paperwork)

CAVA is succeeding in a number of areas the place SG has continued to fail. CAVA is producing very favorable (~25%) 4-wall margins utilizing much less SG&A than SG, and CAVA is rising same-store gross sales (SSS) at a a lot sooner clip. Each ideas burned money in Q1-23, however CAVA earned over $25m money from operations earlier than CapEx, whereas Sweetgreen spent $3m money in operations earlier than development investments. With $280m in proceeds from the IPO, CAVA can even assist fund development from their money stability, given established operations are money circulation optimistic.

CAVA will seemingly see a spike in stock-based compensation expense after going public, but when they find yourself just like SG’s $14m/Q run-rate, they might be averaging about the identical SG&A per location and as a share of income. CAVA may also have varied one-time prices from going public in SG&A this yr.

Their numbers do stack up properly in opposition to Chipotle’s (CMG) 25.6% restaurant margins, 10.9% SSS, and $2.9m AUV. Sure, Chipotle has greater than 10x the models, however CAVA appears to be on a greater trajectory to emulate their success than Sweetgreen.

Dangers

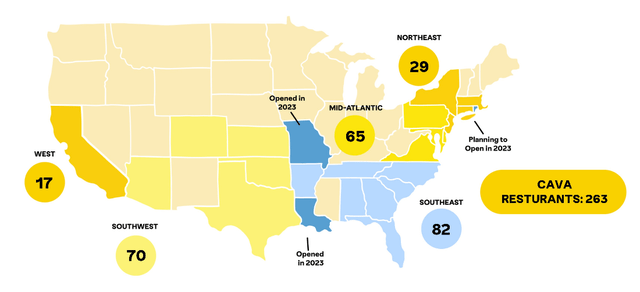

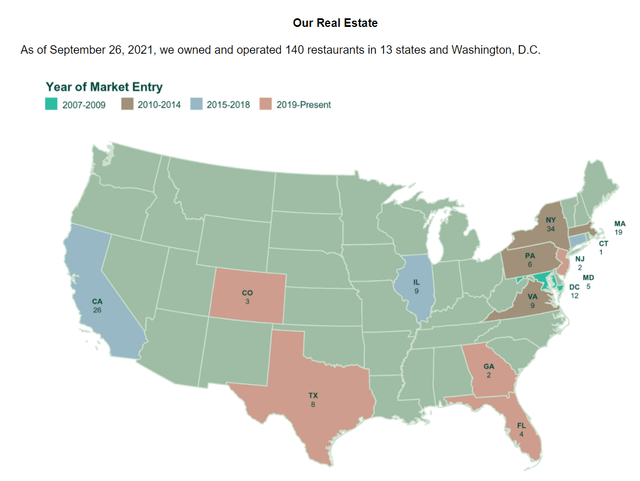

CAVA states of their S1 that they hope to have over 1,000 US areas by 2032. Considered one of my essential issues with Sweetgreen was their capability to develop outdoors of their closely city retailer base. Up to now, CAVA has proven good portability to new markets in comparison with Sweetgreen at IPO. If CAVA experiences diminished AUVs or margins as they develop, their upside case will likely be thrown into doubt.

CAVA Areas (CAVA S1) Sweetgreen 2021 Areas (Sweetgreen S!)

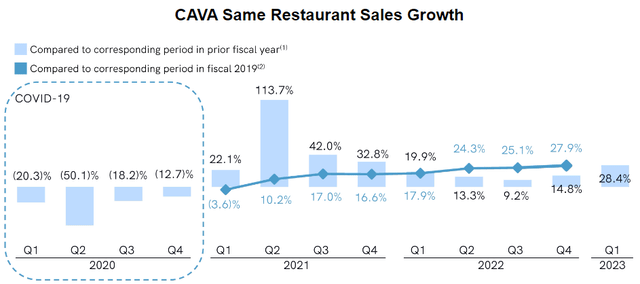

CAVA’s spectacular SSS development comes at a loud time for the restaurant business (and whereas they’ve been integrating Zoe’s Kitchen). Buyers are proper to marvel if present developments will be sustained given the varied headwinds and tailwinds from Covid lockdowns, inflation, stimulus, and so forth. CAVA’s latest outcomes look like properly outpacing friends, albeit over a short time frame:

CAVA SSS (CAVA S1)

Each SG and CAVA have posted working losses all through their existence. CAVA generated optimistic money from operations of $3.4m in FY21 and $6.0m in FY22 whereas Sweetgreen burned $(64.5m) in FY21 and $(43.2m) in FY22 earlier than their giant CapEx investments. CAVA gives a bigger margin of security as a result of they might stop development initiatives tomorrow and function the enterprise profitably, not like SG, which seems to want extra scale to realize profitability.

Valuation

Of their S1, CAVA discloses $203m of income and $16.7m of adjusted EBITDA for the 16 weeks ended April 16, 2023. This can be a little bit of an odd timeframe, however extrapolating to a full yr would recommend $660m annualized gross sales and $54m EBITDA. So, CAVA goes public at ~3x gross sales and ~40x EBITDA on a run-rate foundation, whereas nonetheless producing working losses and unfavorable free money circulation after development spend. Q2 will seemingly embody notable prices associated to the IPO, although they might have a shot at a Q3 working revenue if Q1’s spectacular development continues.

Rising peer Shake Shack (SHAK) trades at related multiples implied by CAVA’s IPO, suggesting this isn’t too unreasonable for an idea with good prospects. SHAK has 449 areas, 18.3% restaurant margins, and did 10.3% SSS in Q1, although with a really spectacular $3.8m AUV ($73k common weekly gross sales). This comparability isn’t excellent as a result of among the SHAK areas are franchised, but it surely’s no less than the same information level for valuation functions.

Evaluating to Chipotle, which trades at a $56B market cap and simply accomplished 1 / 4 with $607m of restaurant margin (23x annualized), may recommend CAVA’s $50m of YTD restaurant margin ought to commerce at $50m (52/16) * 23 = $3.7B, or 50% greater than their IPO worth, however I’d take into account this an aggressive upside case.

Conclusion

The CAVA IPO gives strong development numbers however minimal present profitability. Whereas SG appeared like a flop upon IPO, I believe CAVA has an opportunity to return first rate worth as they proceed to scale their idea. Buyers might certainly have a turbulent expertise as they transition to a public firm, and I’m undecided shares will likely be an instantaneous purchase, however this idea appears value a spot in your watch listing.