Harvepino/iStock by way of Getty Photos

Introduction

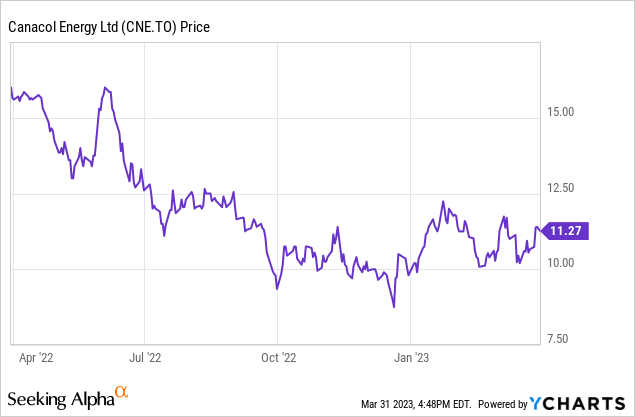

I’ve been a shareholder of Canacol Vitality (TSX:CNE:CA) for fairly some time however sadly I’ve but to comprehend a optimistic absolute return. The market is clearly discounting the corporate’s Colombian operations regardless of the confirmed profitability and the next beneficiant dividend coverage which is absolutely funded by the sustaining free money circulate. An extra profit is the very flat pure gasoline worth in Colombia. Whereas this implies Canacol’s common realized worth didn’t enhance when the pure gasoline market was on hearth in 2022, it additionally means the corporate should not be hit by the present low pure gasoline costs in North America as its successfully realized pure gasoline worth will stay secure round $5.

This text is supposed to be an replace. For all my older articles on Canacol Vitality, please comply with this hyperlink.

The fourth quarter of 2022 did not comprise any huge surprises

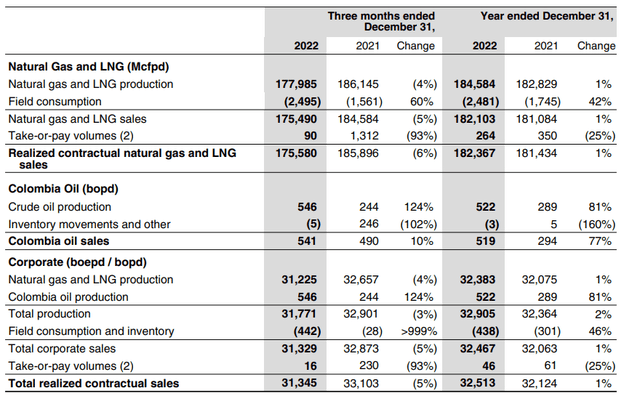

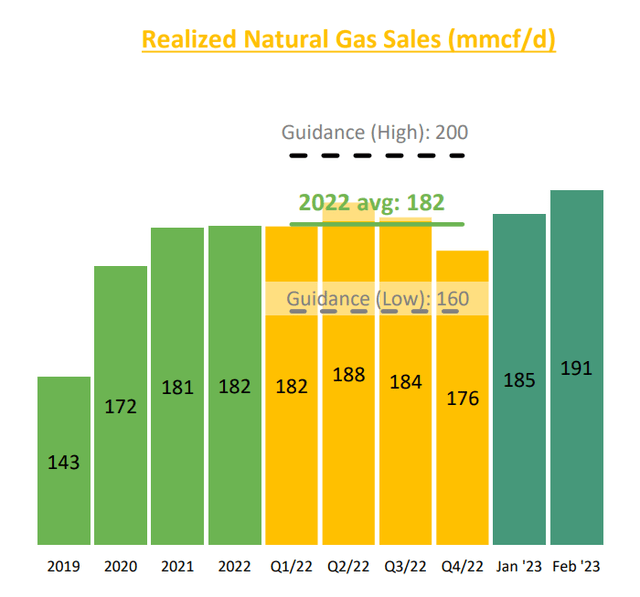

Within the closing quarter of final yr, Canacol produced and bought simply over 175,000 Mcf of pure gasoline per day, and when transformed into an oil-equivalent manufacturing fee, the pure gasoline accounted for an attributable manufacturing fee of 31,225 barrels of oil-equivalent in pure gasoline which resulted in a complete manufacturing of 31,771 barrels of oil-equivalent per day after additionally including the precise oil manufacturing. The full quantity of gross sales was 31,345 barrels of oil-equivalent per day.

Canacol Investor Relations

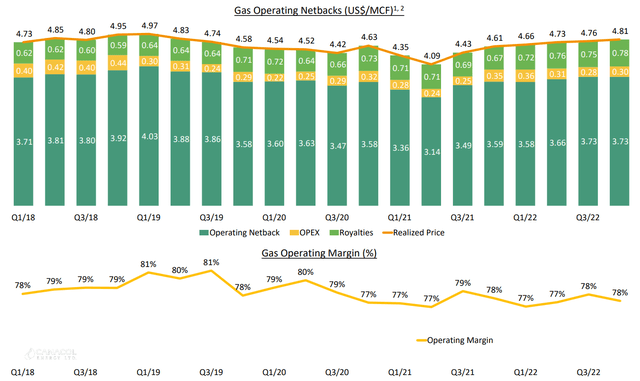

The common acquired worth was roughly $4.81 per Mcf, and the realized pure gasoline worth stays fairly secure given the sturdy home demand and Colombia’s reliance on the import of LNG which is clearly not low cost sufficient to be an actual competitor to home pure gasoline.

Canacol Investor Relations

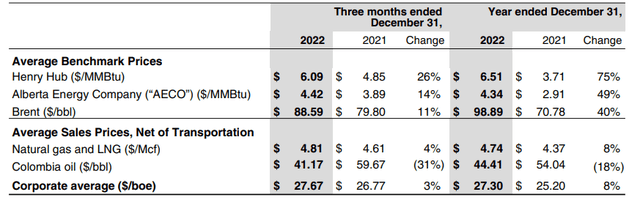

The picture beneath exhibits how secure the pure gasoline worth has been up to now 5 years. It does fluctuate considerably but it surely’s for positive not as unstable because the pure gasoline costs in North America. And due to Canacol’s low-cost manufacturing base, the working margins have a tendency to return in round 77%-80% on a really constant foundation. This makes it simpler to calculate and predict the money flows.

Canacol Investor Relations

The fourth quarter was OK however weaker than anticipated as there was a lower within the pure gasoline demand because of the excessive water ranges within the reservoirs. The overwhelming majority of the electrical energy manufacturing in Colombia comes from hydro. This was only a non permanent impact because the picture beneath exhibits the volumes picked up once more in January and February this yr.

Canacol Investor Relations

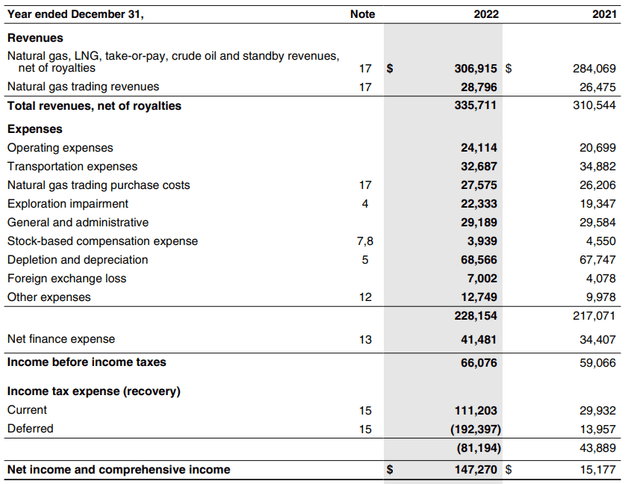

The total-year common manufacturing fee was roughly 182,000 Mcf/day and this resulted in a complete income of $307M whereas the corporate additionally generated a further $28.8M in income from buying and selling actions in pure gasoline. That is an exercise with a really slim margin as the corporate generated simply $1.2M in working revenue on these buying and selling actions.

Canacol Investor Relations

As you’ll be able to see above, the full web earnings was $147M however that is solely attributable to a tax profit. The pre-tax earnings was simply $66M and the normalized web earnings would have been roughly $23M (as Canacol talked about a $43M tax invoice excluding the restructuring on its convention name). That is simply over C$68M/share and contemplating there are 34.1M shares excellent (subsequent to the 5:1 share consolidation), the underlying EPS was roughly C$2/share. Not unhealthy for a inventory buying and selling at simply over C$11.

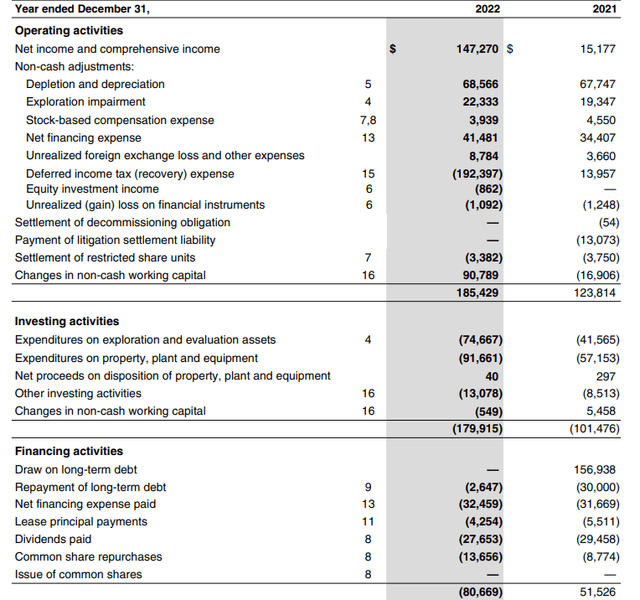

As defined in my earlier articles, I am primarily fascinated about Canacol’s means to generate a optimistic money circulate. And 2022 was one other very first rate yr. Though we see the working money circulate of $185M on a reported foundation was boosted by a $91M money influx from working capital adjustments, it is vital to comprehend the money circulate assertion deducts the $192M in deferred tax good points, however nonetheless included the $111M in present taxes. On an adjusted foundation (i.e. making use of a complete normalized tax of US$43M based mostly on the convention name) and after deducting the $37M in lease funds and curiosity funds, the underlying working money circulate was $126M. There can be a further tax invoice this yr associated to the company restructuring initiatives however that was not a part of the 2022 money outflow but.

Canacol Investor Relations

Whereas that wasn’t sufficient to cowl the $166M in capex, I already defined in a earlier article the overwhelming majority of the 2022 capex was associated to advancing the exploration applications because the sustaining capex was simply $54M.

The brand new reserves replace may be very intriguing

I am tremendous with an organization spending fairly a bit of money on exploration so long as it additionally generates worth. Sadly the corporate solely had a substitute ratio of 169% within the 2P reserve class however it’s encouraging to see Canacol is eyeing 200% for 2023.

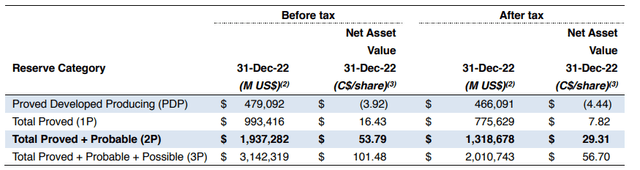

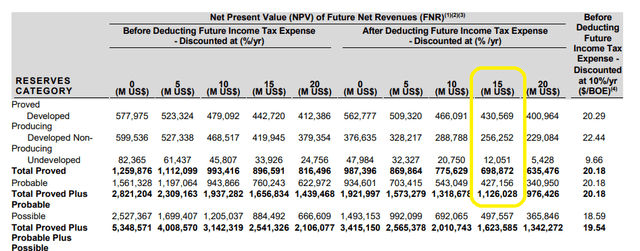

The full NPV10% of the present reserves is estimated at $1.3B and Canacol additionally offered the NAV/share on an after-tax foundation and after taking the online debt of $578M into consideration. As you’ll be able to see beneath, the NAV/share got here in at simply over C$29, which is sort of 3 times increased than the present share worth.

Canacol Investor Relations

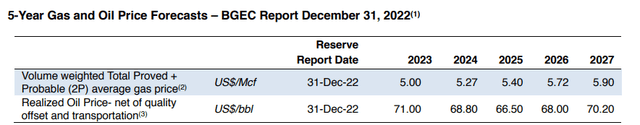

In fact this doesn’t take G&A bills and curiosity bills under consideration so the C$29.31/share overstates what’s realistically achievable, but it surely does verify the corporate is kind of low cost proper now. That being stated, the unbiased consultants used a median pure gasoline worth of US$5 for this yr, growing to nearly $6 in 2027 which is maybe a tad optimistic.

Canacol Investor Relations

Happily the Annual Info Kind accommodates a sensitivity evaluation which additionally supplies the PV15 and PV20 values. And if we might use a reduction fee of 15% as an alternative of 10%, the after-tax NPV15% continues to be very respectable at US$1.13B. After deducting the $578M in web debt, the implied fairness worth (earlier than G&A and curiosity bills) is US$548M.

Canacol Investor Relations

Divided over the simply over 34M shares excellent, that is US$16/share or C$22/share. So there undoubtedly is a margin of security current.

Funding thesis

Whereas the full manufacturing and gross sales volumes will fluctuate (the official steering requires a variety of 160-206MMcf/day), it is vital to know the take-or-pay contracts in 2023 cowl about 160MMcf/day. The inventory is at present buying and selling at simply half its after-tax NPV15% and the reserves and PV calculation will additional enhance this yr as Canacol is focusing on a 200% substitute ratio for its pure gasoline reserves.

I’ve a protracted place and should add to my place maybe by recycling a portion of my funding in Canadian gasoline producer Spartan Delta after its lately introduced strategic sale and spin-off. Canacol Vitality pays a quarterly dividend of C$0.26 and the C$1.04/share on an annual foundation represents a really engaging dividend yield of in extra of 9%.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.