by confoundedinterest17

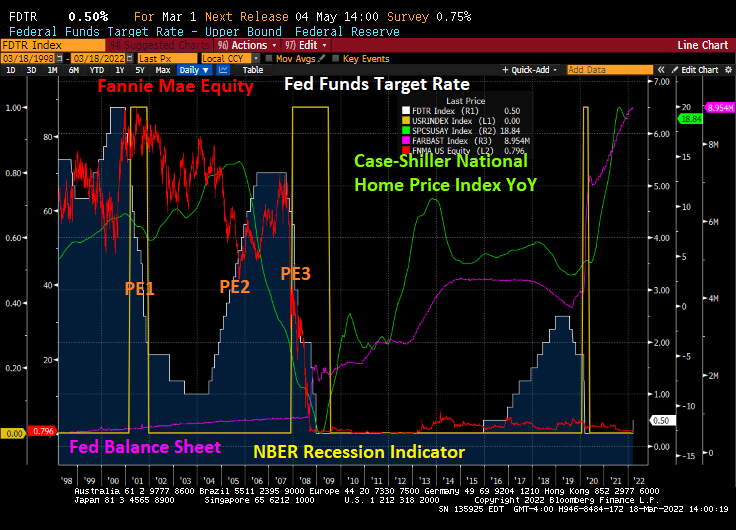

The Federal Reserve isn’t talked about within the motion pictures “The Large Brief” or “Margin Name”, however The Fed’s coverage errors performed a giant position within the demise of Fannie Mae’s and Freddie Mac’s fairness costs.

Here’s a chart of The Fed’s many insurance policies errors. Let’s begin with The Fed decreasing charges too quick across the 2001 recession. They pushed their goal fee from 6.5% in December 2000 all the way down to 1.75% after one yr after which all the way down to 1% (PE1). As dwelling value progress accelerated, The Fed engaged of their second coverage error — elevating charges too quick leading to a dramatic cooling of dwelling value progress. Then got here Coverage Error 3: the dropping of The Fed Funds Goal fee from 5.25% in September 2007 to an eventual 0.25% in December 2008.

With the election of President Obama, The Fed engaged in Coverage Error 4: conserving The Fed Funds Goal fee too low for too lengthy, mixed with their huge asset buy applications (QE).

Lastly, The Fed (below Yellen) lastly raised The Fed’s goal fee ONCE below Obama, however began elevating charges as soon as Trump was elected. The Fed additionally slowed their QE below Trump which as referred to as “Fed coverage NORMALIZATION.” Then COVID struck and The Fed engaged in Coverage Error 5: conserving charges too low for too lengthy … once more whereas massively increasing their steadiness sheet.

Fannie Mae and Freddie Mac, the DC mortgage giants have been accomplished in by The Fed’s whipsaw Coverage Error machine.

Now we’re embarking on PE 5: Powell and The Fed Gang not elevating charges however signalling that they may. Just like the play “Ready for Godot.”