GBP/USD Information and Evaluation

Really helpful by Richard Snow

Get Your Free GBP Forecast

US Q1 GDP Disappointment Does Little for Cable

US Q1 GDP missed estimates of two% development, coming in at a disappointing 1.1%. The print was the primary estimate which usually has the best market-moving potential and notably, had little or no impact after the discharge. The truth is, cable has truly traded decrease within the early afternoon through the London session regardless of a lift from Goldman Sachs who now anticipate a peak rate of interest within the UK of 5%. Markets have priced in round 4.75% for the height so the potential for a bullish repricing stays, notably as charge expectations within the US took a success after yesterday’s banking worries round one other drastic decline within the share value of the fledgling First Republic Financial institution.

GBP/USD Technical Issues and Ranges of Curiosity

The technical outlook for cable recommend an absence of bullish momentum to set a brand new yearly excessive regardless of declining yields within the US and a reasonably forlorn US greenback. Yesterday and so far immediately, prolonged higher wicks reveal a rejection of upper costs or on the very least, a reluctance to commerce greater at present ranges, within the absence of a catalyst. Remember the fact that the potential for a catalyst improves with the busy financial calendar within the subsequent week.

Quick help seems on the zone of help round 1.2445 adopted by the underside of the wedge formation and 1.2345 and the zone across the psychological complete variety of 1.2300. Resistance stays on the swing excessive of 1.2547.

GBP/USD Every day Chart

Supply: TradingView, ready by Richard Snow

Really helpful by Richard Snow

Buying and selling Foreign exchange Information: The Technique

Main Danger Occasions for the Subsequent Seven Days

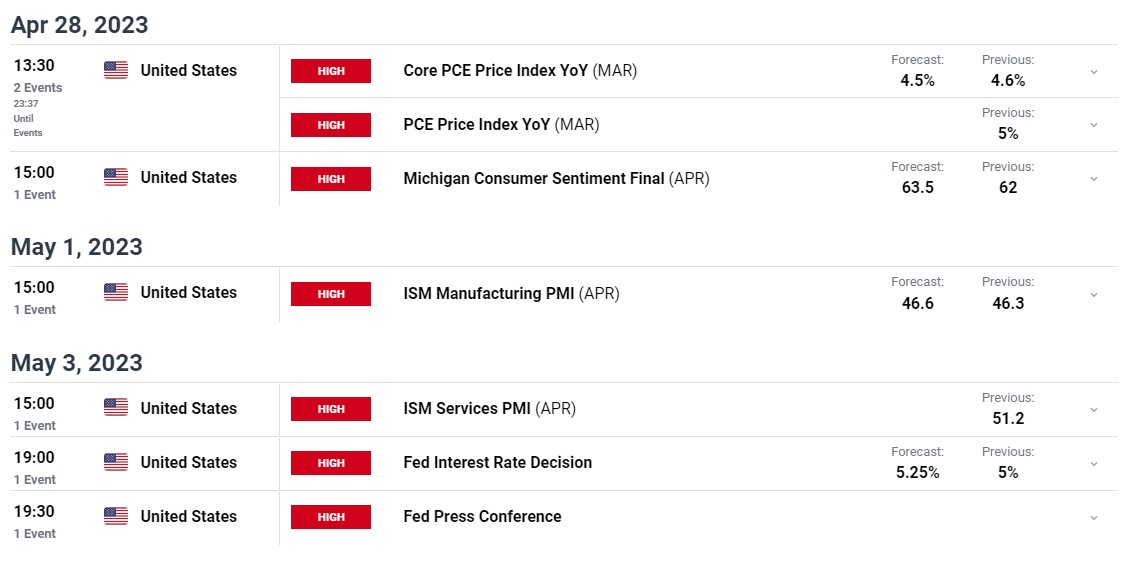

After immediately’s US GDP knowledge, tomorrow we’ll get the ultimate piece of inflation knowledge earlier than the essential FOMC assembly the place markets have decreased the likelihood of a 25 foundation level hike from Jerome Powell and the committee given the current rise in uncertainty and slight carry in volatility. Hotter PCE knowledge could revert these chances again in step with the place they had been every week earlier, nonetheless.

Moreover, each manufacturing and companies PMI (ISM) are due subsequent week the place manufacturing lags the better-performing companies sector – the most important contributor to general US GDP.

Customise and filter dwell financial knowledge by way of our DailyFX financial calendar

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX