GBP/USD News and Analysis

- GBP/USD recovers on news of PM, chancellor meeting with the UK fiscal watchdog

- Cable recovers losses buoyed by fiscal accountability measures and surprise UK GDP beat for Q2

- UK GDP surprise helps lift GBP recovery, US PMI and NFP data up next

Recommended by Richard Snow

Get Your Free GBP Forecast

GBP/USD Recovers on News of PM meeting with the UK Fiscal Watchdog

Liz Truss and Kwasi Kwarteng are scheduled to meet with the UK fiscal watchdog, the Office for Budget Responsibility in the wake of the market dysfunction seen in UK assets over the last week.

The Treasury Select Committee, constituting MPs from all parties, demanded that chancellor Kwarteng provide the full economic forecast from the OBR by the end of October.

A contributing source for the volatile movements over the last week includes the fact that no independent OBR forecast accompanied Kwarteng’s mini-budget despite a draft being made available from the OBR on the chancellor’s first day of office.

Technical Considerations

The 4-hour GBP/USD chart shows the recovery in cable which has returned to levels witnessed in the early morning of last Friday, ahead of the mini-budget that sent UK assets into a spiral.

The improved situation in cable has been supported by the oversight measures as well as a noticeable pullback in the dollar. Upside levels of resistance for the pair appear around 1.1410 which doubles up as the 2020 low and the underside of trendline resistance. Support currently lies at 1.1110 where a further loss in confidence could see the pair trade back towards the 1985 level of 1.0550.

GBP/USD 4-Hour Chart

Source: TradingView, prepared by Richard Snow

UK longer dated gilts appear to have stabilized but the situation still needs to be monitored closely. Any further missteps resulting in a loss of confidence in UK inc could see another spate of selling and subsequent BoE intervention – which is likely to weigh on the pound once again.

UK 30 Year Government Bond (Gilt) Yield

Source: TradingView, prepared by Richard Snow

Major Risk Events on the Horizon

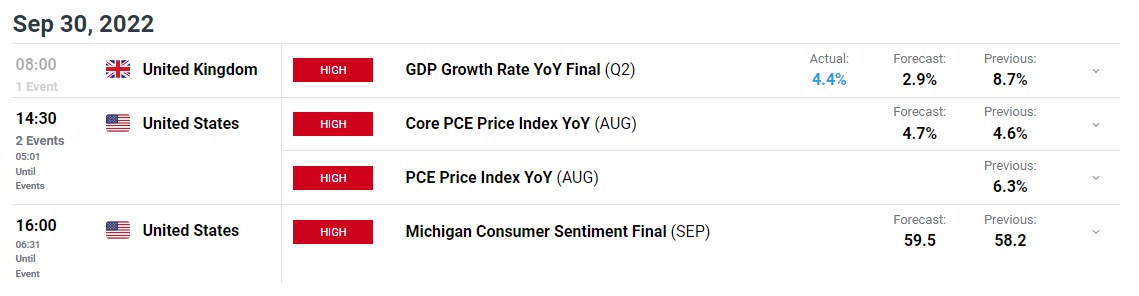

The pound’s recent recovery was buoyed by rather positive, although backward looking, data as GDP growth advanced 4.4% in relation to Q2 last year despite a 2.9% forecast. Later today we see US PCE inflation data and if the August CPI beat is anything to go by, we could see movement in dollar crosses upon a potential surprise in the data (positive or negative) as we head into the weekend. The university of Michigan consumer sentiment report is to show finalized figures for September, expecting another lift in perceptions there.

Next week there is a pick up in US focused data with manufacturing as well as services PMI data from the Institute of Supply Management alongside the US non-farm payroll data where unemployment is forecast to come in at 3.7%

Customize and filter live economic data via our DaliyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX