Wara1982

BrandywineGLOBAL – International Earnings Alternatives Fund (NYSE:BWG) is a globally oriented fixed-income closed-end fund that traders can use to acquire a really excessive stage of earnings from the belongings of their portfolios whereas gaining worldwide publicity. As is the case with many world fixed-income funds, this one has a remarkably excessive yield, with shares boasting a 13.22% yield on the present worth. That’s clearly one of many highest yields out there available in the market in the present day, however sadly, that yield can be at a stage the place there may be some concern over its stability. In any case, for a lot of the previous decade, belongings solely ended up with a double-digit yield when the market was anticipating a distribution minimize. Nevertheless, that’s much less relevant in the present day than it was a number of years in the past because of the easy proven fact that the yields on the whole lot are a lot increased than they was. In addition, funds that spend money on overseas belongings ceaselessly have increased yields than funds that make investments solely in america just because there are numerous overseas international locations by which rates of interest are quite a bit increased than they’re within the home market.

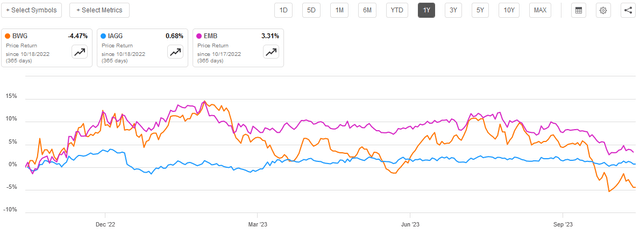

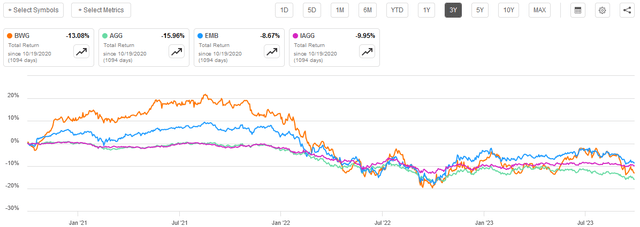

Sadly, the current efficiency of the BrandywineGLOBAL – International Earnings Alternatives Fund has been fairly disappointing. As we will see right here, the fund has underperformed each the iShares Core Worldwide Mixture Bond ETF (IAGG) in addition to the iShares J.P. Morgan USD Rising Markets Bond ETF (EMB):

Looking for Alpha

That is fairly disappointing, particularly since this fund underperformed the rising markets bond index. In any case, this fund does make investments pretty considerably in rising market debt securities. Nevertheless, the portfolio comprises plenty of different issues too, so this isn’t completely an rising markets fund. Thankfully, it does quite a bit higher after we contemplate the affect that the fund’s extremely massive distribution has on its total return. We are able to see that not solely do the distributions fully offset the fund’s worth decline, however additionally they give it a complete return that beats the worldwide bond index by quite a bit:

Looking for Alpha

This actually helps endear the fund to traders, however the worth decline over the interval may nonetheless scare some individuals off. General, although, the fund’s efficiency has been fairly respectable.

Naturally, the large query on everybody’s thoughts is whether or not or not it is smart to purchase the fund in the present day. Allow us to examine this.

About The Fund

Based on the fund’s webpage, BrandywineGLOBAL – International Earnings Alternatives Fund has the first goal of offering its traders with a really excessive stage of present earnings. This isn’t stunning contemplating that this can be a fixed-income fund, as already talked about. As we have now mentioned quite a few instances earlier than, fixed-income securities are primarily an earnings automobile since they haven’t any inherent hyperlink to the expansion and prosperity of the issuing firm. Within the case of bonds, these securities additionally haven’t any internet capital positive factors over their lifetimes, as bonds are each bought and mature at their face worth.

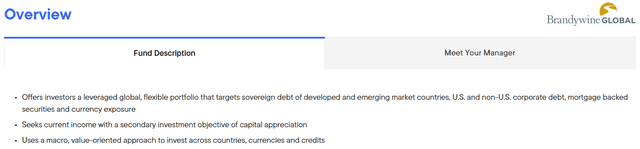

This fund employs a considerably completely different technique with a purpose to obtain its goal than many different fixed-income funds, nonetheless. We are able to see this right here:

Franklin Templeton

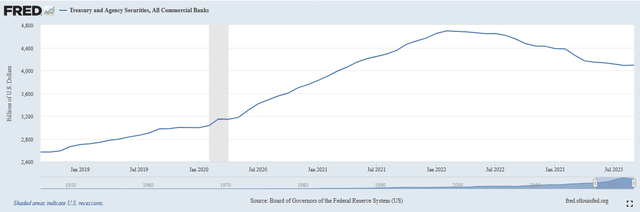

As the outline states, the fund may spend money on each home and overseas company debt, overseas sovereign debt of each developed and rising market international locations, and even some mortgage-backed securities. The truth is, the one factor that isn’t particularly talked about right here is U.S. Treasury securities, which the fund will usually have extraordinarily restricted publicity to. That is really an excellent factor for American traders who may maintain different bond funds (or non-Individuals who might need an American bond fund of their portfolios). It is because america federal authorities is the most important issuer of bonds within the nation, and naturally nearly each American bond fund goes to have important publicity to them. As we have now mentioned in quite a few earlier articles, the funds of the American federal authorities aren’t particularly good in the meanwhile, so it is just pure that bond traders will wish to cut back their publicity to those securities. In any case, as we will see right here, even American industrial banks have begun to cut back their publicity to U.S. Treasuries:

Federal Reserve Financial institution of St. Louis

As this fund doesn’t spend money on U.S. Treasury securities, together with it in a portfolio that comprises different funds that do spend money on these debt choices will cut back your total publicity to American Federal Authorities debt.

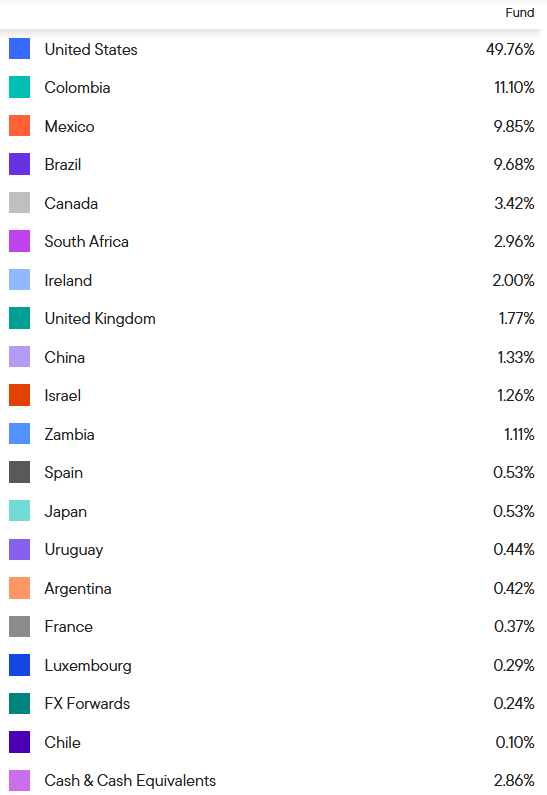

Nevertheless, with that stated, a large share of the issuers whose securities are represented within the fund’s portfolio are American entities. We are able to see that right here:

Franklin Templeton

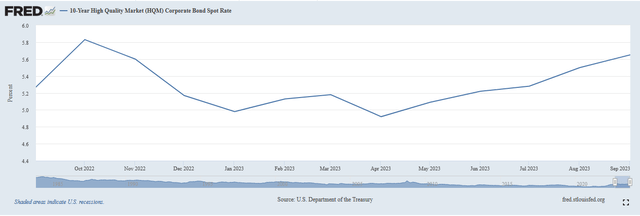

For probably the most half, these are American company bonds, not company securities or different issues which might be implicitly or explicitly backed by the U.S. authorities. As such, they do carry some default threat, however additionally they have increased yields than U.S. Treasuries. As of the time of writing, the ten-year U.S. Treasury is at 4.906% however the ten-year high-quality company spot index is at 5.65%:

Federal Reserve Financial institution of St. Louis

The ten-year high-quality company spot index tracks the typical yield of a portfolio consisting of a combination of AAA, AA, and A-rated bonds with a maturity date ten years into the longer term. Thus, it’s typically thought-about to be a fairly good proxy to see the place corporates are relative to U.S. Treasuries. The general level right here although is that the belongings held by this fund are going to have considerably increased yields than federal authorities bonds with a purpose to compensate traders for the very fact that there’s a threat of default.

In quite a few articles about fixed-income closed-end funds, we mentioned the place rates of interest are heading as a part of our evaluation of the fund. In any case, rates of interest are one of the vital necessary elements for bond traders because of the easy proven fact that bond costs are inversely correlated with rates of interest. Nevertheless, the fascinating factor about this fund is that there’s a combination of nations right here, every with its personal rate of interest regime. For instance, the European Union has not elevated its benchmark rate of interest to almost the identical stage as america over the previous two years. As of proper now, the primary refinancing price, which is the equal of the federal funds price for banks within the European Union, is at 4.50% versus a 5.33% efficient federal funds price. The Financial institution of Japan has not elevated its benchmark price in any respect since 2016. There are bonds from issuers within the European Union in addition to bonds from Japanese entities contained on this fund. These bonds will react primarily based on the rate of interest insurance policies of their respective central banks, not the Federal Reserve. With that stated, just below half of the securities held by this fund are from American entities and so the rate of interest insurance policies of the Federal Reserve are extra necessary than the insurance policies of every other particular person central financial institution when evaluating the efficiency of this fund. This can be why this fund’s efficiency seems to have extra correlation with the Bloomberg U.S. Mixture Bond Index (AGG) than it does with every other bond index, regardless that it’s hardly an ideal correlation:

Looking for Alpha

Thus, it doesn’t seem that this fund will permit traders to completely escape from the financial insurance policies of the Federal Reserve, however it’s going to in all probability do a greater job than a pure home bond fund.

As talked about within the introduction, rising markets tend to have considerably increased rates of interest than developed markets. That is despite the truth that these international locations sometimes have a lot better authorities funds. For instance, Columbia, whose issuers symbolize the most important proportion of the fund’s belongings aside from america, presently has the next:

|

Authorities Debt-to-GDP |

63.6% |

|

Price range Deficit |

4.3% of GDP |

The USA has a present funds deficit of 5.8% of gross home product, so clearly its numbers are far worse than Columbia’s. The market typically permits america to borrow at a decrease price, although. The one largest holding of this fund is Columbian authorities bonds with a 7.25% coupon. It has actually been fairly a very long time since U.S. Treasuries traded with a yield anyplace near 7.25%!

Admittedly, some rising market nations have a historical past of presidency instability, regime modifications, coups, and related issues so there could be a certain quantity of threat concerned to acquire these yields. We are able to nonetheless clearly see although that rising market debt securities basically might be a good option to acquire a excessive stage of present earnings contemplating that their authorities funds aren’t essentially all that dangerous.

Leverage

One of many defining traits of closed-end funds such because the BrandywineGLOBAL – International Earnings Alternatives Fund is that these belongings make use of leverage as a way of boosting their efficient returns nicely past that of any of the underlying belongings within the portfolio. I defined how this works in varied earlier articles. To paraphrase myself:

Briefly, the fund borrows cash after which makes use of that borrowed cash to buy each home and overseas bonds, together with bonds issued by entities positioned in rising markets. So long as the yield that the fund receives from the bought belongings is increased than the rate of interest that it has to pay on the borrowed cash, the technique works fairly nicely to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, this can often be the case.

Nevertheless, the usage of debt on this trend is a double-edged fund. It is because leverage boosts each positive factors and losses. As such, we wish to be certain that the fund will not be using an excessive amount of leverage since that may expose us to an extreme quantity of threat. I typically don’t like a fund’s leverage to exceed a 3rd as a share of its belongings because of this.

As of the time of writing, the BrandywineGLOBAL – International Earnings Alternatives Fund has leveraged belongings comprising 43.53% of its portfolio. That is fairly a excessive stage of leverage. The truth is, it is among the highest ranges that I’ve ever seen a closed-end fund possess. As such, the fund is nearly actually going to be far more unstable than most world bond funds, and its draw back dangers are amplified in a worst-case state of affairs. Whereas there could also be some traders who’re snug with a high-risk, high-reward technique like this, that’s in all probability not the profile of the everyday income-seeking investor.

Distribution Evaluation

As talked about earlier on this article, the first goal of the BrandywineGLOBAL – International Earnings Alternatives Fund is to offer its traders with a really excessive stage of present earnings. This isn’t stunning contemplating that the fund’s primary technique is to buy bonds from all around the world after which borrow cash to purchase much more bonds, benefiting from the distinction between the borrowing price and the yield of the bonds. Most of the bonds, though actually not all of them, come from nations by which rates of interest are a lot increased than they’re within the developed world. Because the fund’s leverage amplifies the efficient yield, we will assume that the precise quantity of earnings that the fund brings in is a reasonably excessive share relative to the online asset worth of the portfolio. The fund collects all of those funds after which distributes them to its traders regularly, internet of the fund’s personal bills. It could actually in all probability be anticipated that this can give the fund’s shares a really excessive yield.

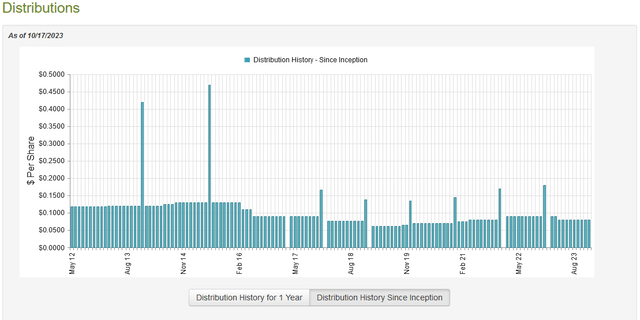

That is actually the case, because the BrandywineGLOBAL – International Earnings Alternatives Fund pays a month-to-month distribution of $0.08 per share ($0.96 per share yearly), which supplies the fund a really spectacular 13.22% yield on the present worth. The fund has sadly not been particularly per respect to its distribution over time. The truth is, as we will see, the distribution has assorted to a terrific diploma because the fund’s inception:

CEF Join

That is nearly actually going to show to be a turn-off for any investor who’s searching for a secure and secure supply of earnings to make use of to pay their payments or finance life-style bills. Nevertheless, it isn’t particularly stunning for a fixed-income fund contemplating that the belongings held by these funds are extremely delicate to modifications in rates of interest. This might be very true with this fund because it has publicity to plenty of completely different international locations, currencies, and central financial institution insurance policies. We’d usually anticipate a fund like this to range its distribution over time to correspond to the general efficiency of its funding portfolio. In any case, we don’t need the fund to pay out greater than it manages to earn in funding income since that may be damaging to the fund’s belongings and show to be unsustainable in the long run. Allow us to examine the fund to determine precisely what’s going on right here.

Thankfully, we have now a comparatively current doc that we will seek the advice of for the aim of our evaluation. As of the time of writing, the fund’s most up-to-date monetary report corresponds to the six-month interval that ended on April 30, 2023. This was actually an fascinating interval for america, as traders have been typically optimistic that the Federal Reserve may rapidly pivot on its financial coverage and start easing, because it has executed for a lot of the previous decade. As such, American shares and bonds typically rallied, and yields fell. The identical factor really occurred in rising market bonds and the worldwide bond market, though the diploma of the rally assorted from nation to nation. The fund could have been capable of benefit from this and generate some capital positive factors by promoting appreciated belongings.

Through the six-month interval, the BrandywineGLOBAL – International Earnings Alternatives Fund obtained $10,345,418 in curiosity and $129,169 in dividends from the belongings in its portfolio. After we subtract out the cash that the fund needed to pay in overseas withholding taxes, we see that it had a complete funding earnings of $10,386,466 throughout the interval. The fund paid its bills out of this quantity, which left it with $6,656,630 out there for shareholders. Sadly, this was not sufficient to cowl the $8,731,755 that the fund paid out in distributions throughout the interval. At first look, that is actually going to be regarding as we usually like fixed-income funds to have the ability to fully cowl their distributions out of internet funding earnings.

Nevertheless, there are different strategies by which the fund can acquire the cash that it must cowl the distribution. For instance, it might need been capable of promote some appreciated securities right into a typically pleasant market with a purpose to understand some capital positive factors. The fund had blended outcomes right here, because it reported internet realized losses of $14,937,278 however these have been offset by $20.951,737 in internet unrealized positive factors. General, the fund’s internet belongings went up by $3,939,334 over the interval after accounting for all inflows and outflows. Thus, the fund technically did handle to cowl its distributions throughout the interval. Nevertheless, it needed to depend on unrealized positive factors to try this, and unrealized positive factors may be very simply erased by a market correction. Thus, it could have misplaced a few of that cash by now and its funds could not really be as robust as they seem. We must wait a number of months for the fund to launch its annual report with a purpose to know for sure.

Valuation

As of October 17, 2023 (the latest date for which information is presently out there), the BrandywineGLOBAL – International Earnings Alternatives Fund has a internet asset worth of $8.55 per share however the shares presently commerce for $7.16 every. This provides the fund’s shares a 16.26% low cost on internet asset worth on the present worth. That is a gigantic low cost that’s considerably higher than the 14.27% low cost that the shares have had on common over the previous month. Thus, the present worth appears like an excellent entry level for the fund.

Conclusion

In conclusion, the BrandywineGLOBAL – International Earnings Alternatives Fund is among the few closed-end bond funds out there that maintain important positions outdoors of america. This might be fairly helpful for traders who wish to diversify their belongings away from america. The fund’s extremely excessive yield provides to its enchantment, particularly as a result of it largely managed to cowl it throughout the latest interval. The most important draw back right here is the fund’s use of leverage, because the fund is extremely leveraged and seems to be utilizing a high-risk, high-reward technique. This provides it quite a lot of volatility that some traders could not wish to take care of. Nevertheless, it does seem like an excellent fund with a beautiful valuation when you can abdomen the volatility.