Is the market lastly bottoming out after tumbling greater than 17% from its mid-February peak after Trump’s fast-moving tariff plans sparked a significant selloff?

Nobody—not analysts, not specialists, not even the loudest speaking heads—can predict its subsequent transfer with certainty.

A recent wave of unhealthy headlines may ship indexes decrease once more, making knee-jerk reactions to breaking information a expensive mistake.

As an alternative of chasing the most recent market noise, contemplate a better method: concentrate on particular person shares that could be forming a backside, aligned along with your danger urge for food and long-term targets.

For beneath $10 a month, InvestingPro members have been utilizing a reside listing of the market’s Most Undervalued and Most Overvalued shares, which are actually additionally accessible for native markets.

The concept is straightforward: somewhat than making an attempt to name the precise backside, concentrate on shares which might be already displaying indicators of stabilizing and doubtlessly reversing course.

Instruments like Honest Worth can assist with that – it’s grounded in additional than 15 widely-used monetary metrics and presents a constant, research-backed view of the true intrinsic valuation of a inventory.

Some buyers utilizing these undervalued alerts have uncovered compelling alternatives amid market downturns. Listed here are a couple of standout examples:

1. Warner Bros: Honest Worth Sends Undervalued Sign – Inventory Pops 56%

Warner Bros Discovery Inc (NASDAQ:) kicked off 2023 with a large 56% surge in January, peaking at slightly below $16. However the rally was short-lived.

Because the U.S. banking disaster rattled markets, WBD’s inventory tumbled, triggering a virtually 18-month downtrend as analysts slashed earnings estimates.

Then, the tide shifted—and Honest Worth detected one thing was altering.

On August 9, 2024, InvestingPro’s Honest Worth fashions flagged WBD as undervalued, figuring out a possible turnaround when the inventory was buying and selling at simply $7.03—properly beneath its intrinsic worth estimate of $10.00.

Regardless of challenges in its conventional TV enterprise, WBD nonetheless reported $39.9 billion in income and $7.4 billion in EBITDA—key alerts of restoration that Honest Worth picked up on earlier than the market did.

The outcomes? A robust 56% rebound in simply seven months, as WBD’s inventory surged to $10.19—rewarding buyers who adopted the Honest Worth sign.

As of final week, this inventory skilled a significant selloff because it tumbled to $8.09.

Is that this dip value shopping for?

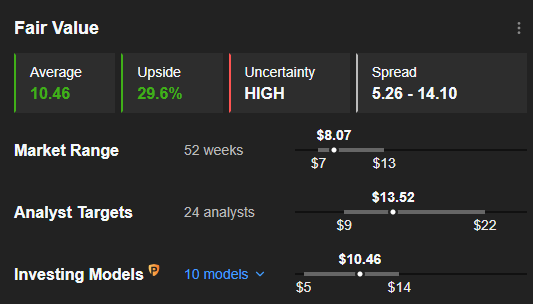

Honest Worth is signaling a possible 29.6% undervalued alternative as soon as once more.

Supply: InvestingPro

2. Nokia Shattered Expectations With a Gorgeous 51% Rally

In April 2024, the Honest Worth fashions recognized Nokia (NYSE:) as considerably undervalued whereas it was buying and selling at simply $3.52 per share. The sign pointed to a significant disconnect between Nokia’s market value and its true value.

Quick ahead to March 16, 2025, and Nokia surged 51.64%, hitting $5.33—outpacing even Honest Worth’s preliminary 42.53% upside projection.

On the time of the decision, Nokia, a world chief in telecom infrastructure and expertise options, was caught in a sideways sample.

But, it nonetheless reported $22.8 billion in income and $3.28 billion in EBITDA, indicators that Honest Worth recognized as indicators of an impending turnaround.

The inventory’s rally got here alongside notable monetary enhancements, with EPS climbing from $0.16 to $0.24, reinforcing Honest Worth’s bullish outlook.

After the latest market selloff, the inventory is presently buying and selling close to $4.6 a share.

3. Tencent Good Dip-Purchase Yields 52%, Outperforming Expectations Once more

When honest worth recognized Tencent Music Leisure Group (NYSE:) as considerably undervalued in September 2024, the inventory traded at simply $9.48.

With the abrupt selloff in August 2024, buyers puzzled if this dip was only a knee-jerk response by the market.

The Honest Worth software – whereas not a market-timing instrument – serves as a vital metric for buyers assessing a inventory’s true potential via elementary information. It flagged Tencent Music as a minimum of 38% undervalued, setting a goal value of $14.38.

The corporate’s earlier earnings confirmed the bettering fundamentals, with income rising to $3.97 billion and EBITDA climbing 13.5% to $1.06 billion.

Quick ahead to twenty seventh March 2025, and buyers who acted on this perception bagged a outstanding 52% achieve.

Tencent Music, China’s high on-line music and audio leisure platform had robust fundamentals even earlier than its breakout.

On the time, the corporate reported $3.77 billion in income and $935.5 million in EBITDA—clear indicators of monetary energy that many missed.

As of now, the inventory has entered a downtrend as soon as once more, seeming to stabilize at simply round $12.75.

Backside Line

After a unstable March, April has introduced one other wave of uncertainty as markets value within the impression of Trump’s tariffs and the likelihood of a world commerce battle. However seasoned buyers know that each dip holds alternative.

Whereas destructive headlines might strain shares, in addition they create golden probabilities for these ready to behave.

Examples like Warner Bros. Discovery, Nokia, and Tencent are proof – every surged 50% after forming potential bottoms, turning market pullbacks into revenue alternatives.

With InvestingPro’s Honest Worth insights, you may lower via the noise and spot potential bargains, all for slightly below $10 a month.

***

Disclaimer: This text is written for informational functions solely. It isn’t meant to encourage the acquisition of property in any method, nor does it represent a solicitation, supply, suggestion or suggestion to speculate. I want to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding determination and the related danger belongs to the investor. We additionally don’t present any funding advisory providers.