marekuliasz/iStock by way of Getty Photos

Co-authored by Treading Softly

With nine-twelfths of the 12 months over, we’re marching shortly into the ultimate interval of the 12 months. This typically comes with plenty of holidays and enjoyable adventures for kids – Halloween, Thanksgiving, Veterans Day, and Christmas are all proper across the nook.

Sometimes, the climate turns colder, and typically snow even begins to fall, relying on the place you reside. The opposite factor that involves thoughts is that we frequently see a speedy uptick in sickness. The flu, RSV, and supposedly COVID are all anticipated to make some fairly sturdy inroads this 12 months, being a part of the brand new seasonal norm for sicknesses.

Gasoline gross sales sometimes spike as effectively, as all of us begin to journey just a bit bit extra to go see family and friends. Coincidentally, we have seen throughout the worldwide scale that oil manufacturing is anticipated to be decreased, serving to oil costs to stay excessive.

Healthcare costs have additionally not likely modified in that they are a few of the vaguest and hardest-to-discover issues within the universe. Sadly, not like a McDonald’s, you possibly can’t stroll into the hospital and get a menu with all the costs of various providers that they provide so that you could be comparability store.

I can definitively say that from each of those conditions and within the seasonality of our lives, you possibly can generate sturdy revenue with out having to gamble with completely different corporations out there.

In the present day, I need to take a look at two completely different funds that give you the power to learn from the sturdy costs of commodities, and likewise profit from the long-term payouts that the healthcare sector is ready to present.

Let’s dive in!

Choose #1: BCX – Yield 7%

As I’ve mentioned in my Market Outlooks, whereas inflation is slowing down, it doesn’t imply that something you purchase will likely be cheaper. The inflation charge measures the tempo of value will increase, not absolutely the enhance in costs. In case you have a product that’s promoting for $90 one 12 months and $100 the following, that’s $10 of inflation and an 11.1% inflation charge. If that very same product sells for $102 the next 12 months, the inflation charge has fallen to 2%. We’d say that inflation has slowed to the Fed’s focused 2% charge. Be aware that at $90, 2% inflation would solely be $1.80, however at $100, 2% inflation can be a $2.00 enhance.

That is what is occurring all through the financial system. Inflation is “slowing down”, however costs are nonetheless rising on most gadgets. Costs are rising at a slower charge, however it’s a slower charge ranging from the next value established from the excessive inflation of 2021 and 2022. The influence of inflation occurred, and the upper base of costs is one thing we are going to stay with ceaselessly.

Why am I bringing this up? Throughout inflation, traders have been piling into commodity corporations, excited on the prospect of excessive commodity costs driving costs larger. Now that the narrative has shifted, many traders have piled out.

True, costs of most commodities have come down from their COVID-era highs as provide chain disruptions have gotten a factor of the previous. Nonetheless, the costs of most commodities are nonetheless larger than they have been from 2010-2019. Commodities have been pressured by low costs for a decade, and now the tide has turned. Firms that managed to outlive when costs have been low are actually thriving.

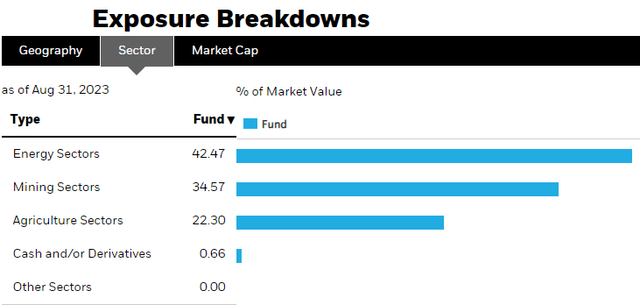

BlackRock Assets & Commodities Technique Belief (BCX) is a method we will spend money on varied commodity-driven corporations. BCX invests in three main segments: Power, Mining, and Agriculture. At present, it’s heaviest in vitality and is benefiting from oil rising again above $90/barrel. Supply

BCX Web site

BCX primarily invests in massive, well-established commodity corporations. Over 90% of its portfolio is invested in corporations with a market capitalization exceeding $10 billion. It then generates extra revenue by writing coated calls on roughly 1/third of its portfolio.

BCX decreased its dividend throughout COVID, however has since raised it. The present dividend is now barely larger at $0.0518/month in comparison with $0.0516 pre-COVID. Because the setting continues to be constructive for commodity corporations, we consider that there will likely be room for BCX to extend its dividend much more.

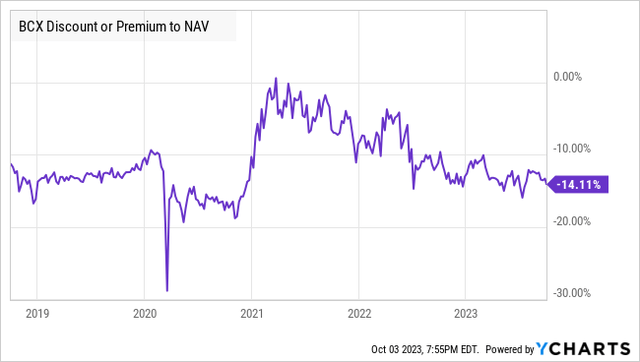

In the present day, BCX is buying and selling at an ideal low cost to NAV. As famous above, BCX primarily invests in corporations which have $10 billion+ market caps. These are corporations we might spend money on immediately if we wished. Nonetheless, with BCX, we’re getting a 14% low cost!

YCharts

Plus, our revenue retains coming in each month with none extra effort from us. So, as I sit again listening to people complain concerning the value of oil, lumber, or meals, I’ve to sip my espresso and canopy up my smile as I take into consideration the dividends pouring into my account!

Choose #2: HQH – Yield 10.6%

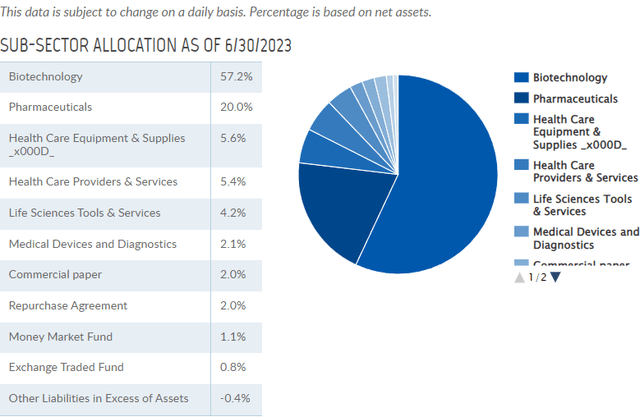

Tekla Healthcare Traders (HQH) is a CEF that focuses on the healthcare sector, with a particular deal with biotechnology and prescription drugs which make up over 77% of the present portfolio. Supply

Teklacap Web site

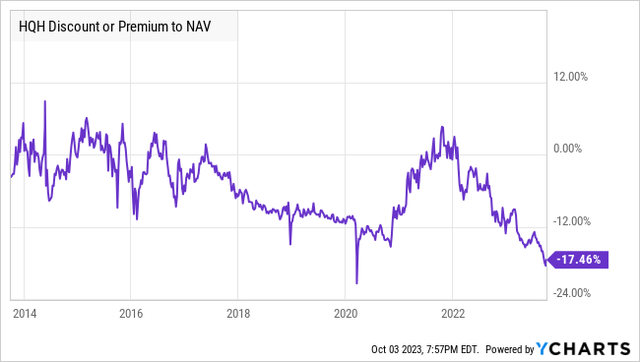

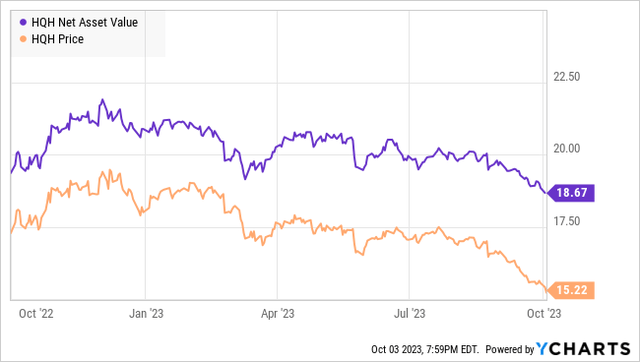

One thing fascinating has occurred this 12 months. HQH is buying and selling on the steepest low cost to NAV in over a decade, excluding a really temporary dip in March 2020.

YCharts

Be aware that NAV just isn’t too removed from the place it was a 12 months in the past. It has been comparatively steady over the previous 12 months. The share value for HQH has been on a gradual downtrend.

YCharts

Anytime a CEF trades at a bigger low cost than common, it’s price a glance. Particularly a CEF like HQH, which primarily holds publicly traded frequent equities.

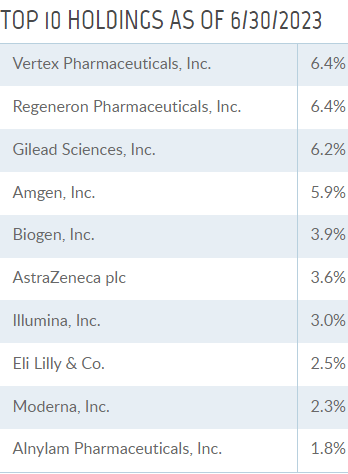

HQH’s prime 10 are all extensively recognizable, simply buyable shares within the healthcare sector:

Teklacap Web site

You can purchase these shares your self. Then once more, you possibly can pay 18% much less shopping for with HQH. I prefer to pay much less, plus HQH will convert the capital features from these holdings into dividends.

HQH has a variable dividend coverage, and it pays out 2% of NAV every quarter. Be aware that the dividend fee is calculated primarily based on NAV, not the market value. So after we can purchase at a steep low cost like we will at present, our yield on funding is way larger.

HQH’s value is heading down, however the costs of the shares that it owns have stored NAV within the $19-$21 vary for over a 12 months. Because of this, we will get a a lot larger yield at present and profit from capital features when the share value will get nearer to NAV.

HQH has a really lengthy historical past, going again to 1987, offering traders with nice dividends and whole returns. The supervisor Tekla is being acquired by Aberdeen, however this is not going to change the personnel managing the fund every day. I’ve voted in favor of the merger and encourage others to do the identical.

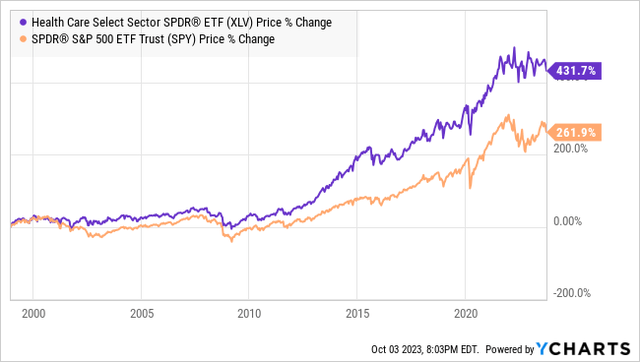

Healthcare has all the time been a sector that has to take care of politics, massive capital expenditures, and rules. Nonetheless, additionally it is a really worthwhile sector that serves important social wants and needs. With an growing old inhabitants, demand for brand new drugs goes to proceed to extend. A whole lot of the massive corporations on this sector do not pay a lovely dividend, so to achieve publicity to it whereas following the Earnings Technique, CEFs like HQH are a superb choice.

Conclusion

With HQH yielding 10.6% and BCX yielding 7%, we’re in a position to get pleasure from sturdy publicity from two sectors which can be going to thrive going ahead. Commodity costs stay elevated over historic norms as a result of a discount in commodity inflation implies that its costs should not climbing as quickly. It doesn’t imply that costs have declined. Moreover, healthcare has been a sector that has traditionally outperformed the S&P 500 (SPY).

YCharts

As an incremental investor, I am not essentially fearful about all the time beating the market itself, however I’m all the time fearful about beating the market on the extent of revenue that I get versus what the revenue of the market supplies.

On the subject of your retirement, you are not going to have the ability to pay your grocery invoice by telling them how a lot your portfolio has risen in paper worth that you have by no means unlocked and do not need accessible in your pockets. That is one thing I typically suppose individuals use to impress each other however doesn’t truly assist their life-style. Folks prefer to inform you, “my portfolio is up 10% 12 months thus far,” however the money of their pockets is simply as sparse because it’s all the time been. On the subject of the true world, real-world money is essential, and that’s one thing {that a} quarterly or month-to-month dividend from a holding can give you. Similar to once you stay in your house, you do not have to fret about what its worth is day by day since you’re having fun with the tangible advantages it supplies. Likewise, you do not have to fret concerning the value actions of a safety you are holding if its dividends are nonetheless offering you with these tangible advantages. A type of advantages is monetary safety, and you’ll have that.

That is the fantastic thing about my Earnings Technique. That is the fantastic thing about revenue investing.