Justin Sullivan

Broadcom Inc. (NASDAQ:AVGO), a major entity within the semiconductor area, is a promising funding prospect. Broadcom excels in networking chips, catering to sectors like wi-fi communication, automotive, and industrial purposes. Such chips are important in units from smartphones to servers. As networking positive factors significance in generative synthetic intelligence (AI), Broadcom is primed for development. CEO Hock Tan’s recognition of the corporate’s AI endeavors signifies its dedication to the AI sector. Broadcom’s constant monetary well being and engaging valuation make it a worthy funding possibility. This text delves right into a technical evaluation of Broadcom’s inventory value to determine future projections and funding prospects. The evaluation reveals a distinctly bullish pattern for the inventory, with any market corrections seen as prime shopping for alternatives for buyers.

Unraveling the Broadcom Alternative

Within the ever-evolving realm of AI, NVIDIA Company (NVDA) has dominated headlines, its inventory rallying immensely behind hovering demand for AI chips. Certainly, Nvidia has been a poster little one for the AI increase within the inventory market, primarily due to its graphics processing items (GPUs) which discover purposes in gaming, autonomous autos, and more and more, in AI. Whereas this surge is noteworthy, it has pushed Nvidia’s trailing PE ratio to over 200, suggesting that the inventory could also be overvalued and comes with related dangers, particularly with the unpredictable nature of the AI market.

Broadcom emerges as a compelling different to Nvidia when it comes to funding. Although Broadcom could lack the mainstream model resonance of Nvidia or Intel within the semiconductor business, its efficiency is important. The inventory has surged by over 5,000% over the previous 13 years. Specializing in networking chips, Broadcom’s choices cater to a plethora of industries, together with wi-fi and broadband communication, automotive, and industrial sectors. Their chips discover their manner into varied units – from smartphones and servers to switches.

With networking being a essential factor in generative AI, Broadcom is well-poised to realize from the rising demand on this house. In a testomony to the corporate’s focus and development within the AI realm, CEO Hock Tan revealed vital development in income from generative AI-related alternatives. Merchandise just like the Tomahawk 5 and the brand new Jericho3-AI chip additional underscore the corporate’s dedication to AI, providing unparalleled efficiency in AI networks.

Broadcom’s resilience can be witnessed in its constant income development. In contrast to opponents, the corporate has weathered business challenges commendably, at the same time as sectors like PCs, gaming, and knowledge facilities confronted headwinds. Its spectacular 46% working margin and 65% adjusted EBITDA margin point out the agency’s strong pricing energy and the premium prospects assign to its merchandise.

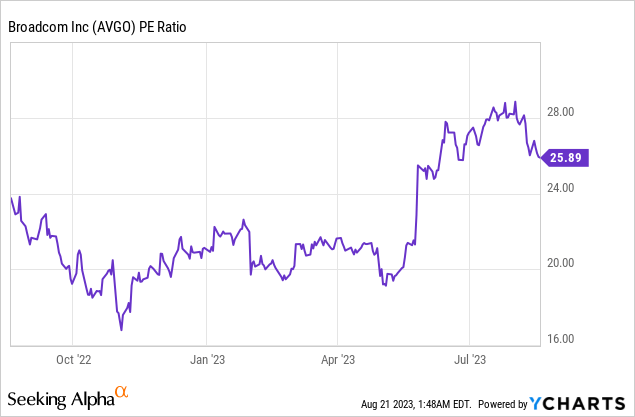

Maybe probably the most attractive side for potential buyers is Broadcom’s valuation. Broadcom in all fairness priced with a PE ratio of simply 25.89 and provides a beautiful dividend yield of two.17%. Contemplating the corporate’s prospects in AI and its constant development trajectory, it undeniably stands out as a beautiful purchase.

A Deep Dive into Broadcom’s Upward Momentum

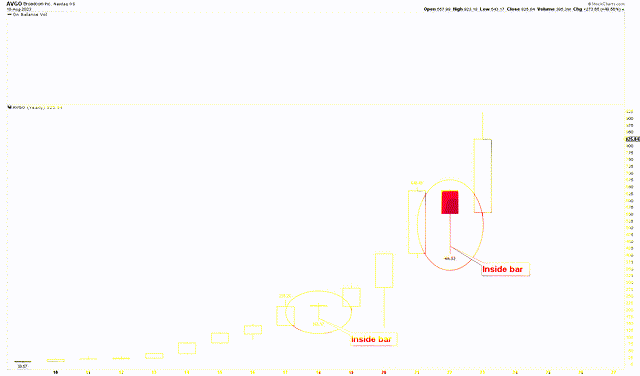

The yearly chart beneath depicts a strongly bullish outlook for Broadcom. The inventory value has exhibited a constant upward trajectory, marked by bullish yearly candles from 2009 to 2021. Notably, 2018 noticed an exception with an inside bar sample, indicating intense value compression earlier than a major value rally. This compression was resolved in 2019, resulting in a value surge culminating in a peak of $648.49 in 2021. Subsequently, a value correction unfolded in 2022, characterised by an inside bar sample. This prevalence alerts the additional potential for a robust upward motion, which occurred in 2023 when the within bar was breached. The persistent value improve for Broadcom reinforces the anticipation of sustained greater costs sooner or later.

AVGO Yearly Chart (stockcharts.com)

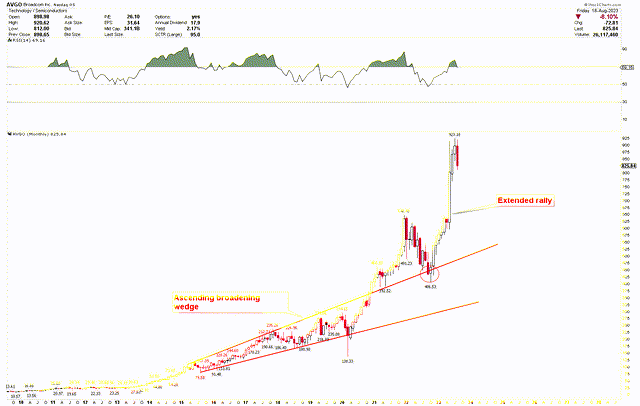

To know the underlying extremely bullish sentiment for Broadcom, the month-to-month chart underscores this outlook via the extended rally originating from ascending broadening wedge formations. These formations originated from the 2015 low of $79.58. The wedge was disrupted in 2021 attributable to heightened volatility skilled in 2020 and 2021. The height value in 2021, reaching $648.49, prompted one other decline that encountered strong help from the ascending broadening wedge, fortifying it as a basis for future rallies. This wedge help generated a backside at $406.53.

AVGO Month-to-month chart (stockcharts.com)

The above chart demonstrates a pointy value drop for Broadcom through the Covid-19 downturn. Like many tech corporations throughout varied industries, Broadcom encountered vital market fluctuations. This decline could be traced to world financial slowdowns, provide chain points, and a cutback in non-essential purchases, casting doubts about fast company outcomes. Nevertheless, the part post-recession noticed a outstanding value restoration, pushed by a fast shift in direction of digital options, elevated tech reliance, and a booming demand for semiconductors. The transfer to distant work and on-line actions spurred demand for digital infrastructure and cloud options. Being a key determine within the semiconductor house, Broadcom was ideally positioned to harness these tendencies. Its numerous choices and considered mergers additional amplified its potential to grab post-pandemic know-how calls for.

The chart additionally signifies that the present inventory value resides throughout the overbought area, suggesting potential corrections. Nevertheless, given the robustly bullish formation, such corrections are prone to be seen as compelling alternatives for long-term buyers to enter the market.

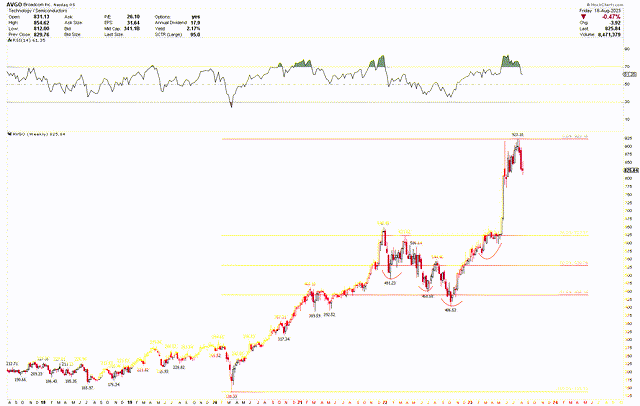

Investor Concerns

To delve deeper into the pivotal ranges for Broadcom, the supplied chart illustrates the Fibonacci retracement ranges stemming from the 2020 low of $138.33 to the head of all-time highs at $923.18. Ought to the market provoke a corrective descent from this formidable resistance level, probably the most strong help rests on the 38.2% retracement degree, at $623.37. The continuing pullback goals to usher the market towards the next shopping for threshold, providing buyers a potent probability to capitalize on this correction by making astute shopping for choices. Moreover, the Relative Energy Index (RSI) on the weekly chart additionally alerts an impending correction directed towards the help ranges.

AVGO Weekly Chart (stockcharts.com)

Market Danger

The present inventory value of Broadcom is located throughout the overbought vary. Though the prevailing bullish sentiment and formation present a foundation for the chance of additional appreciation, there may be additionally an underlying danger of a pointy and fast corrective pullback.

With the rising adoption of AI and networking chips, quite a few corporations are coming into the scene to grab a share of this extremely worthwhile market. This heightened competitors can exert strain on Broadcom’s revenue margins and its standing out there. Whereas AI serves as a major driver of development, it is essential to notice that Broadcom’s core experience stays centered round networking chips. Consequently, any broad business decline or sector-specific downturn within the networking area may adversely have an effect on Broadcom’s general efficiency. The notable decline in worth witnessed through the Covid-19 recession is proof of Broadcom’s vulnerability to world financial occasions. Moreover, the corporate’s inventory may very well be negatively impacted by future geopolitical tensions, pandemics, or substantial financial downturns.

The semiconductor business has encountered disruptions in its provide chain beforehand. If Broadcom encounters difficulties in sourcing important uncooked supplies or elements, or if its manufacturing processes expertise interruptions, this might impede its potential to provide and ship merchandise, consequently affecting its income era.

Backside Line

Within the fast-paced world of AI and the semiconductor business, Broadcom has demonstrated plain resilience, constant development, and powerful positioning within the networking chip sector. Whereas Nvidia stays a pivotal determine within the AI chip panorama, Broadcom’s spectacular efficiency over the previous decade, its strategic path beneath CEO Hock Tan, and its engaging valuation make it a compelling consideration for buyers. The technical evaluation signifies a sturdy bullish trajectory for the corporate, with potential corrections providing potential entry factors for long-term buyers. Nevertheless, like several funding, Broadcom is just not devoid of dangers. The corporate faces potential challenges from rising competitors within the AI and networking chip markets, provide chain disruptions, and broader financial and geopolitical uncertainties. Traders should weigh these dangers in opposition to the potential rewards of capitalizing on Broadcom’s continued development and business relevance. In essence, Broadcom stands out as a sturdy and value-driven contender within the semiconductor area. Traders could think about shopping for the inventory throughout any value dips. The robust help lies at $623.37. Alternatively, a surge past the file excessive of $923.18 may set off a sturdy rally to elevated ranges.