USD/CAD PRICE, CHARTS AND ANALYSIS:

- USDCAD is Intriguing at Current because the Loonie and USD Cancel Every Different Out Facilitating a Interval of Consolidation

- Canadian Retail Gross sales Stagnate Regardless of an Upward Revision to Final Months Print.

- The Drop in Canadian Inflation Information and Stagnating Retail Gross sales Level to a Maintain from the BoC Subsequent Week.

- To Be taught Extra About Worth Motion,Chart Patterns and Transferring Averages, Take a look at the DailyFX Training Sequence.

Learn Extra: The Financial institution of Canada: A Dealer’s Information

USDCAD value motion continues to frustrate and confuse market contributors because the often trending pair has remained comparatively rangebound for the previous two weeks. The pair has struggled to interrupt out of the 1.3570-1.3780 mark (most up-to-date excessive and low) because the stronger Greenback has stored the bulls . The upper oil value appears to be serving to the loonie and holding USDCAD from advancing past the 1.3700 stage for now.

Are you simply beginning your Buying and selling Journey? Concern Not, DailyFX has you coated with one of the best suggestions and tips for newbie merchants. Obtain the Free Information Under!!

Beneficial by Zain Vawda

Foreign exchange for Rookies

CANADIAN RETAIL SALES DATA AND BANK OF CANADA

Canadian Retail Gross sales appeared to stagnate is September whereas the August print was revised from a earlier -0.3% to a print 0f -0.1%. The August retail turnover nonetheless must be taken with a pinch of salt given the port strikes in British Columbia. 12% of surveyors reported decrease enterprise exercise due to points with provide chain logistics brought on by the strikes.

Supply: Statistics Canada

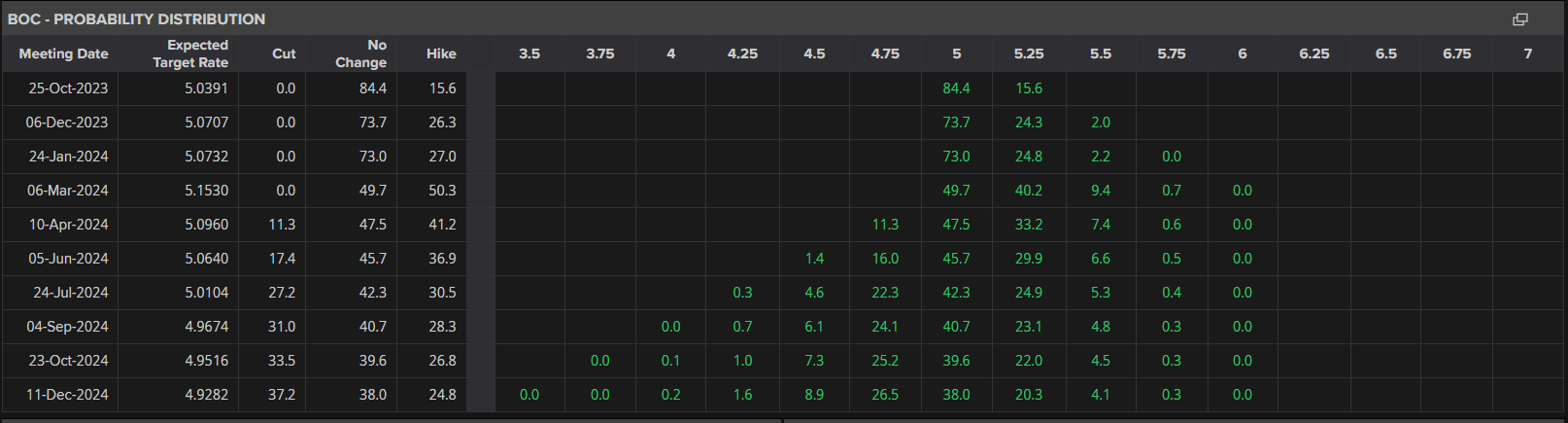

A constructive for the Financial institution of Canada (BoC) as Canadian inflation slowed down in September regardless of the rise in gasoline costs. The Core and Headline price coming in under expectation and will definitely assist given the pessimistic tone we heard just lately from Deputy Governor Vincent. The inflation launch and stagnation in Retail Gross sales ought to certainly imply a pause from the BoC at subsequent week assembly. Markets contributors are at present pricing in an 84.1 likelihood that charges will likely be held regular and only a 15.9% likelihood of a 25bps hike. The BoC assembly is scheduled for subsequent week Wednesday, October 25 at 14h00 GMT.

For all market-moving financial releases and occasions, see the DailyFX Calendar

In search of actionable buying and selling concepts? Obtain our prime buying and selling alternatives information full of insightful suggestions for the fourth quarter!

Beneficial by Zain Vawda

Get Your Free High Buying and selling Alternatives Forecast

TECHNICAL ANALYSIS USDCAD

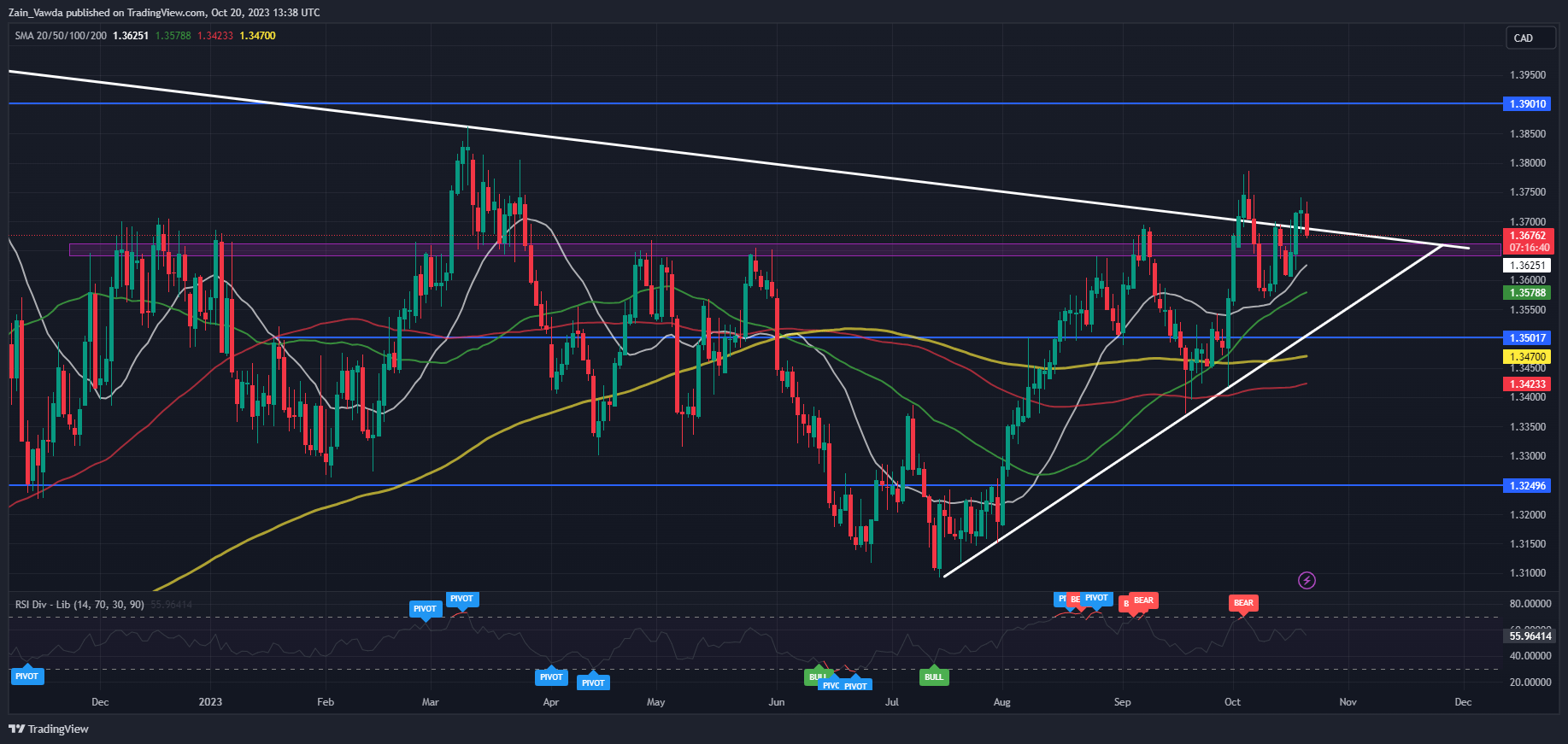

USDCAD failed in its makes an attempt to pierce via the 1.3700 resistance space. That is the second failed try within the final two weeks, the earlier of which fell simply brief across the 1.36920 mark.

In the meanwhile it truly is a tug of warfare between USD and CAD bulls which appear to be canceling one another out. On the floor it does seem the USD is a extra enticing proposition however given the present local weather the CAD has been capable of maintain its personal. The CAD is essentially deriding its power from increased oil costs, because the drop in inflation and stagnation in retail gross sales ought to’ve have aided the bulls in facilitating a break above the 1.3700 mark.

In different phrases, the longer there may be concern about escalation within the Center East the US Greenback and Oil costs are more likely to stay supported. This in flip may imply extra rangebound value motion for USDCAD. An enchancment in sentiment nonetheless may very well be simply what the Physician ordered for CAD bulls to take a look at a push towards the 1.3500 mark and probably decrease.

Key Ranges to Preserve an Eye On:

Help ranges:

Resistance ranges:

USD/CAD Each day Chart

Supply: TradingView, ready by Zain Vawda

IG CLIENT SENTIMENT

Looking on the IG shopper sentiment information and we are able to see that retail merchants are at present internet SHORT with 67% of Merchants holding brief positions.

For Ideas and Methods on Learn how to use Shopper Sentiment Information, Get Your Free Information Under

| Change in | Longs | Shorts | OI |

| Each day | 3% | -10% | -7% |

| Weekly | 0% | 10% | 7% |

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda