GOLD PRICE OUTLOOK:

- Gold costs (XAU/USD) rally vigorously, reaching their highest stage since late December

- Nevertheless, these good points is likely to be vulnerable to reversal subsequent week if U.S. jobs information surprises larger

- The February U.S. nonfarm payrolls report is scheduled to be launched on Friday morning

Most Learn: USD/JPY Recovers on Ueda’s Dovish Remarks, Vital Tech Ranges Forward

Gold costs (XAU/USD) staged a outstanding rally this previous week, breaking previous key technical thresholds to succeed in their highest level since December 2023. By Friday’s shut, the valuable steel had notched a considerable weekly acquire of two.33%, settling close to $2,082.

Bullion’s bullish momentum could be attributed partly to a reasonable pullback in U.S. Treasury yields, a response triggered by two important financial studies that left buyers pondering their implications for the Federal Reserve’s financial coverage stance.

To start out, January’s core PCE deflator got here in at 0.4% m/m and a pair of.8% y/y, assembly consensus estimates. Wall Avenue, rattled by latest CPI and PPI information, had been bracing for one more upside inflation shock, however was relieved when the FOMC’s most popular worth gauge landed exactly on its anticipated mark.

Keen to achieve insights into gold’s future path? Uncover the solutions in our complimentary quarterly buying and selling information. Request a duplicate now!

Advisable by Diego Colman

Get Your Free Gold Forecast

Including to the narrative, disappointing manufacturing PMI (ISM) figures confirmed an accelerated contraction final month, reinforcing the retreat in yields. Merchants speculated that weak manufacturing unit sector output could lead the U.S. central financial institution to start out easing its stance sooner than initially envisioned.

Wanting forward, merchants needs to be attentive to the upcoming February U.S. jobs information for insights into the market’s trajectory. A blockbuster report mirroring January’s sturdy numbers would undermine hopes of an early Fed pivot towards price cuts, probably sending gold costs tumbling.

Alternatively, if nonfarm payrolls figures underwhelm projections and trace at mounting financial headwinds, rate of interest expectations are more likely to recalibrate towards a extra dovish outlook, weighing on yields. This situation is poised to assist treasured metals.

UPCOMING US JOBS REPORT

Questioning how retail positioning can form gold costs? Our sentiment information offers the solutions you’re on the lookout for—do not miss out, get the information now!

| Change in | Longs | Shorts | OI |

| Each day | -11% | 7% | -2% |

| Weekly | -16% | 24% | 1% |

GOLD PRICE (XAU/USD) TECHNICAL ANALYSIS

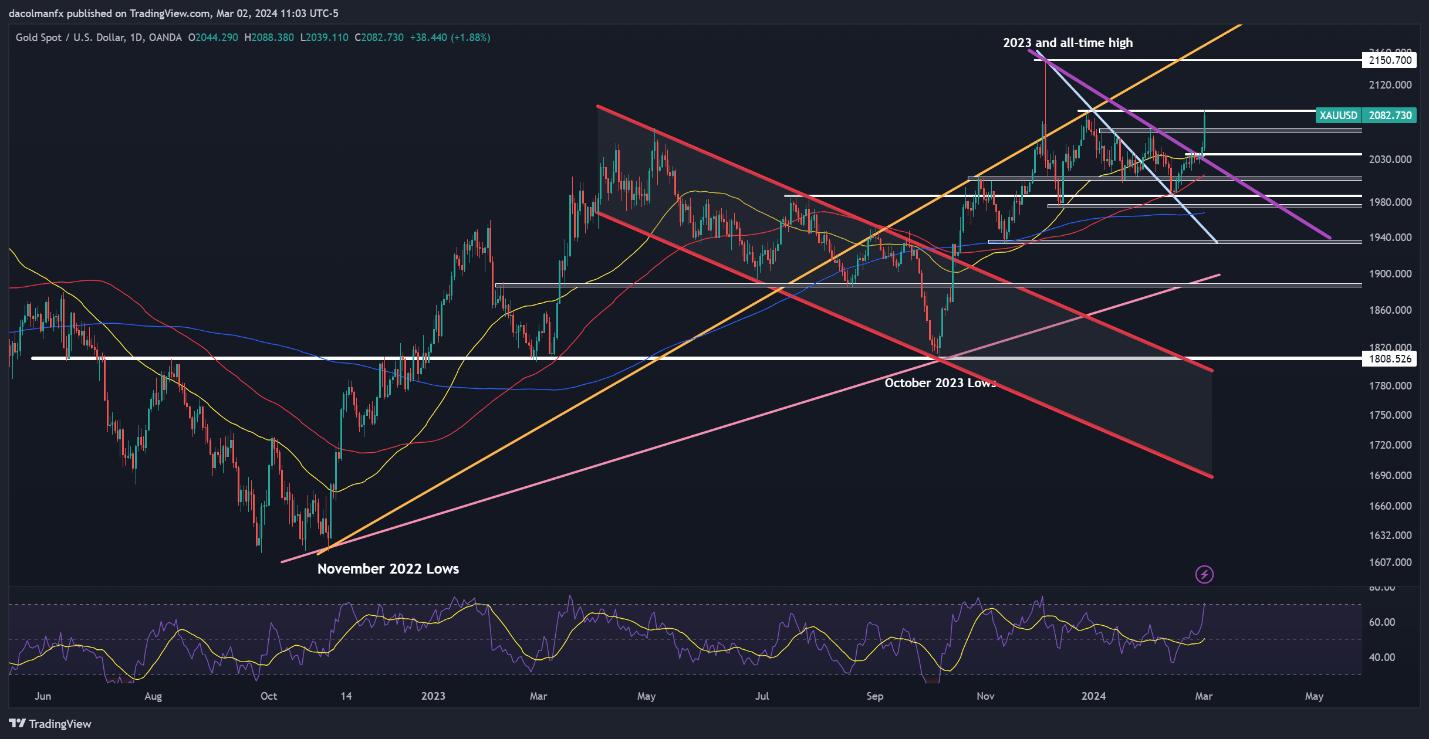

Gold surged past trendline resistance at $2,035 and breached one other key ceiling at $2,065 this previous week, edging nearer to surpassing late December’s swing excessive round $2,085. Failure by bears to comprise the worth at this level would possibly set off a rally towards the yellow steel’s file within the neighborhood of $2,150.

On the flip aspect, if sellers stage a comeback and spark a bearish reversal, preliminary assist seems at $2,065. Additional losses beneath this stage may result in a retracement in direction of the 50-day easy transferring common at $2,035. If weak point persists, consideration will flip to the $2,010/$2,005 vary.

GOLD PRICE TECHNICAL CHART

Gold Worth Chart Created Utilizing TradingView