Final week, we mentioned why the extra bullish technical formations had been at odds with the various recession forecasts. Not surprisingly, that article generated substantial pushback from readers, mentioning varied bearish basic measures.

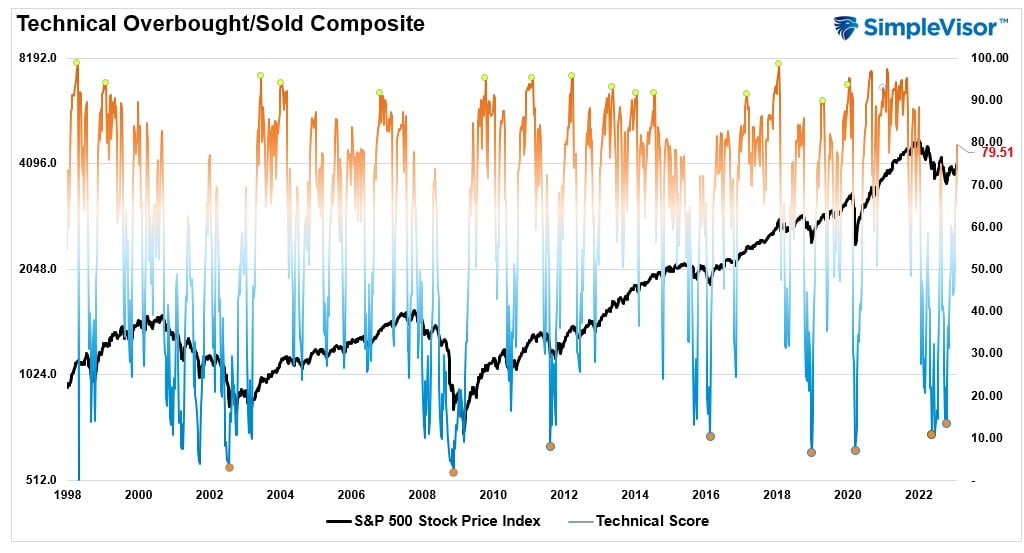

As I mentioned in our newest “Bull Bear Report,” the technical backdrop has improved markedly for the reason that October lows.

“I beforehand mentioned the inverse ‘head-and-shoulder’ sample already suggests a market backside has fashioned. A strong break above the downtrend line (with a profitable retest) would verify the completion of that sample. Notably, the 50-DMA is quickly closing in on a cross above the declining 200-DMA. Such is named the ‘golden cross’ and traditionally signifies a extra bullish setup for markets transferring ahead.“

“The market surge final week bumped into resistance on Friday as markets pushed effectively into 3-standard deviations above the 50-DMA. Nonetheless, whereas the weak spot on Friday was not surprising, additionally it is crucial to find out whether or not the present breakout is respectable.”

Moreover, our weekly technical composite gauge isn’t again into bull market mode because it has risen above a studying of 70. Such is the primary time that measure was reached in over a 12 months.

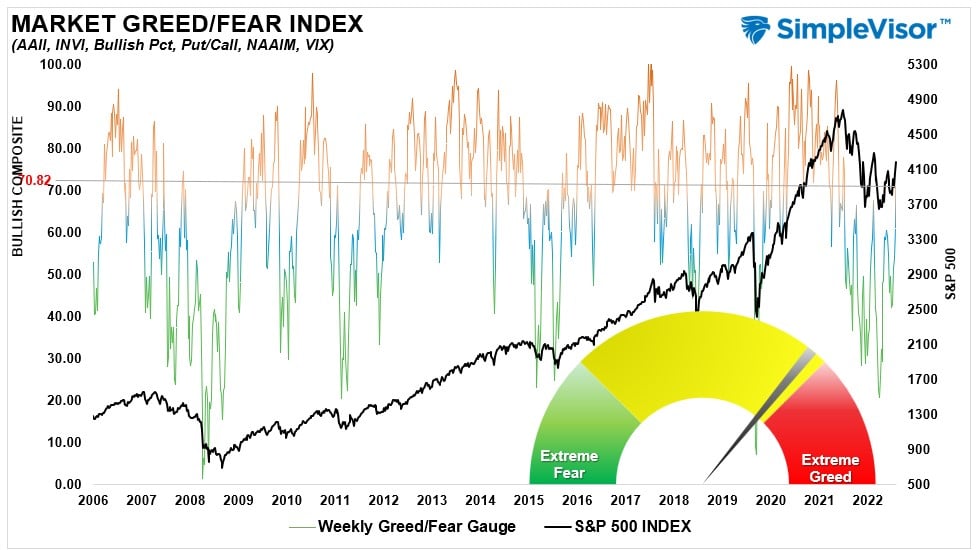

Additionally, investor sentiment has moved again into “bullish mode,” with our composite worry/greed gauge, which measures sentiment and positioning, pushing in the direction of “greed” ranges.

From a historic view, these technical measures have at all times preceded a continuation of a extra bullish pattern for the market. Nonetheless, the vital level is that whereas the technical backdrop has improved, we should nonetheless acknowledge a threat to the technical bullish view. As I concluded:

“If the ‘bear market’ is ‘canceled,’ we are going to know comparatively quickly. To substantiate whether or not the breakout is sustainable, thereby canceling the bear market, a pullback to the earlier downtrend line that holds is essential. Such a pullback would accomplish a number of issues, from working off the overbought situations, turning earlier resistance into help, and reloading market shorts to help a transfer greater. The ultimate piece of the puzzle, if the pullback to help holds, will probably be a break above the highs of this previous week, confirming the subsequent leg greater. Such would put 4300-4400 as a goal in place.

A break BELOW the downtrend line, and the present intersection of the 50- and 200-DMA, will recommend the breakout was certainly a ‘head pretend.’ Such will verify the bear market stays, and a retest of final 12 months’s lows is probably going.

Nonetheless, whereas the technicals are bullish close to time period, I can not disagree with the readers’ basic arguments.

Elementary Issues

Greg Feirman of Prime Gun Monetary made an attention-grabbing remark final week.

“These of us who take a extra basic strategy are left scratching our heads as a result of the value motion doesn’t match what we’re seeing from company earnings. Apple reported a 5.5% decline in income in its 4Q22 – and that quarter had 14 weeks in comparison with 13 within the 12 months in the past interval. Web Earnings fell 13.4%. Whereas Google’s (GOOG/GOOGL) general income was +1%, when you dig somewhat deeper income in its core promoting enterprise was truly -4%. And whereas Meta (META) had an enormous reduction rally, the basics had been removed from stellar with income -4.5% and EPS -52% in comparison with a 12 months in the past.

And so all of it units up for a showdown in coming weeks. My rivalry is that “the market is a voting machine within the quick time period, and a weighing balance in the long run” (Ben Graham). That’s, worth will comply with the gang within the quick time period however the crowd will comply with fundamentals in the long run. So whereas the market could proceed to rally within the days and weeks forward, ultimately this rally will peter out and we are going to look again at it as simply one other bear market rally. When you’re on this debate between technicians and fundamentalists, concentrate as a result of we’re all about to study one thing a technique or one other.”

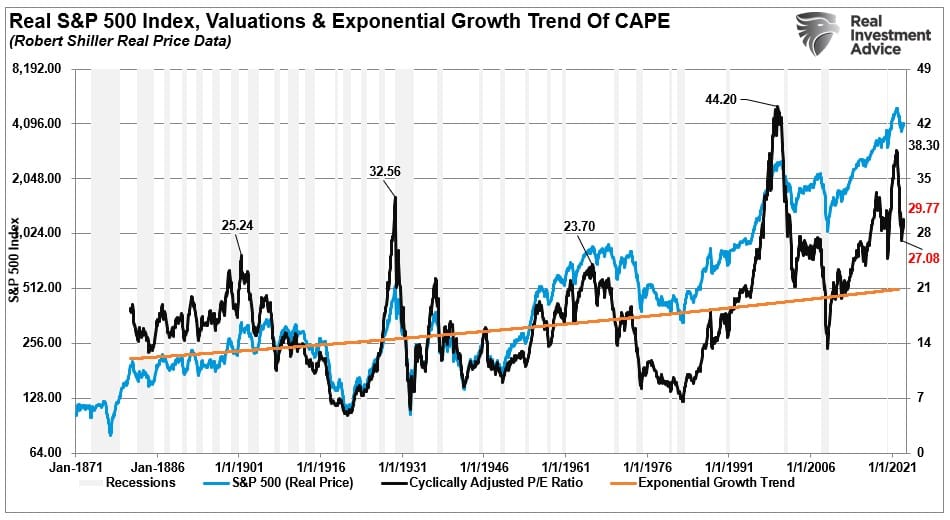

Greg is right. Because the starting of the 12 months, the rise available in the market has been purely a operate of valuation enlargement as each earnings, and earnings estimates, proceed to deteriorate. As proven, valuations are rising to 29x, trailing actual earnings, which is traditionally costly.

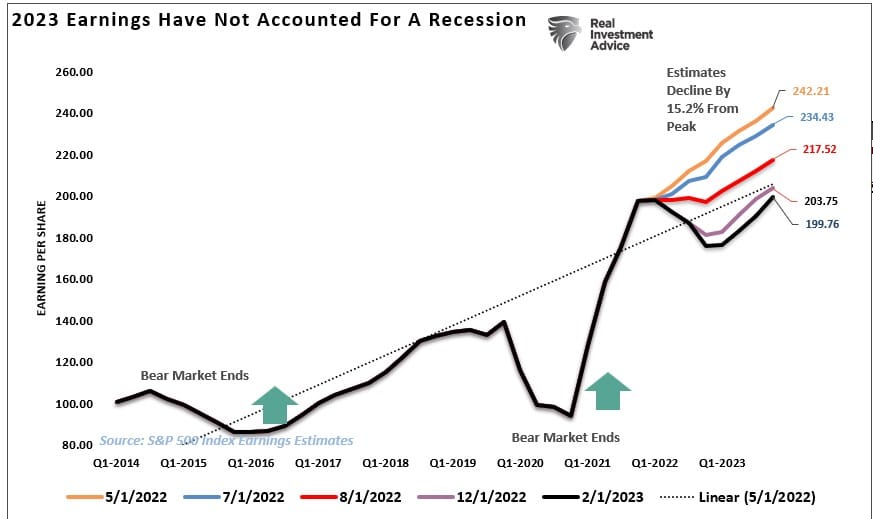

Such is going on as earnings and estimates proceed to deteriorate sharply, regardless that analysts stay optimistic a few restoration later within the 12 months.

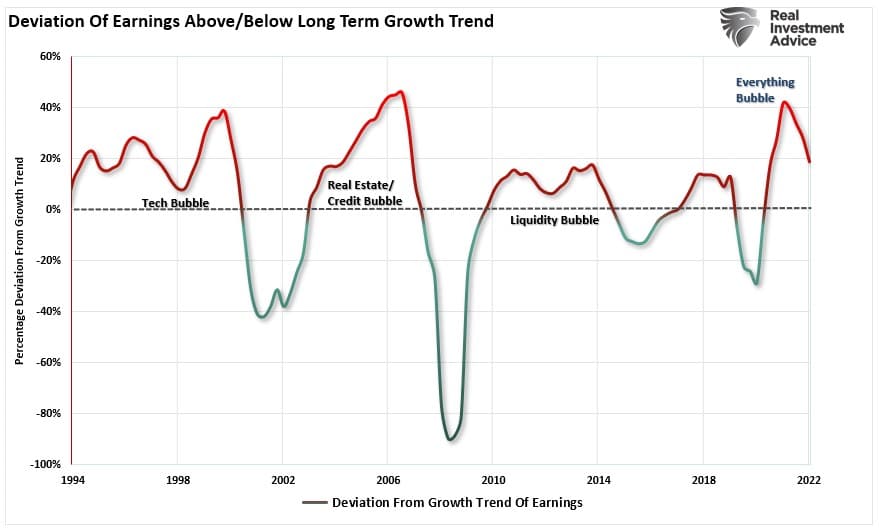

Nonetheless, the hoped-for earnings restoration is contingent on a a lot stronger financial atmosphere to help that development in earnings. Provided that earnings stay 20% above their long-term development pattern. The anticipated restoration appears overly optimistic as a result of large stimulus injections that pulled ahead consumption.

With a lot financial knowledge pointing to additional weak spot within the months forward, market fundamentals stay difficult to the technical bullish narrative.

Nonetheless, traditionally, the markets have a tendency to cost financial and basic recoveries 6-9 months prematurely. Such would recommend that the extra bullish optimistic views of a “delicate touchdown” situation within the economic system could possibly be potential.

The one problem with that view, once more from the elemental perspective, is that traditionally with working effectively above 5% and the Federal Reserve persevering with to hike , “goldilocks outcomes” didn’t beforehand come to fruition.

Bull Now, Bear Later?

So, what ought to an investor due with such a dichotomy?

The reply is extra easy than it appears.

The market can defy financial and basic realities within the quick time period. Greg famous that the market is a “voting machine” within the quick time period. In different phrases, the market will reply to the “votes” of the herd available in the market. Nonetheless, the market will “weigh” the elemental measures and worth accordingly over the long run.

For buyers, relying closely upon both the “votes” or the “weight” can result in extra disappointing outcomes over the long run. As I’ve famous beforehand, many buyers missed out virtually totally in the marketplace’s advance from 2009 to the current for varied legitimate, basic causes. Sure, they missed the crash in 2008 however misplaced way more in missed capital features over the following decade.

“Far more cash has been misplaced by buyers attempting to anticipate corrections than misplaced within the corrections themselves.” – Peter Lynch

Guidelines To Observe

For the second, the market is again in a extra bullish mode. As such, we want a algorithm to navigate that bullish pattern till it will definitely ends.

- Reduce losers quick and let winners run. (Be a scale-up purchaser into energy.)

- Set targets and be actionable. (With out particular targets, trades develop into arbitrary and enhance general portfolio threat.)

- Emotionally pushed selections void the funding course of. (Purchase excessive/promote low)

- Observe the pattern. (The long-term, month-to-month pattern determines 80% of portfolio efficiency. Whereas a “rising tide lifts all boats, ”the alternative can also be true.)

- By no means let a “buying and selling alternative” flip right into a long-term funding. (Check with rule #1. All preliminary purchases are “trades” till your funding thesis is proved right.)

- An funding self-discipline doesn’t work if it isn’t adopted.

- The chances of success enhance considerably when the technical worth motion confirms the elemental evaluation. (This is applicable to each bull and bear markets)

- Markets are both “bullish” or “bearish.” Throughout a “bull market,” be solely lengthy or impartial. Throughout a “bear market,” be solely impartial or quick. (Bull and Bear markets are decided by their long-term pattern)

- When markets are buying and selling at, or close to, extremes do the alternative of the “herd.”

- Do extra of what works and fewer of what doesn’t (Conventional rebalancing takes cash from winners and provides it to losers. Rebalance by decreasing losers and including to winners.)

Don’t Choose a Facet

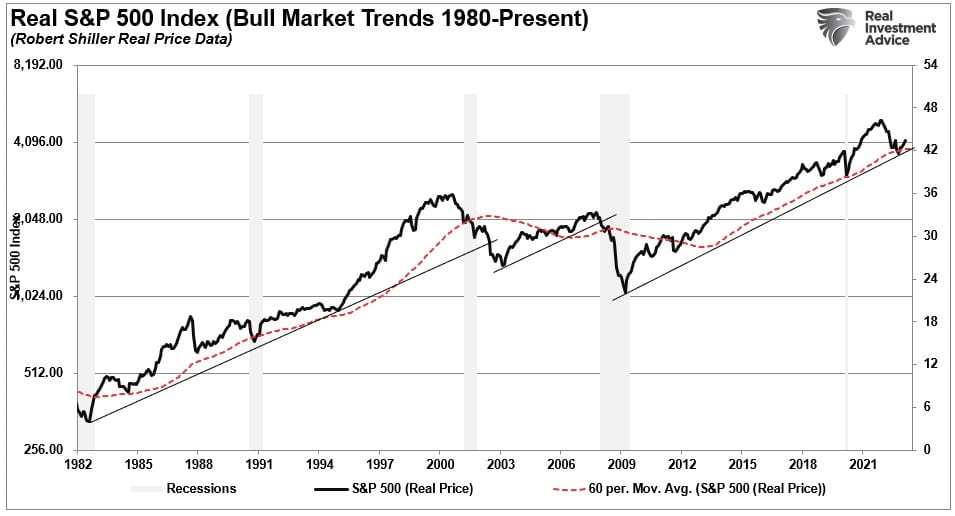

Word there are a number of references to the “long-term pattern” of the market. That pattern stays bullish as measured by each pattern traces and the 60-month transferring common. With the market not too long ago bottoming at these trendline helps, such suggests the longer-term bull market stays intact.

Sure, the basics will ultimately matter, and they’ll matter rather more than many at the moment assume. Nonetheless, for the now, the bulls stay answerable for the market.

- Put aside the thought of being both “bullish” or “bearish.”

- When you decide a aspect, you lose objectivity to what’s occurring inside the market.

- How lengthy will the technical bull run final? I do not know.

- However when it ends, and the basics start to re-emerge, we may have loads of warning to regulate accordingly.