Thapana Onphalai

Overview

Cybersecurity is a secular development trade. Whereas this assertion is not any revelation, choosing the most effective corporations to spend money on could also be troublesome for many with little expertise or information concerning the nuts and bolts of the cybersecurity space. Therefore, I selected International X Cybersecurity ETF (NASDAQ:BUG) with a purpose to get diversification in a unstable and costly sector that’s removed from being dominated by a number of trade leaders.

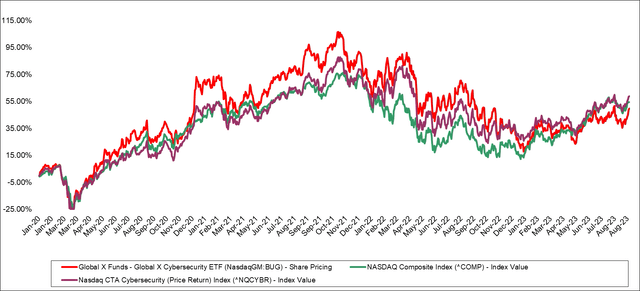

The BUG ETF run by International X began buying and selling in 3Q2019, tracks Indxx Cybersecurity Index and has US$650m in AUM a fraction of CIBR and half of HACK.

Efficiency vs NASDAQ (Created by creator with knowledge from Capital IQ)

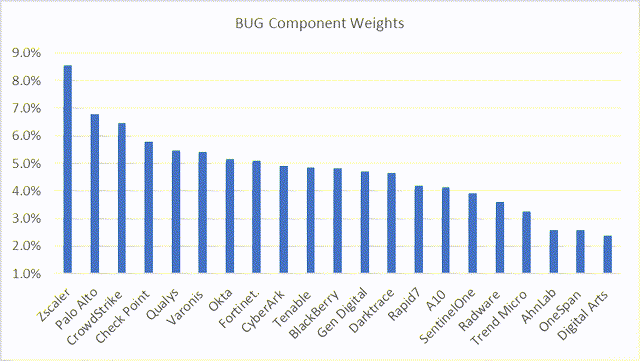

BUG is a fairly diversified portfolio with the biggest part, Zscaler (ZS), at 8.5% regardless of lower than half the market cap of Palo Alto (PANW). I solely discovered 4 corporations with mediocre EPS development estimates of below 6%.

BUG Holding Weights (Created by creator with knowledge from International X)

Wanting Below The Hood

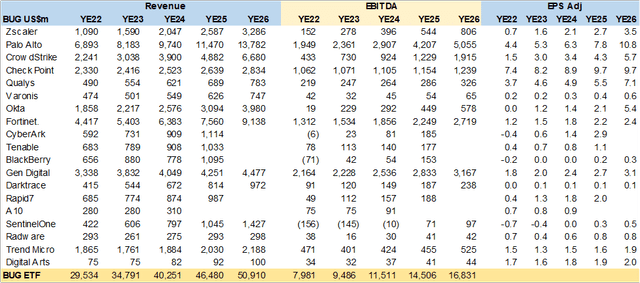

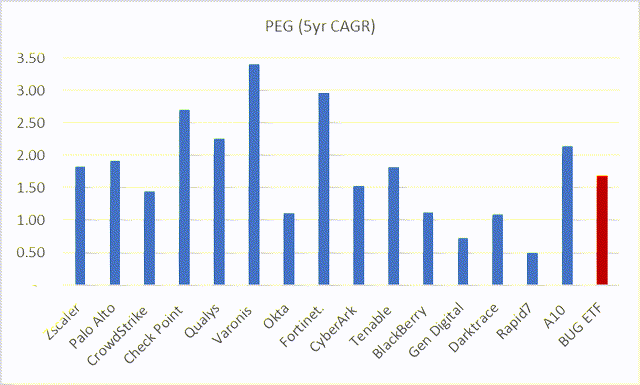

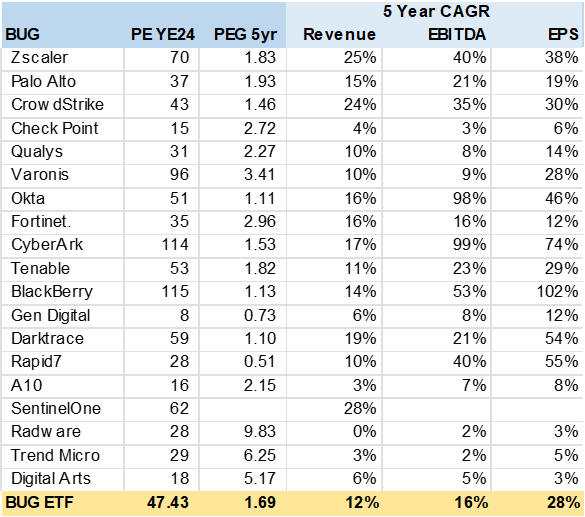

To higher assess the medium and long run outlook of the ETF I performed a backside up evaluation of the 23 shares it holds. Utilizing consensus estimates I calculated upside potential, income, EBITDA, and Adjusted EPS development. I then in contrast these basic traits to every shares valuation utilizing the PEG (PE to Development) technique.

Adjusted EPS provides again inventory based mostly compensation. For my part, this can be a affordable adjustment to make so long as one makes use of totally diluted shares. In any other case you could be double counting, i.e. lowering EPS by the financial price of the shares granted in addition to new shares to be issued. Inventory based mostly compensation price just isn’t money move merchandise.

BUG Holding Consensus Estimates (Created by creator with knowledge from Capital IQ)

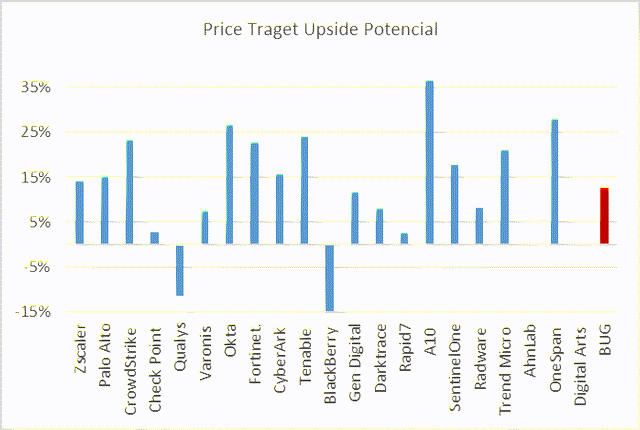

BUG Might Have 12.7% Upside Potential

The primary evaluation is on the potential upside of the portfolio utilizing consensus value targets’ which can be usually a 12 month view or to year-end 2024. Many of the shares have a big analyst following that tends to even out very bullish and damaging forecasts.

The ETF has a 12.7% 12 month upside based mostly on consensus value targets. The typical, if all shares had equal weight, is 13.2%. This implies it is a comparatively nicely balanced portfolio by way of upside potential.

BUG Holding Consensus Worth Goal Upside Potential (Created by creator with knowledge from Capital IQ)

Excessive Development Does Not Come Low cost

The BUG portfolio has a 28% EPS (adjusted) 5 yr CAGR, which could be very excessive and on par with what an investor would possibly anticipate from this sector. On the similar time this development is priced at 47x PE YE24. To higher place this valuation into perspective I in contrast the expansion fee below the PEG technique. The rationale relies on the premise {that a} PE near the expansion fee or a ratio round 1, signifies an inexpensive valuation. Beneath 1 it is low cost and much above 1 costly.

BUG has a PEG of 1.69x, not loopy costly and consistent with the SP500 which seems to be buying and selling at 20x PE on 12% EPS development or a PEG of 1.6x.

BUG Holding Consensus PEG Comps (Created by creator with knowledge from Capital IQ)

Some outliers within the consensus display screen are Rapid7 (RPD) with PEG of .51 and on the damaging aspect Checkpoint (CKPT) (at 2.7x).

BUG Holding Consensus Development Charges (Created by creator with knowledge from Capital IQ)

Conclusion

BUG is a stable ETF to realize diversified publicity to the highest Cybersecurity shares, a excessive development house that’s susceptible to important volatility. Its inventory weights do favor Zscaler that hits above weight class at 8.5% but has half the market cap of Palo Alto. Valuation seems affordable relative to excessive EPS development and will outperform the broader market long run.