British Pound Q2 2023 Technical Forecast:

Really useful by Nick Cawley

Tips on how to Commerce GBP/USD

The British Pound’s technical outlook is impartial with the UK foreign money prone to be comparatively secure to marginally firmer over the approaching weeks. And meaning we have to take a look at the dynamics of different main currencies to see if there are any probably engaging set-ups in opposition to Sterling. Two currencies spring to thoughts, the US greenback and the Euro.

Each the US Federal Reserve and the Financial institution of England have hiked charges over the past 12 months, protecting the rate of interest differential between the 2 currencies roughly equal. Going ahead this will likely change with the Fed prone to pause earlier than beginning to minimize charges later this 12 months whereas the BoE might have one other hike earlier than they pause. Whereas the speed differential between the 2 currencies might not widen dramatically, sentiment might underpin GBP/USD.

The every day GBP/USD chart exhibits how the pair has traded sideways over the previous three months with cable at the moment eyeing the resistance at 1.2448. The transferring common set-up is optimistic and will proceed to underpin the transfer larger, whereas the current sequence of upper lows point out ongoing energy within the pair. If the pair breaks and opens above resistance at 1.2448, then a previous excessive at 1.2667 comes into play. Trying forward, GBP/USD in Q2 might proceed its sideways commerce with a slight upside bias.

GBP/USD Each day Worth Chart

Whereas Sterling might push larger in opposition to the US greenback, it’s prone to battle in opposition to the Euro, once more on charge differential expectations. The European Central Financial institution has been very vocal about the necessity to proceed mountain climbing rates of interest over the subsequent few months in its ongoing battle in opposition to inflation and it will result in the rate of interest differential in opposition to the British Pound widening, favoring the Euro.

| Change in | Longs | Shorts | OI |

| Each day | -4% | -3% | -3% |

| Weekly | 0% | -19% | -10% |

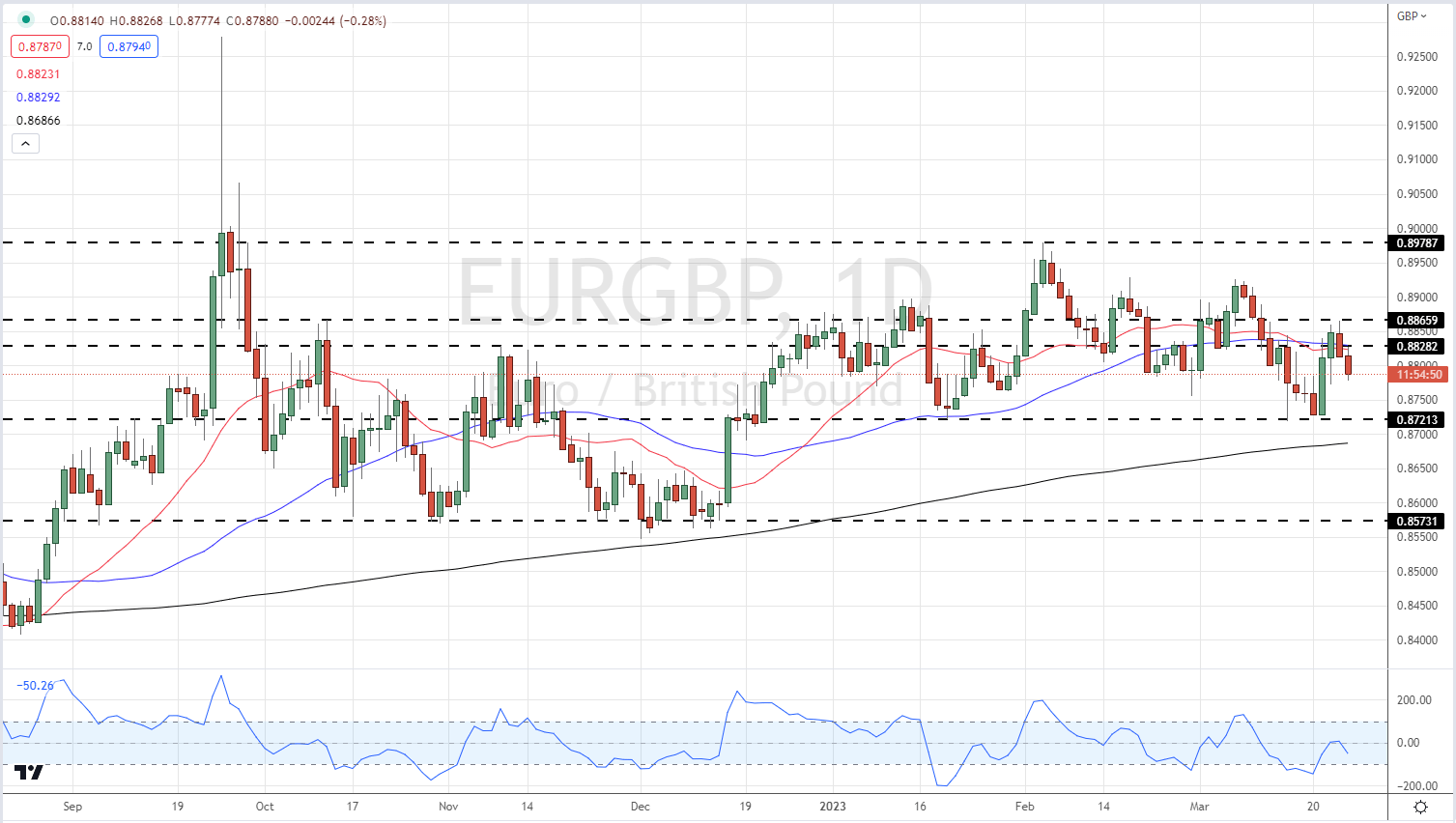

The Each day EUR/GBP chart once more exhibits a reasonably well-defined sideways sample with assist and resistance at 0.8712 and 0.8978 respectively. The assist stage appears to be like moderately robust having been examined and rejected over the past 4 months, and except there’s a basic change within the ECB’s pondering, or if a contemporary Euro Space banking disaster hits, this stage ought to maintain. Slightly below assist sits the 200-day transferring common which can present further underpinning. A confirmed break above a current double high round 0.8825/30 ought to enable the pair to re-test 0.8978 and probably larger with little in the best way of technical resistance above right here.

EUR/GBP Each day Worth Chart

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication