British Pound (GBP/USD) Evaluation and Charts

- Moody’s improve having little impact on Sterling.

- UK employment information and S&P PMIs are the following potential GBP drivers.

Beneficial by Nick Cawley

Get Your Free GBP Forecast

The British Pound is little modified as merchants open their books for the week with little macro information round to start out a transfer. The state of affairs within the Center East stays unpredictable and really unstable, whereas the proposed Israel transfer into Gaza is seemingly nonetheless on maintain. Market sentiment is risk-averse on the open and more likely to keep that manner forward of every week packed full of probably unstable releases and occasions. The delayed UK unemployment might be launched tomorrow morning (07:00 UK) earlier than the most recent S&P World PMIs hit the screens at 09:30 GMT.

For all market-moving financial information and occasions, see the DailyFX Calendar

One other ranking company, Moody’s, was within the information lately after it upgraded the UK’s long-term outlook to steady from unfavourable and reaffirmed the UK’s Aaa3 ranking. Moody’s positioned a unfavourable outlook on the UK after ex-PM Liz Truss’s disastrous mini-budget final yr. The following UK Price range might be on November twenty second.

UK authorities bond yields stay elevated forward of subsequent week’s BoE assembly with the 10-year benchmark eyeing a recent re-test of ranges final seen in August 2008. The each day chart reveals a triple prime formation for UK 10-year yields, a sample that usually means that the market is about to show decrease.

UK 10-12 months Gilt Yields

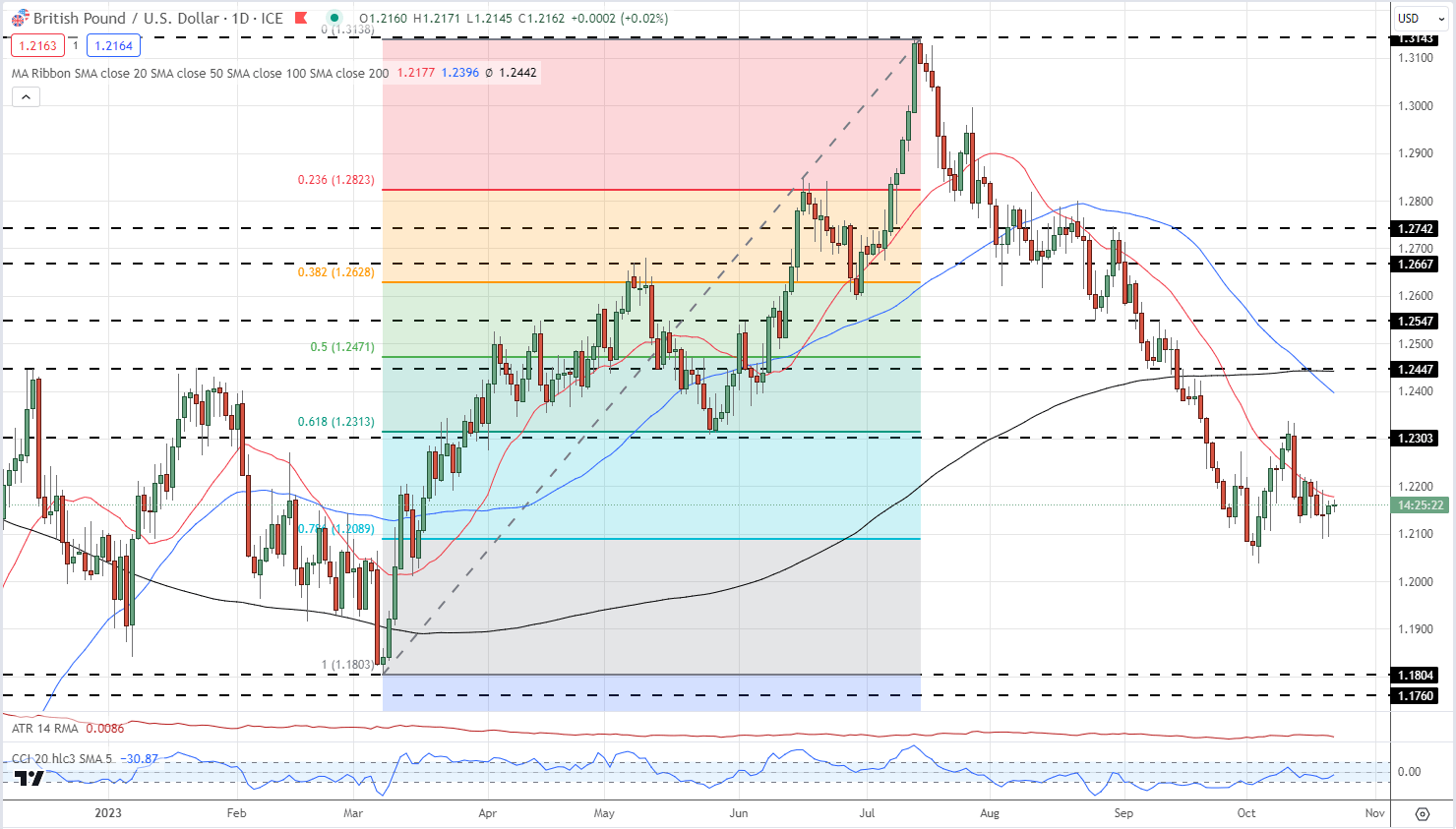

Cable stays caught in a short-term vary between 1.2089 (78.6% Fibonacci retracement) and a previous horizontal excessive of round 1.2303. The chart stays unfavourable with a demise cross fashioned final week, whereas the 20-day easy shifting common continues to information the pair decrease.

Study The way to Commerce GBP/USD

Beneficial by Nick Cawley

The way to Commerce GBP/USD

GBP/USD Every day Value Chart

IG Retail Dealer information reveals 69.28% of merchants are net-long with the ratio of merchants lengthy to brief at 2.26 to 1. The variety of merchants net-long is 0.86% larger than yesterday and 4.78% decrease from final week, whereas the variety of merchants net-short is 1.22% larger than yesterday and 14.46% larger from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests GBP/USD costs could proceed to fall.

| Change in | Longs | Shorts | OI |

| Every day | 3% | 6% | 4% |

| Weekly | -4% | 7% | -1% |

Charts utilizing TradingView

What’s your view on the British Pound – bullish or bearish?? You may tell us by way of the shape on the finish of this piece or you may contact the creator by way of Twitter @nickcawley1.