British Pound (GBP) Newest – GBP/USD Evaluation

- BoE hawk Catherine Mann is worried about wage development.

- Sterling’s latest revival continues, 200-dsma offers help.

Really useful by Nick Cawley

Get Your Free GBP Forecast

Financial institution of England MPC coverage member Catherine Mann, certainly one of 4 rate-setters who voted to go away rates of interest unchanged on the final central financial institution assembly, warned this weekend that inflation could rise once more within the coming months. Talking to the Monetary Instances, Ms Mann stated latest surveys recommend that, ‘There’s an upwards ratchet to each the wage setting course of and the value course of and . . . it could be structural, having been created throughout this era of very excessive inflation during the last couple of years” she added. “That ratchet up will take a very long time to erode away.”

Ms Mann’s warning comes forward of a busy financial launch schedule with the most recent UK employment, wages, inflation, and GDP information all set to be launched over the approaching days.

For all market-moving financial information and occasions, see the DailyFX Financial Calendar

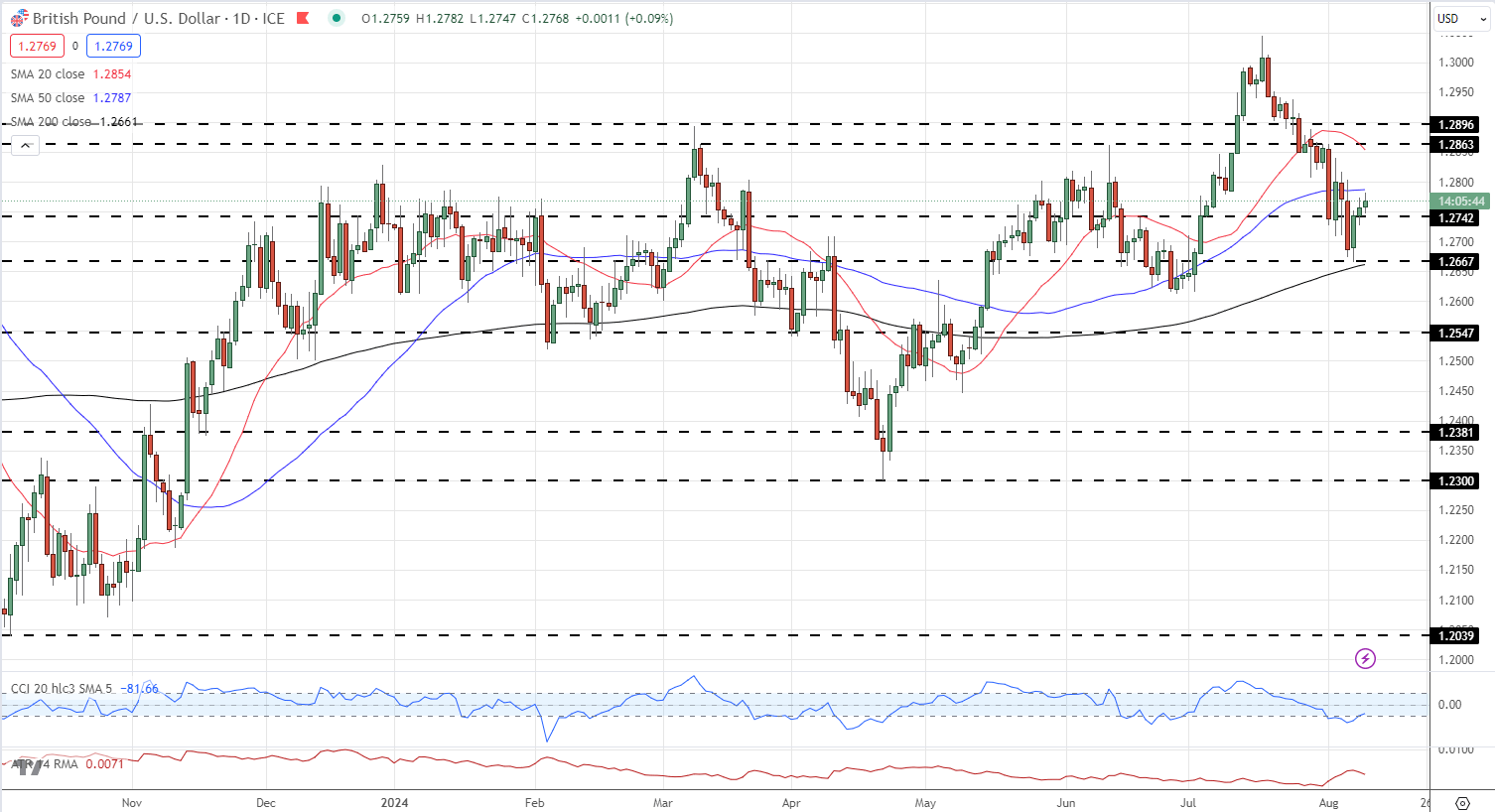

GBP/USD touched a multi-week low of 1.2665 final week primarily based on Sterling weak spot and US greenback power. The pair has pushed increased since, helped by a supportive 200-day easy shifting common, and presently trades round 1.2770. Cable is attempting to interrupt out of a pointy one-month downtrend after printing a 13-month excessive of 1.3045 on July 17, and this week’s financial information will determine the pair’s future. Assist stays round 1.2665, bolstered by the 200-dsma at 1.2661, whereas near-term resistance is round 1.2863.

GBP/USD Every day Worth Chart

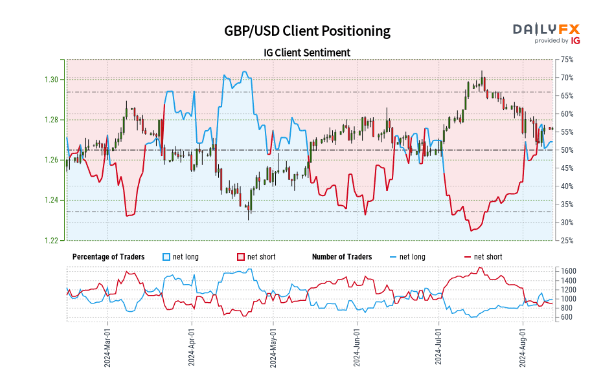

Retail dealer information exhibits 51.94% of merchants are net-long with the ratio of merchants lengthy to brief at 1.08 to 1.The variety of merchants net-long is 0.92% increased than yesterday and 13.53% increased from final week, whereas the variety of merchants net-short is 0.44% increased than yesterday and 4.78% decrease from final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-long suggests GBP/USD costs could proceed to fall. Merchants are additional net-long than yesterday and final week, and the mix of present sentiment and up to date modifications provides us a stronger GBP/USD-bearish contrarian buying and selling bias.

| Change in | Longs | Shorts | OI |

| Every day | -11% | 19% | 5% |

| Weekly | -17% | 30% | 6% |