BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Macro environment pointing to sustained downward pressure for brent crude.

- CFTC data shows added longs.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil opened the week marginally lower after demand side fears continue to overwhelm forecasts despite the recent OPEC+ supply cut announcement. The macro environment has slipped into further turmoil with the eurozone entering the winter months heightening recessionary fears, leaving the regions crude oil demands negligible. Looking at the latest CFTC positioning (see image below), net longs have risen sharply but due to the lag in data, last week’s reaction has likely changed to the downside reflective in the current price.

Recommended by Warren Venketas

Get Your Free Oil Forecast

ICE BRENT CRUDE OIL CFTC POSITIONING – TOTAL OVERNIGHT INTEREST

Source: Refinitiv

Over the weekend, China’s 20th Party Congress commenced revealing no change in their ‘zero COVID’ policy which has been stifling crude oil demand estimates. From a USD perspective, last weeks CPI print is likely to keep the greenback elevated throughout 2022 adding further pressure on brent crude bulls.

TECHNICAL ANALYSIS

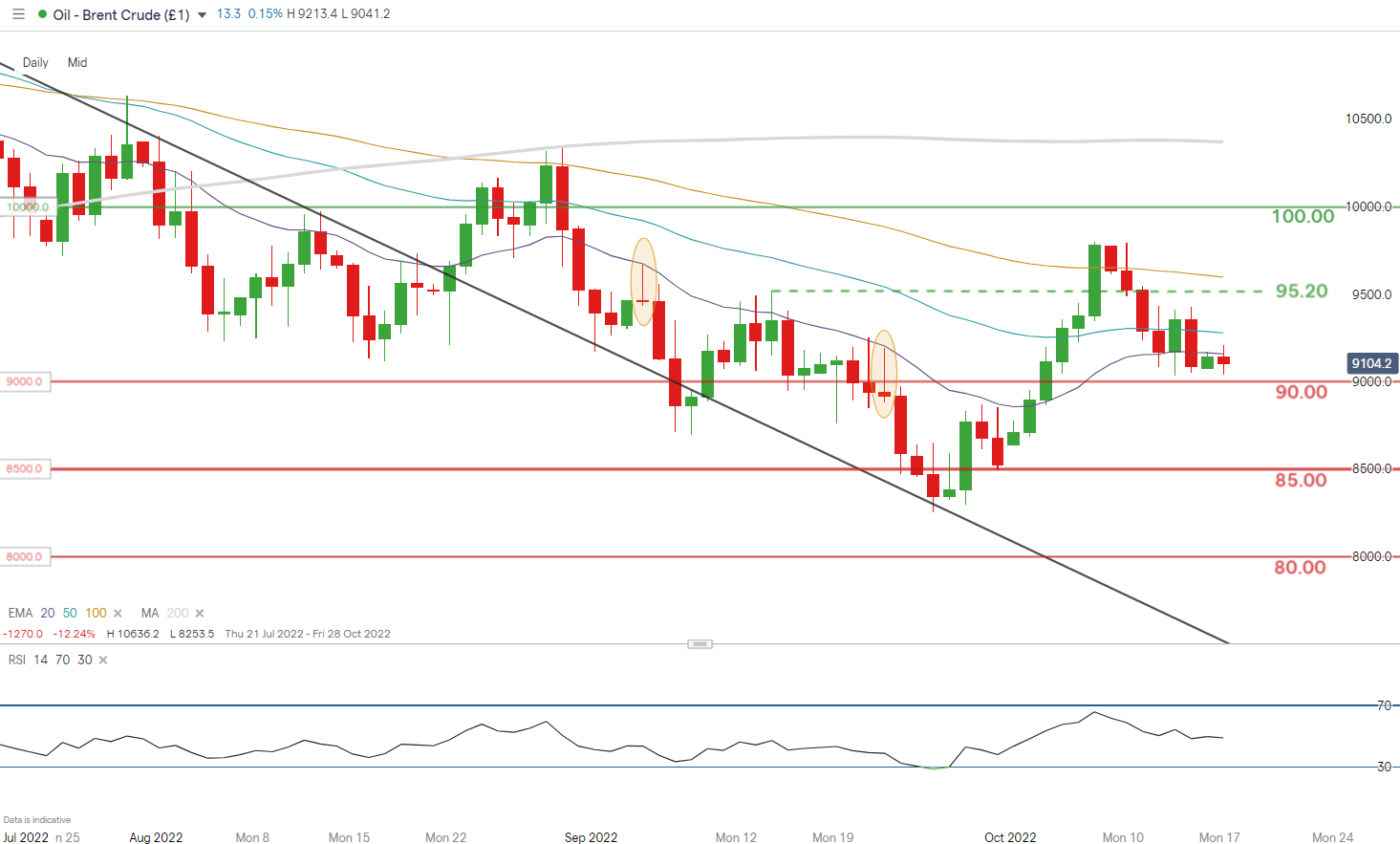

BRENT CRUDE (LCOc1) DAILY CHART -UNDATED

Chart prepared by Warren Venketas, IG

Brent crude daily price action shows some mixed movement today yet still holding above the 90.00 support handle. It seems after the OPEC+ output reduction statement, this is the new ‘line in the sand’ for now but a break below (daily candle close) could quite easily open up 85.00 and beyond. Bears may be preparing for such a move considering the mounting headwinds facing crude oil.

Key resistance levels:

- 95.20

- 50-day EMA (blue)

- 20-day EMA (purple)

Key support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are NET LONG on crude oil, with 70% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but recent changes in long and short positioning result in a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas