BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Chinese economic data leaves brent crude demand wavering.

- PMI’s show dwindling economic strength across the globe leaving brent vulnerable.

- Brent crude trades below $90, can bulls defend once more?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil starts the trading week marginally lower after mixed Chinese economic data – see calendar below. Most of the downside stemmed from Chinese crude oil import data which is roughly 2% lower for the same period last year. China’s ‘zero COVID’ policy has a lot to do with uncertain demand forecasts limiting any potential crude oil upside.

Source: DailyFX economic calendar

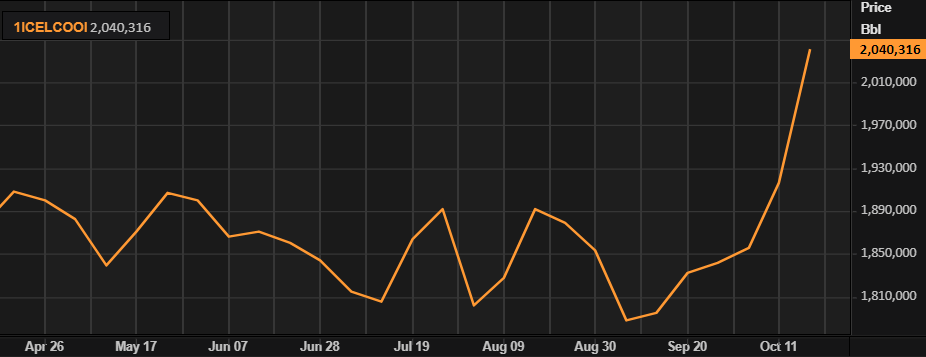

Brent crude market positioning for last week shows yet another increase reflective in last week’s price action but may have tapered off this week with demand destruction and recessionary fears keeping brent prices depressed.

Recommended by Warren Venketas

Get Your Free Oil Forecast

ICE BRENT CRUDE OIL CFTC POSITIONING – TOTAL OVERNIGHT INTEREST

Source: Refinitiv

The USD opened weaker in early trading but has since regained some support adding to bearish momentum for brent crude. This comes despite talk around the possibility of the Fed easing off on the current pace of monetary tightening. From a U.S. perspective, S&P PMI data will be the focus for today with estimates slightly lower than the previous print. Any upside beat could sustain the dollar’s ascendency leaving brent crude exposed to further downside. The United Kingdom and euro areas have already released its PMI statistics, falling short on all metrics respectively, amplifying global slowdown concerns and lesser brent crude requirements.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

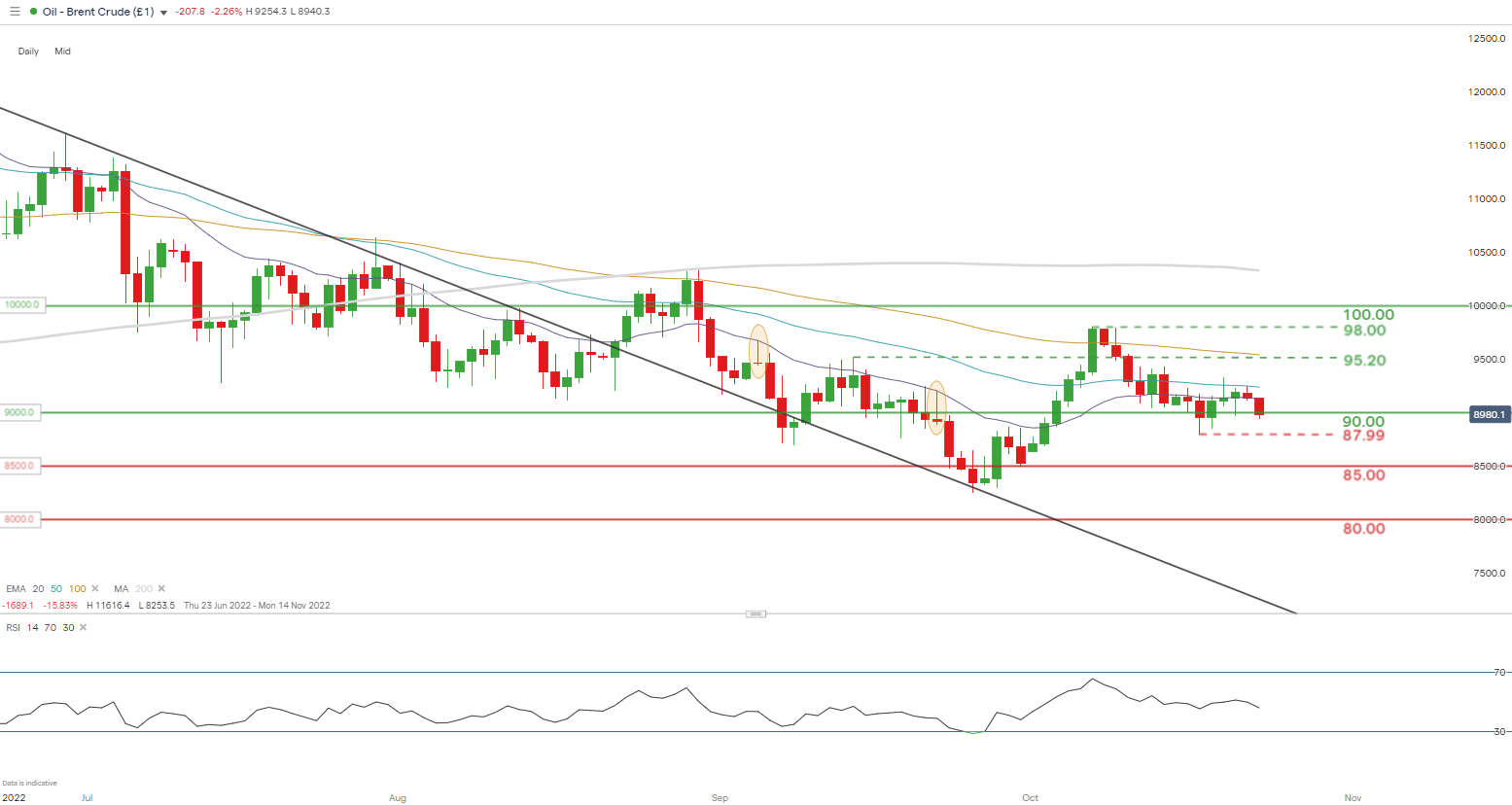

BRENT CRUDE (LCOc1) DAILY CHART -UNDATED

Chart prepared by Warren Venketas, IG

Brent crude daily price action has now fallen below the psychological 90.00 support level post UK and euro PMI. The most recent October swing low at 87.99 will be key for bears looking for subsequent support at 85.00. From a bullish perspective, defending the 90.00 handle may keep the line in the sand firm after OPEC+ supply cut announcement and may coincide with a possible bullish crossover via the 20 (purple) and 50-day (blue) EMA’s.

Key resistance levels:

- 95.20

- 50-day EMA (blue)

- 20-day EMA (purple)

Key support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are NET LONG on crude oil, with 68% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but recent changes in long and short positioning result in a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas