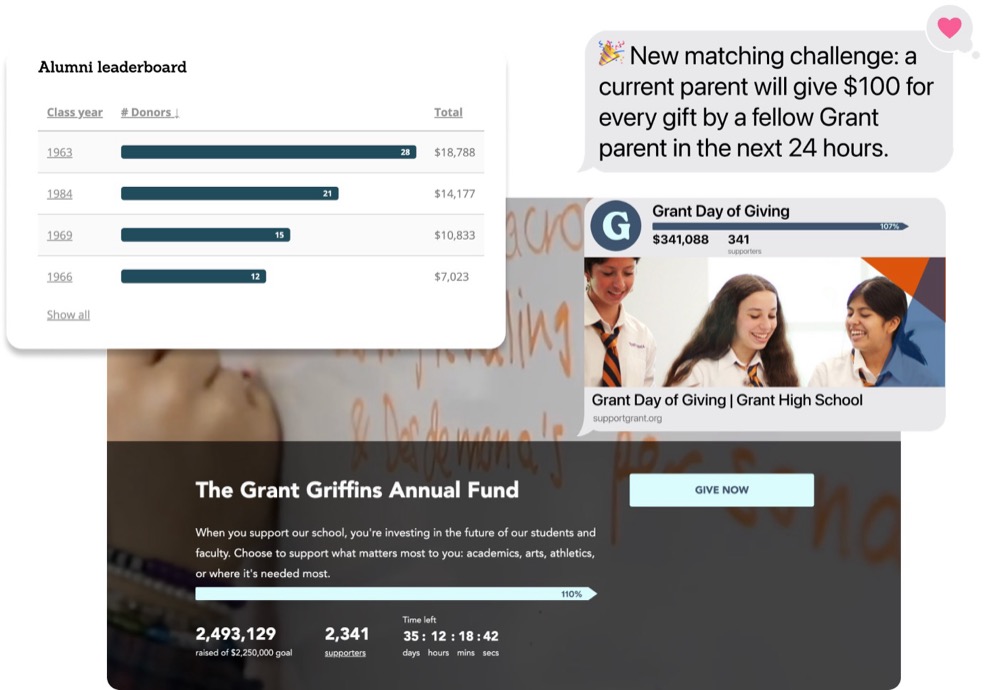

Ok-12 faculties throughout america face a persistent problem in fundraising: development groups wrestle with fragmented instruments, outdated donor experiences, and restricted assets to handle every thing from annual giving campaigns to dwell auctions. Whereas increased schooling establishments and nonprofits have entry to classy fundraising platforms, the 130,000 Ok-12 faculties nationwide have been largely underserved, forcing small groups to cobble collectively a number of techniques or depend on generic options that don’t meet their particular wants. Increase My College addresses this hole as the one fundraising platform purpose-built solely for Ok-12 development groups, consolidating workflows for annual giving, reunions, auctions, golf outings, and giving days right into a single, intuitive system. The platform combines partaking fundraising pages with trendy cost choices like Apple Pay, Venmo, and PayPal, whereas options like dwell leaderboards, remark partitions, and sensible donor suppression enhance participation and simplify marketing campaign administration. Over the previous faculty yr, lots of of colleges utilizing Increase have raised greater than $100M throughout 100,000 donors, attaining a 98% retention fee and an 85 web promoter rating that demonstrates sturdy product-market match on this specialised vertical.

AlleyWatch sat down with Increase My College CEO and Founder Holman Gao to be taught extra in regards to the enterprise, the founder’s journey, current funding spherical that brings the corporate’s whole funding to $10M, and far, way more…

Who have been your buyers and the way a lot did you elevate?

Increase My College has raised an $8M Collection A led by Excessive Alpha with participation from Allos Ventures, Far Out VC, and strategic angel buyers akin to Scot Chisholm, founding father of Elegant, which was acquired by GoFundMe in 2022. This Collection A brings whole firm funding to $10M.

Inform us in regards to the services or products that Increase My College affords.

Increase My College is a fundraising platform particularly designed for Ok-12 development groups. Colleges elevate extra money with Increase by offering a extra partaking and simplified fundraising expertise to their donors. The Increase platform streamlines workflows for quite a lot of fundraising initiatives, together with annual giving, reunions, auctions, golf outings, and giving days.

What impressed the beginning of Increase My College?

I constructed the primary model of Increase after I wanted to write down a verify to donate to my highschool’s math group. From there on, our mission has been to create a better manner for faculties to interact their communities and fundraise extra effectively.

How is Increase My College totally different?

Increase is differentiated by our focus as the one fundraising platform purpose-built for Ok-12 development groups. There are already a ton of platforms constructed for increased ed and non-profits, however none for Ok-12 development, despite the fact that they’ve fewer assets than their bigger counterparts, but face the identical expectations to fundraise in a customized manner. Increase allows smaller groups to do extra by means of one system by having extra out-of-the-box options and hands-on faculty help.

What market does Increase My College goal and the way large is it?

Increase’s present focus is the 130,000 Ok-12 faculties within the US, and our platform is greatest suited to faculties with at the least one full-time development skilled on employees.

What’s your corporation mannequin?

Increase operates on a subscription and platform price mannequin. Ok-12 faculties every have their very own distinctive wants, so we provide three totally different plans so faculties can use Increase for all or any of their giving, occasions, and auctions.

How are you getting ready for a possible financial slowdown?

We really feel grateful to be comparatively insulated from a possible financial slowdown. Colleges will at all times be round whatever the financial local weather, and our platform is instantly tied to highschool income, which is why we’ve by no means had a down month in Increase’s historical past.

What was the funding course of like?

Our funding course of got here collectively easily — we went from sharing our deck to a signed time period sheet in two weeks. We attribute this success to assembly buyers earlier than we began actively elevating and being extremely clear with buyers on how we see Increase rising. This allowed us to floor the buyers who have been actually excited by Increase’s story earlier than we even began elevating.

What are the most important challenges that you just confronted whereas elevating capital?

Our largest problem whereas elevating was that, just like different CEOs, elevating capital was basically a further full-time job, and it required me to step away from the enterprise briefly. We’re grateful to have an ownership-driven group, which meant that productiveness didn’t drop whereas I used to be out of pocket.

What elements about your corporation led your buyers to write down the verify?

In response to our lead investor, Excessive Alpha Associate and Co-Founder Mike Fitzgerald, Increase’s focus and success in a single market was a crucial issue of their funding choice. This story confirmed by means of our metrics, together with spectacular ARR, 98% faculty retention, and 85 web promoter rating, which all signaled clear product-market match.

What are the milestones you intend to realize within the subsequent six months?

The current funding can be used to scale Increase’s go-to-market initiatives and develop our product breadth for Ok-12 development groups.

What recommendation are you able to provide firms in New York that wouldn’t have a recent injection of capital within the financial institution?

In Increase’s historical past, we’ve at all times benefited from the worth coming from sticking to a slender focus, no matter how a lot capital Increase has had. Focus and prioritization are typically my prime suggestions for up-and-coming founders.

The place do you see the corporate going now over the close to time period?

Increase is at the moment serving over 250 faculties, serving to them elevate over $100 million final faculty yr. Our close to time period aim is to proceed doubling our faculty base and rising a robust presence in all 50 states by subsequent yr.

What’s your favourite summer time vacation spot in and across the metropolis?

I’m a giant fan of outside sports activities & actions! I like taking part in outside pickleball or volleyball within the metropolis throughout the summer time, or taking the ferry to Rockaway Seashore for a getaway.