Shares have been flat once more yesterday because the occasions the remainder of the week get a bit extra attention-grabbing, with revisions at the moment, on Thursday, and on Friday.

It appears clear that bond charges are ready patiently for a sign or a purpose to go greater. At this level, it looks like the shall be heading sharply greater and doubtlessly again to five% or beneath 4%. Nonetheless, I believe 5% is extra seemingly.

There may be plenty of proof to help the concept that charges go greater from right here, being one among them.

Proper now, oil is butting up towards resistance at $79, and that is the fourth time oil has hit this stage for the reason that finish of January. A get away might ship oil again to the mid to higher $80s.

Gasoline is another excuse to suppose that charges go greater as a result of gasoline seems to be heading greater primarily based on its technicals.

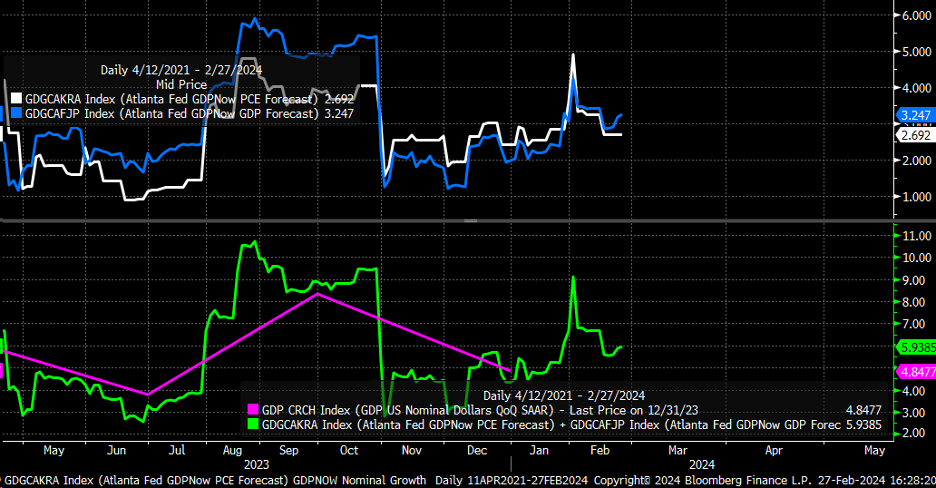

The Atlanta Fed GDPNow mannequin means that nominal progress within the first quarter shall be round 6%, suggesting that charges go greater.

I’d suppose then that the would additionally transfer greater, with the pushing again to the 106 space.

The financial knowledge and the truth that inflation is caught round 3% will seemingly pressure the market to tighten monetary circumstances once more.

Circumstances should tighten as a result of why ought to traders receives a commission a charge of curiosity that’s inadequate given the expansion and inflation outlook of the economic system?

If the economic system stays robust and charges rise, why shouldn’t the greenback recognize?

If charges and the greenback recognize, monetary circumstances should tighten except high-yield traders settle for smaller and smaller reductions on the added threat they should take.

The company bond advance-decline line has already turned decrease, seemingly as a result of charges have turned greater, one other divergence sign between shares and nearly all the things else.

However we are able to see what occurs. Issues get extra attention-grabbing at the moment.

Youtube Video:

Unique Submit