Boeing Co., an aerospace titan, finds itself in a storm. For 9 consecutive days, its shares have been on a relentless descent, shedding 1.07% to shut at $208.40 in a buying and selling session that painted a blended image for the inventory market. Whereas the S&P 500 Index managed to eke out a modest 0.12% acquire, touchdown at 4,467.44, the Dow Jones Industrial Common slipped by 0.20% to settle at 34,575.53.

This descent isn’t with out cause. Boeing faces a collection of hurdles converging like a storm. Ongoing points with its 737 MAX deliveries, reducing demand for its wide-body jets, stiff competitors from Airbus and different rivals, and uncertainty within the international aviation trade all contribute to this turbulence.

Intriguingly, a report by Bloomberg provides depth to this narrative. It revealed that Boeing delivered a mere 22 of its 737 MAX planes in August, a pointy decline from 35 in July and 50 in June. Sources within the know level fingers at Boeing’s provider, Spirit AeroSystems Holdings Inc., citing manufacturing woes with fuselages and different very important elements of the 737 MAX. The report went on to disclose Boeing’s have to droop deliveries of choose 787 Dreamliner planes as a result of high quality points and the need for rigorous inspections.

These supply numbers are very important, providing perception into Boeing’s monetary well being. The corporate continues to grapple with the aftermath of the grounding of its best-selling 737 MAX jets in 2019 following two deadly accidents that claimed 346 lives. Moreover, decrease demand for its wide-body planes, just like the 787 and the 777X, displays altering developments in aviation. The shift in direction of smaller, fuel-efficient planes and decreased worldwide journey has impacted these once-prominent fashions.

Throughout the aisle, arch-rival Airbus SE is gobbling up market share and securing substantial orders. Airbus chalked up 40 deliveries in August, taking its yearly complete to 384. A coup de maître arrived within the type of a colossal order from China, valued at an estimated $37 billion. This hefty order included 260 of Airbus’s A320neo household jets and 40 of its A350 wide-body plane.

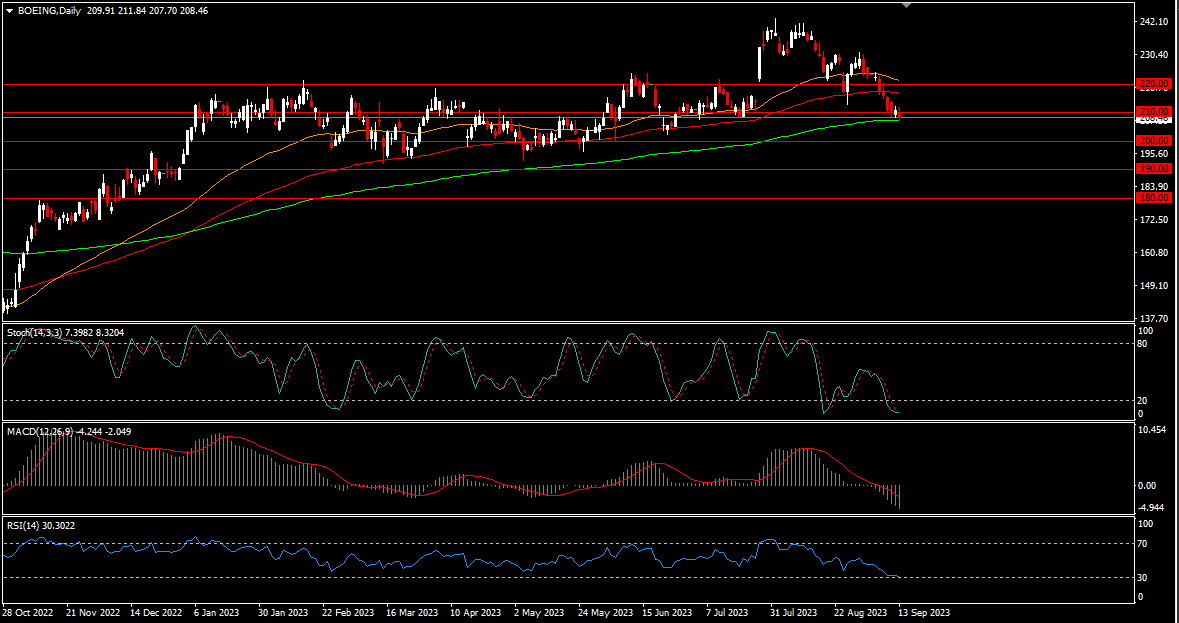

For Boeing, the inventory worth paints a disheartening image. Since reaching a zenith of $243.10 in August 2023, it has been a deadly journey. Help ranges have crumbled, together with the 50-day and 100-day transferring averages, with the inventory teetering simply above the 200-day transferring common. Psychological obstacles at $220 and $210 have been breached, and now the $200 threshold beckons ominously. This stage carried significance from February to Might 2023. Ought to the inventory worth plummet under, a path to $190 and $180 opens huge. Conversely, if it claws again, resistance looms at $210 and $220, bolstered by the transferring averages.

Technical indicators echo this sombre tune. The MACD stays under the zero line and sign line, signalling adverse momentum. The RSI sits under the 50 stage, indicating bearish strain. The Stochastic oscillator hovers in oversold territory, suggesting a possible reversal or consolidation.

Boeing, as soon as the large of the skies, now faces turbulence, battling headwinds from all instructions. The trail forward stays unsure, and traders watch with bated breath as this aviation behemoth navigates via stormy skies.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.