Bitcoin is at a pivotal second, with bulls struggling to reclaim costs above $85K and bears failing to push BTC under $80K. This indecision out there has led to rising bearish sentiment as many traders speculate whether or not the bull cycle is coming to an finish.

Macroeconomic uncertainty and erratic selections from U.S. President Trump proceed to gas market volatility, creating aggressive worth swings throughout crypto and U.S. inventory markets. Buyers are actually on the lookout for key technical alerts to find out Bitcoin’s subsequent transfer.

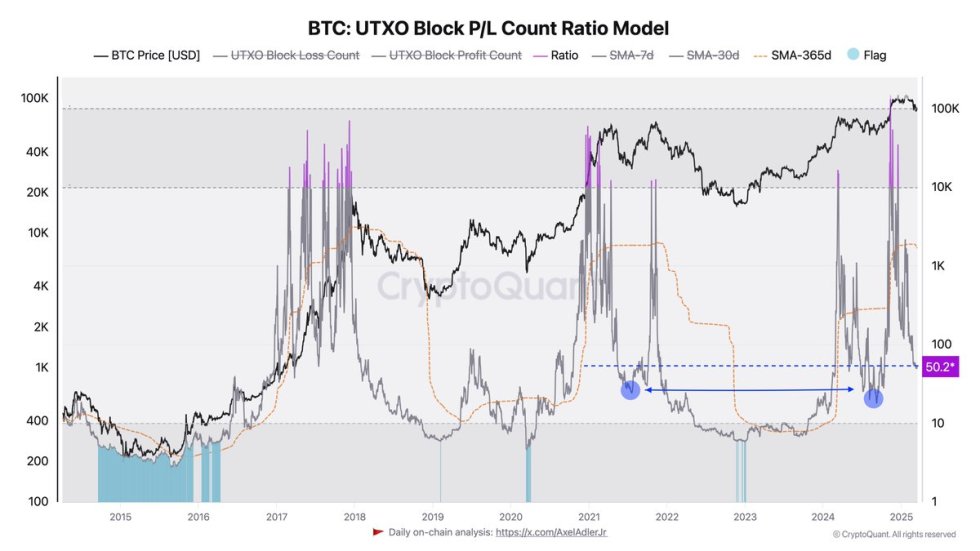

In accordance with CryptoQuant’s newest insights, the Bitcoin UTXO Block P/L Depend Ratio Mannequin is at the moment at 50.2. This metric measures what number of current BTC transactions are occurring at a revenue versus a loss, offering insights into market sentiment and potential reversals.

With BTC trapped in a good vary, the market is at a make-or-break second. If bulls reclaim momentum and push Bitcoin above $85K-$90K, a robust restoration rally may observe. Nevertheless, if BTC drops under $80K, it may sign additional draw back forward, confirming the worst fears of bearish traders.

Bitcoin Faces Continued Correction

Bitcoin’s downtrend deepened after shedding the $100K stage, with a confirmed bearish pattern as soon as BTC dropped under $90K. Since reaching its all-time excessive of $109K in January, Bitcoin has plunged over 29%, and the market reveals no clear indicators of restoration but.

The continuing commerce struggle tensions between the U.S. and main world economies, together with Europe, China, and Canada, have added to investor uncertainty. Macroeconomic instability, tight financial insurance policies, and rising inflation considerations have made threat belongings, together with crypto and shares, extra risky.

Amid this backdrop, prime analyst Axel Adler shared insights on X, highlighting that the Bitcoin UTXO Block P/L Depend Ratio Mannequin is at the moment at 50.2. This metric assesses what number of current Bitcoin transactions are occurring at a revenue versus a loss, providing key insights into market sentiment and potential reversals.

Adler famous that if this metric drops simply 30 factors, it might attain historic ranges the place earlier cycle corrections ended. This consists of the July 2021 correction following China’s mining ban, which marked the top of a serious downtrend earlier than BTC recovered sharply.

With Bitcoin hovering between $80K and $85K, traders are expecting indicators of capitulation or accumulation, which may decide the following main transfer out there.

BTC Worth Struggles Between $85K and $82K

Bitcoin is buying and selling between $85K and $82K, with no clear path for the approaching days. The worth motion stays unsure, as bulls wrestle to regain momentum, whereas bears fail to push BTC under $80K.

A key concern for merchants is that BTC is buying and selling under the 200-day shifting common (MA) at $84,200, a important stage that always dictates market traits. If Bitcoin fails to reclaim this stage, the following draw back goal may very well be under $80K, doubtlessly testing main demand zones round $78K-$75K.

Nevertheless, bulls nonetheless have an opportunity to step in and stop additional draw back. If BTC reclaims the $85K-$86K vary, this might set off a restoration rally, bringing $90K again into play. A decisive break above $90K would sign renewed energy and a possible pattern reversal, shifting sentiment again towards bullish territory.

For now, the market stays in a consolidation part, with merchants expecting a breakout in both path. A failure to reclaim $85K may reinforce bearish strain, whereas breaking above key resistance ranges may pave the best way for a stronger Bitcoin restoration.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.