Credit score markets expect the US credit standing to be minimize by six ranges, and we see the world’s costliest Papa John’s pizzas. Every week, our crew takes you thru the final seven days in seven charts.

1. Bitcoin Is Now the fifth Largest Asset by Market Cap

has reached a record-breaking milestone, surpassing $110,000 for the primary time. At this valuation, it ranks because the fifth most respected asset globally by market capitalisation, overtaking tech giants Alphabet (NASDAQ:) and Amazon (NASDAQ:). The subsequent asset above it in rankings is Apple (NASDAQ:).

Supply: Companiesmarketcap

2. Time to Replace the Worth of the (In)well-known Pizzas…

15 years in the past, Florida-based programmer Laszlo Hanyecz made use of 10,000 bitcoins to buy two Papa John’s pizzas. In right now’s market, the worth of those pizzas would exceed $1.07 billion…

Supply: Coingecko

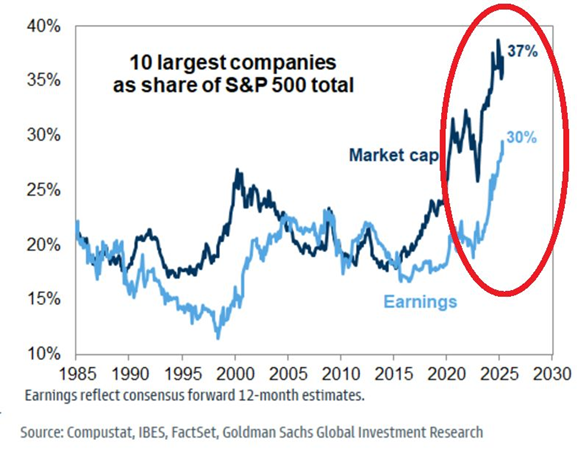

3. Market Focus BUBBLE Has Risen As soon as Once more

The ten largest shares now make up 37% of the overall market capitalisation of the —a degree that stands 10 proportion factors increased than the height reached through the Dot-Com Bubble.

In distinction, these corporations contribute round 30% of the index’s complete earnings.

Supply: World Markets Investor, Goldman Sachs

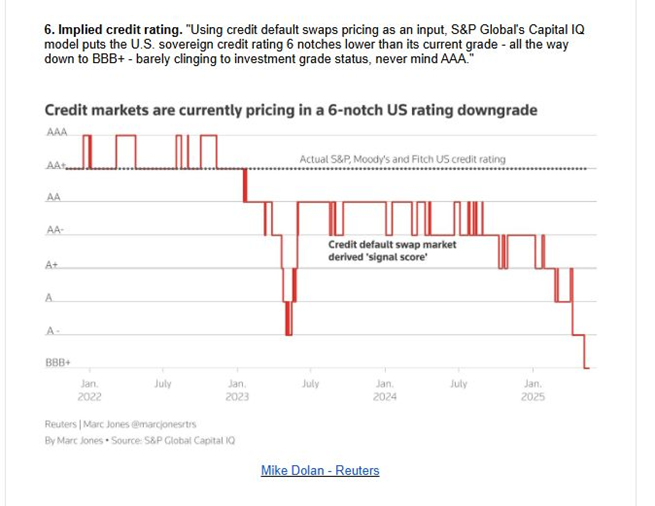

4. Credit score Markets Are At the moment Pricing 6 Notches Of Downgrades For US Sovereign Credit score Ranking

Primarily based on credit score default swap pricing, S&P World’s Capital IQ mannequin means that the US sovereign credit standing ought to be downgraded by six notches from its present degree—putting it at BBB+, simply above the brink for investment-grade standing and much from its AAA ranking.

Supply: Mike Dolan – Reuters

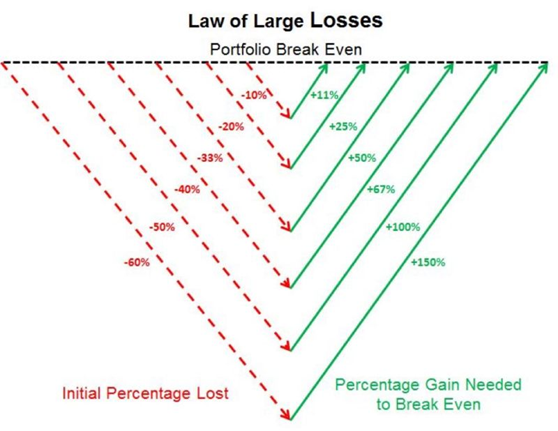

5. How Losses Compound

The chart beneath illustrates the required proportion good points to recuperate from varied ranges of losses.

Supply: Steve Burns

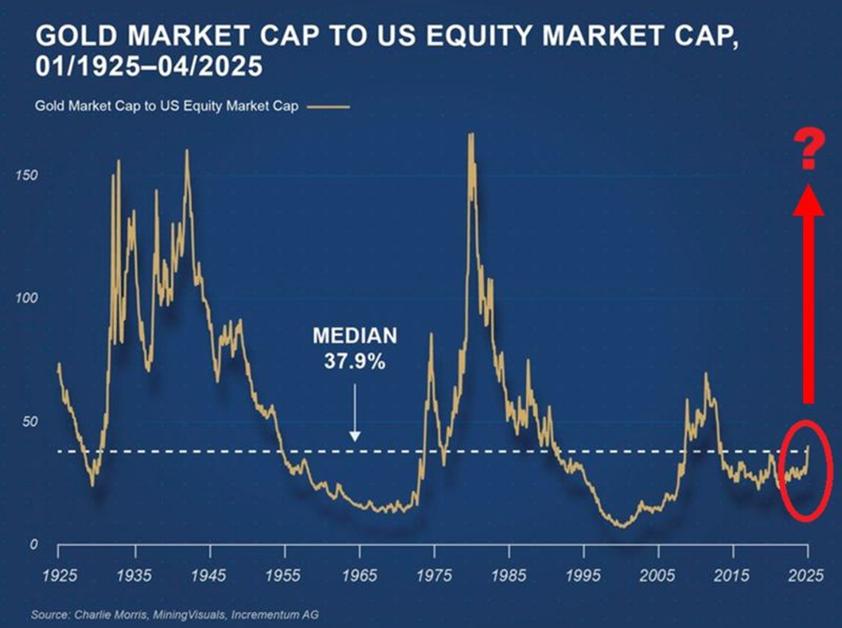

6. Gold on the Highest Stage Versus US Equities in 12 Years

The ratio of ’s market capitalisation to that of the US fairness market has reached its highest level in 12 years, aligning exactly with its long-term median.

Contemplating ongoing geopolitical tensions and potential shifts in monetary markets, one would possibly marvel: are we on the verge of a situation paying homage to the Nineteen Seventies?

Supply: World Markets Buyers, Incrementum AG

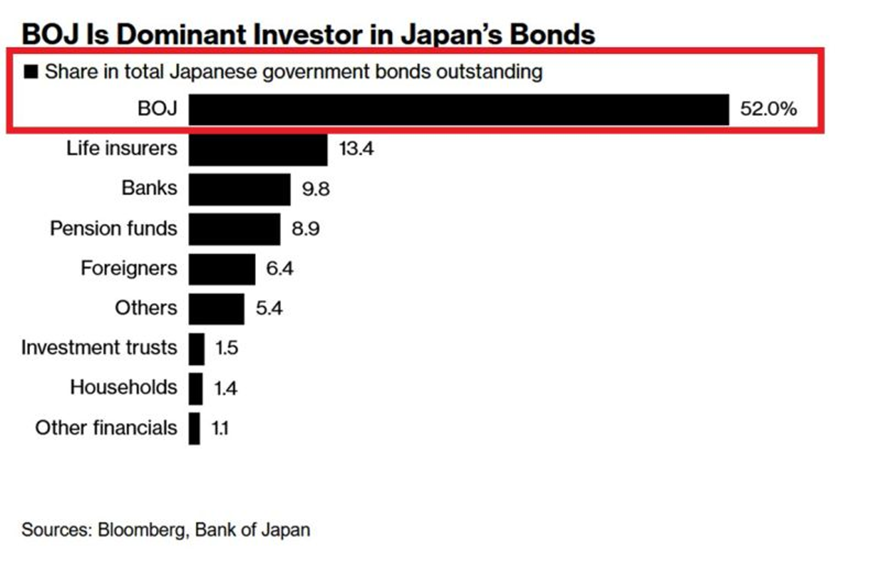

7. The Financial institution of Japan Owns a Whopping 52% of Its Home Authorities Bond Market

Might this sign the start of the tip for US Treasuries? The Financial institution of Japan at present holds a staggering 52% of its home authorities bond market.

Nonetheless, since July, it has been slowly scaling again its holdings.

Japan’s authorities debt market is valued at roughly $7.8 trillion, making it the third largest on this planet.

Supply: World Markets Investor, Bloomberg