Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In his August 5 “Macro Monday” livestream, crypto analyst Josh Olszewicz delivered a assessment of the market’s late-summer state, arguing that whereas Bitcoin’s value motion has gone quiet, the broader cycle stays intact. “We’re on this pocket of seasonal weak spot for August and September that we usually see most years,” he defined, pointing to seasonality charts displaying that traditionally, Bitcoin underperforms on this time window. “It’s a excessive chance that August and September is a huge nothing burger,” he added.

Is The Bitcoin Bull Run Over?

At day 978 of the present cycle, the query many traders are asking, Olszewicz famous, is straightforward however existential: is the cycle already over? Will it finish this yr? Or is there extra upside forward? His reply leaned cautiously optimistic. “I’m within the ‘most likely not over but, may proceed’ camp,” he mentioned. “However we must see what occurs in This autumn. Finally, that’s going to find out it.”

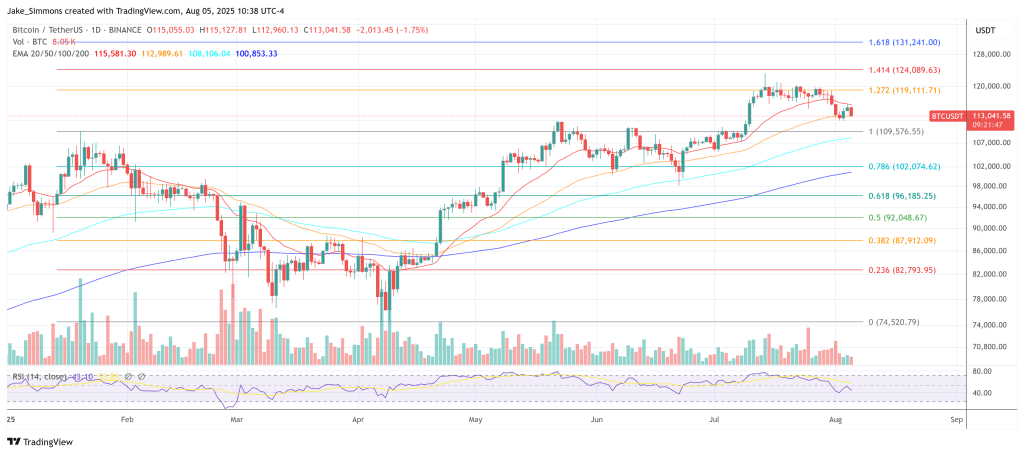

From a technical standpoint, the analyst sees no purpose to declare the highest is in. “Technicals nonetheless look fantastic. Worth nonetheless appears okay. We had a pullback. All that’s fantastic,” he mentioned, emphasizing that Bitcoin has not but exhibited the everyday parabolic advance related to main tops. Nor produce other macro or on-chain metrics proven indicators of terminal overheating. “We don’t produce other metrics screaming from the rooftop saying it’s time but.”

Associated Studying

Nonetheless, the short-term setup is underwhelming. After a cup-and-handle breakout that briefly pushed value towards the $122,000–$123,000 area, momentum pale. Olszewicz doubts such ranges will be reclaimed quickly: “Within the subsequent two weeks we’ll know if we are able to begin to creep again in direction of $120,000, which is asking rather a lot admittedly for August.” The wildcard, he mentioned, is ETF flows. “Can we see ETF flows for any purpose? Then can we see treasury corporations persevering with to purchase? These are the marginal consumers proper now.”

He urged that ETF consumers may return attributable to a mix of underweight positioning, opportunistic dip-buying, and month-to-month rebalancing dynamics. Nonetheless, he stays impartial general. “Only a normal softening of any bullishness we could have had,” he mentioned. “Now it’d be a unique story if that is October and we’re seeing this. That’s not regular.”

An additional purpose for warning is the collapse in futures foundation throughout main belongings. “Premium is all the way in which all the way down to beneath 7% on BTC. It’s beneath 8% on ETH. And I feel SOL is a bit more illiquid, however even SOL is manner down—15% from 35%,” he famous. That contraction in futures premiums, usually an indication of speculative demand drying up, displays a broader risk-off temper. “Not loads of bullish sentiment, not loads of craziness,” Olszewicz noticed.

Associated Studying

On-chain danger metrics affirm the pattern. “There’s a decline right here in danger urge for food,” he mentioned, referring to metrics like unrealized revenue versus MVRV. He added that if Bitcoin had been to enter a parabolic advance, “you will note this metric shoot up… However what’s it going to take?”

This autumn Or Bust

He floated just a few potentialities: fee cuts, weakening Fed independence, or maybe simply seasonal power and macro chaos in This autumn. However for now, he suggested merchants to “take it simple on the 50X leverage,” particularly those that’ve already made vital beneficial properties this cycle. “Do I must put danger again on? Do I must be as dangerous as I used to be earlier?” he requested rhetorically. “Or does it make extra sense to be much less dangerous right here?”

From a macroeconomic perspective, the image is blended. Inflation information from Trueflation stays low—at the moment at 1.65%—however Olszewicz warned that new put up–August 1 tariffs could increase costs within the months forward. “We’re including inflationary pressures with tariffs, little question about it,” he mentioned, although the impact will take time to seem within the information. In the meantime, core PCE is headed within the unsuitable path, and the Atlanta Fed’s GDPNow mannequin is printing 2.1% development for Q3—hardly recessionary, however not sturdy both.

Labor market information continues to cloud the outlook. “If we account for a non-collapsing labor drive participation, we could possibly be as excessive as 4.9% on the precise unemployment fee,” Olszewicz warned. “And we’re persevering with to see a degradation in job availability for manufacturing,” significantly in “Heartland Rust Belt varieties of jobs.”

Liquidity dynamics are additionally in flux. He drew consideration to the draining of the Fed’s reverse repo facility—as soon as a $2 trillion reservoir of sidelined capital—which has supported danger belongings by means of 2023 and 2024. “As this will get drained nearer to completion, there’s a possible chance for liquidity hiccups and a liquidity intervention by the Fed,” he mentioned. Importantly, this has saved general US liquidity flat, offsetting quantitative tightening. “Regardless of QT, the drain of the reverse repo has offset QT, and US liquidity by this metric has been principally flat since 2022.”

What modified the sport, Olszewicz mentioned, was not liquidity per se, however the launch of spot Bitcoin ETFs. “That has actually been, for my part, an enormous distinction maker,” he defined. “We acquired ETF approvals right here, ETF began buying and selling right here, and the remaining is historical past so far as flows are involved.”

In conclusion, Olszewicz emphasised that whereas the broader danger urge for food has declined and value motion stays uninteresting, there isn’t any proof but that the Bitcoin cycle has topped. “The cycle’s most likely not over,” he mentioned. “It’s simply sleeping—and This autumn will in the end decide whether or not it wakes up.”

At press time, BTC traded at $113,041.

Featured picture created with DALL.E, chart from TradingView.com