Key Takeaways

- Bitcoin dropped 5% to $102,900 after Israeli airstrikes on Tehran.

- Gold surged to $3,420 as buyers sought safer belongings amid rising tensions.

Share this text

Bitcoin slumped 5% to $102,900 early Friday after Israeli airstrikes hit Tehran, whereas spot gold surged to $3,429 in a flight to security, TradingView knowledge reveals.

On Thursday, the main digital asset managed a modest rebound to $108,450 from $107,000, whilst markets absorbed bearish alerts from reviews that Israel had notified US officers of its intent to launch an operation towards Iran.

Tensions escalated after Israel launched “Operation Rising Lion” towards Iran, with Israeli Prime Minister Benjamin Netanyahu stating, “This operation will proceed for as many days because it takes to take away this menace.”

Prime Minister Netanyahu:

“Moments in the past, Israel launched Operation Rising Lion, a focused army operation to roll again the Iranian menace to Israel’s very survival.This operation will proceed for as many days because it takes to take away this menace.” pic.twitter.com/3c8oF1GCYa

— Prime Minister of Israel (@IsraeliPM) June 13, 2025

US Secretary of State Marco Rubio stated Israel took “unilateral motion towards Iran” and had knowledgeable the US that the strikes had been obligatory for self-defense, AP reported.

The army motion comes amid heightened considerations over Iran’s nuclear program. The Worldwide Atomic Power Company’s Board of Governors censured Iran on Thursday for not cooperating with inspectors, prompting Tehran to announce plans for a 3rd enrichment website and the deployment of superior centrifuges.

The US has begun pulling some diplomats from Iraq’s capital and providing voluntary evacuations for US army households within the broader Center East area. The State Division issued warnings for Individuals to go away Iraq, citing “heightened regional tensions.”

Trump’s envoy Steve Witkoff indicated that nuclear talks with Iran would proceed, although Israel’s army motion might escalate regional tensions and impression US pursuits.

Bitcoin has traditionally seen short-term worth declines during times of geopolitical turmoil, as buyers are likely to shift towards conventional safe-haven belongings.

Nonetheless, the crypto asset has often rebounded swiftly, supported by its rising notion as a digital retailer of worth.

On the time of writing, BTC was buying and selling at round $103,100.

The crypto market is beneath strain as Bitcoin extends losses. Ethereum dropped beneath $2,500, whereas XRP fell to $2.1.

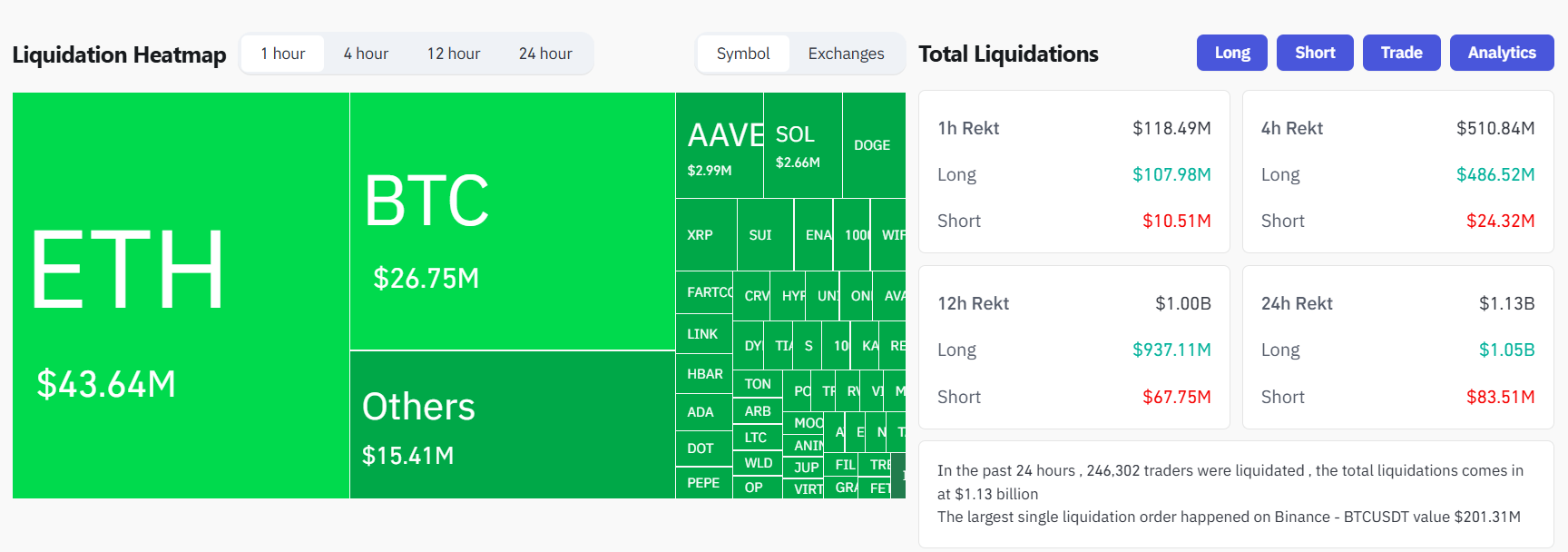

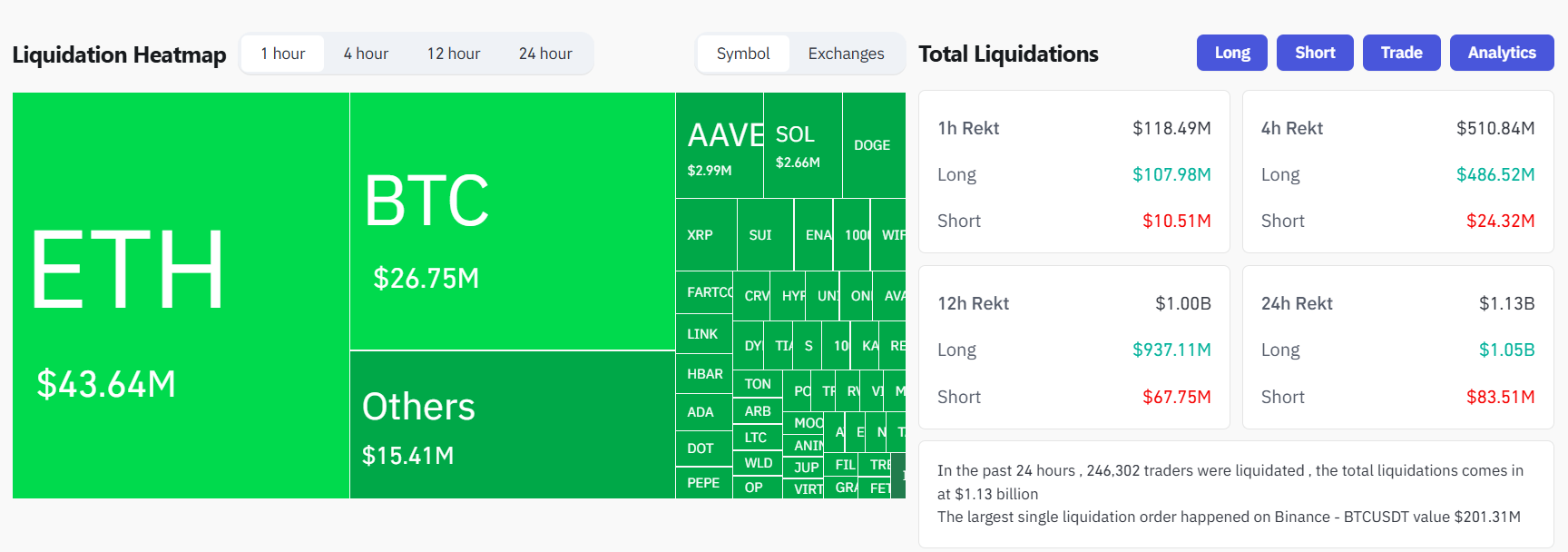

In accordance with Coinglass knowledge, leveraged liquidations throughout crypto belongings surged to $1 billion within the final 12 hours. Lengthy positions accounted for the overwhelming majority of losses at roughly $937 million, in comparison with $67 million for brief positions.

Share this text