Key Takeaways

- Bitcoin and altcoins fell in a broad crypto market decline forward of the Fed Chair’s Jackson Gap speech.

- Market volatility elevated as buyers anticipated doable Fed charge adjustments and reacted to ongoing inflation issues.

Share this text

Bitcoin slipped underneath $113,000 on Tuesday, triggering a market-wide downturn that despatched Ethereum, XRP, and Solana decrease. The full crypto sector fell to $3.8 trillion, down 3.5% on the day.

The value of Bitcoin dropped almost 3% within the final day to $112,696, marking a return to ranges not seen for the reason that starting of the month, CoinGecko knowledge reveals.

Ether dropped greater than 4% to $4,100 after flirting with file highs up to now few days. Losses are unfold throughout main altcoins, with XRP down almost 6%, Dogecoin and Chainlink off over 5%, and Sei and Cardano plunging 8%.

The pullback comes forward of the Fed’s Jackson Gap symposium on Friday, the place Chair Jerome Powell is scheduled to ship his keynote tackle. Markets are bracing for whether or not he indicators a September charge reduce or doubles down on inflation issues, particularly after US inflation knowledge supplied combined indicators in July.

The headline CPI slowed to 2.7% however core inflation edged as much as 3.1% and PPI climbed 3.3%. The mix of weakening job progress and protracted worth pressures has raised stagflation fears, which might complicate the Fed’s decision-making.

“Greater‑than‑anticipated PPI numbers (producer costs jumped 0.9% month‑on‑month towards a 0.2% forecast) have difficult the Fed’s coverage framework, so the market shall be on the lookout for hints on the Fed’s pondering forward of its September coverage assembly,” stated QCP Capital analysts in an announcement. “Final 12 months, Powell used Jackson Gap to telegraph an easing bias; this 12 months, Trump’s tariffs and political stress create a way more contentious backdrop.”

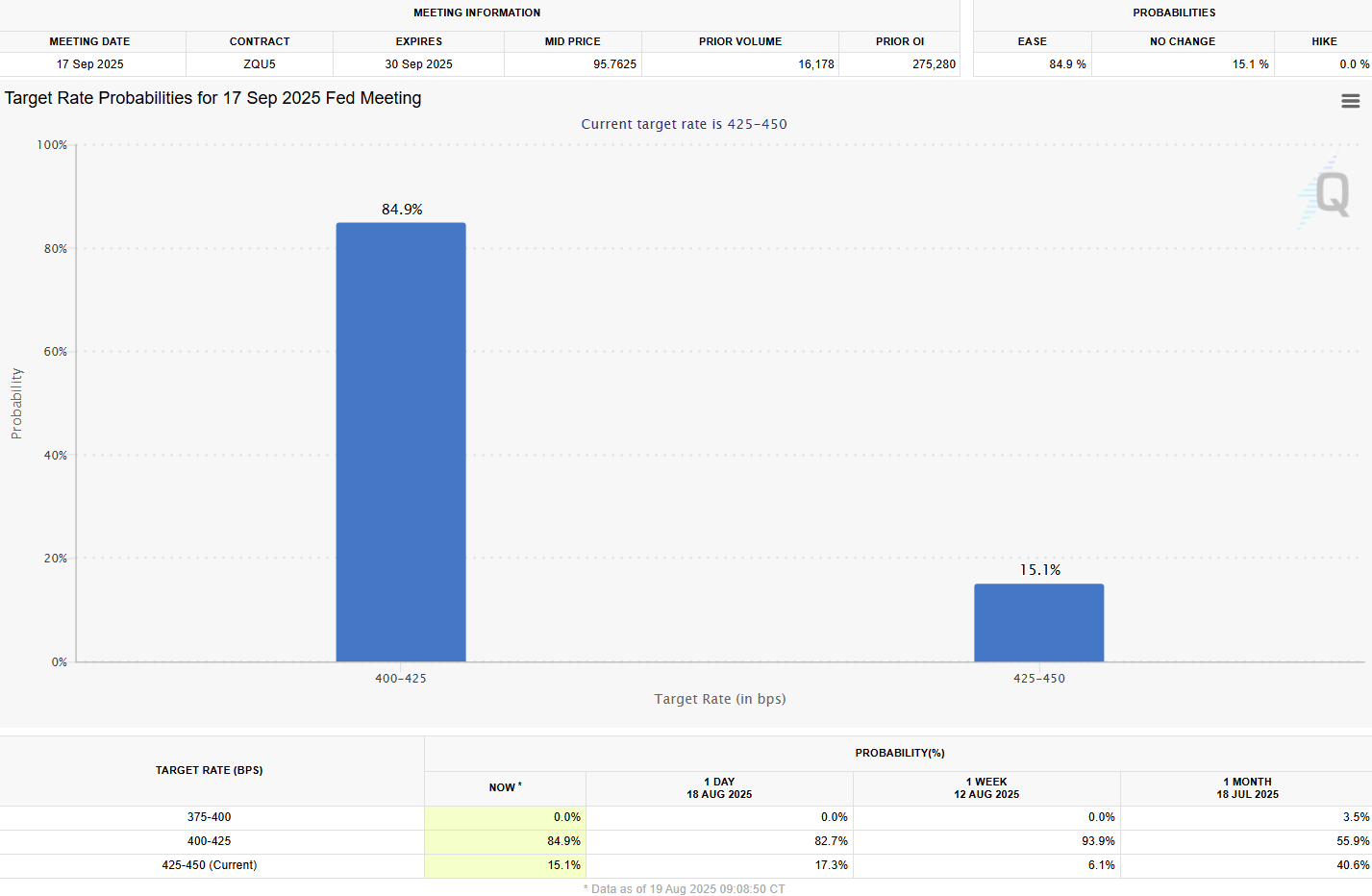

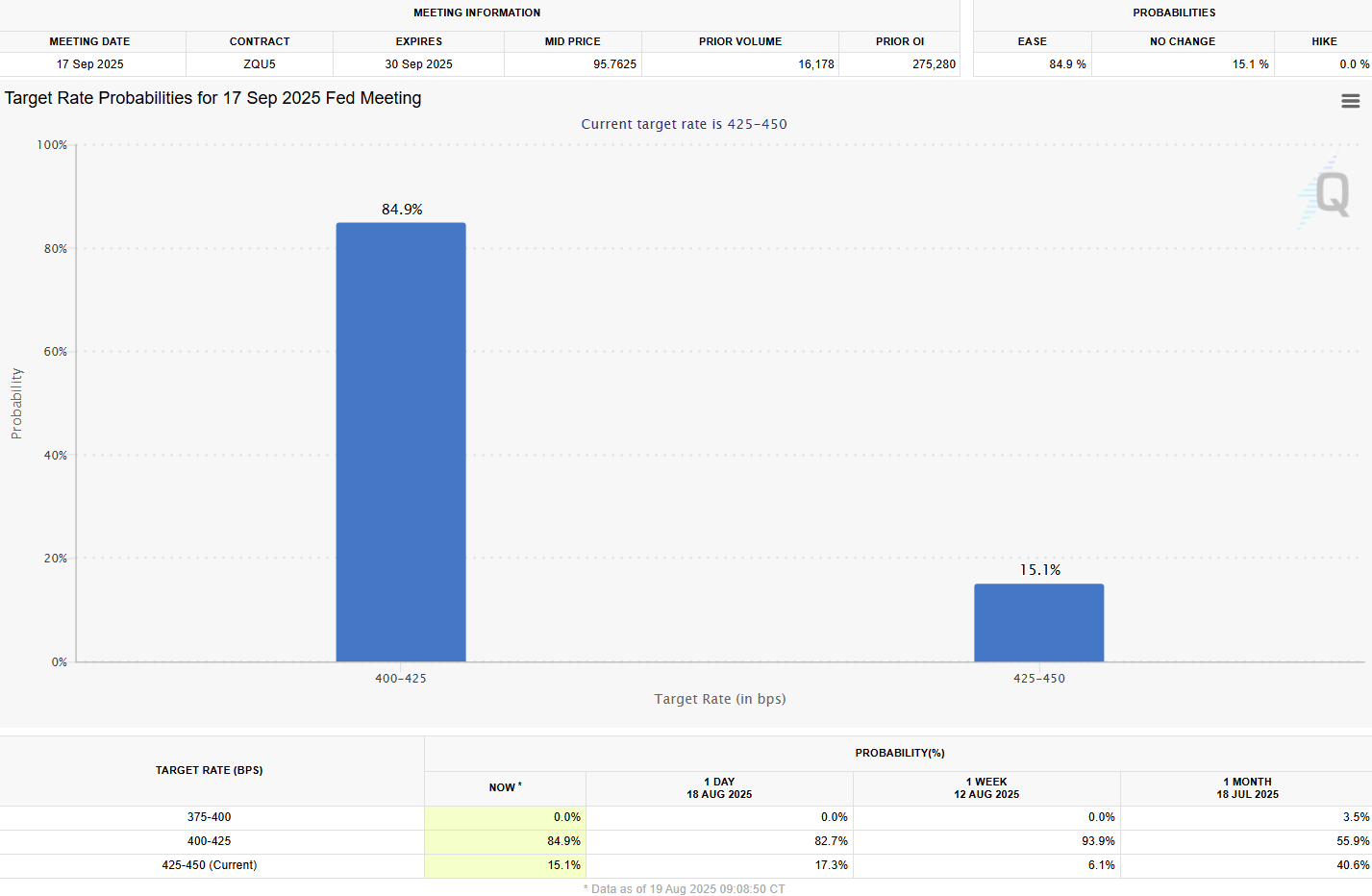

Merchants are nonetheless pricing in a 25-basis-point reduce on the September 17 FOMC assembly, although odds have eased following hotter-than-expected inflation readings.

Analysts predict Powell shall be cautious throughout his closing Jackson Gap speech. The Fed Chair could acknowledge that dangers to employment and inflation are balancing, suggesting a reduce might be acceptable if traits proceed, however he’s unlikely to decide to a selected coverage motion.

Since expectations for a September reduce are already priced in, any trace that motion could be delayed might really feel like a tightening of coverage for buyers.

Nonetheless, indicators that quantitative tightening could finish or that regulatory shifts are coming might increase liquidity and doubtlessly reignite Bitcoin’s rally towards year-end, analysts counsel.

Elsewhere, US shares additionally mirrored uncertainty at Tuesday’s market shut.

The S&P 500 fell almost 0.6% and the Nasdaq Composite dropped round 1.5%, whereas the Dow Jones Industrial Common edged up.

Tech and chipmakers led losses, with Nvidia down 3.5%, AMD off 5.4%, and Broadcom decrease by 3.6%. Palantir sank 9%, the worst S&P 500 performer, whereas Tesla, Meta, and Netflix additionally slipped.

Share this text