Key Takeaways

- Bitcoin’s resilience hints at a structural break from inventory market actions.

- The rising sample of impartial worth motion positions Bitcoin in the direction of the $100,000 degree.

Share this text

Shares dipped, gold slipped, however Bitcoin bounced. That’s the large story from this week’s tariff shake-up.

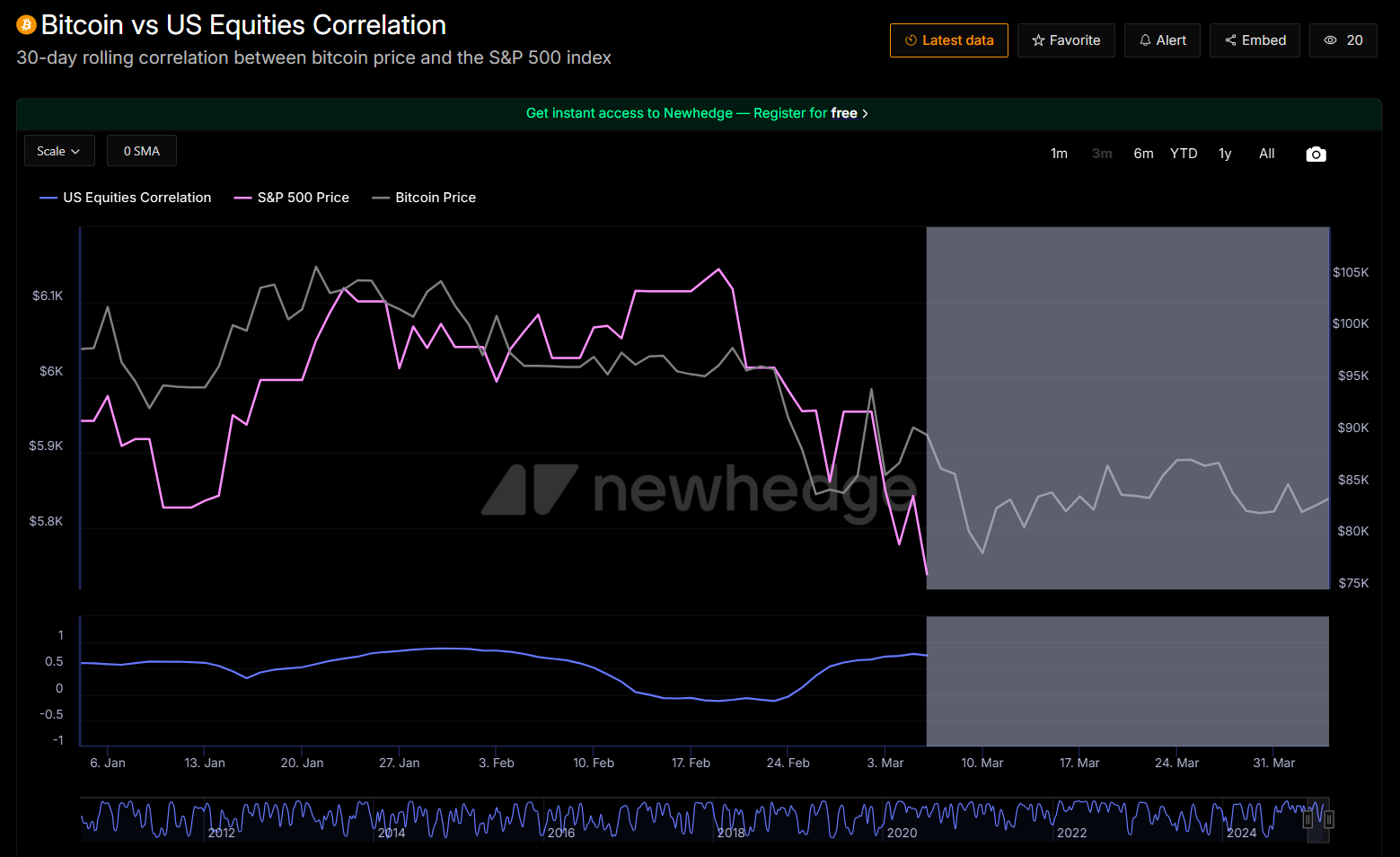

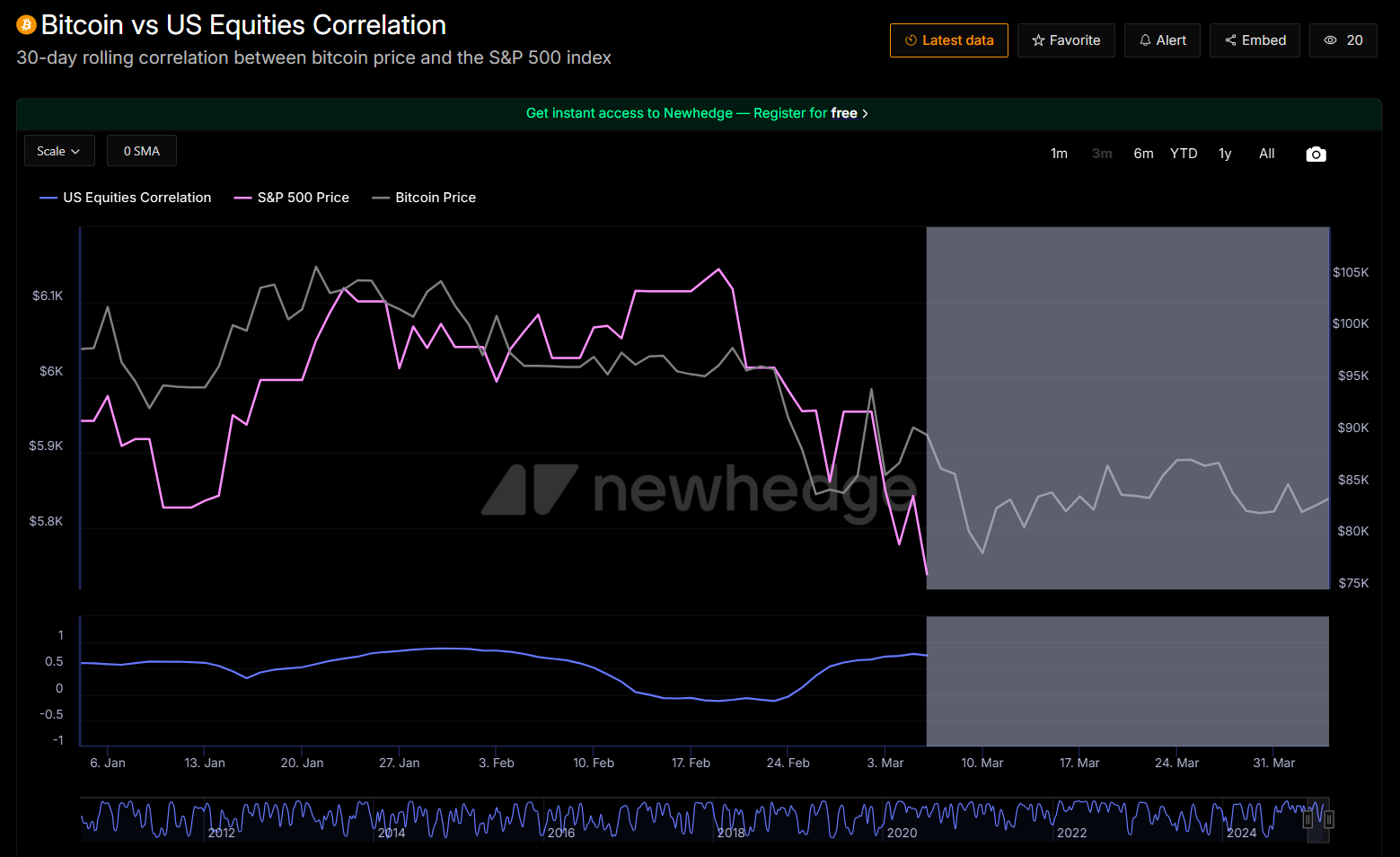

Bitcoin is exhibiting early indicators of breaking its correlation with US equities because it remained resilient above the $82,000 mark throughout a Friday downturn that erased $2.5 trillion from the S&P 500 Index.

Markets reeled Thursday within the first full session after President Trump’s tariff announcement, setting the stage for a two-day sell-off that worn out over $5 trillion of US equities.

By the top of Friday, the S&P 500 and Nasdaq Composite had each tumbled practically 6%, and the Dow plunged 5.5%—its largest one-day loss since June 2020.

Bitcoin did present some pullbacks as quickly as tariffs had been introduced, falling to $81,500 within the wake of the announcement. Nevertheless, it swiftly rebounded to succeed in $84,600 by Friday.

On Friday, regardless of dealing with renewed strain within the early hours, the digital asset demonstrated resilience—stabilizing and climbing again above $84,000 throughout intraday buying and selling.

On the time of writing, Bitcoin was altering palms at round $83,700, with a slight lower over the previous 24 hours, in line with TradingView.

Commenting on Bitcoin’s latest break from shares, Blockstream CEO Adam Again acknowledged that the prior correlation between Bitcoin and conventional markets might need been extra of a byproduct of market dynamics, presumably pushed by market maker exercise exploiting liquidity circumstances.

“[I] was pondering the coupling was pretend. Possibly market makers [were] utilizing Bitcoin market scarcity of fiat liquidity to auto-correlate Bitcoin, noticeable on US market [opening],” he mentioned.

The divergence in habits might sign that Bitcoin is getting into a section of impartial worth motion, which may assist Bitcoin’s motion towards the $100,000 worth degree sooner than beforehand anticipated.

Market analyst Macroscope suggests Bitcoin’s worth trajectory may comply with gold’s historic developments. If Bitcoin reclaims $100,000, it may set off a shift of capital from gold to Bitcoin and a repeat of historic outperformance over different property, in line with the analyst.

“In earlier cycles, a reclaim of the latest excessive has kicked off a brand new interval of outperformance,” he mentioned.

Tariffs as a possible catalyst for Bitcoin’s progress

Trump’s aggressive tariffs are geared toward correcting international financial imbalances, and whereas these measures are inflicting ache in conventional markets, they may be the catalyst that enables Bitcoin to lastly decouple from its affiliation with risk-on tech shares, mentioned BitMEX co-founder Arthur Hayes in a latest assertion.

“$BTC hodlers have to study to like tariffs, possibly we lastly broke the correlation with Nasdaq, and might transfer onto the purest type of a fiat liquidity smoke alarm,” Hayes acknowledged.

The analyst famous in an earlier assertion that the damaging penalties of those tariffs will drive governments and central banks to reply by printing extra money to stabilize the economic system and the Treasury market.

This, in flip, enhances Bitcoin’s attraction as a scarce and decentralized different, appearing as a hedge towards fiat foreign money debasement.

That mentioned, regardless of the worry surrounding tariffs, Hayes, in addition to many crypto buyers and analysts, see them as probably a constructive improvement for the long-term worth of Bitcoin.

“Right this moment’s market response to tariffs is a reminder: inflation is simply the tip of the iceberg,” mentioned Technique’s co-founder Michael Saylor in a Friday assertion. “Capital faces dilution from taxes, regulation, competitors, obsolescence, and unexpected occasions. Bitcoin provides resilience in a world filled with hidden dangers.”

Share this text