An inflow of $2.5 billion in stablecoins is anticipated to doubtlessly drive a major surge within the Bitcoin value, as detailed in a brand new report by Markus Thielen, a market researcher at 10x Analysis.

Bitcoin Value Increase Is Incoming

In his newest analysis word, Thielen explains the essential significance of monitoring and analyzing crypto cash flows, which give essential insights into market situations that may both speed up or inhibit Bitcoin’s value actions. “Merchants are sometimes caught off guard by value crashes, overlooking the essential alerts these flows provide. Nonetheless, the inverse can also be true; a sustained improve in cash flows can drive larger costs, however many additionally miss these indicators,” Thielen writes.

Associated Studying

The researcher explains that cash flows can predict value actions in each instructions. In April 2024, signaled a value correction as “broad cash flows largely paused.” Thielen provides, “a resurgence in sure cash flows helped elevate costs as markets approached bottoms. The essential issue was monitoring the sustainability of those flows, as rallies typically misplaced momentum with out continued assist.”

The report highlights the latest actions involving main stablecoin issuers. Thielen factors out that final evening, Tether minted $1 billion in USDT, categorizing it as a list construct somewhat than speedy market issuance. This distinction is important because it suggests a preparatory step for potential future market actions somewhat than speedy liquidity injection.

Furthermore, the researcher particulars an vital remark relating to current issuances by Tether and Circle, which cumulatively quantity to almost $2.8 billion. Thielen interprets this as a powerful indication of institutional buyers deploying contemporary capital into the crypto market, which traditionally alerts bullish situations for Bitcoin. “If this pattern of issuance (not simply minting) continues, Bitcoin might see additional positive factors,” remarks Thielen.

Associated Studying

Additional supporting Thielen’s evaluation, the on-chain evaluation platform Lookonchain reported yesterday through X: “Tether Treasury minted 1B USDT on Ethereum once more 20 minutes in the past. Over the previous yr, a complete of 32B USDT has been minted by Tether Treasury!”

Moreover, Lookonchain might have discovered a motive for the massive issuance of latest stablecoins. The agency discovered that substantial quantities of USDT flowed to Cumberland. They remarked, “In simply 8 days, Cumberland has injected 1.04B USDT into the crypto market! An hour in the past, Cumberland acquired 141.5M USDT from Tether Treasury once more and transferred it to main exchanges akin to Kraken, OKX, Binance, and Coinbase.”

Extra Bullish Catalysts

Crypto analyst Miles Deutscher delivered another excuse to be bullish on Bitcoin through X. He famous the present market situations resemble the multi-month consolidation from 2023, suggesting a possible finish to this part based mostly on comparable chart formations and a pointy decline in retail curiosity.

“This feels eerily much like August-October final yr. Retail curiosity is evaporating quick (YT views have fallen off a cliff over the previous week). Apathy amongst present market contributors. Lack of clear narratives (and the #Bitcoin value motion appears an identical too),” Deutscher acknowledged.

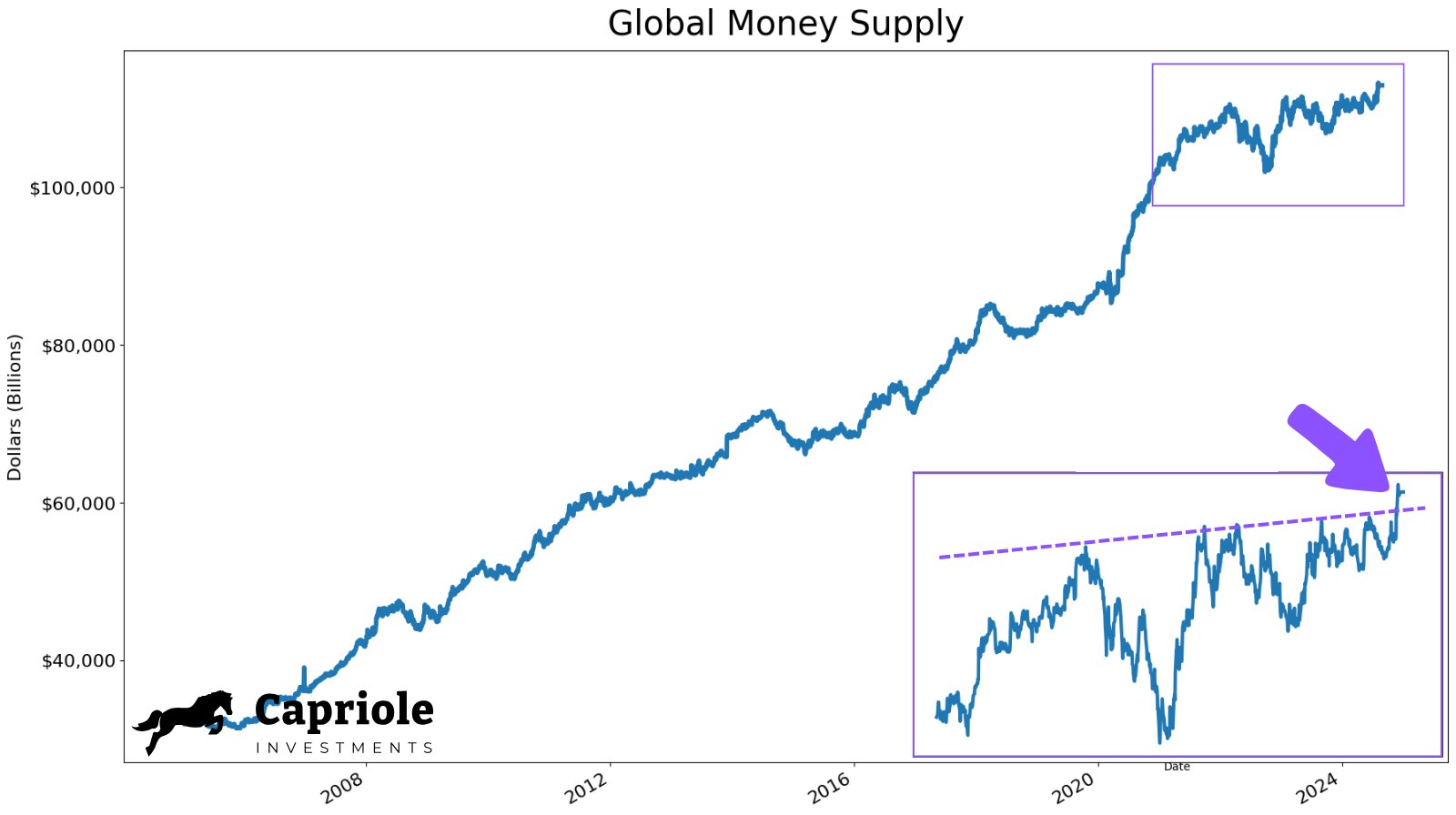

Charles Edwards, founding father of Capriole Investments, added a macroeconomic perspective, noting the growth of the worldwide cash provide as a historic driver for rising Bitcoin costs. “International cash provide is exploding up. Plus, we simply broke out of an enormous 4-year consolidation. What do you assume this implies for Bitcoin?” he posed rhetorically, suggesting a bullish outlook based mostly on this issue.

At press time, BTC traded at $60,853.

Featured picture created with DALL.E, chart from TradingView.com