Este artículo también está disponible en español.

Regardless of the latest Bitcoin worth crash, crypto analyst TradingShot has steered that this isn’t the top of the highway for the flagship crypto. This got here as he revealed why BTC might nonetheless rally to as excessive as $200,000 on this market cycle.

Bitcoin Value Set To Rally To $200,000 Regardless of Latest Crash

In a TradingView publish, TradingShot predicted that the Bitcoin worth might rally to $200,000 regardless of the latest market crash. The analyst famous that Bitcoin has began this new 12 months with excessive volatility amid geopolitical and financial information enter. He added that this 12 months is the final 12 months of this bull cycle.

Associated Studying

Nevertheless, the latest Bitcoin worth crash doesn’t imply that the flagship crypto is near its market peak, as TradingShot remarked that the cycle high might begin forming round November. He made this prediction based mostly on historic tendencies, because the three earlier tops have been both in November or December.

The crypto analyst additionally famous that the final cycle high shaped above the Pi Cycle Prime and on the LGC Zone from the highest. According to this, TradingShot predicted that the Bitcoin worth could possibly be near $200,000 even when BTC barely exams the underside for the LGC 2nd Zone from the Prime by November 2025.

TradingShot added that, technically, the projected Peak Zone for the Bitcoin worth ought to be between $180,000 and $200,000. He remarked that this vary should still be beneath the Pi Cycle, so it appears to be a good state of affairs. Normal Chartered additionally shared an analogous prediction final 12 months, stating {that a} rally to $200,000 by year-end 2025 is “achievable.” In the meantime, Bernstein analysts described a $200,000 prediction by year-end as a “conservative” estimate.

A Value Rebound Might Be On The Playing cards

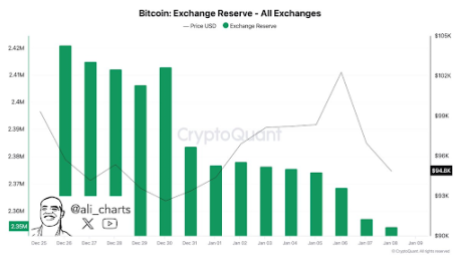

The Bitcoin worth has suffered a horrible begin to the 12 months, dropping to as little as $93,000. Nevertheless, crypto analyst Ali Martinez has shared some positives that recommend a worth rebound could also be imminent. In an X publish, the crypto analyst revealed that greater than 22,000 BTC, price $2.10 billion, had been withdrawn from exchanges over the previous week.

Associated Studying

This presents a bullish outlook for the Bitcoin worth since heavy Whale accumulation usually precedes a worth restoration. In the meantime, Martinez talked about that 63.92% of Binance merchants are actually going lengthy since BTC dropped to as little as $93,000. These merchants had been beforehand shorting BTC when the flagship crypto was buying and selling above $100,000. With these merchants now going lengthy, a rebound could also be imminent.

On the time of writing, the Bitcoin worth is buying and selling at round $93,000, down over 2% within the final 24 hours, in response to information from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com