Bitcoin is going through a vital take a look at as its worth continues to swing with out clear course, weighed down by tense macroeconomic circumstances. Regardless of the volatility, Bitcoin stays resilient above the $81,000 mark—an essential psychological and technical stage that bulls have managed to defend. The current surge introduced non permanent optimism, however issues over US tariffs and the escalating standoff with China proceed to loom, fueling fears of a possible world recession if no settlement is reached.

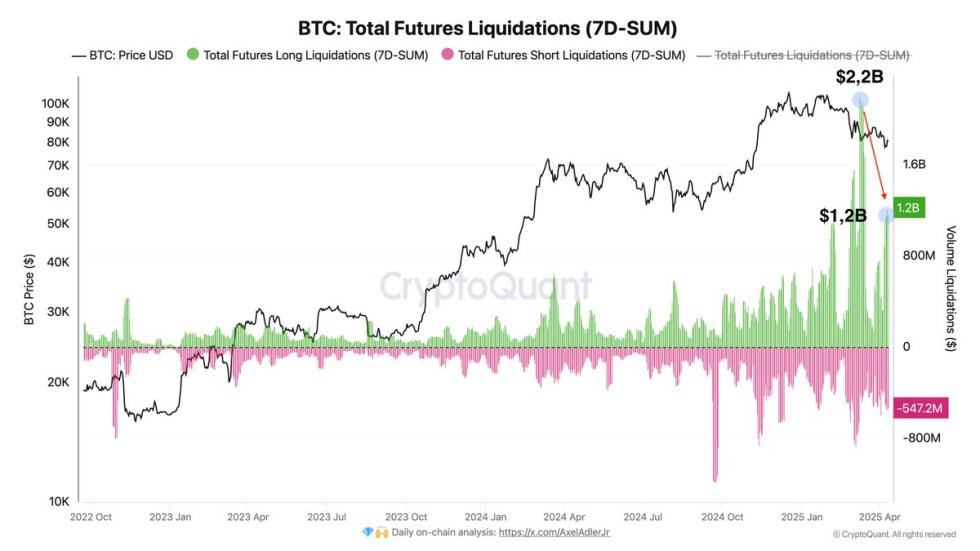

Whereas the broader financial atmosphere stays unstable, there are indicators that the worst could also be behind for now. Based on knowledge from CryptoQuant, the weekly quantity of lengthy place liquidations has considerably decreased over the previous month—from $2.2 billion to $1.2 billion. This means that merchants have gotten extra cautious with leverage and place sizing, probably stabilizing short-term worth motion.

The discount in liquidations additionally displays a cooling of aggressive speculative exercise, which frequently precedes more healthy market circumstances. Nonetheless, for Bitcoin to construct on its present energy, bulls should push the worth above resistance ranges round $85K–$87K. Till then, the market stays on edge, awaiting stronger indicators of restoration or renewed draw back momentum pushed by macro elements.

Bitcoin Reveals Indicators Of Stabilization Amid International Uncertainty

Huge worth swings proceed to shake each the crypto and fairness markets, with heightened volatility pushed by ongoing geopolitical tensions and monetary uncertainty. Bitcoin, specifically, has skilled intense stress in current weeks, but the asset has managed to carry key help ranges, signaling that bulls could also be regaining management. Whereas the worst of the drawdown may be over, sentiment stays combined as merchants weigh the affect of US tariffs, world financial fragility, and the rising threat of a recession.

The broader macroeconomic atmosphere continues to unsettle traders. Commerce battle escalations, significantly the continued standoff between the US and China, have added to fears that world development may take a big hit. Regardless of this, Bitcoin seems to be stabilizing. Bulls are cautiously stepping in, trying to reclaim larger ranges and reestablish momentum.

Supporting this cautiously optimistic outlook, CryptoQuant analyst Axel Adler shared current insights revealing that over the previous month, the weekly quantity of lengthy place liquidations has dropped from $2.2 billion to $1.2 billion. This decline suggests a shift in dealer habits—towards lowered leverage and smaller positions—indicating elevated warning amid the chaos. Such habits typically precedes market stabilization, as extreme risk-taking subsides and the inspiration for more healthy worth motion begins to construct.

Whereas dangers stay, together with unpredictable financial coverage and geopolitical fallout, Bitcoin’s resilience and the lowered liquidation development level to a market that’s starting to regain steadiness. Bulls now want to substantiate energy by pushing previous essential resistance zones, however for now, indicators of a possible restoration are slowly rising.

BTC Faces Quick-Time period Resistance Amid Restoration Effort

Bitcoin is at present buying and selling at $83,400 after a powerful bullish transfer pushed it again above the important thing $81,000 help stage. This current surge has offered non permanent reduction for bulls, however important hurdles stay earlier than a full restoration could be confirmed. The $81K mark has confirmed to be a vital psychological and technical stage on this cycle, and reclaiming it’s important for the uptrend to proceed.

Regardless of the optimistic momentum, BTC now faces speedy resistance on the 4-hour 200 shifting common, which at present sits close to $83,500. This technical stage has persistently acted as a short-term barrier since Bitcoin misplaced the $100K milestone earlier within the cycle. A decisive break and shut above this zone could be an essential sign of energy, probably paving the best way for a push towards the $85K–$87K vary.

Nonetheless, if bulls fail to keep up management and BTC slips again under $81K, it may set off renewed panic promoting and a deeper continuation of the downtrend. In that situation, the $80K stage turns into the final line of protection earlier than a possible transfer towards $75K. With volatility remaining excessive and macroeconomic dangers nonetheless in play, the approaching days will likely be essential for Bitcoin’s short-term trajectory.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.